Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. Well, let us just say that the Europeans were not all to blame for this sell off, it was also the Americans with another poor show on the jobs front. Jobs are just not being added fast enough, perhaps the only beneficiaries are the Republicans currently, although Mitt Romney's fund raiser over the weekend attracted some choice comments that were more than just eyebrow raisers, they were just plain rude. Check it out, it is in some parts quite funny: Mega-Rich Donors Live Up To Stereotypes At Romney Fundraisers In The Hamptons.

That juicy quote from a clearly very wealthy person, tees up the headline perfectly: "But my college kid, the baby sitters, the nails ladies - everybody who's got the right to vote - they don't understand what's going on. I just think if you're lower income - one, you're not as educated, two, they don't understand how it works, they don't understand how the systems work, they don't understand the impact." Ouch. And of course the mainstream is using that quote to their advantage, come on lady, poor dumb people just not getting it? Seems like those Botox "treatments" might have actually gone through your skull. And into your grey matter that seemingly "gets it". Election time, you have to love all the ugly tricks and antics. Having said that though, I saw a post yesterday that suggested that the top 400 American tax payers pay more tax than the bottom half of the other 138 million registered federal tax payers in America. Don't believe me? Check it out: Top 400 Taxpayers Paid Almost As Much in Federal Income Taxes in 2009 as the Entire Bottom 50%.

OK, back to the local market, where we saw the Jozi all share index sink 296 points, or 0.87 percent to 33930 points when all was said and done, dragged lower by resources, which closed nearly a percent and a half lower. Banks caught a bid, and added nearly 0.4 percent, the problems in both the US and the UK have been fairly well documented. The Rand weakened as the concerns about Europe were highlighted with the Spanish bond yields rising above 7 percent. Again. {Sigh}

I suppose of it is any consolation, at least there is an immense attraction for the local bonds, for our government bonds which continue to sail into unchartered territory as far as the yields are concerned. During the month of June, according to this piece (S.Africa bond ylds hit new lows but political risk looms) from the folks over at Reuters, we saw inflows to our bond market to the tune of 20 billion Rand. And the yields of the shorter term debt (2015) have dipped below 6 percent. South African government debt maturing in 2021 however has a yield just above 7 percent. So, in essence this is comparable to Spain. So, whilst Spain might not be Uganda, or such other country, South African yields are comparable to Spanish yields.

Political risk my friends, whether you believe it to be true or not. We also share another dubious statistic with Spain, a very high unemployment rate and a much higher than the average rate youth employment problem. It is not a "challenge". It is a problem. And just this morning the labour picture in South Africa looks a little poorer, as per the Adcorp Employment Index, June 2012. Most of the job losses have been (if you scroll down and have a look at the tables) in the mining sector (a whopping 8.05 percent fall), Manufacturing (a depressing 4.46 percent fall) and construction (down 4.66 percent) as well as a broad category "Transport, storage and communication" (which fell 8.56 percent).

All in all it makes for pretty ugly reading. In fact for a much smaller sized population and economy relative to the US, the job losses of 82,520 folks over two months locally is a pretty poor showing. The only good thing I guess, is that the informal sector continues to grow employment numbers, but not enough to pick up the slack. If I had to put that number into and American context, that loss of 82 thousand jobs of two months, the non-farm payrolls number would have clocked around 300 thousand lost jobs, if I just compare the sizes of the labour force (7.5 times the size of ours). There would be no way in hell that Barrack Obama would be re-elected with labour numbers like that. These calculations of mine are on the fly, and would require some looking at carefully. See if I am right, I am taking this Adcorp data and taking the "employment situation" as per the Department of Labor in the US website, and coming to pretty "fast" conclusions. Either way, we are losing jobs whilst the US are gaining jobs, albeit at a slower pace. Neither makes me feel particularly good.

Byron's beats takes a look at some local company news, and an Indian acquisition.

- Today Adcock Ingram announced the acquisition of an Indian medicine business called Cosme Farma for $86m. This move is to gain access to the massive Indian drug market where 1.2bn people with a high disease burden call their home. If you are interested in the details here is the release but for the sake of this report I want to bring Aspen into discussion.

At the end of October 2008 both shares traded at R30 a share. Both were doing well all the way up until Jan 2010 when they started to diverge. Adcock now trades at R60 while Aspen sits at all time highs just below R130. But where did these guys differ?

In May 2010 Aspen announced the acquisition of Sigma, an Australian drug company for a whopping R10bn. It was criticized by many as it was during a time where the likes of Pick n Pay were trying to exit Australia because it was so hard to do well there.

When Aspen released results in March this year it was very clear that the Sigma deal had saved them. The South African division had completely under preformed due to increased competition and less ARV's required by the government due to donations. In 2010 South Africa was responsible for 62% of EBITA while Asia Pacific contributed 8%. In 2011 SA dropped to 39% while Asia Pacific contributed 34% to EBITA. Profits were up 28% that period all thanks to the Sigma acquisition.

Had this deal not been executed Aspen could very well be trading at R60 today. The share looked expensive and investors had high expectations for growth. But not many knew how tough it was operating in SA that year. What is my point here? There are 2, the benefit of diversification and the value of a good management team.

Here, diversifying geographically was the key. They saw an opportunity in Sigma who were struggling but had access to the lucrative Asian market. Adcock who do operate throughout Africa are still very reliant on SA. I saw an interview with Aspen CEO Steven Saad fairly recently and he explained how difficult the Sigma deal was to execute. Sleepless nights spent negotiating in boardrooms often goes unnoticed. And this is why management is so key. Yes, they have the incentives to do well and are big shareholders themselves but when you watch that Aspen share price go up and up you must realise that things could have been very different and a lot of hard work is being done. Hence why we are happy to stick with Aspen for the long term even if at times the share looks expensive.

As for Adcock, this move seems good in principle and rather late than never. Whether the acquisition will be successful or not depends on management's ability to buy the right assets. We can only wait and see.

New York, New York. 40o 43' 0" N, 74o 0' 0" W. The real wait was for afterhours and the start of earnings season, but the normal trading session saw trading action swing in both directions, but end in the red after all was said and done. Again, the last hour of trade saw Wall Street end comfortably off the lows, the late buying bias. Equally the opposite often happens, perhaps this is Joe Public getting back into the market slowly after a period of withdrawals, I will check that out shortly.

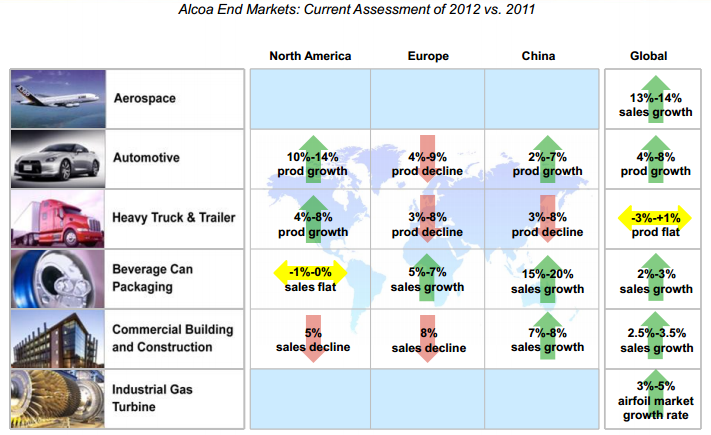

The kick off of earnings season started with not necessarily two businesses that would make for investment grade, but nevertheless decent enough indicators of the US economy. Alcoa, which of course is the aluminium (or as they say in America Aloo-min-him) producer, is an indicator of the economy. I guess that is so, because Alcoa sells aluminium products to the aerospace, automotive, heavy truck & trailer, beverage can packaging, construction and gas turbine industry. Many of those industries themselves are indicators of where the local market is going. Trucks, planes and automobiles. Without spending too much time on the Alcoa numbers themselves, let us have a look at what is normally the most important slide (for me) in the Alcoa presentation, is the following 2012 Market Conditions slide:

Look at the global picture, all looking just fine to me, considering the issues that everyone has to contend with. About the only number that stands out for me is the massive beverage can packaging growth in China. Amazing, expectations are for nearly 20 percent growth. Europe is the clear laggard. I am going to pay attention to this slide over and again, to get a sense whether or not the European region is improving. Pre market the stock is flat, and over a year however the price is down 40 odd percent.

Currencies and commodities corner. Dr. Copper is last at 343 US cents per pound, the gold price is higher at 1593 Dollars per fine ounce, whilst the platinum price is slightly higher at 1441 Dollars per fine ounce. The oil price is lower at 85.51 Dollars per barrel. The Rand is firmer, last at 8.17 to the US Dollar, 12.70 to the Pound Sterling and the Euro at 10.11. We are seeing improving markets as the day goes on, the poor (rich) chairman of Barclays is taking a pasting from politicians on our screens as we speak. Pfff.... but as Paul pointed out, from what he read on Twitter (via Sarah Butcher): "At the moment Barclays is paying 3 times more in bonuses to top executives than it pays in dividends to shareholders." That is an issue for shareholders, who should be more vocal with this.

Parting shot. Yesterday I messed up, I can't believe it. Sometimes one says things without thinking them through properly, I knew what I wanted to say, but it came out wrong. I was on Power Lunch on CNBC and at the end of the interview I meant to say "Good headlines and cheap stock prices don't normally go together" but rather what came out was "Bad headlines and cheap stocks don't come along together". Dumb. What an idiot. And it took me until I got back to the office to recognise that I had actually said the wrong thing. But that holds true, bad headlines DO go alongside cheap stocks, and whilst we continue to see the prices subdued because of the European flipping and flopping, that will have proved to have been an opportunity over the medium term. And if you were wondering what medium term means around here, it means 3-5 years and much more for long term. Long term is 7-10 years, don't let anyone else tell you otherwise. But like we often say, borrowing a line from many others in our industry, my favourite holding period is forever.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment