"Perhaps, as we discussed in the office that some folks are starting to concede that the sum of the parts is and should be worth more than it is currently. As Naspers effectively is a proxy for Tencent, along with all their other businesses (including these new ones), surely we should not as South African investors second guess Chinese investors valuations of Tencent? It seems as if we apply a discount to the Hong Kong valuation, the stock (Tencent) trades on a multiple forward of 30, which is expensive by most measures, not too much when the company is growing earnings in the region of 40 percent."

To market, to market to buy a fat pig. A flat day for the equities markets locally after all was said and done, resources lagging heavily, industrials were the stocks holding us together, more on Naspers below, where we look at the deal announced Friday as well as a trading update. That was pretty huge for the local markets and the difference between being down on the day and flat. That is the difference between having a portfolio that is spread across different investments and a portfolio that consists of only a couple, or one company.

John Maynard Keynes (the English economist) wrote extensively on the concentrated portfolio, consisting of one stock only at times. Quite simply he said something which I guess we would all know and understand well anyhow: If an investor chooses a single stock well, its return will greatly exceed that of the general market. A bad choice may result in total loss of the investor's funds. Quite true, Keynes in fact crushed the index solidly over a period of 20 odd years with this approach, bearing in mind that he (Keynes) had both the Great Depression and the Second World War to contend with!

Amazing really, he managed a return of some 12 percent per annum in his capacity as an investment advisor for a specific fund he looked after, over the same time period the British market was down. 1927 to 1945 is when the Chest Fund crushed the index, returning 480 percent whilst the index was down 15. Amazing, imagine if Keynes had been around today. And to think that Keynes was an economist. I am only kidding, I know many economists, they are all brilliant, it is fair to say that Keynes was in a school of his own in this regard.

Another day, another set of Naspers news, this time it had to do directly with earnings. This was a trading update for the six months to end September, the first half of Naspers' financial year. Earlier in the day the stock had seen a serious leg up on the news that they were entering into JV's with separate businesses around the developed world to pursue classifieds. I am not too sure about you personally, it is not something that I spend a lot of time doing, looking at classifieds. I suspect that the classifieds of yesteryear and the classifieds of today are browsed in a very different manner.

I am not too sure why the Naspers share price should have rocketed up so much on the classifieds news, if you missed our write up on Friday, here goes, a quick refresher: Naspers is classified. Classified indeed. Byron will get that!! Lots all happening, the stock soared nearly 9 percent on a down day, reaching an all time high of 1603 and some change during the course of the morning.

Perhaps, as we discussed in the office that some folks are starting to concede that the sum of the parts is and should be worth more than it is currently. As Naspers effectively is a proxy for Tencent, along with all their other businesses (including these new ones), surely we should not as South African investors second guess Chinese investors valuations of Tencent? It seems as if we apply a discount to the Hong Kong valuation, the stock (Tencent) trades on a multiple forward of 30, which is expensive by most measures, not too much when the company is growing earnings in the region of 40 percent. In fact, if the Tencent share price "went nowhere" for a couple of years, the share price would probably only then look attractive to many naysayers.

I think that there is a level of arrogance in applying a discount to Tencent from the local asset management community. That is a story for another day, often the ghosts of expensive stocks past come back to haunt you, calling something lower to a level that you think is acceptable discounts what the collective market thinks. So here is the Trading Statement:

We expect core headline earnings per share to be between 18% (1 473 cents) and 24% (1 548 cents) higher than the comparable period's 1 248 cents. Shareholders are reminded that the board considers core headline earnings an appropriate indicator of the sustainable operating performance of the group, as it adjusts for non-recurring and non-operational items.

And then the trading update continues:

It is expected that earnings per share for the six months to 30 September 2014 will be between 180% (2 209 cents) and 190% (2 288 cents) higher compared to the prior period's 789 cents, mainly as a consequence of gains recognised by our associates on the sale and re-measurement to fair value of investments. These gains have been excluded from both core headline earnings and headline earnings per share. Headline earnings per share for the period are expected to be between 18% (1 089 cents) and 24% (1 144 cents) higher than the prior period's 923 cents.

These results will be out on the 25th of November, next week Tuesday. No doubt they will be exciting, they always are. Seeing as Tencent, the share price has barely budged (OK, up a little since their results last week Wednesday), the classifieds deals are the ones that have gotten people very excited, the realisation that there are all sorts of other businesses here, more especially the satellite TV business. On our market BHP Billiton has been eclipsed by Naspers, that does however not take into account the two separate share registers that BHP Billiton have. Naspers however has a market cap of 648 billion Rand, and whilst the three companies ahead of them (BAT, SABMiller and Glencore) have their primary listing elsewhere, Naspers have their primary listing here in Johannesburg. Wow, a grand success story.

Things that we are reading, that we think you should be too

Tesla is one of the hardest stocks to value because they are a disruptor in the car industry and no-one can accurately predict how many Tesla's will be sold in the coming years - We will all drive a Tesla in 25 years: Ron Baron. An interesting piece of information from the video is that a Tesla only has 18 moving parts compared to your "average" combustion car that will have over 2000.

An interesting blog piece that looks at the emotive topic of taxes and "are the rich paying enough" - New CBO study shows that 'the rich' don't just pay their 'fair share,' they pay almost everybody's share. These numbers are all averages and does not look at the tax figures on a individual basis but the conclusion of the author is that the rich are paying more than their fair share.

Another feather in the hat of human problem solving - Google-backed initiative will pinpoint illegal fishing in near-real-time. Its great to see one of the company's that we own being able to invest in this technology.

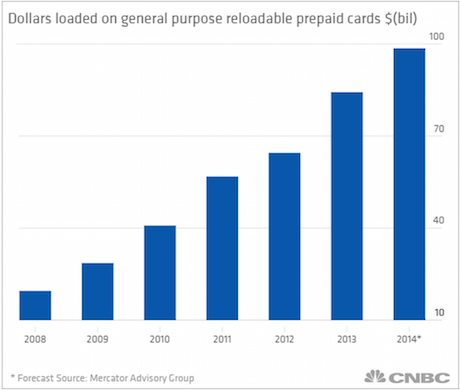

The article focuses on new regulations for pre-paid cards, I am more interested in the graph showing usage of the cards.

.

.

Prepaid cards are not big in South Africa, buying gift vouchers is the only place I can think of where these type of cards are used. These cards are as good as cash and you don't need a bank account to use/ have one, so they are great for the unbanked and for people who prefer something closer to cash. A good trend for Visa. Here is the article if you want to know more about the regulations that are proposed - CFPB proposes widespread prepaid card regulations

Home again, home again, jiggety-jog. Stocks are higher here, not so much, the gold companies are comfortably ahead of the rest of the market, as are the platinum companies. A bounce. That bounce is taking all the stocks across the board marginally higher.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment