Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. Well, well, we took off in the second half of the afternoon, risk on came back in what is a festive week in the USA. The sense globally, at least that I get is that there is going to be another round of coordinated policy response, the Chinese inflation worry is dissipating, the Europeans have kind of steered away from hard and fast austerity thanks to the people having spoken, and the US economic growth although better than Europe, still looks anaemic in dare I say it, an election year. We saw the commodities complex benefit yesterday, in particular the oil price and the copper price surged during the day. The oil price also got a lift as the Iranians of course are no longer able to export oil as freely, potentially removing as much as one million barrels of supply a day. Exacerbating the supply side is that Norwegian workers in the oil industry are striking currently. So, now you know why the oil price took off yesterday.

The Jozi all share index closed up shop at 33986, up 333 points, or .99 percent. All sectors measured decent enough gains, financials, resources, industrials all participating in the European afterglow rally from last Friday. And we are steadily heading back to the highs, so clearly the balance of the market believes that the worst might be behind us. But, that is the optimist in me, many others would call themselves realists when in reality they are pessimists. Mark Mobius is right, you have to be an optimist to be a long term investor, you have to have conviction around your investment thesis. I suspect that the local and global vehicle sales numbers we saw yesterday were upside surprises, the recent PMI numbers that we see have a lot to do with the European dithering and hence delaying of spend or paralysis of decision making of sorts.

MTN yesterday decided to unleash a release which calls for the immediate dismissal of the Turkcell US claims, check out the official release: MTN dismisses Turkcell US claim. They use some pretty strong and colourful language, well I thought so anyhow, the first part and last part I think is most important. Here is a copy/paste. "... the US court does not have jurisdiction over the subject matter of Turkcell's claim, because Turkcell has not alleged a violation of the law of nations as required under US law for the sort of claim Turkcell is seeking to bring... " AND " ... the US court lacks personal jurisdiction over MTN and its subsidiary, MTN International..., which is also named in the US action. MTN and MTN International both lack sufficient contact with the United States to be subject to the jurisdiction of the US court." MTN are suggesting the US courts dismiss the case, Turkcell will respond to this motion by mid August. I hope that I have used the correct legal terminology.

Second, as MTN point out, Turkcell have already been sent packing in Paris (that is France guys) in front of a arbitration tribunal, in which their former Iranian JV partner was involved. MTN reckons that the case will be thrown out by the end of the year, but I then wonder what Turkcell would do next, because clearly they are not letting this just lie down or go away. The MTN share price in recent days has awoken from their seemingly long slumber, and are pretty close to their 52 week high. In contrast, poor Telkom traded at a 52 week (and all time low in their current format) low yesterday. That of course is another story, for another day. In a way, Telkom are admitting defeat through their increasing of their ADSL offering.

Another sad story is the operational update from the fellows over at Aquarius Platinum, who this morning have released a Operational Update. I guess the only positive thing that you could say about them relative to the rest of the sector is that they are taking a proactive view when compared to their industry peers. And I guess although ugly for their shareholders in recent weeks and months, Aquarius you could argue have done the right thing. In fact Aquarius say as much, with Stuart Murray saying the following: "I would hope that the other industry players follow suit and cut the unneeded production that is depressing the industry." Interesting, not so?

As you can see from the release, Aquarius have terminated their mining contract with Murray and Roberts Cementation, and Aquarius will assume the owner operator role. As they point out, this is part of the cost saving initiative. Poor Murray's, both the construction company and Stuart the CEO of Aquarius, I feel bad for both them, circumstance I guess. The other good news is that 75 percent of the workers at Marikana have been placed in "other organisations" as the news release puts it. Everest is on care and maintenance, as you well know.

The overall impact is heavy, from a production point of view, the company has produced 412,594 4E oz so far to the end of the financial year, with the next financial year (the one we have just started) expected to yield around 327,500 4E oz. So roughly 85 thousand fewer ounces this year, not a train smash, but certainly much lower than the group production in 2008 which topped 500 thousand ounces and was even better back in 2007, with 530 thousand ounces produced. Going backwards is not what shareholders want to be reminded of, that is for sure. A sad state of affairs, but as Stuart Murray points out: "The Board and management of Aquarius are acutely aware of the difficulties facing the industry at present, and are monitoring the business and financial health of the Company as closely as we have always done. We believe that the measures we have outlined today and over the past few weeks once again demonstrate our commitment to controlling our own destiny while carefully husbanding our assets on behalf of shareholders and thereby ensuring the survival of the Company in these extremely difficult times." Survival mode at the moment, hanging in there. All I can say is that emissions controls don't look like they are going out of favour anytime soon.

Byron's beats looks at an issue that is probably the most close to my heart, other than family, and that is education.

- You know the saying "good things happen to good people". Well sometimes good things happen to good companies. And I don't mean good as in well run. I mean good in the context of performing a good service which helps build our nation. Yesterday Curro, the private schooling company made an announcement headed Curro, PIC and Old Mutual join forces to expand quality low-fee schooling.

It is a joint venture between Curro and the OMIGSA schools fund. This fund is backed by the PIC and Old Mutual and has financing of up to R397.1 million. Curro will add a further R42.9 million bringing the fund to R440 million. The purpose of the fund is "to play a supportive role to Government in addressing the educational needs of South Africa in the lower income market and to put in motion the objectives set out in Curros pre-listing statement."

This is how the fund will work according to the announcement. "The joint venture includes the incorporation of an operating company that will operate schools, to be known as the Meridian Independent Schools, and a property owning company, held 65% by Curro and 35% by the OMIGSA Schools Fund, that will provide the school facilities and premises for the schools, with Curro being appointed as the manager of the schools. The Meridian Independent Schools will focus on providing private schooling to students where the majority of parents earn less than a defined threshhold, currently R200 000 (two hundred thousand Rand) per annum."

So basically they are putting in 10% of the capital but owning 65% of the fund. Sounds too good to be true not so? This Moneyweb interview with CEO Chris van der Merwe explains it very well. You see what he says right at the end there. Curro have specialised expertise to manage the schools and that is where their bargaining power comes in. Old Mutual and the PIC get good PR for investing in a project which will benefit our nation. In fact many say education is the core solution to most of our problems. I agree.

It is also important to note that through this fund Curro are targeting the lower to middle income bracket. This is where the gap seems to be in the market and where we see future growth in this sector. Like I mentioned earlier, this is also a good example of why we like to invest in positive themes that are seen favourably by government and the public. I can't see this kind of a deal being struck with a Tobacco company. All in all this is a fantastic deal for Curro and a great deal for the nation and the 100 000 children who stand to benefit.

Do you remember that instant messaging software called ICQ? When you got a message from someone it popped up and said uh-oh in a very high pitched voice. Remember? Well, I heard that voice again as the Barclays Libor scandal escalates, the chairman Marcus Agius (the only true defender of London/Rome) resigned first, then Bob Diamond the CEO yesterday morning, and then if that was not enough, the COO Jerry del Missier announced his resignation. My twitter feed lit up, even one that made me laugh from the fake Christine Lagarde account: "*BARCLAYS CLEANING LADY RESIGNS WITH IMMEDIATE EFFECT"

But this is not a laughing matter. Bank of England deputy governor Paul Tucker is under the spotlight, because the sense is that the Bank of England is involved. How? Well, Tucker queried with Diamond via a telephone call late October 2008 (at the height of the non trust of banks of one another) how Barclays could submit such a high borrowing rate at the time. If you recall from that time Libor spreads blew out. Still confused about Libor is used for? Don't worry, here is "simple" explanation of how banks get to the published rate: The Basics of BBALibor. Now as I can tell from my reading, the actual process is not THAT old, it has been around since 1985 and accepted as the standard.

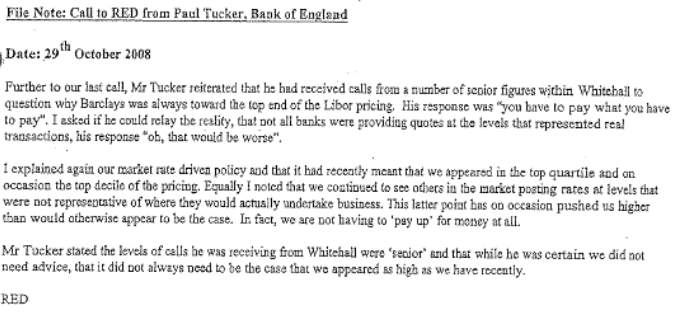

So, why would Tucker be at fault here? And how is this all going to come out in the wash? Well, we do not have to wait long at all, because as luck would have it the Treasury select committee will grill Bob Diamond today. The seemingly unapologetic Bob Diamond, but I am pretty sure that he does have certain regrets, if not apologies for the broader public. Remember that Barclays did not seek assistance of any sort during the depths of despair, the same time as "that" phone call. Barclays have submitted documents ahead of the hearings, INCLUDING that call and the note that RED (Robert Edward "Bob" Diamond) made on the day. The full submission including all the Libor rates submitted are included in this document, Supplementary information regarding Barclays settlement with the Authorities, but I have cut the note made on the day. Excuse the fuzziness, but that is how it appeared in the submission:

So, the sense from the mainstream is that bankers are evil, money grabbing, greedy individuals who mostly do "things" at the expense of their clients and the broader public. But this note suggests that pressure from the regulators was placed on a major global bank to somehow influence their submission. Everyone of course was chatting back then, and the regulators were very close to the institutions trying to maintain some form of stability. But the last question worth asking, where were the law makers and regulators when we always need them? Mostly asleep at the wheel, if you read Too big to read "Too big to fail" you will get the sense that SEC Chairman Christopher Cox was not exactly up for the job. Well, he was criticised by all and sundry openly as being more than asleep at the wheel, nowhere to be found. So whilst the popular line might be to point fingers at everyone here. And Joe Public might feel let down. The ONLY folks in the pound (no pun intended) seat here could be Osborne/Cameron and they could use this to score cheap political points over Darling/Brown. And I have no doubt that they will do this, kick them while they are down you know.

New York, New York. 40o 43' 0" N, 74o 0' 0" W. It was a shortened session on Wall Street, with trade only up to 1pm, allowing people more than enough time to get to their respective fireworks displays (not yet, that is reserved for day) or hot dog eating contests. Picnic type foods is what I am led to believe, to watch the various displays and patriotic marches, music and attractions. In terms of economic data points before all these festivities there were the auto sales, which looked like a comfortable beat to me. Session end all the indices closed higher. The nerds of NASDAQ tacked on 24 points to close at 2976 points, the broader market S&P 500 added eight and a half points to 1374, whilst blue chips, the Dow Jones Industrial Average added 72 points by the end of the session to 12943. All the majors near some pretty important milestones, 3000 on the NASDAQ and 13000 on the Dow. And I guess 1400 on the S&P, although that is further away I am thinking.

Currencies and commodities corner. Dr. Copper is last 352 US cents, the gold price is lower at 1615 Dollars per fine ounce, the platinum price is off a touch at 1476 Dollars per fine ounce. The oil price is lower at 86.94 Dollars per barrel for WTI as per the NYMEX quote. The Rand is slightly weaker, at 8.12 to the US Dollar, 12.72 to the Pound Sterling and 10.21 to the Euro. The market is marginally higher on a VERY slow trading day.

Parting shot. Happy birthday the United States of America, which turns 236 years old today. Well, in the form that we are used to anyhow, this is obviously a holiday that Americans hold near and dear to their hearts, they are a patriotic bunch, you can't fault them for that. The WSJ has a great article on what the USA looked like back then in 1776, check it out: Fleming: What Life Was Like in 1776.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment