"Why have we seen such strong performance from the share price? At current levels the share trades at 21 times earnings excluding the impairment one offs. Nestle (24 times), Kraft (18 times) and Mondelez (22 times) all big global food manufacturers trade at similar multiples. Why shouldn't Tiger trade at 21 times earnings then? It is operating as the biggest food producer in Sub Saharan Africa, which is expected to grow collective GDP by 5.8% in 2015. What we have seen here is a rerating in the sector (AVI has also done really well)."

To market, to market to buy a fat pig. All around not the best day for the local equities market, it always depends where you are invested however. Precious metals, thumbs up (blue thumb), the rest of the majors, not so much. In the end the local market had fallen nearly half a percent, we did manage to hold the 50 thousand level however. What we also managed to hold were the Super Eagles last evening, a 2 all draw with the Nigerian football team away from home. This is a good result, bearing in mind that we were a man short. Bafana is starting to grow up, perhaps time to refer to the team as men and not boys?

Over the seas and far away where the grown investment community often acts like a bunch of younger people (needing comfort blankets from the Fed statement), markets settled lower after all was said and done. Coincidentally there was a Fed announcement last evening -> Minutes of the Federal Open Market Committee. Nice. It is always a good idea to read these.

It is however not a good idea to form investment ideas around what the Federal Reserve are likely to do, that would be getting it completely wrong in my view. That is all that I think is relevant in this ongoing conversation about when rates are going to rise in the US, when it happens, it will happen and there is very little that you (or anyone else) can do about it. From a perspective of owning companies, interest rates are always going to have an impact, do not make it a close consideration. You should own companies for years, not from cycle to cycle as a result of monetary policy, I have heard Buffett say that if rates went up 50 basis points next week that would not stop him from buying a company today. Exactly.

Remember that today we also have local rates decision, inflation is inside the band and the fuel price is plunging. Consumers are about to get more cash back in their pockets without having done anything special. The FRA (Forward Rate Agreements) have suggested that there is a small chance of a 50 basis point hike and a marginally bigger, but still small chance of a 25 basis point hike. Over 80 percent chance then of no change in interest rates. I suspect that the new Reserve Bank governor might talk heavy and wave his new big stick, just to announce himself. We shall wait and see.

Company corner snippets

Discovery have released a trading statement yesterday, the market was pleased I think with the overall performance. How can I say that when the trading statement came out at five minutes past the "closing bell"? It is not a trading statement that is ordinary, the release points out that as a result of acquiring all of Prudential's shares in the JV, the undiluted and basic earnings per share are expected to be 85 percent higher than the 301.4 (undiluted EPS) and 307.7 cents (basic EPS). That 85 percent is around 260 cents, just for the half year that is. Wow, that sounds huge! Wait, there is more: "The accounting effects of the release of the put option liability will not have any impact on normalised earnings or normalised headline earnings per share." More complicated actuary speak, I must ask friends of mine who are in that field. Yes, I have friends. So, given all this difficulty, a more detailed trading statement for this half will be released mid February next year. We shall see where the market settles this morning.

Woolworths have released a trading update for 20 weeks to 16 November, which includes David Jones in the numbers for the first time (effective 1 August), here is a little snippet: "Group sales increased by 47.5% for the first 20 weeks of the 2015 financial year over the comparable 20-week period in 2014. Excluding the impact of David Jones, Group sales grew by 11.9%." You must remember now that there are three operating subsidiaries, there is the South African Woolworths, then there is Country Road and now there is David Jones. They will report separately on these three, all the sales of merchandise under the Country Road in South Africa will be reported on as Woolworths. It seems from a pretty quick review of the trading update (that coincides with the annual report and ahead of the AGM next week) that all is good. A couple of people I speak to now say that they are working hard on the food side and are starting to make huge progress in the local market, winning market share. Good news. What is not good news is that the share price has fallen, the big issue I think is food price inflation, the lower energy prices will help consumers in the coming months.

I read the FT article: Apple plans to push Beats to every iPhone and came away a little puzzled. Notwithstanding the fact that the company spent a huge amount on acquiring the service, it is now going to be paid for by their customers by everyone with an iOS operating system (new) which will be pre installed. This is actually a good example of extending the ecosystem to existing customers to counteract falling iTunes sales, offer your customers something they want, a music streaming service. Taylor Swift has been sceptical, she is one of the best selling artists globally, at least this year. She reckons she is worth more, you could argue without streaming platforms like Spotify (Swift has pulled her work from that platform), she would not have as wide an audience. We will see how Apple customers respond to the streaming music services, it is a very grey area. For us as investors, this represents a shift to more annuity based income, for Apple that is.

Tsogo Sun released their six month results this morning. Everything is about flat, dividend unchanged, adjusted earnings down a little, on a per share basis unchanged. Other than that, the good news is a buyback of 12 percent of the share in issue. Weak sentiment, consumer struggling, they even point to government austerity (negatively impacted by a significant reduction in government travel post-election) and the impact of Ebola on hotels outside of South Africa. True story. The company is investing heavily in their own business, having committed 4.7 billion Rand to increasing their ownership of the Cullinan Hotel, an independent hotel management group in the UK (25 percent for 145 million Rand), expansion on Emnotweni Casino and Southern Sun Maputo, continued monster construction on Silverstar Casino, as well as refurbishment of Gold Reef City Casino and the associated Theme Park and adjacent Apartheid museum. You must go, if you have never been. The outlook is weak I am afraid for the next six months, the stock is down over five percent.

Gold Fields results for the 3 quarter were released this morning. All in costs of 1096 Dollars per fine ounce, current price of 1187 Dollars per fine ounce, Nick Holland the CEO of the company was on open exchange earlier today and he suggested that many a producer was under pressure below 1300 Dollars per fine ounce, all in costs. Having chatted to fund managers globally. Holland said that the stock had traded well this year on the promise of making cash for their shareholders. Phew, I am not too sure that many people who trade these stocks aggressively have a solid view on these matters. Anyhow, Holland said South Deep is the future of the business, it will be extremely well mechanised, never done in South Africa before and as he suggests, the last gold mine in South Africa. Wow, that is pretty telling for the rest of the industry.

Byron beats the streets

Yesterday morning we received full year results from one of our recommended stocks, Tiger Brands. Before we delve into the numbers let's just reflect on what the share price has done over the last three and a half years. Thanks Google Finance for the below graph.

The performance in recent months has been astonishing. More on that later.

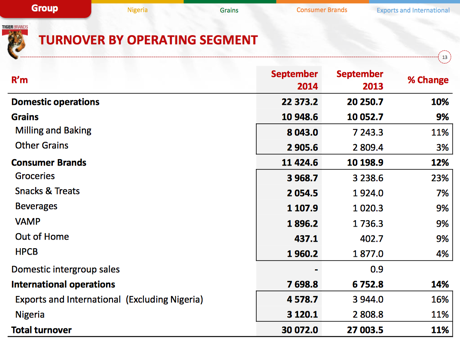

Turnover increased by 11% to R30bn, operating income increased by 15% to R3.6bn and HEPS increased 15% to 1804c. There were of course some once off impairments which we need to clear the air about before we delve deeper. A further impairment of R105 million was implemented on top of the R849 million impairment from the first half of the year for Dangote Mills.

And this was for a business that lost R282 million in the year. It lost R384 million last year so we are seeing an improvement at least. Tiger Brands is working extremely hard to turn this business around but it will take time. Each quarter the loss is decreasing and once the operational side is sorted Tiger will be well positioned, the demographics of Nigeria speaks for itself, we will have to be patient to see the results from this acquisition. Fortunately for us, we are patient investors.

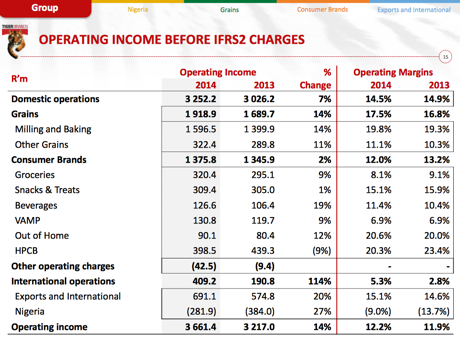

As you can imagine, within the sales of R30bn there are lots of moving parts. I hacked the below two tables from the presentation (Big up to Tiger, their presentations are always great!) which shows you sales and where they make their profits.

As you can see, a solid performance from the grains division. We have seen bumper crops and lower soft commodity prices, that is why margins in this division have increased by 90 basis points. Consumer brands had a tougher period margin wise. This is what happens when you have a weak consumer facing heavy inflation. Their international business excluding Nigeria is doing nicely and contributes a solid 19% to operating income and growing.

Why have we seen such strong performance from the share price? At current levels the share trades at 21 times earnings excluding the impairment one offs. Nestle (24 times), Kraft (18 times) and Mondelez (22 times) all big global food manufacturers trade at similar multiples. Why shouldn't Tiger trade at 21 times earnings then? It is operating as the biggest food producer in Sub Saharan Africa, which is expected to grow collective GDP by 5.8% in 2015. What we have seen here is a rerating in the sector (AVI has also done really well).

Tiger have also come through a very tough period where they have implemented heavy cost cuts making them leaner and meaner. They have pushed their brands hard in order to steal market share during a very competitive period. Tiger Brands are well positioned to benefit from a consumer which has normalised to current prices. As inputs decrease thanks to lower commodity prices Tiger will have more room to expand margins and relieve the consumer with some price decreases. Everyone wins!

I am impressed with these results. Nigeria will take a while, especially with the current pressure from lower oil prices but the rest of the business is in tact. We continue to add.

Things that we are reading, that we think you should be too

The title of this article tells you all you need to know -How America Got Crushed By The Crisis And Then Came Back In One Chart. Note that corporate profits since 2007 are up the same percentage as the stock market is up since 2007.

Tesla is setting itself up to sell hundreds of thousands to millions of cars a year -Tesla to enter India with new sedan at attractive price. This year they will sell around 40 000 cars, so there is still huge room to grow and the market has priced Tesla for that growth.

The problem of using non-renewable energy -These charts show you who's using the most of our non-renewable energy resources. The author of the blog is focussing on the problem of climate change and that not enough is being done. My argument is that using clean and renewable energy is the result of having a strong rich economy, so you have to go through the "dirty" phase to build your economy. In the grand scheme of things using dirty energy for 50 years is a drop in the ocean when we look at how old the globe is?

China allowing foreign companies in is a good thing for the companies and for China over the long run -Visa and MasterCard Poised to Enter China. This news is great for us as Visa owners, even though it may take a couple years to filter through, this is the long term time frame that we take.

Home again, home again, jiggety-jog. Japanese exports jumped nearly 10 percent during the month of October, that is the good, the very average is that the Chinese Factory gauge, the HSBC PMI index registered a low of 50, which was marginally lower than what folks expected. Plus, European PMI data was worse than anticipated, that matters. Everyone is anxious about rates going up sooner, we own companies, not interest rates. That is a little naive, of course we are all connected.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment