Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. After starting better here, and enjoying a decent day, the rally was scuppered by the release of the non-farm payroll numbers, which were lighter than anticipated. And worse than the market expected means that the selling starts, the Jozi all share index closed down 51 points, or 0.15 percent to end at 34170. I guess you could say that this is not very good news, US unemployment data in the last three months has been weak, but so then has the economic news, European austerity and uncertainty has weighed heavily globally on markets, I suspect that the Greek elections and the Greek momentum had a lot to do with confidence (lack thereof) during the first part of the quarter just past. And by no means is the European crisis finished, it is ongoing all the time as governments try and balance growth and austerity

A trading update from Kumba Iron Ore on Friday looked weak, but once again this is as a result of the same factors that we were referring to above, a slowing European economy which is resulting in a global slowdown. As Byron often says, if someone does not need a new washing machine in Spain or Italy, and the goods are manufactured in China, well, that means less business for the Chinese. And that means less demand for the raw products too. ALTHOUGH, the internal consumption story in China is one that still continues to impress the pundits, or so I am led to believe. China still has a relatively unbalanced economy. But back to this main story, Kumba Iron Ore expect earnings for the first six months of the year to clock 7.1 to 7.5 billion Rands, which on a per share basis is between 22.10 ZAR to 23.40 ZAR. Which on balance sounds good, and the share price is acceptable at 559 ZAR a share, bearing in mind that the distributions have been amazing. The payout ratio in recent years has been around 80 percent of earnings.

The first six months of last years' earnings clocked 28.20 ZAR per share, so we are going to see a comfortably lower set of earnings relative to that period. The full year number last year was 53.13 ZAR a share (24.93 for the second half), with 44.2 ZAR paid out to shareholders by way of dividends, including Anglo American who are a nearly two thirds shareholder. The reason for the lower earnings are explained in a simple one liner and are "largely attributable to a decrease in export iron ore prices in the period". I have been watching the monthly change at the SA ports, and the key one (as far as Kumba Iron Ore is concerned) to watch here is Saldhana Bay, where the volumes have been growing. Indicating that the volumes should be slightly higher, remember that in the second half of the year last year, production fell. What is different this year is that the newly "opened" Kolomela mine, which should produce between 4-5 million tons per annum this year and 9 million tons per annum from next year, 2013. Total sales last year were 43.5 tons, it will possibly be the number to watch.

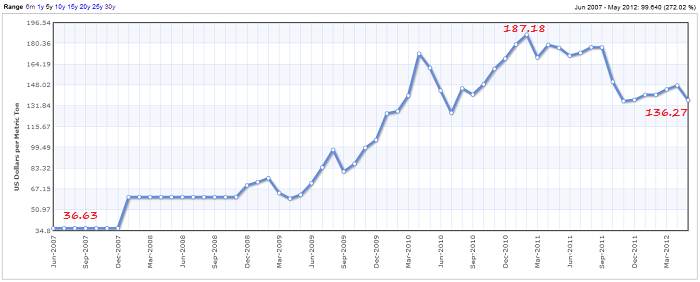

But I thought, let us check out a five year iron ore pricing graph to see what Kumba Iron Ore are talking about, which I sourced from here: Iron Ore Monthly Price - US Dollars per Metric Ton. Here is the graph, which just shows the highs and lows and recent price.

These prices are average monthly prices and are perhaps a blended price of the spot market and the contract prices. You can see at the bottom left, the prices were set annually by the majors in a negotiated settlement with the steel companies. And then everyone kind of set that as the benchmark. I was trying to do a simple back of the matchbox type iron price, with the first six months of last year seeing an average price of 177 odd Dollars per ton. For the six months just past the price is roughly 20 percent lower at 141 Dollars per ton, that was the simplest calculation that I could do. Helping Kumba out would be the weakening Rand to the US Dollar. The results are expected to be released around the 20th of July.

Beware the one commodity stock is the message I guess, this no doubt is weighing on Exxaro too, which is lower on this news, and another piece of news that was pointed out to me this morning. Iluka Resources, which mines zircon missed earnings expectations by a country mile. It is an Australian mineral sands mining company, and from what I have read have blamed almost all the worlds markets for having missed almost every metric that analysts find important. Zircon is used in the making of ceramics, fancy plates and tea cups and so on, think your grandmothers finest tea cups when you were a kid! It is also used in construction, another sign that the Chinese economy is slowing. We do not have to wait too long to find out, the Chinese release their second quarter GDP number on Friday (expected 7.6 percent), as well as retail sales (expectations are for a 13.5 percent jump) and industrial production (9.8 percent growth expected). This without a doubt is the single biggest release of the week and no doubt will have everyone focused.

New York, New York. 40o 43' 0" N, 74o 0' 0" W. Non-farm (as opposed to NO farm payrolls, that would have been worse) payrolls clocked 80 thousand new jobs for the month of June, and the quarter clocked the worst seen since 2010. Well, I guess the optimistic types would be tempted to say that at least jobs are being added here. And you remember that piece that we posted on Friday, which suggested that the unemployment number would have been a whole percentage point lower if the government had kept all their jobs. But the unemployment rate remained the same, at 8.2 percent and government changes in jobs were not that bad for the month of June, recording a loss of 4000 only, state and local government jobs lost are 586 thousand since December 2008. Wow. So, on balance you could argue that the system itself is working, getting rid of unnecessary government jobs when the tax receipts fall, and now might be seeing a stabilization of that trend. Session end all the indices closed higher, off their worst point, reversing that trend in the last hour or so. Losses for Blue chips and the broader market were lower by one percent or so, whilst the nerds of NASDAQ sold off by 1.3 percent.

Byron's beats looks into the most favourite of seasons over here at Vestact, earnings season. There is earnings seasons from quarter one through to four, so that is like football, cricket, rugby and athletics seasons, but these are the same teams participating. And we get roughly a month and a half from each season, around half the year is spent with proper markets direction from companies.

- That time of the year is starting again. It is a time that can be very exciting for us equity enthusiasts and for me is the most important information source we can get to really see the state of the economy. I'm talking about the US earnings season which kicks off this week and starts with, as always, the big aluminium producer Alcoa.

In the US they report quarterly so this happens 4 times a year. So far the economic data for this quarter has been negative and I have a feeling we will see this showing up in the earnings numbers. I say this because we already saw numbers from Nike (whose economic calendar differs from the rest) which showed weaker demand from China. If that is a theme we see throughout these companies we could be in for a wild ride.

In the last earnings quarter nearly 80% of companies beat earnings expectations and out of the ones I looked at, most of the beats came from developing nation growth. This is why I am slightly worried about the numbers coming through this quarter. As ever, it will be really interesting to see what companies say about the conditions that they are currently operating under. Forward looking statements will also be very interesting and can move share prices extensively depending on the sentiment of the statement.

I've always said it is a lot more constructive to listen to what a company like Caterpillar have to say about demand in China than a 70 year old professor who spends the majority of his time in an office. Of course you have to try and filter through bias issues.

If we do get a bunch of misses there could be some good buying opportunities presenting themselves. We know how reactive the US market is to misses or beats. I would also assume expectations to be lower and most of the negativities to already be factored into the market. As ever we will follow and cover these releases extensively and will relay them onto you guys as they come in. Be prepared!

Currencies and commodities corner. Dr. Copper is last at 341 US cents per pound a little higher on the session. The gold price is slightly lower at 1580 Dollars per fine ounce, the platinum price is also lower, last at 1435 Dollars per fine ounce. The oil price has ticked up a little, remember the Norwegian lockout takes effect today, 84.63 Dollars per barrel for NYMEX WTI. Brent is last at 98.41 Dollars per barrel. As the risk off returns somewhat to the market, the Rand of course will sell off. 8.29 to the US Dollar, 12.84 to the Pound Sterling and 10.22 to the Euro is where it was quoted last. We are around two thirds of a percent worse by mid morning here in Jozi. ECB president Mario Draghi will deliver a testimony to the European parliament today, I guess that does hold some interest for many, we shall keep an eye on that. After the bell, as Byron said is the real meaty part of the markets for us.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment