Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. Wow. For all the problems and issues that seem to be crossing our screens on a daily basis, it might be difficult for some folks to believe that yesterday we clocked an all time high on the Jozi all share index. The overall market closed off at the highs of the day notwithstanding the hard landing, soft landing debate around Chinese economic growth, that is still getting many anxious, in my world that is a non debate. Their sporting prowess as a nation has certainly grown, they have the numbers, and now they have the facilities, no wonder they are going to be so hard to beat in the coming decades.

But that is another story altogether, the soothing Mario Draghi words are still echoing through markets, and either shorts are rushing out in a hurry, or folks are deciding they cannot stay on the sidelines any longer. Because it seems that the European debt issues are going to be resolved one way or another. In a very slow and distinctly European fashion. In this office that is all that we have expected all along, even the perma-bear, "the Nouriel" Roubini suggested that the perfect storm that he predicted for next year, well that might not happen. In 2013 that is. I guess if you are bearish on life in general and were given wedgies at school (it happens) then your outlook on life is never going to be as cheerful as someone who enjoyed their childhood. That is what keeps humans in check, born optimists and born pessimists posturing against one another all the time.

Waffling again here. The Jozi all share index closed at 34959 points, a gain of 0.83 percent on the day, thanks in large part to a late rally, which coincided with a stronger open in the US. All major sectors were strong, banks were up over a percent, retailers rocked and added nearly one and three quarters of a percent, the resource sector added over a percent and a half. Someone pointed something out, at one point in the morning yesterday, the share price of BHP Billiton was more (in Rands) than the share price of Anglo American. So what? Their market caps are vastly different, Anglo is not the giant in the mining space that it once was, and BHP Billiton are the big daddy amongst the mining resource companies. Globally. I often say that we are lucky to have access to a company of such quality.

But what is that about, the two share prices roughly the same? As at close of business, BHP Billiton had closed up just over two percent at 242.90 ZAR, whilst Anglo American added 1.3 percent to end at 246.54 ZAR. I then thought, let us separate the currency translation, and because Google Finance deals with the majors, it is easier to compare the two. So let us start with a five year view of the two entities. BHP Billiton is up 38 percent, whilst Anglo American is down nearly 30 percent. Over ten years Anglo American is up 101 percent (these are all prices in London, the currency translation is irrelevant here, I am guessing for the purposes of this exercise), whilst the BHP Billiton is up an astonishing 548 percent. Over the last year things are not so pretty, Anglo is down nearly 34 percent and BHP Billiton are off an equally yucky, but less noticeable 17.3 percent. Less noticeable in the current environment, because the currency has buoyed our price locally, over one year the GBP has strengthened by nearly 17 percent to the ZAR. So I guess it should come as no surprise that BHP Billiton in Rands is off three percent over the last year, and Anglo American is down nearly 23 percent. Ouch. That has to hurt.

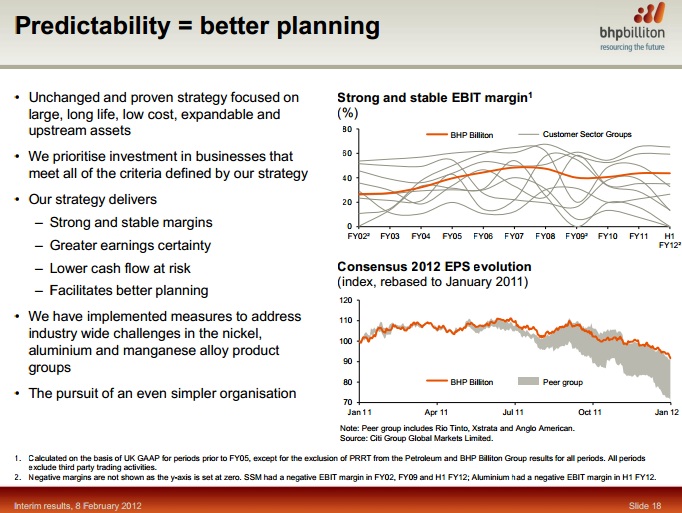

What has the market told you however? In my view it all goes back to the graphs on slide 18 of the presentation Interim results - Half year ended 31 December 2011. I have incorporated it here in this newsletter for you to see.

Look at the slide carefully, first the top graph shows you that the margins are more stable than their peer group, which are Rio Tinto, Anglo American and Xstrata, the only noticeable missing major is Vale. But that is the point that I am trying to make, BHP Billiton has the least volatile earnings of the lot. And we like the energy cluster. Anglo on the other hand continue to have issues in their platinum business, regarding costs, but then again, everyone has that in South Africa. I think in the end it does come down to the quality of your portfolio, and for the time being BHP Billiton has that well sewn up. For longer dated commodity holdings we continue to prefer BHP Billiton.

Byron's beats looks at some under the radar "stuff" from the most misunderstood big cap in our market. In my humble opinion.

- Naspers, our favoured local technology stock has been fairly active of late. Because the company is so big, when it makes an acquisition below a certain size it doesn't have to report it so sometimes it seems like the company is not acquiring assets like it used to in the past. Of course this is not the case. Recently they took over 70% in the largest online retailer in Romania called eMAG. The value was not announced but the media reckon around 100 million Euro's was paid by Naspers. The retailer which was launched 11 years ago plans to expand further into Eastern Europe using the financial backing of the multinational giant.

This is one of many as Naspers attempts to become the Amazon of the developing market. This article from Moneyweb quotes Koos Bekker, the CEO, saying that they look to make 10 to 20 acquisitions in the year to March 2013 and that they see lots of opportunities in the e-commerce space.

According to the article a few acquisitions have already been made. "This year, Naspers has purchased majority stakes in Netretail SRO, an online retail business in central Europe, and Internet Mall AS, a Prague-based website selling household goods such as washing machines. It also invested in Resolva.me, a Brazilian site that offers ratings of dentists, lawyers and other professionals."

I checked the company's financial statements for the year ended 31 March and it states that the company is sitting on R9.8bn in cash so there is definitely room for a few more acquisitions. We really like this company and the way they go about their business. Their track record for finding little diamonds in the rough has been brilliant and the next Tencent could be just around the corner.

We also really like the e-commerce sector which has huge potential. I am sure you have all bought stuff online by now and the easier it gets and the more reliable it becomes, the demand will only increase. Yesterday I wrote about Amazon and how well their e-commerce division was doing. We are still very happy to be adding to this company and are not deterred by its high valuation in terms of earnings. This is a sum of the parts company and when you look at that way, like Sasha has broken down for you on a number of occasions, it looks cheap.

New York, New York. 40o 43' 0" N, 74o 0' 0" W. Although stocks closed lower on the session it was in a way comforting (for the bulls at least) that after such a strong rally that stocks consolidated. It is after all another big week of earnings, and more so for the stimulus junkies, who are awaiting imminent action form the Federal Reserve. Perhaps the weak-ish (spell check said weakfish, I had to change to weak-ish, not even sure what a weakfish is) GDP read on Friday was the tipping point for the Fed. That number is too weak was the shouting from the gallery, the Fed are going to have to announce something more. More quantitative easing, more bond purchasing, more something else, because the spill over from Europe is causing a great deal of anxiety. Of course at the same time Treasury Secretary Tim Geithner is visiting his European counterparts, he met German Finance minister, Wolfgang Schauble, yesterday. Excuse me for leaving the umlauts off, my HTML skills are limited. If you ever wondered why Schauble is in a wheel chair it is because he was shot. In 1990 someone tried to assassinate him, and Schauble was shot in the face and spine, according to Wiki. Strong man mentally and obviously tough physically to carry on. And of course he carries higher political spirations, he was ever so close 14 years ago, but it was not to be.

Geithner is looking to the Germans to buy bonds of peripheral states, seemingly not too outlandish a request, but politically Angela Merkel has been weakened by this crisis. Rephrase, when the next elections in Germany come along, do not be surprised to see someone new. Because all across Europe this has been the case, recent elections have seen the incumbents voted out. Tim Geithner does not want to be that guy, although the job itself is a stressful one, I am not too sure if he wants to stay on. In an American context the FOMC meets Wednesday and Thursday to discuss the state of the US economy and might well present other options at their Thursday announcement, which will be around a quarter past eight in the evening here in Jozi. That announcement will come after the monthly ADP jobs report on Wednesday (the consensus number is around 120,000 jobs added) and of course before the big one. The whale of all economic reports, because the market says that is what it must be. The monthly non-farm payrolls number, and consensus is for around 100 thousand additions for the month of July. Remember that the three months prior to this have been stodgy at best. And if those two numbers are not enough for you, then the monthly ISM manufacturing number is released tomorrow. Big end to the week here.

Currencies and commodities corner. Dr. Copper is last trading at 344 US cents per pound, higher on the session, the gold price is also a little higher, last at 1627 Dollars per fine ounce. The platinum price is last trading at 1419 Dollars per fine ounce, I am willing the auto recovery in Europe higher. The oil price is last at 90.16 Dollars per barrel. The Rand is steady to weaker, last at 8.18 to the US dollar, 12.83 to the Pound Sterling and 10.10 to the Euro. We are lower on the session here to start with.

Parting shot. A crisis is only a crisis when it affects you. I was struck that perhaps this is the case through a tweet from an Italian fellow, Alberto Nardeli, who did the calcs on the European youth unemployment rate, with the release of the data this morning: "EU youth unemployment: 22.6% - Greece 52.8%, Spain 52.7%, Portugal 36.4%, Italy 34.3%, Ireland 29.2%, France 22.8%, UK 22%, Germany 7.9%". So perhaps in the words of former president Thabo Mbeki, you could well say if you were German, crisis, what crisis? Although the serious rockers amongst you will recognise that phrase as a title to a Supertramp album released years ago. Not just our former president who has used this famous line, there seem to have been many politicians over the years. But you get my point, it only feels really bad if you are in the middle of the crisis. Like the political problems going on in Romania right now. I am sure that unless you were paying attention, you have not seen too many references to that!

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment