"I think that all you need to know about Europe and their problems is that more people want to get into and live in Europe, as a result of their wealth and prosperity than want to leave Europe, for other places on the planet. Over the last 9 years there are "only" three economies that have gone backwards in Europe, the obvious ones, Greece, Italy and Portugal. Germany and in particular Eastern Europe has certainly prospered by being one economic zone, providing the much needed cheaper labour in what is an expensive place to work, the benefits are of course not the same for all Europeans. Perhaps that would be the leveller."

To market, to market to buy a fat pig. A bit of a choppy day for stocks locally, we must remember that last week was huge, stocks rallied around five percent here and globally went to some previously unseen levels. The Japanese experiment continues, the Yen is at a 7 year low, inflation is starting to creep into the Japanese economy, it is what they want, right? In Europe, in Brussels to be precise (went through the train station once), the European Commission has changed their forecasts of growth for each country. And let us just say that it looks ugly, uglier than before. There are many painful things that many of these countries can do, Greece is starting to make a comeback. As is Ireland and Cyprus.

They are however tiny in comparison to the really big economies that matter in Europe, Greece and Portugal have similar sized economies, they are however together around 3 percent of the total GDP of the European economies combined. It is more important what happens to Germany, France, the UK and Spain, rather than Malta, Slovakia, Serbia, Latvia or Bulgaria. Those economies could all double and it would not even move the needle. In fairness to all the other countries of Europe, Germany (80.5 million), France (65.6 million), the United Kingdom (63.9 million), Italy (59.7 million) and Spain (46.7 million) collectively have more than 60 percent of the population of Europe, it would be obvious that their economies would be bigger in aggregate. In terms of their contribution to overall GDP to the EU, here goes, Germany 20.9%, France 15.8%, United Kingdom 14.6%, Italy 11.9% and Spain 7.8%.

Inside of the OECD (Organisation for Economic Co-operation and Development), the richest people on a per capita basis (net average) are the Swiss, at 512 thousand Dollars per person. On a median basis, Australia trounces everyone, being the most middle class of all the OECD countries. In terms of biggest populations, the USA still trounces everyone, France is not that far behind, Italy beats Germany. That is right, Italians and French people are richer than German people, perhaps the most obvious point is that there was less rebuilding after the second world war, less of the destruction both economically and physically. That is why the Europeans will continue to pull together, they know what not to do, too many wars over too long a period, into a time of peace and prosperity.

I think that all you need to know about Europe and their problems is that more people want to get into and live in Europe, as a result of their wealth and prosperity than want to leave Europe, for other places on the planet. Over the last 9 years there are "only" three economies that have gone backwards in Europe, the obvious ones, Greece, Italy and Portugal. Germany and in particular Eastern Europe has certainly prospered by being one economic zone, providing the much needed cheaper labour in what is an expensive place to work, the benefits are of course not the same for all Europeans. Perhaps that would be the leveller.

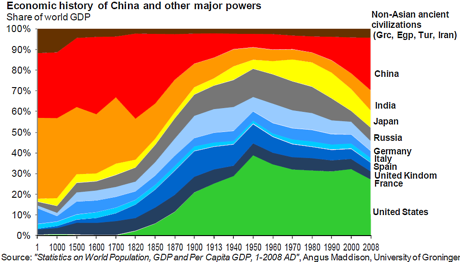

OK, back to markets quickly, locally we fell around half a percent, resource stocks went backwards. Over the seas and far away (from us) stocks in New York were mixed, another mixed session, it is holding the levels though. Futures indicate a marginally higher opening. As you were. Over the last three months the S&P 500 is up nearly 4 percent. I suspect that we will continue to make headway through to the end of the year, the global economy will continue to grow, there will be hiccups along the way. Check this long term graph that I managed to find on the web, an old graph of global GDP estimates from year one to year 2000, via Angus Maddison, who was a British economist who excelled in this analysis ->

As you can see, China is making a comeback relative to where they used to be 400 years ago, India has lots of work to do. The Americans, as you can see, are the new kids on the block, on a relative basis.

I need your help. Yes, you the people of the newsletter! I need as many retweets as possible. If you do not know what that is, sign up for twitter and then follow the link below via an image dropped in there. Follow and then retweet, I need the votes to assure me of a "semi final" spot over the rest of the pack. So I am begging my audience, I need you!

Click, vote, I will see via my notifications. Thanks in advance sports lovers, I know you're the best {wink}. This is perfectly inline with any person lobbying for votes in the midterm elections, the Republicans have crushed the Democrats, I need to win here too. So please. Vote for me, if you want me to win, to borrow a line from Arnie in the Terminator.

This is different. BHP Billiton is one of the first (of any sort of scale) companies in the US to sell crude abroad. The ban of selling crude oil abroad in the US has existed for 40 odd years, it is OK to sell refined products, not the raw materials. It seems, from this WSJ article -> New Oil Shipment Shows Cracks in U.S. Export Ban, that one of the biggest private companies by sales globally, Vitol SA, will then sell onwards.

Last year Vitol did over 300 billion Dollars worth of turnover, total employees are less than five and a half thousand folks. Wow. Vito are not exactly squeaky clean, I suspect that when you are a major selling energy all around the world you have to deal with everyone. Sadly economic and democratic freedoms are not all equal.

So what does this mean? Oil prices have been on the slide for months now, we are now at a three year low on oil prices after yesterday taking another drubbing. Of course this is excellent news for consumers (see this post -> Food and Gas Prices are Deflating Fast), general consumers will have more money in their pockets, in order to spend on other things. That is better for global trade, ironically more spending means that more goods have to get to certain points, more goods getting around requires more transportation which means greater energy usage.

In other words, the oil price has to stabilise at some point, I suspect that we are pretty close, without knowing anything extra, other than what I have read. Remember that all the extra crude from the US brought online in the last half a decade has meant close to energy independence for the US, ironically the lower prices means that there has to be pressure brought on the same said producers, higher prices mean greater exploration and pushing boundaries, lower prices mean cost controls. Anyhow, as the article points out, the economics at current prices means that it is not high margin business, building those long term trade relations however could be key here.

Things that we are reading, that we think you should be too

We have shared links about Uber before, it is the future and hopefully will get cheap enough to substitute owning a car - How Uber Is Changing Night Life in Los Angeles

Since the market correction in October there has been less talk about the market being too high. Still an interesting perspective from a frontline investment bank - GOLDMAN: The Risk Of A Stock Market Crash Is Low.

This article highlights why resource stocks have such small weightings in our portfolios - An Opportunity in Precious Metals Stocks?. These stocks are very cyclical, its feast or famine which is not ideal for most investors and "Volatility is roughly double that of the S&P 500 over this same time frame while the S&P 500 gained almost exactly double the annual returns, 11.20% per year to be exact."

Home again, home again, jiggety-jog. Stocks are flat here mid morning, resource prices lower again! Some Rand weakness starting to creep in here again.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment