Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. There was something very different yesterday, the JSE started disseminating information locally with the matching having moved from London to a home grown system. The idea was that speeds would have improved dramatically, but this is clearly not the landscape that we roam, the eat-what-you-kill space, but rather we are at the other end of the spectrum. So whilst we noted that the JSE and the broader participants were struggling it was by all accounts a success at the end of the session I would argue. Now there was something also different about yesterday, the 2nd of July according to Wikipedia is exactly the midpoint in the year, and we ticked over to the 2nd part of the year after midday. Now you might have thought that this would have happened a day earlier, but count your knuckles and you will see that both July and August have 31 days, and of course you know that February has fewer days in the year, even though this year was a leap year. Which begs the question, are we halfway, or not? Well, perhaps this Tumblr picture can help you, we are NOT there yet. Check out: number of days in each month

Yesterday we kind of went nowhere, the Jozl all share index closed down at 33683, a loss of just 25 points on the day, or less than one tenth of a percent. Resource stocks were the biggest losers on the day, down two thirds of a percent, PMI data across the globe helped nobody, falling mostly bar for a few surprises here and there. My simple theory is that PMI's will improve in the coming months as confidence returns, the Europeans are at least on track looking for some sort of integration processes as far as their banking institutions go. I take this as a move in the right direction.

Goodbye Big Boy! We could learn a thing or two from this. This morning the news comes that Bob Diamond is a goner, he has resigned from Barclays. Remember that the Chairman is staying until his replacement is found. That is yesterdays news, he is now staying until a CEO replacement is found too. A rudderless ship? Well, it seems that we might have been led to believe that the deckhands were acting like ragamuffins below deck whilst the bloated management, the XO and CO were not quite asleep at the wheel, but dozing. When I say that we could learn a thing or two, all I am saying is that accountability is key for any business, organisation or country, when someone is caught out. And in this case Bob Diamond has also fallen on his sword.

Ultimately someone needs to take responsibility, but it is a hard one, must the top man be accountable for 140 thousand odd employees across the 50 or so countries that the company operates in? I guess the short answer is yes. Banking again is falling into that domain where the public are outraged, and Barclays employees monkeying with Libor is just another example of what lies in those murky and muddy waters when investing in these entities. I am sure that most bankers, like lawyers and doctors hold their industry in high esteem and it is a small part that causes such scandals, when uncovered. But, for us, for these very reasons, these companies do not make compelling and enduring investments.

It is not something that we give enough airtime around here, Byron did briefly chat about PMI's yesterday, but perhaps because there is enough media coverage. The local Kagiso PMI monthly release as per the release is: "An economic activity index based on a survey conducted by the Bureau for Economic Research in conjunction with CIPS Southern Africa and sponsored by Kagiso Tiso Holdings" So, this is a survey and there are various questions asked to various managers about how they see manufacturing conditions. The segments include employment, business activity, prices, new sales orders, suppliers performance, backlog of sales orders, expected business conditions, inventories and purchasing commitments. I am not sure about you, but when I am busy and someone is looking to do a survey, I either say that I am sorry, or ask how quick it is, so that I can get it over with quickly. So, does it depend what time of the month the survey takes place, on a day of either good news, or bad news? It is a bit like price targets, yesterday I was asked for a price target on the ALSI 40 from here on out for the rest of the year. Their (Thomson Reuters) guess is as good as mine, anything can happen over the next 12 months.

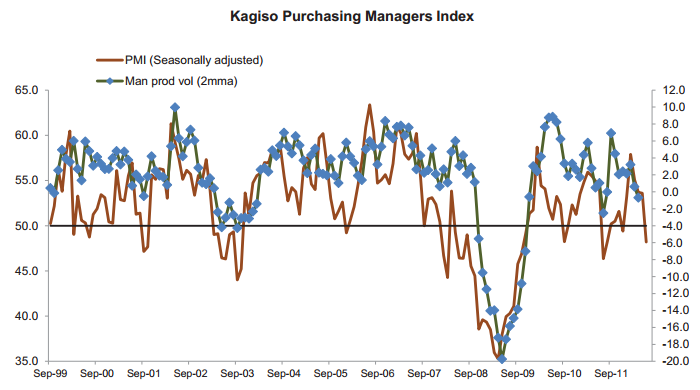

But back to this PMI, because sentiment is key in decision making and normally people are a whole lot more bullish about the future when the present looks rosier than the previous months. As was pointed out to me once upon a time, good news headlines and cheap stock prices don't come along at the same time. When the news is bad, or not good, that is when you get cheaper stock prices historically. This is almost always true, the quality of the company matters more than the stock price in the short term. But the same company with a cheaper stock price, now that is something to get excited about. We digress, again, apologies, back to the local PMI number which fell into contracting territory for the month past, the official June 2012, from the release: Kagiso Purchasing Managers Index

"The seasonally adjusted Kagiso PMI ended the second quarter on a weak note as the index declined sharply to below the key 50 index point mark. At 48.2, the PMI lost 5.4 index points and is now at the lowest level since August 2011 with almost all of the key sub-indices posting sharp losses. Whereas the early stages of 2012 saw the domestic PMI registering significantly more positive results than was the case in our key export markets such as the EU and China, the latest figures are more in line with the weak numbers seen in these countries for some time already."

