Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. Yech, we finished much lower than where we started, at one stage we were within touching distance of an all time high, but the Jozi all share slid 66 points, or 0.19 percent to close up shop at 33225 points. Banks and platinum stocks were hardest hit, the precious metal stocks are looking all beat up right now. We were discussing the future for the platinum companies here (well, we do that often) but we came to the conclusion that there is one big difference between these companies and the gold companies. Of course, most of it has to do with where most of the production comes from, South Africa of course. There would be some irony if Chris Griffith could take over at Amplats at the bottom of the market, and leaving Kumba Iron Ore near the top of the market. Some folks might attribute a turn around to him, even if it was just the market. Of course a very good manager can make an enormous difference.

And he (Griffith) will have this as a starting point: Anglo American Platinum Limited posts decreased headline earnings due to lower sales and weaker prices. That is just this morning, perhaps as I heard once, you can only go forward with your backs to the wall. But that obviously implies that you have hit the wall. Operationally "things" are looking tough. Gross sales fell 22 percent (5.4 billion Rand) to 19.53 billion Rands. Lower sales volumes accounted for the bulk of the revenue fall, whilst prices received accounted for 1.1 billion Rands less. Platinum sales fell 21 percent in the first half to 967,400 ounces, whilst equivalent refined platinum production (own mines and JV's) increased by 1.1 percent to 1.18 million ounces. Wow. In 2006, in the era before the iPhone, the company for the comparable half produced 1.34 million ounces. And back then the average platinum price received was 1104 Dollars per ounce. In 2006. And Amplats managed to earn 4.5 billion Rands. Right now, for the first half 2012, Amplats made 2.73 ZAR per share. Back then, in 2006, there was enough in the kitty to pay 14 Rands a share worth of dividends.

There is no mileage in comparing the past and now, other than to say that the well documented cost issues are known to the market. You can improve labour relations over time and as such improve productivity. Amplats said as much, in the release: "labour productivity improved by 11% to 6.54m2 over the same period." Excellent, whatever Amplats are doing at a productivity level, it is going in the right direction. Costs are a massive issue though with "Cash operating costs up 11% year-on-year to R14,478 per equivalent refined platinum ounce on above inflation increases in the cost of electricity, diesel, caustic soda, steel balls and reagents" Raw materials costs increasing, I suppose that goes both against and for you, depending where the cycle is.

So we know that they are struggling to keep pace with production targets, those are getting revised downwards almost every time that they report. The market is looking ropey for their product and the price has told you that, but that has been an opportunity for jewellery demand, although strong, was not able to offset weak autocat (Europe accounts for 47 percent of autocat platinum demand) and investment demand. Industrial demand is unchanged. I suspect that autocat demand will come back in the next 18 months, perhaps a little stronger than anticipated.

But buying single commodity stocks comes with a health warning, when the going is good, it is very good, when it is bad, well, it turns out like this. Badly. The stock is down 2.6 percent this morning, trading at the worst price in an absolute age. The dividend has been suspended again sadly. But this is a company that accounts for roughly 40 percent of all global production. They are the price maker. If there is a serious review of their operations (ongoing) then we could well see the platinum price rally into the close of the year, in anticipation of future projects being placed on hold. There is already some of that, spending has been ratcheted back and grand plans are not in place for now. Like I said in introducing this piece, this might well turn out to be another genius piece of timing.

So why did markets all fall down on Friday, we were spared from the worst of the selling, but in Europe they were not. Byron asked us here what a very bad or very good day was (a general question) and I tried to remember the indiscriminate selling in 2008 and early 2009. I picked up a specific date, the 29 of September 2008 where the all share lost nearly 1400 points on a single day! 1412 points to be exact. That was a drubbing. The 6th of October, a few days later saw the market sell off 1655 points. The 15th of October saw the market fall 1545 points. Phew. That was aggressive selling for you! But there was selling of another kind, in Europe and in Spain. Again.

The Spanish ten year bonds spiked again, but the equities market felt worse, down 5.8 percent. All this, as a result of the regional governments, Valencia being the trigger Friday, more over the weekend in the form of the region of Murcia, asking the national government for help. So, whilst the regions look for help, the parent is under pressure. Just this morning the ten year is yielding 7.5 percent. Not good. So expect a little bit of selling whilst the market is looking for answers. The Euro is taking another beating, nearly through the 1.20 mark to the US Dollar. Anxiety up, selling accelerated, nervousness higher and buyers are scarce. Adding to the anxiety in Spain this morning is quarter on quarter GDP reduction of 0.4 percent. Same old story, Monday again! Stock market in Spain has lost another 4.33 percent this morning. Yech again!

Byron's beats checks out two companies in two completely different sectors, one we like, the other, well..... not so much.

- On Friday we had two trading updates which could give us some sort of indication of what's happening in their relevant sectors. Firstly we had one from Group Five who operate in the construction sector and then we had a voluntary one from Truworths, the biggest clothing retailer in the country. Let's look at the Group Five update first.

As expected things do not look good but there is a light at the end of the tunnel. Now to understand this update you need to understand the structure of the company. This is a short description as per their website.

"Group Five Ltd is an investment holding company with interests in construction, infrastructural development, manufacturing, and operations and maintenance industries. The company does not trade and all of its activities are undertaken through its subsidiaries, joint ventures and associates."

As a holding company in a struggling sector they have had to take lots operating losses, restructuring costs and impairments to the carrying value of assets. Exposure to the Middle East and the struggling steel manufacturing sector locally have been big loss makers. This has resulted in headline earnings per share to drop between 60%-70% while fully diluted earnings will come in at a loss of up to 300c per share. So where is the light? They do mention that excluding all the impairments from last year things are looking a lot better for 2013. This is another reminder of why we don't like the sector, especially exposure to the builders themselves.

On the other side of the spectrum we had a voluntary update from Truworths, a company that has been on a tear for the last few years. In June 2008 it reached as low as R21. Now, 4 years later it has more than quadrupled, trading at R97 after reaching an all time high on Friday.

According to the update earnings per share will grow between 14%-17% on the back of a 53 week period. Sales increased 12.7% while product inflation increased 8%. Gross trade receivables increases 14% to R3.8bn with credit sales now contributing 73% to retails sales. Good numbers for the company on what is already considered at a high base. Let's look at the valuations to get a perspective of the sector.

Last year headline earnings per share came in at 456c. This was up 21% on the previous period. According to this update, earnings should come in at 528c giving the stock a current PE of around 18.3. Sasha has covered this a lot recently and it is quite clear that foreign investors love our retailers awarding them a premium. And let's be honest, they have been right. We expect the retail sector to remain strong and we expect them to carry on trading with this premium.

New York, New York. 40o 43' 0" N, 74o 0' 0" W. Stocks sank on those Spanish anxiety’s again, influenza can be a bad thing. Spanish influenza is nothing to laugh at, the 1918/9 pandemic wiped out 3 percent of the world's population. Wow. On Friday, the sellers of equities, with Spanish anxiety, wiped out around a percent off the averages. There were very few bright spots, but the one that was perhaps the brightest were the results from General Electric.

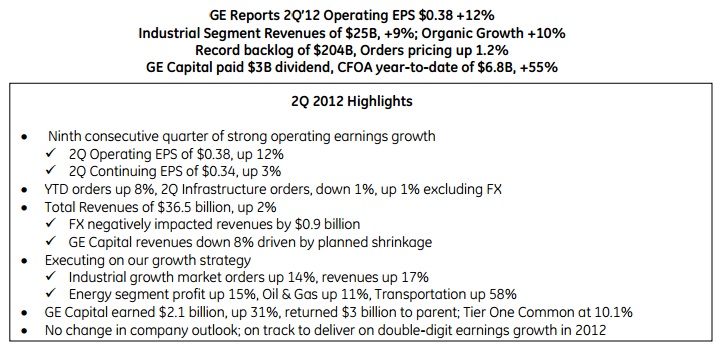

It is difficult to figure out when the company was actually founded, but the General Electric timeline on Wiki suggests 1890. In 120 years the business has become perhaps one of the most iconic company names on the planet. These were results for the second quarter of 2012, and the media release is available here: GE Reports 2Q’12 Operating EPS $0.38 +12%. The heading is actually a great summary of how the business is looking:

If you look at the presentation, which is always a wealth of information, GE 2012 second quarter performance, scroll to slide number 3, which shows the massive backlog, which is now 204 billion Dollars. So, what does a backlog tell you? Well for one, notwithstanding all the flopping and falling around in Europe, the GE order book is the strongest ever. I guess that could change at any one given time, but it is what it is. Strong. Meaning that whilst we are anxious, or seemingly anxious, business is pushing ahead with new orders.

Whilst we like GE a lot as one of the starting points when building a diversified portfolio, the questions will always remain, is GE finance going to return to anything like it was half a decade ago? Perhaps not immediately, and that is not the reason that we own the business. We like the energy, oil and gas, healthcare and transportation parts of the business, not so much the real estate assets. But GE Capital represents over 30 percent of sales and as much in profits. And the success of these quarterly numbers could largely be attributed to GE Capital, the Industrial part of the business owed all of their headway to energy infrastructure. Expect that specific division of GE Industrials to continue to grow as America seeks internal energy solutions and less reliance on external oil supplies. Good for the Dollar, good for the US, not so good really for the Middle East. We continue to buy the stock at these levels, looking for a greater unlock of value in a business division split. Perhaps it won't happen immediately, or even in half a decade, but in the interim you own perhaps one of the bluest of blue chips anywhere in the world. And for the time being, the strategy over at GE is to make GE Capital smaller. I can think of a way to do that immediately!

Currencies and commodities corner. Dr. Copper is last at 334 US cents per pound, getting punched in the kidneys. The gold price is lower at 1572 Dollars per fine ounce, the platinum price is boxing out of the same corner as Dr. Copper, last at 1390 Dollars per fine ounce, down 20 odd Dollars an ounce on the session. The oil price is also taking a drubbing, down at 88.75 Dollars per barrel. Good news for the consumer, not so much for the producers of oil. The Rand is weaker at 8.40 to the US dollar, 13.04 to the Pound Sterling and 10.16 to the Euro. We are taking a hit here this morning, not as bad as markets across the globe, but that is because we are being helped out by a weaker currency. Which is bad for inflationary pressures, but the Reserve Bank for better or worse has cut rates.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment