"In the Middle East there are only 383 out of a total of 9669 beds (nearly 4 percent), Southern Africa at nearly (79 percent), Switzerland the balance, 17 percent. So ..... you can quickly see that the kinds of facilities external to South Africa are a lot more profitable, on a per bed basis."

To market, to market to buy a fat pig. The Dollar strength continued, contrasting economic data on both sides of the Atlantic, in the US, the ADP jobs data (a precursor to the non-farm payrolls number this Friday) was stronger than anticipated, clocking 230 thousand jobs for the month of October, in Europe however the picture was different. UK services PMI dropped to a low for the year, missing estimates, across the channel and into Germany services PMI clocked a 22 month low. Just how much the sanctions and the freeze in trade with the Russians has to do with the downturn and stodgy European conditions, time will tell.

The Dollar was boosted by both favourable numbers in the local US economy and worse data in Europe, the knock on effect to the broader commodities market was felt here, there and everywhere to borrow a line from Dr. Seuss. My youngest daughter loves those books, they all come flooding back when I read them to her. Just to think, the bulk of the books written by Theo Geisel (Dr. Seuss), were written long before I was born. Over 600 million copies sold of all the books, there were around 60 books in total, pretty prolific guy. Agatha Christie sold over 4 billion books according to wiki (69 books and 19 plays), some Spanish lady by the name of (excuse my ignorance) Corin Tellado published over 4000 novels. Yowsers. Barbara Cartland wrote 23 in a single year, ending up with 722 in her lifetime. I don't know whether to be pleased or ashamed that I have never read a Cartland novel, Agatha Christie on the other hand, I have read many of her works, none for over twenty years however!!!

Back to markets, getting distracted here, more than a little. A strong Dollar normally means weaker commodity prices, the gold price gave up more ground and is now trading at levels last seen 4 years ago. Below 1150 Dollars an ounce. Higher prices along the way over the last decade have meant that the higher cost producers have been able to get by, at least they have been able to stay afloat, reduce debt and restructure, cut out unprofitable operations. As this Bloomberg piece points out -> Plunging Gold Price Has Mining Companies Selling At Loss, the problem is very close to home.

Taking an excerpt of that article: Gold fell to a four-year intraday low of $1,137.10 an ounce today, below production costs for seven of 19 mining companies tracked by Bloomberg Intelligence, including Harmony Gold Mining Co., South Africa's third-largest producer, and Primero Mining Corp. Two more producers are within $50 of the figure. Read further down the article and you find that Harmony's all in sustaining costs are 1245 Dollars per fine ounce. Holy smokes, that is more than knee deep, a leaky boat up the creek, forget the paddle.

If you read the transcript of the interview that Alec Hogg did with Graham Briggs, the Harmony CEO yesterday, Briggs says the following: "Alec, look it is obviously, as you say, quite interesting and probably for most of us, believe it or not, exciting times. There are certain things that we can control and other things we can't. Of course, the gold price is one of those we can't but we have to adapt to it, as one of the external factors. What we can adapt to is to try and increase the production and keep the costs under control or even get the costs down, and that is really, where our focus is." Exciting times? So unless the Bloomberg article got it wrong, how could one be excited about being that deep down? Look, there is a whole lot less debt, they can ride this out. Equally frustrating for them is the general lawlessness, 150 odd people lighting fires underground and mining illegally. Imagine that this happened in the basements of Standard Bank, or Investec, or even PPC for that matter?

That article from yesterday (sorry to repeat), in which we included the the excerpt from that article An Opportunity in Precious Metals Stocks? "Volatility is roughly double that of the S&P 500 over this same time frame while the S&P 500 gained almost exactly double the annual returns, 11.20% per year to be exact." Avoid all of the precious metal stocks I am afraid, single commodity stocks too.

A company NOT to avoid is one involved in the growing sector of healthcare. You might buy fewer restaurant meals, you may go down in the food stakes to brands of lower quality, heck, South Africans might even eat humble pie and downgrade to a lesser German automobile, the shock and horror of it all. When it comes to your health however, you are almost always inclined to go with the best affordable option, the truth is that the wealthier you are, the more you can spend on quality life saving therapies or procedures. Which is why we like businesses like Mediclinic, that company released their results this morning, for the six months to end 30 September 2014.

The company continues to grow well across all their segments, revenue at a group level grew 19 percent to 16.828 billion Rand, normalised EBITDA was 18 percent better to 3.329 billion Rand, with marginal lower EBIDTA margins at 19.8 percent. Basic normalised HEPS increased 22 percent to 185.2 cents, remembering that the share price is 97.81 ZAR. A dividend of 31 cents (interim) is 11 percent higher than in the prior reporting period. The dividend at the full year stage was 68 cents, an 11 percent or so increase on that is around 75 cents, add the two together, slash off the 15 percent dividend tax and you get to less than a one percent yield. You are not owning this company on the yield, that is for sure.

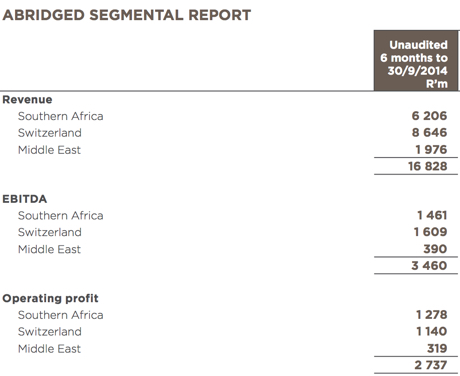

From a geographic point of view, here goes, this is the split:

So, here goes, Southern Africa is 36.9 percent of revenue, it is a much bigger profit generator, 46.7 percent of the group. Obviously from that, you can tell that from a revenue point of view that the group is more an international business, Switzerland is 51.4 percent of revenue, it is however only 41.6 percent of operating profits. The Middle East (all 2 hospitals and 9 clinics) represents a large portion of profits.

Also, if one wants to throw in number of beds here, let me use that opportunity. In the Middle East there are only 383 out of a total of 9669 beds (nearly 4 percent), Southern Africa at nearly (79 percent), Switzerland the balance, 17 percent. So ..... you can quickly see that the kinds of facilities external to South Africa are a lot more profitable, on a per bed basis. On the premise (checking out profits) that not all beds are the same, let us work out operating profits per bed, per region. And then work it out on a day basis, operating profits per bed, per day, per region. Not tricky, just a little math. So, divide the operating profits, per region by the number of beds, by the number of days during the year (half of a year = 182.5 days) and then hey presto, you get a number.

Roughly, Southern Africa is 917 ZAR per bed per day of operating profits on 4 453 Rand of revenue (same basis total revenue per bed per day), in the Middle East each bed generates 4 564 ZAR of operating profits off of 28 270 Rand of sales, in Switzerland the daily bed revenues are 28 712 Rand, with operating profits per bed per day at 3 786. Operating margins are pretty similar right, however costs are obviously much higher where the richer people (as a collective) are, in the Middle East operation and Switzerland.

Of course not all beds are occupied at all times, the occupancy rates for the last six months are as follows, Southern Africa 75.6 percent, Switzerland lower than the prior two full years at 72.3 percent, this is as a result of being measured against the occupancy rates for the full year, the first half in Switzerland coincides with Summer, Winter is a higher period of occupancy for hospitals in Switzerland. True story. I cannot find an occupancy ratio for the UAE/Middle East business. Perhaps too few beds to measure accurately, I should put a question into the people at their investor relations.

Medical healthcare is an emotive business, the users of the service are frustrated, it is after all your life that is being delt with. Nobody wants to be ill, or have any surgery, at least not of the elective kind. If you can be one of the most reliable partners, attract the best talent and continue to offer a better than the state (the alternative) solution, you are well placed. Healthcare is also a necessity for upwardly mobile middle income people, of course it is as much a demographics story as any other. As more people in the developing world move into the middle income brackets, those businesses should continue to expand. As importantly, as richer people live longer, as a result of more expensive therapies, better nutrition and more healthy lifestyles, medical care of the quality kind becomes more important in their lives.

The stock looks expensive, at just under 100 Rand, expensive however for a reason. Whilst the company continues to ramp up their infrastructure (both new facilities and spend on current facilities, hospital equipment is expensive), top line growth should moderate to the mid teens, profits too, earnings per share should be able to reach 6 Rands plus in the next two and a half years. The dividend will still be average at best, this is however a growth company operating increasing in rich countries at scale, most of their customers across their markets are able to afford the quality care. We continue to accumulate the company, buy.

Things that we are reading, that we think you should be too

Having a look at the evolution of books and where we are heading - From Papyrus to Pixels. Moving away from publishing houses will make it easier for people to publish but will also allow poorer quality material into circulation.

Lower oil prices takes sometime to filter through the economy, let hope that it stays at these levels for a long period of time - Cheaper Oil Arrives Too Late to Help Snakebit Farmers.

Competition in online retail is heating up as companies strive to get new customers and keep old ones - Amazon.ca raises stakes in same-day delivery service. For a company like Wal-Mart it is all about keeping their customers as more and more sales are done online and less in brick and mortar stores.

Home again, home again, jiggety-jog. Tiger Brands released a trading statement yesterday, moments before the market closed. We can cover those tomorrow, it has been an epic time for the stock, up an astonishing 5 percent. A food producer up that much! The company is trading at record highs, what does not help a producer of raw commodities in the short term definitely helps someone who buys raw commodities and then sells it onwards, like Tiger Brands. Results soon, 19th of November. That is not enough however for the rest of the market, all the stocks combined are marginally lower after another record setting day for the Dow Jones Industrial Average as well as the S&P 500.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment