Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. We were better at one stage during the day, clocking a percent or better, but we slid during the middle of the day and settled to a level around where we closed. Which was 193 points better to 33858 on the Jozi all share index, a gain of 0.58 percent on the day. The resource ten did little to help the overall market gain traction, Anglo American actually traded down 1.2 percent on an ABSA capital report that mining output would be impacted this year again as a result of electricity constraints (Eskom) and strikes. More on that a little later, we will also talk about their (Anglo) diamond acquisition when put next to BHP Billiton and Rio Tinto looking to exit their smaller diamond businesses. As I said, I suspect that there is nothing sinister in that, because for both the Australian based companies, the diamond assets are non-core to their overall business.

PPC released a Merrill Lynch Investor Conference slideshow two days ago. Or was it yesterday? This is as far as I can tell, a yearly event, and every year PPC does this presentation. On both their business and the overall cement business in South Africa. It really is worth a look as both an interested party, as well as a shareholder of PPC specifically. We will have a look at a few of the key slides, I am sure that you are all slided (an invented word) out from yesterdays message on the Fed. But, these are important, and a picture always tells you a lot. Although, I started reading my daughters Alice in Wonderland last evening and they seem engrossed enough. No pictures. Imagination.

PPC have said that sales volumes for the first five months of their financial year (they are a September year end) have been 9.4 percent better than the prior year. Imports have put pressure on the coastal market, but at this stage imports only represent around 5 percent of total South African demand. So, in reality this is not that big. PPC hiked prices by 5 percent on the first of Feb this year and as a result they have seen a negative impact on sales. But as they put it, "Price still has better leverage on bottom line than volume." I believe them.

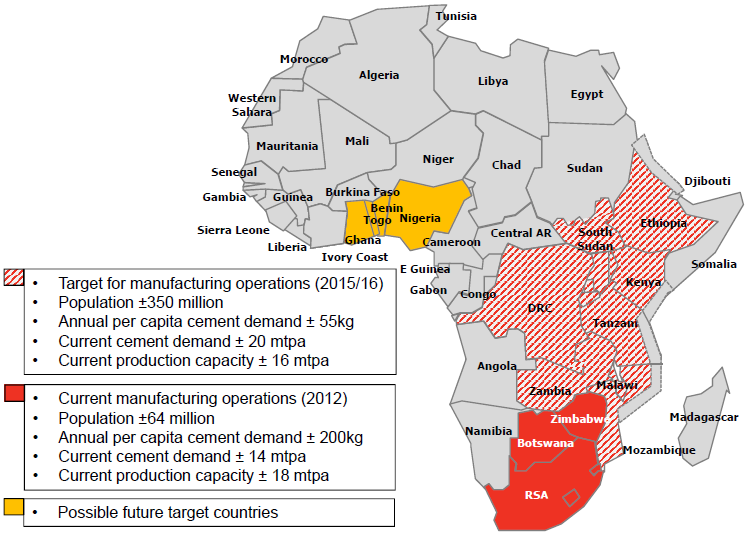

Perhaps the most exciting part, or the real rump of the slide show for me anyhow is this part, their African expansion plan. PPC are looking to increase the percentage of African sales to 40 to 50 percent of the overall sales mix by 2016, it is currently 18 percent. Which then means that PPC will be a lot more exposed to other currencies, and as we know is both a good and bad thing, swings and roundabouts. Either way, PPC will be building plants in the below geographies, you can see that East Africa will be the first focus, and then they will target West Africa.

And as you can see later in the slideshow, most of the initial focus will be on green fields plans, looking to build plants with capacity of 600 thousand to one million tons of cement per annum. According to the slide show, these plants are set to cost around 200 million Dollars apiece. But, they will have to more importantly find limestone deposits within a 250km radius of their core markets. And that is what is going to take time.

We are aware that Sephaku cement is building a sizeable plant (as far as we know around 2.5 million tons per annum) in the Lichtenberg area. Where corn and cement meet, both Lafarge and Holcim have plants here. Don't knock Lichtenberg either, apparently the largest cheese factory in the country is there too, courtesy Clover. Yum. The story today is in Engineering News -> Sephaku says new cement project on track.

See that, 2.5 million tons per annum. Just to put that number into perspective, the last cement sales stat from the Cement and Concrete Institute refreshed our memories as far as cement sales are concerned. In 2009 yearly sales were 11,783,670 tons, 2010 dropped to 10,870,394 tons and 2011 was 11,234,335 tons. So, you do not have to be a genius to see that 2,5 million tons added to this mix is really sizeable. And PPC clearly see this market getting crowded, hence the push to faster growing and less developed northern neighbours.

Quite a lot of people have been asking questions about Rio Tinto exiting their diamond business, this after BHP Billiton announced a similar strategy. All after Anglo American announced that they were taking an even larger and much more sizeable stake in the diamond asset that they own already. Remember, two refreshers -> Anglo American acquiring De Beers stake from Oppenheimer family and BHP Billiton looks to offload their diamonds business. As you can see, for BHP Billiton, less than two percent of underlying EBIT. So, nothing sinister here about Rio Tinto and BHP Billiton getting out, they are just noncore. Moving along now....

What? Foxconn is buying 1.6 billion Dollars worth of Sharp, or 9.9 percent. My immediate thoughts, like everyone else, is why? And then of course I (and everyone else had already) put two and two together, Foxconn and Apple and television. Err, but that only makes three. Of course the fourth one is the Apple TV. Or perhaps it is going to be called the iWatchTV. It is tricky to understand the relationship between Hon Hai and Foxconn, but the two are intertwined. And as this Bloomberg article points out, Sharp are in trouble -> Foxconn Counts on Apple's Future Through Sharp Investment. Either way, this does confirm that Foxconn see their customers (which include Microsoft (Xbox) and Amazon (Kindle)) needing better displays. Sharp closed limit up, over 16 percent. As I often say, proximity to China will hold Japan in good stead. So, whilst their population might be ageing, the same could be said for China too, the growing middle class across the rest of Asia will help existing Japanese businesses too.

Byron's beats are back. He talks about a sector that I really like.

- This morning we had yet again some fantastic full year results from Capitec who are finally growing their earnings into what was historically a very expensive share. And clearly expensive for a very good reason, these guys are still on a tear. Headline earnings per share were up 49% to 1125c with a dividend of 300c being paid. The stock trades just north of R200 which puts the share on a historic valuation of 18 and a dividend yield of 1.5%. I wouldn't worry about the yield, it is still very much a growth stock.

According to management this growth was attributable to a heading they have labelled 'It is all about the clients'. "Acquiring new clients and encouraging existing clients to use more of our products and services is what we do. We've acquired 877 000 new active clients for the year." This has grown their client base to 3.7 million while loans advanced grew by 35% to R19.4bn.

"The unsecured credit market is showing continued growth. Unsecured credit (excluding credit card facilities) granted during the year to September 2011 grew by 56% according to the statistics published by the National Credit Regulator ("NCR"). The loan sales reported to the NCR by Capitec for the same period grew by 71%."

I suppose the biggest question being asked is about the quality of these loans. Many people have been calling the unsecured loans sector in South Africa a bubble. I beg to differ for two reasons. Firstly I think we underestimate how under banked we still are as a nation thanks to our horrific past. We also underestimate the informal sector who have unsecured loans as their only form of finance even though they have a consistent income. Secondly, disposable income in South Africa is growing. Standard Bank had this to say in their financial results last month. "While households took on additional debt, growth was lower than the increase in disposable income, bringing down the household debt-to-disposable income ratio to 75% from 78% in 2010." Above inflation wage hikes thanks to our overpowered unions actually has some positive knock on affects on the economy and specific companies in the right industries.

So how do they see the future? The focus is on clients, growing the numbers and improving services. They plan to open 55 new branches and are clearly confident that the demand is still there for affordable banking and unsecured loans. As an investment we still prefer African bank. Micro lending seems to be where the best returns are and that is where African bank dominate with a loan book of R44.6bn, more than double Capitec's. They are also on a massive growth drive using their Ellerines stores as kiosks. The valuations look cheaper and the dividend yield is higher. If you hold Capitec however I wouldn't be selling, it is a fantastic business, but you did not need me to tell you that.

New York, New York. 40o 43' 0" N, 74o 0' 0" W. Stocks fizzled from earlier sizzling time, all the major indices turned lower in the last hour of trade. In fact, the nerds of NASDAQ were comfortably above one third of a percent higher an hour before the close of trade, and ended up trading in the red. But the winners remained winners, a whole host of stocks closed near their highs.

I have been asked this question before, with some of your stocks at a 52 week high, are you still buyers? Well, some of them are nowhere near their all time highs, some of them are there for a reason, either an improving outlook or PE expansion has led us to this point. So the question was, do we buy, or do we hold back a little. I like to think of it in this way. You are never ever going to get the timing right. I would loved to have bought GE stock for 1.20 in 1980, currently 20 Dollars. That would have been great. Or Coca-Cola for 1.50 back in that year too, the stock trades above 70 Dollars a share now. Both these companies trade below their all time highs of the biggest PE expansion we have ever seen, back in late 1999 and early 2000. Coke pays a 51 cents per share dividend per quarter now, versus a 15 cent dividend when it traded at that all time high, quite clearly the stock was overvalued at that point. Very overvalued. And now? Well, US domiciled companies have changed their sales mix geographically, into much faster growing parts of the world.

Currencies and commodities corner. Dr. Copper is lower at 383 US cents per pound, the gold price is also lower at 1676 Dollars per fine ounce. Ditto the platinum price, which is down at 1632 Dollars per fine ounce. The oil price is also lower at 106.29 Dollars per barrel. The Rand is weaker at 7.63 to the US Dollar, 12.15 to the Pound Sterling and lastly 10.18 to the Euro. We have started lower here today, in part slippage in the last part of New York trade.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment