Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. Boom. We closed at the best levels of the day, a Chinese cheer on the GDP meet (and greet) saw us initially open higher, led by resources which gained two percent on the day. The Jozi all share index added nearly a percent and one fifth, 390 points to the good to close at 33780 points. Banks sank just over one third of a percent, I suppose the same news really, banks under pressure in Britain and the US, from a reputational (and earnings) point of view, one should expect a whole lot more regulation and scrutiny. Banking forms one of the most valuable roles in society, it is of no coincidence that countries with advanced banking systems also have the most prosperous societies. But the future of banking in its current format, like most industries I guess, is being questioned by society. To blame is easy, to accept responsibility, well that is just hard. And when all the cogs have a careful inward reflection of the ills of the last banking crisis, just as many over-leveraged individuals are to blame. The loan officer might have made the loan too easily, but it took someone to ask. After all, we always think that we are "good" for it, not so?

The reasons why we do not like big banks are perhaps not plentiful, but will become apparent as we go along. The incentives are too strong (currently) for excessive risk taking. I have no problem with the way that people make money, it is just a question of risk. Now that might sound strange to you, that I have no problem with it, but I didn't say that I would be a shareholder or encourage people to be shareholders. The banking crises are well documented through the ages, and at the core often have the same root cause, greed of some sort. Managed greed is what ultimately leads to prosperity, caring greed if there is such a word is rare. But history has shown that society (and more recently so) is protected by big government from their own wrongdoings alongside the risk taking of banks. Governments do not want to be voted out as a result of the banking system falling over. As was pointed out to me by a good friend of the blog, it took the Republicans over 20 years to get back into the White House after the Great Depression. Perhaps the war had something to do with it, but the fall out of banks failing, unemployment rising led to a lot of push back from general society towards the perceived architects of the crisis, the free market types.

The solution is not an easy one, there is no one size fits all banks globally, even though we are moving in that direction. And I guess it is about the economics models that are followed by each and every country, currently the American model is seen to be not working, but the European model seems to be not working either. Not working is a relative term, because I am guessing for instance in East Timor those poor folks are trying to find their feet. And if ever there is a working government in Somalia, they will have their problems too. These banking and economics crises are rich people problems, because elsewhere in the developing world (as much as the Spain is not Uganda gaffe that is fun to explore) I am sure the problem of too many benefits would be a nice to have for the under developed world.

That would mean that if you have the relative resources to deal with the issues at hand, your expectations just need to be managed downwards, but you still have the resources. In South Africa we are in a rare and unique situation where there is an enormous gulf between the problems of the rich and poor. And in-between the two there is a very healthy and well regulated banking system. And a well run central bank. And treasury and the revenue collection authorities are good. So, in that respect we are all good, so in the years to come we should have a prosperous economy? Well, I hope so, although state control of the economy is not necessarily the best way to go about building wealth. My argument sometimes that I use in that regard is that the state is now a bigger contributor to the pensions savings schemes, through more employees contributing, and then becomes a bigger investor in locally listed entities. You see where I am going with this? The state, through the Government Employees Pension schemes is actually is a bigger investor as every month goes by. And as such, the irony might be that the state wants more control, but the private sector is getting bigger shareholders from government employees savings.

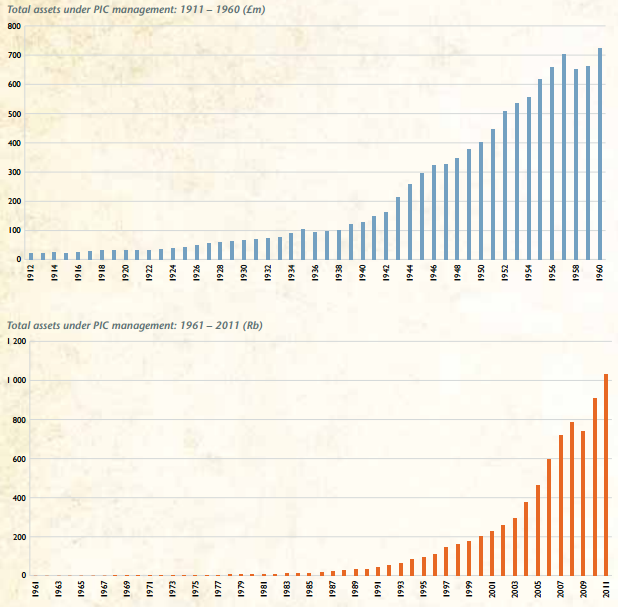

As per the PIC annual report in 2011, assets now top 1 trillion Rands (they did then) and equities represented nearly half a trillion Rand. Offshore is represented for the first time in 2011, a mere 25 billion Rand. The year prior, 2010, that offshore exposure was zero, zip, nil. The massive ramp up in total assets under management is astonishing, it has increased fivefold from 2000 to 2011. Now to put that into perspective, the PIC assets under management took 62 years to double from 100 billion Rands to 200 billion Rands as I understand it from the PIC integrated annual report 2011. These next graphic shows you actually how successful the forced savings from a growing government sector has been. For the country that is.

Amazing, yes? I am guessing that you can directly attribute the growth of the government wage bill to stronger unsecured lending growth numbers in our economy. The two go hand in hand, as people get wealthier in a relative sense, their access to credit improves, as well as their ability to service that debt. And as long as banks maintain the correct risk profiles, people make headway in life. I am yet to meet a person that was proud of reneging on a credit contract and telling the whole world to do the same, the "moral hazard" argument that Rick Santelli once used. All I am trying to point out above here is that the government through their equity holdings of their employees, have become more powerful in big business in South Africa. And as such, could influence South African companies more through the board room. But that would require more skills at a board level, and I am not too sure if government, let alone any fund manager is up to that kind of active approach. But that is not what happens for now.

OK, but we were discussing the banks and their role in society. Should they be more like utilities, or change and evolve and push the limit with regards to innovative new products that make their stakeholders money? Or should the two be split up? The practice of money making using excessive leverage is not new, but there could be a serious argument to be made that financial engineering outside of normal lending and transactional activities leads to innovation and greater advancement of human kind. Financial engineering of the last crisis is almost always of the Icarus kind, the wings work, the way you use it to fly, well those do not work if you push the envelope. Your wax melts. And lest you need a reminder, the Barclays stock price is getting hammered this year. Down 11 percent year to date (down 78 percent over five years), most of that moving in the wrong direction as a result of the lofty Libor fine.

Surely law makers must also take some blame. As Paul Kedrosky snarkily tweeted: "Pegging rates by surveying self-interested bankers on what rates they might, but don't, you know, actually lend at: How could that go wrong?" That is the core of the issue, if something is that important as LIBOR is, then why is it not managed in a much better way. This analysis has a good conclusion, but offers few solutions: Analysis: Banks behave badly redux: Is it killing confidence? I think yes, as Doug Kass from Seabreeze has said, all these scandals do little for confidence. Whilst law makers will use this opportunity to lay on the regulations, I am sure that it will not prevent the next crisis. As investable companies, big banks are not for us, and I also wonder how confidence levels are sitting at these big institutions.

New York, New York. 40o 43' 0" N, 74o 0' 0" W. Whoa. Friday was a huge day, the expectations of Chinese intervention in their economy was one of the reasons that US markets rocketed ahead, the other was perhaps the Fed would be soon to act. Remember that Ben the bearded (the measured) Bernanke testifies twice this week and the Fed speak interpreters look for signs of QE3. Not that the ship was ever built, but because the Fed might see the recent signals from China and Europe as an opportunity to act. We could see that, and coincidently, the Fed dual mandate could be called for, heading into US presidential elections. Many are starting to cite that single event as a reason why there would be more accommodative action, myself, I am not convinced that their independence is compromised by that. There are too many Fed armchair critics for my liking, let the smartest minds do what they have to. In the same way that the Europeans must solve European issues and problems and undoubtedly will solve their issues. Just give them time.

Currencies and commodities corner. Dr. Copper is last trading at 346 US cents per pound, the gold price is lower at 1584 Dollars per fine ounce. The platinum price is also lower at 1418 Dollars per fine ounce. The Nymex WTI share price is slightly lower at 86.8 Dollars per barrel, the Brent crude oil price is higher at 102.65 Dollars per barrel. The Rand is firmer, 8.26 to the US Dollar, 12.84 to the Pound Sterling and 10.07 to the Euro. Surely it must be time to buy some of those if you are long Dollars? We are slightly lower to begin with.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment