Samsung falls far from the Apple tree

"I know that the two products look similar in design and feel, and the optimal design might have been held by one or the other, or both. I use optimal in the sense that the single button design is huge for the fans. Now there is actually a number, 1.05 billion Dollars in damages has been awarded to Apple by a US court, which has led the Samsung board to hold an emergency meeting overnight."

Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E. Friday. I was away, watching the mountains, looking for my new spot when the Drakensberg becomes the highest spot on the planet after the events of the 2012 movie come true. The mountains never move, the news flows slowly like a spring stream and the people seem rested. At least from the point of view of the outsiders, like myself. Friday the markets locally closed slightly lower, down 0.14 percent from their all time highs on the close Thursday. Today we have started better and back at all time highs. Tell me when we are at 36 thousand points. I have a small gripe. There are people that think that the levels of the ALSI 40 matters, and there are those who follow the levels religiously. Talking about support at that level or this, breaking this and that, that is not for me. If the US markets drive global markets, then surely you should be following technical levels there, and the best chartists on that side of the world? Or have I got it wrong? I am not too sure.

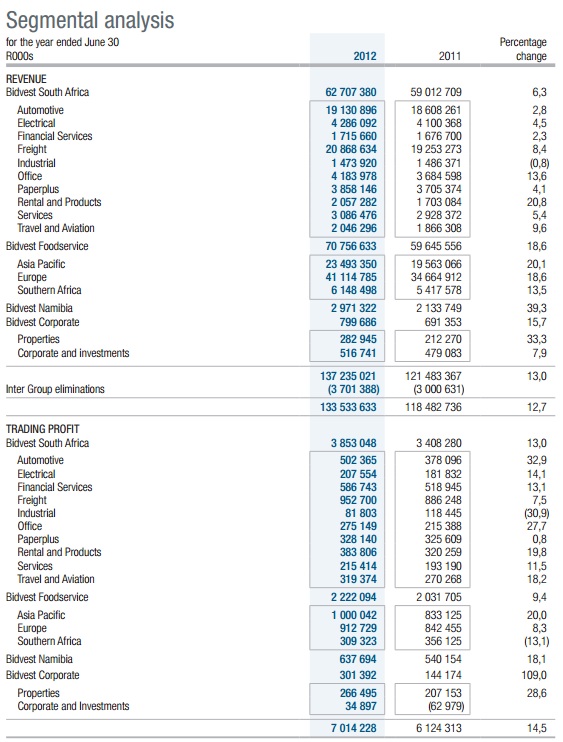

Bidvest have released results for the full year to end June this morning. They look decent enough in this "challenging" environment. The results were pretty much telegraphed in the trading statement, which we wrote up over ten days ago: Bidvest trading update. Here are the numbers that you need to know. Revenue increased 12.7 percent to 133.5 billion Rands, the companies trading profits increased to 7 billion Rands, normalised HEPS clocked 1352.3 ZA cents per share. Perhaps the biggest surprise to the upside is a 29.6 percent increase in the dividend to 622 cents per share. Perhaps this is just to take into consideration the change in dividend taxation. You, the shareholder will get 290.7 cents per share for the second half of the year, 255 cents was paid for the final dividend last year.

To get a real understanding of the business you need to understand all the profitability of the various segments. As we often reflect on, revenue counts for naught if you can't be profitable. So, in trying to determine which are the best businesses that Bidvest owns, there is no better place to look than the segmental analysis. And this you can get for yourself from the The Bidvest Group Limited Audited results for the year ended June 30 2012.

What is immediately visible is that Bidvest Foodservice, the European division is nearly 30 percent of total revenue, but is only actually 13 percent of trading profits. Asia Pacific on the other hand, is just over 17.5 percent of total revenue, but at 14.25 percent of the total trading profits, is the most important profit contributor overall. And of course has the superior margins. My point I guess is simple, if there is a bounce back in the coming year(s) in Europe, then I would presume that is a positive for Bidvest. What always amazes me though is the Bidvest Namibia division. A mere 2.2 percent of total revenues (with an increase of nearly 40 percent) translates to 9 percent of total profits. This is huge and indicates that the margins in the country just to the North West of here are nothing short of spectacular.

What is the attraction of owning this company? It is a valid question of course. Are you owning the genius of Brian Joffe, the current CEO and his deal making expertise? Because over the years he has put together this business, he has been called the Warren Buffett of South Africa. But, unlike Warren Buffett, Joffe does not own the same percentage stake in this business (Bidvest) as Buffett holds in Berkshire Hathaway. He used to own around 23.3 percent economic value in the company, but I think that was before he gave away a whole whack to the Bill and Melinda Gates foundation. And I guess if you want to be nit picking, then you could say that Brian Joffe is a whole lot better paid than Warren Buffett. This company is a steady performer, well diversified and pretty defensive. We continue to accumulate the stock at current levels.

This has been confusing me for a long time, the ongoing patent disputes between Samsung and Apple. I know that the two products look similar in design and feel, and the optimal design might have been held by one or the other, or both. I use optimal in the sense that the single button design is huge for the fans. Now there is actually a number, 1.05 billion Dollars in damages has been awarded to Apple by a US court, which has led the Samsung board to hold an emergency meeting overnight. A Korean court called it a tie on Friday, at least that is what a Marketwatch article says: Apple, Samsung tie in Korea verdict. The upshot of it all is that Samsung devices might be banned from selling their blockbuster products in the US. For the time being. Which is of course is not good for the company, the share price in Korea ended the day down 7.61 percent. Down 97 thousand Won on the session to close at 1,178,000 Won. More confusing is dealing with the large outlandish numbers.

A good friend of mine asked me once (several times) whether or not he could buy the Samsung devices stock separately, and I said no. Not easily anyhow. First things first, the stock is only available to investors in Seoul and through a GDR program in London, check out their Samsung investor relations page. But more importantly I told my good mate Bruce, you can't own the juicy parts, the phone and the tablets. You have to own all the other products when you buy Samsung Electronics. And that includes fridges, washing machines, air conditioners, TVs, laptops, copiers, cameras, networking devices and chips. Check out the Samsung 2011 Annual Report.

And inside of the handset sales, you want to only be with the high margin smartphones right? Well, as per that annual report: "Worldwide demand for mobile phones was a staggering 1.5 billion units in 2011. Samsung Electronics accounted for 330 million of those units, far exceeding our target. We realized impressive growth in smartphone sales as well. The bestselling GALAXY S II sold more than 20 million units since its launch in April 2011." So it is always going to be tough to own the company on these sort of numbers. Even if the sub segment is the most profitable, unlike Apple you get exposure to all the other products. I am left with the same conclusion as I had initially with my chat with Bruce. You can't really get exposure to what you want to. My advice to him is the same as before. If you want to not be owning Apple shares, and are looking for the competitor, then perhaps the place to be looking is Google. And not Samsung. The matter is not over. Samsung are appealing the ruling. So this is by no means finished. And in the short term, the real winner is seen as Nokia/Microsoft. See Nokia to Microsoft Seen Benefiting From Possible Samsung Ban.

Byron's beats has a look at something that was complicated. But not complicated as in a soapie, much more complicated than you would think, financial engineering at perhaps its finest.

- We have liked Steinhoff for a while now on the basis that Europe is not going to be as bad as everyone thinks. This is because they have big exposure to the European consumer through their Conforama business and also why they look so cheap based on earnings. It is a complicated one to assess. Steinhoff have been very busy of late restructuring with the likes of JD Group and KAP. Before we look at the numbers let us try and understand what the Steinhoff structure actually entails.

I'm not going to explain how this was all done because that is a whole new story all together, Sasha did a good job, in January this year in an article titled: Steinhoff looking to take control of JD Group. So let's look at the structure of the business as we see it today. Steinhoff Europe constitutes that Conforama business which is the second biggest furniture retailer on the continent. They also do manufacturing, sourcing and logistics all over Europe.

Locally they own 62% of KAP which is a R7bn listed company and has a whole host of brands in Timber, Logistics and industrial. This is from the ShareData description. "KAP International Holdings Ltd is an investment company with a portfolio of diverse manufacturing businesses. These include canned and value-added meals, maize milling, leather products, footwear, bottle resin, automotive products and towelling products."

They also own 50% plus one share of JD group who have brands such as Joshua Doore, Russels, Unitrans, SteinBuild and Incredible Connection. Many of these brands have been integrated from Steinhoff as an exchange for equity in JD group. Lastly they own 20% of PSG following a deal between Marcus Jooste and Christo Wiese whereby they swapped Steinhoff shares for PSG. As you can see it is all very complicated with a separate listing of the European business on the cards. In interviews with Marcus Jooste he says they are looking to be an investing holding company mainly in furniture retail, transport and you manufacture. There are lots of potential synergies there.

Ok here's the trading update, which looked good:

"Accordingly, shareholders are advised that both the earnings per share ("EPS") from continuing operations and headline earnings per share ("HEPS") from continuing operations of Steinhoff, for the year ended 30 June 2012, will be between 30% and 35% higher than the EPS and HEPS from continuing operations, as reported for the comparable period ended 30 June 2011."

These results include the first full year of Conforama results as well as the consolidation of JD group and KAP. Last year the company made 258.9c so we should be expecting around 345c. For a company trading at R25.80 they look very cheap. I guess there are a few concerns. Europe is of course facing a long term recession or stagnant growth at the least. That European business is 65% of revenues. There is also the complexity of it all. It's difficult to understand the business as well as what Marcus Jooste will be up to next. We continue to like it as a contrarian view on Europe but only for the hardy investor with a high pain threshold.

Currencies and commodities corner. Dr. Copper is higher at 346 US cents per pound, the gold price is steady at 1670 Dollars per fine ounce, the platinum price is also steady at 1540 Dollars per fine ounce. The oil price is higher at 97.04 Dollars per barrel, this is as a tropical storm heads across the gulf. The Rand is weaker, at 8.40 to the US Dollar. UK markets are closed today. Bank holiday. I thought bankers got paid too much in the UK, why do they deserve bank holidays too? Kidding! A public holiday with no particular attachment to an event or a person, that sounds about right to me!

Parting shot. My absolute favourite Johnny Cash song is actually a duet performed with June Carter. Although I read that Jackson (song) was a cover by the two, which changes my view on the song no way at all. At least the rendition. But why do I bring this up? In perhaps the most anticipated event of the week, once again the annual Jackson Hole pow-wow hosted by the Federal Reserve Bank of Kansas City becomes the most watched place. Why? Because Ben Bernanke, the Fed chairman, will give a speech Friday at 10am E.D.T. So what, the Fed chair gives speeches all the time? Well, the short termers mark this speech as a possible clue to further monetary easing. Do I care? Not really, but obviously this event will have a marked impact on short term price movements, one way or another. The rumour mills are suggesting that the short termers are going to be bitterly disappointed with further QE not coming. But that would mean that the medium term outlook for equities is better, not so?

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment