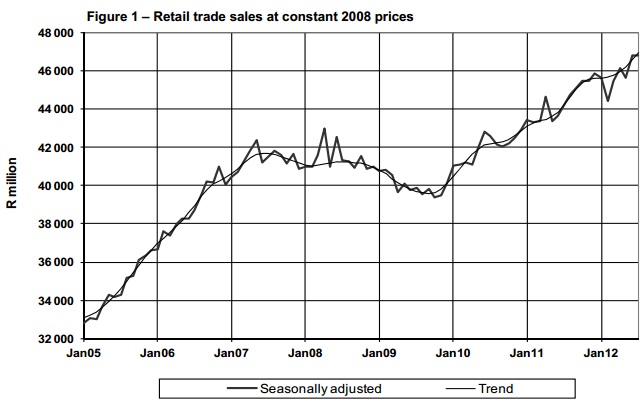

Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E. After all was said and done I guess it was a disappointing end to the days trade, the all share barely budged from where we had started off. Banks had a good day, remember that there is an MPC meeting today, the Reserve Bank is expected to keep rates on hold. In large part due to rising CPI, which you can read here via the StatsSA website: Consumer Price Index - August 2012. Both Food and Transport, as a result of rising energy costs hit the CPI basket hard. At the same time I guess that would have translated to lower retail sales, although these are for the July 2012. But still, the headline number missed the estimates, some might say that was a sizeable miss. This is as people cut back on discretionary spend. This graph from the release shows you that retail sales have continued to climb and recover:

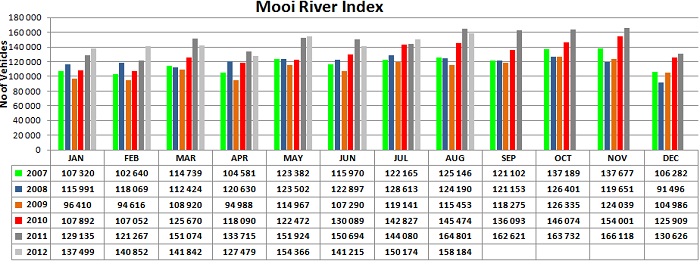

What did interest us however was that retail sales had slowed quite significantly, earlier in the cycle than you might have expected. Consumers became stretched earlier in the cycle. The Mooi River index for the month of August showed a four percent drop when compared to the prior August. So what does that mean? Well, quite clearly it is not as good as late last year, it is tougher out there.

However, in a series of nine reads for the month of August, this is the second best. But, 158 thousand passes through the Mooi River toll plaza of trucks with five axles or more compares very favourably with 87 thousand trucks passing through in August 2004. It all makes for rather interesting reading though. Clearly, although we are still at historically elevated levels, we are seeing a flattening as the overall economy splutters.

Yesterday I had the opportunity to get feedback from a few business folks who thought that the Lonmin wage settlement was a very bad thing for South Africa. Yes, higher wages continue to make us less competitive. First, don't get me wrong, if people work harder and their performance exceeds expectations, then they must get paid more. Productivity is a major issue. I was not surprised then to come across this Economist article: Could the deal be contagious? This line I guess is what we know already: "Looking at Lonmin, other miners may conclude that militancy is the best way to squeeze more money out of their employers."

That is not so great I guess for wage settlement and negotiations in our country. There was union scrambling yesterday. TimesLive is running the story: Vavi rejects 'dangerous' Lonmin wage deal. And then an interesting interview on Moneyweb involving Peter Major, I really like that guy, but it starts with Simon Scott, the acting CEO of Lonmin. I snarkily made a comment yesterday which suggested that now that the wage negotiations are over, Ian Farmer (the sick CEO) might come back to work. That was unfair, I have no idea about his personal circumstances.

But you should read the transcript: The costs of Lonmin's 'historic' wage agreement. 192 million Rands extra added to their yearly costs. The second half of the conversation is with Major, who has, as Al Pacino (Lt. Col. Frank Slade) in Scent of a Woman says: "I've been around, ya know?" Major has been around. And he says, from the interview: "We can, but we've got to be more productive, we've got to be more efficient and unfortunately we've got to be more educated, harder working as well, and we can move up the curve. But you can't move up the curve if the industry is going broke and costing jobs year after year. And that's what's happened here. So it's a good place for us to be aiming to get to, but there's a lot more countries that are making a lot less than us that are just about as productive."

Like I said, people must get paid more, but the company paying them more must be getting more too from the employees. I suspect that this is only the beginning of what is becoming a tougher environment for companies to operate. The government, for their part have threatened to charge anyone who incites violence. I guess companies might feel that this approach could somewhat neutralize what could become an explosive situation. Think about it, what would you be feeling if you were a rock drill operator at Impala Platinum and you are earning a whole lot less than the Lonmin employees? You are doing the same job, getting paid less.

- Byron's beats

Yesterday Japan, the world's 3rd largest economy, announced a programme to ease monetary policy in order to stimulate their economy which has been in a decline for decades. Let's just say that this is not their first stimulus plan announced. What surprised the market was the extent of the stimulus with an increase of its asset buying program to 80 trillion yen ($1 trillion) and a 6 month extension of the program to the end of 2013.

This was on top of the Fed's program to buy $40bn a month of mortgage backed securities and the ECB's willingness to buy debt from Euro-Zone countries who are struggling with lending rates. So are we having central bank wars or to simplify it, currency wars yet again? Remember that if a country prints money it lowers rates and increases the supply of their currency. This should decrease the value of that currency as supply increases and locals search for higher yields elsewhere. Countries like Japan, The US, many Euro-Zone countries and China prefer weaker currency's because they are big exporters.

But if all of them put more money into the system it will cancel out their attempts to weaken currencies, much like the prisoners dilemma. Central banks have to print money just remain neutral. What are the negative repercussions here? People immediately assume negative connotations to this type of behaviour. The biggest risks of too much money in the system are asset bubbles and inflation. So is this going to happen?

It's a bit of a catch 22. Inflation is low because there is not enough demand out there which means companies have little pricing power. People are deleveraging after getting burnt in 2008 and banks are still very risk averse. But the whole reason for the stimulus is to create demand which in turn will bring about inflation. For central banks it is about managing this and being a buffer for the cycles. That is why mandates are to keep inflation rates within a band and if demand were to increase then mission accomplished with a new mission to curb inflation arising.

I feel that at this stage there is enough room for all this stimulus. Right now growth is the priority. I also think that the negative connotations that come with 'printing money' are unwarranted. Every man on the street who has very little knowledge of the topic immediately criticizes central banks without much substance. Printing money can be sustainable if there are enough assets to act as collateral. That is the case, populations are growing and assets are being created all the time. Innovation.

But most importantly, central banks best tool is to create confidence. It gives businesses and individuals that little nudge needed to get the ball rolling. That, for me is the best news from all of these announcements.

Digest these links.

What? This is a crazy story, but then again the Russians are about the right people for this. Russia reveals shiny state secret: It's awash in diamonds The Russians have been hiding the biggest stash of diamonds. But don't stress, this is not going to smash Anglo, these are industrial grade diamonds. But how do you hide this for so many years? I guess location is key, the site of the impact crate is an hour and a half flight from a town, Khatanga, that is one of the most northern Russian inhabited places. I guess this is hardly anything other than a hamlet with a population of around 3500. Russians. Amazing and hardy people. Nuts though.

Is the housing market starting to take off? Yes or no? Well, now I am starting to see the mainstream stories titled Housing Takes a Leap Ahead. Most of this comes after some very pleasing housing data yesterday. Still, I am mindful that we are a LONG way from where we ought to be on housing in the US. But with the program from the Fed, who knows, perhaps this time next year the picture will look very different.

Lies, damned lies, and Argentina's inflation statistics. The suggestion is that nobody believes the statistics coming from Argentina. I guess this is not new. But what did strike me is how inflation seems to strike. Because the other day, running on the BusinessInsider was a slideshow titled How 9 Countries Completely Lost Control Of Inflation. War and dumb economic decisions including nationalisation of key resources. Yip. That is why I think Argentina is running a higher than reported inflationary figure. Another reason to believe that state intervention in the economy should be limited to collection of taxes to run the various social programs.

Hmmm... I could see this job coming. The WSJ had this story from two days ago, Baxter Robot Heads to Work. It is subscription only, but the story is simple. For 22 thousand Dollars you can replace humans with a robot. Of course the tasks performed are pretty low key tasks. You can watch this Rethink Robotics: Meet Baxter. Like I said on Twitter, this Robot is counter revolutionary. Any factory owners out there who think that they could improve productivity with this device, let me know what you think!

New York, New York. 40o 43' 0" N, 74o 0' 0" W Markets were buoyed by the better than anticipated housing data, existing home sales were a really big beat, housing starts were a narrow miss, whilst building permits were a marginal beat. All these indicators are pointing towards a steadily improving market. And like I said above, the Fed is also going to be key to all of this. Driving rates down, refinancing, more money in the pockets of consumers and rising housing prices might be just the start that the housing sector needs in the US. Oh, and fiscal cliff. Possibly the one serious issue that could derail confidence for half a year or so, I suspect that post the US elections that the folks in the US will get cracking. Or at least I hope so, not too many people have the same amount of confidence that I do, and I guess rightfully so.

Currencies and commodities corner. Dr. Copper is last at 370 US cents per pound, lower on the session. The gold price is also lower on the day, last at 1757 Dollars per fine ounce. The platinum price is also lower at 1602 Dollars per fine ounce. I guess it is fair to say now that the production is coming back on line, the price should be lower. The whole of the resources complex is lower as the Chinese manufacturing data looks feeble again, even though it is higher than last month. The oil price is getting crushed as the Saudi's decided that this was the time to act. 91.48 Dollars per barrel, the move up and down in recent days has been eye popping. The Rand is weaker. Risk is off, thanks to the aforementioned HSBC flash Chinese PMI data. And stocks are slightly lower to start with.

Sasha Naryshkine and Byron LotterEmail usFollow Sasha and Byron on Twitter011 022 5440

No comments:

Post a Comment