Here is the graphic from the release, which is far more telling than the explanation above.

So is this something that is happening locally? Not at all sports lovers, this is a worldwide phenomenon, check out this glorious chart courtesy of Scotty Barber, who you MUST follow on Twitter, the stuff that he produces is legendary! This is of the PIIGS (without the P) PMI compared to the stronger economies in Europe. The picture looks exactly the same.

BUT WAIT! There is more, I found a more global one, this time courtesy of Bloomberg, this is PMI's across the globe, which includes the Chinese:

So, that leads me to believe that we are all following each other here, worried about the same thing. Confidence in the business world will be largely determined by central bankers and politicians for the remainder of the year. Expect a better plan and timeframes from the Europeans, whilst the US has election campaigning. And the sense from market participants is that we should see policy response in light of the weakening numbers globally.

New York, New York. 40o 43' 0" N, 74o 0' 0" W. Byron will explain what happened with a specific release, but I guess the Friday hurrah could explain why the Dow ended essentially flat last evening on Wall Street, but there was a surge in the last hour again, the S&P 500 closed one quarter of a percent higher and the nerds of NASDAQ added more than half a percent. The thinking, and that was explained above was that policy response is imminent.

Byron's beats checks out the disappointing ISM number yesterday

- Following the relevant manufacturing reads yesterday there can be no doubt that Europe is taking its toll on the global economy. If a European family decides to stick with their old washing machine because they cannot afford a new one the Chinese manufacturer will lose a sale. The same applies to a products produced around the world and this in turn has a knock on effect.

Even the resilient US economy has been hit. I'm not surprised, Europe is their largest trading partner. According to the US Census Bureau last year the US exported $3.3 trillion worth of goods to Europe and imported $4.48 trillion from the region. Imagine how many ships that takes to transport those goods across the Atlantic. I did a quick Google search and couldn't find a number. If you have any info please send it through.

This has caused the US factory sector to shrink for the first time since July 2009. The reading came in at 49.7 compared to 53.5 last month. Remember that anything below 50 is a contraction. This will also hamper confidence as companies start holding back their expenditures in order to face the turmoil with strong balance sheets.

US companies also face another challenge in the form of currencies. The Euro is weakening against the dollar which makes US exporters less competitive. This is a short term issue because a weaker Euro will in turn benefit the European economies which indirectly picks up their demand for US goods.

On this news the DOW dropped 85 points but later in the day regained all of these losses. Why is the market so resilient to such negative news? Because most of the downside is already factored into share prices. This is not an unknown-unknown. If we have a major drop then we could see a huge sell off but everyone knows that a weak European economy will have a negative impact on everyone else. The fact of the matter is that companies are prepared. They have learnt their lessons from the past.

There are also solutions out there. State assets can be sold, labour laws can be loosened, banks can be allowed fail or be bailed out if need be, lending prices can be controlled. The collective debt to GDP in Europe is 80% which is more than manageable, as a collective. That is why the market is riding on what the policy makers are saying. We are still positive their decisions will be more positive than negative. Jim Cramer says that if it weren't for Europe the US economy would be steam rolling and markets around the world would be at all time highs. The future is always uncertain but stocks do look cheap.

I saw an interview on Bloomberg TV in which Mohamed El-Erian of PIMCO and "new normal" fame was chatting about the way that he and his firm see the short term. Now El-Erian is always concise, smart and works for the biggest bond firm in the world, so let us just say that he did not get there by luck. But PIMCO is always cautious, I guess it is in their nature as bond investors. You might have heard about the "fiscal cliff", well, El-Erian warns that the event might trigger a recession in the US next year, something that many believe will be the case. But signalled this far forward, surely lawmakers will do something about it? Remember the debt ceiling debate though, and how that worked out for us? How the politicians fumbled and milled around until the 11th hour. Well, these two events are related, because the fiscal cliff refers to the points next year when the automatic spending cuts start to happen. And the so called Bush tax cuts expire at the same time.

Moody's have run some of their models and the suggestion is that if the automatic spending cuts are to take place and the automatic return of the taxes, the impact could mean that the US economy could contract by as much as 3.6 percent, and that would almost inevitably lead to the US recession. So, what to do? Well, I think that the lawmakers are actually aware of the lack of their actions last time and as such will act quicker, expect something more concrete by October, that is my best guess.

Currencies and commodities corner. Dr. Copper is higher, last at 351 US cents per pound, the gold price is higher at 1608 Dollars per fine ounce. The platinum price is last at 1463 Dollars per fine ounce, while the oil price is much higher at 84.38 Dollars per barrel. The Rand is much firmer as risk on is back, perhaps the EU summit did more for sentiment than we know. Last quoted at 8.11 to the US dollar, 12.73 to the Pound Sterling and 10.21 to the Euro, all stronger against those major currencies. We have started a bit better here today, catching the late rally in the US, but remember folks, tomorrow is the fourth of July, which is the US Independence Day. The USA turns 236 tomorrow, well, at least in the form that we all know well.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment