Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. Mario Draghi saves the day. Sort of. Globally stocks were looking a little weak, after some iffy housing data in the US saw folks questioning the housing recovery, and the same old problems persisting around the borrowing costs of Spain. And Italy. I think the single thing that confuses/frustrates/concerns all market participants is the slow pace at which the respective bodies/governments/central bank seem to be acting. Everyone wants a grand plan, a solution to the current crisis and they want it yesterday. Give us that credible plan yesterday! And that is the problem with market participants, all hyped up on thirteen espressos before breakfast and then another dozen thereafter, Mr. Market wants to see a plan. Give it to us! Now! So when we have periods that seemingly nothing is being done, then the same old anxiety sets in, Spain can't afford to borrow at these levels, unsustainable they say. This is probably true.

But what happened yesterday? Why did the market from just after midday move higher and end two thirds of a percent better, the Jozi all share index poked its head back over 34 thousand? What did Mario Draghi say? Well, I sort of ended off in our message yesterday suggesting that the short and sweet speech, in that Draghi said that the ECB would do anything it takes, and do whatever it needs to in order to preserve the Euro. And whatever they would do, it will be enough. He was talking to a crowd at a conference in London. What happened thereafter was that the Euro rallied, Spanish and Italian bond yields fell sharply, indicating that folks were buying! From what I had heard earlier from those in the know, the Spanish bond market sounds were a few crickets chirping, not much action. Because people were cautious, not willing to commit. If you want more insight, follow the Bloomberg link here: Draghi Says ECB Will Do What's Needed To Preserve Euro: Economy.

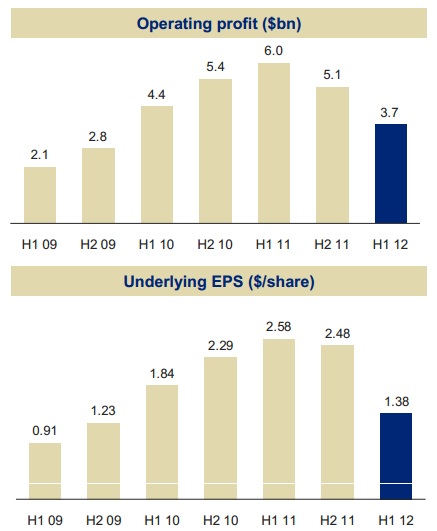

Anglo American have released their interim results this morning, and it looks like an earnings miss, the stock has sold off in a market that is moderately higher at the get go. I saw a brief interview with Cynthia Carroll on CNBC this morning, she was getting excited about controlling costs. But the facts are, as per the release, HALF YEAR FINANCIAL REPORT for the six months ended 30 June 2012: "Anglo American reported an operating profit of $3.7 billion, a 38% decrease. EBITDA decreased by 31% to $4.9 billion and underlying earnings decreased by 46% to $1.7 billion." Of course, because Anglo American has all the listed parts, we get to see quite a few of them over the last couple of weeks, before the actual number. And in fact, the biggest surprise for me (other than the delays at Minas-Rio and miss in earnings) is that Anglo have UPPED their stake in Kumba Iron Ore by 4.5 percent to 69.7 percent!

Anglo has a very well known portfolio, but this newsletter is intended for a very broad audience, so we need to tell you what the company does. You might well say, oh, it is a diversified miner, but in our world, a diversified miner is not just a diversified miner. Your underlying portfolio can look very different from your market peers. As per Anglo's website, the "portfolio of mining businesses spans bulk commodities - iron ore and manganese, metallurgical coal and thermal coal; base metals - copper and nickel; and precious metals and minerals - in which it is a global leader in both platinum and diamonds." There are some of those bulk commodities that we like a lot, iron ore, coal and copper, but diamonds not so much and "things" look a little tougher for the platinum industry than five years ago. A whole lot tougher, read David McKay's article in MiningMx: SA platinum sweats amid cash-flow crunch. We like the energy part of the business that is in BHP Billiton, you know that already, we have been buyers of that one over Anglo for the better part of half a decade.

The parting outlook, which we will deal with now, almost confirms what a lot of people have been starting to say, that the current quarter perhaps represents a bottoming of sorts. I think that it needs a copy paste in whole: "The short term outlook for the world economy has deteriorated in recent months. The Eurozone crisis has intensified, adding to economic uncertainty both inside and outside the euro zone. After a promising start to the year, the US economy has weakened in response to greater fiscal uncertainty. The major emerging economies - notably China, India and Brazil - have also slowed. Significant policy easing, however, should underpin a recovery."

Well, that does sound somewhat reasonable, but the question remains, if you are to buy this business today, at the current share price of around 250 Rands a share, what are you getting? Forget the past. The current share price represents the outlook and prospects. We might not all agree that the rapid urbanisation in emerging markets is an enduring theme, that is set to continue to dominate over the next decade, or more, but that is still our base case. I have no doubt that lower middle class people want to work their way up the chain of wealth, work harder, have access to more "things" and improve the lives of the next generation. In his own dry way Milton Friedman wondered why that was, parents creating a much better life for their children whilst compromising their own, cost savings and the like. But that is the human element that economics tries to understand, the behaviour of the current generation and the repercussions for their offspring.

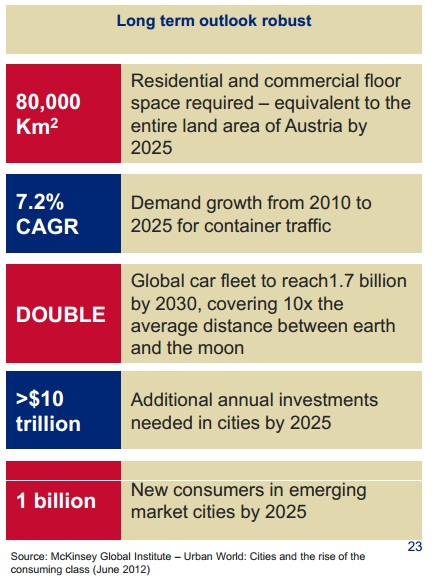

Anglo has a nice slide that shows all that still needs to be done. According to McKinsey, that is. That would mean a lot of resources would still be required and as such, Anglo and many others in the sector, BHP Billiton, Rio Tinto, Xstrata and Glencore would all be in the sweet spot. I left Vale out, that wasn't nice.

But in the end it all comes down to valuations. If you wanted to know why the stocks in the resource space were starting to look so cheap, then look no further than this slide in their presentation:

So that is why the stock and the sector looks cheaper before today, the earnings just had to catch up. Cheap yesterday, today, well not so much and often cheap for a reason. Bill Miller, the iconic Legg Mason fund manager avoided the sector, because the earnings were not reliable enough. The only positive that I can take away from these results is that the dividend has been upped to 32 US cents, from 28 cents last time. And the Kumba purchase, adding to that position. In the end it does depend on whether you think that this time is different or not. Are we in the middle of a commodities super cycle, rather than a commodities boom? I believe the answer to that is yes. But whether or not Anglo can execute properly, well, we answer that question for our clients by buying them what we think is the superior of the two (or more) choices in our market, BHP Billiton.

Byron's beats talks about one of the most astonishing South African success stories, no matter which way you look at it. Their product, well, folks are more excited about their product than their business. Not us.

- Yesterday afternoon we had an interim management statement from SABMiller for the first quarter ended 30 June 2012. Just to get a perspective of how well this company has done let's look at its share price. It is now trading at R354, it bottomed at R130 at the height of the crisis but proved very defensive even during the big fall. It has doubled from July 2007 when it traded at R183.

And on top of what seems to be a higher base all the time, these numbers came through.

"On an organic basis lager volumes were 5% ahead of the prior year for the quarter. Soft drinks volumes were 6% higher than the prior year for the quarter on an organic basis. Organic, constant currency group revenue grew by 8% for the quarter, with group revenue per hectolitre up by 3% on the same basis reflecting selective price increases and improved mix in most regions. Including the effect of acquisitions and disposals, total volumes were up 10% compared with the corresponding quarter of the prior year. The group's financial performance for the quarter was in line with our expectations.".

From a geographic view Latin America grew volumes 6%. Europe grew 7% which includes Eastern Europe who just hosted the Euro 2012. Poland, the host nation increased volumes by 11%. Volumes were still depressed in Western Europe. The US also had a tough quarter, down 1.4% on their MillerCoors brand while Africa again grew nicely at 9%. Lager volumes grew 7% in the Asia Pacific region which included a 5% increase from China, a 24% increase from India and a 8% decrease in Australia. Locally volumes grew 1% on the back of a slowing consumer despite Easter falling into the quarter.

See a trend here? SABMiller have been one of those companies who have successfully targeted the developing market consumer. Expansions into South America, Africa and Asia have all been successful. But what does the future hold? In the medium term I still think they will do well but I am concerned about their long term trends. The social impacts of alcohol are drastic and you will never see legislation loosening towards the industry. A Higher drinking age and ever increasing taxes on the product is taking place here in South Africa and even more so in Developed nations. That doesn't mean we have missed the boat or cannot jump right onto it. We are big favourites of Coca-Cola in our New York portfolios who target the same sort of market but with less social implications. So whether you like an ice cold Coca-Cola or like to slip a little brandy into it, you always win with Coke.

London Bridge is not falling down. At all, just in the nursery rhyme. But perhaps their finances will have a serious problem in the years post the 2012 Olympics. The issue is not so much the what you thought it might cost at the beginning, when you bid, but rather what it ends up costing you. AND, is it then worth it? Montreal took 30 years to pay back the debt of the 1976 Summer Olympics, but I guess at least they paid it back. Anyone remember those? I remember Athens in 2004, it cost the Greeks 10 times more than they budgeted, topping out above 16 billion Dollars. Oh well, at least someone in this office got good use out of that new airport, when Byron was a travelling student he slept under the escalators. Two nights, one on the way in and one on the way out. He says that it was very cosy, he showed us a picture in the office yesterday.

For the purpose of this fun piece I will use three articles as a reference point (not all new ones), first an NY Times one titled Cost Complaints, an Olympic Rite, Voiced in Britain and then a Forbes article, titled How Much Will The London Olympics Cost? Too Much. And then lastly, a much more recent one titled The Olympics - The London model. It seems that whilst London has under-budgeted initially, they have managed to use existing infrastructure for specific parts of the game, they have still overspent.

Not all Olympics are economic disasters, but some are, recently Barcelona and Athens have not covered themselves in glory in those departments. I suspect that in the future the IOC old boys club will have their work cut out, they will have to also make the decision based on time zones, stronger emerging market buying power and viewership, and where the best place is to host. I would think that we would be silly to bid inside of the next two decades for the Olympics. And as much as the Durban people might tell me that their weather is better, Cape Town is more appealing as a host city.

New York, New York. 40o 43' 0" N, 74o 0' 0" W. Stocks ratcheted up some serious gains as many believed that the ECB announcement, plus imminent Fed action squeezed some of the shorts out in a hurry and forced the watchers off the sidelines to a call to arms to buy stocks. That may, or may not look cheap depending on which way you look at it. Earnings expectations have been ratcheted down, that is true, and so I guess the beats are off a lower base. Not everyone says things look fabulous and there have been many conflicting views. But that is what makes a market. Last evening all the major indices gained, the Dow and the S&P 500 added a percent and two thirds, whilst the nerds of NASDAQ added just a little over a percent and one third.

Facebook. Something that did not exist when we started this business, Vestact. The markets gave the very first results as a listed company a big thumbs down. Unlike. The share price in after market trade sank nearly 11 percent, in normal trade the stock dropped 8.5 percent. Since listing the stock has lost nearly one third of their value. All looking rather patchy and the reason for the fall off prior to the results were weaker results and a patchier outlook from Zynga. The listing of Zynga has been, well, pretty darn awful. Zynga has lost two thirds of its value since listing in December last year. Print (a virtual print) an upside down smiley face for both, but a complete washout for Zynga.

Here we go, a first for the company: Facebook Reports Second Quarter 2012 Results. The opening statement from the chap who runs the business, rock star (in a nerdy way) and hoodie wearing CEO Mark Zuckerberg is quoted as saying: "Our goal is to help every person stay connected and every product they use be a great social experience". First question that anyone asks about this statement is that this is very nice, but how do you actually monetize that? Well, Zuckerberg continues: "That's why we're so focused on investing in our priorities of mobile, platform and social ads to help people have these experiences with their friends."

That still does not answer the question for anyone who is asking the serious questions, how does Facebook plan to make more money over the coming years? Serious money. More than they are making now of course. Because at current valuations (around 100 times earnings) it seems too much to pay for pedestrian (relative to earlier in their business cycle) growth at this stage, revenue growth of just 32 percent year on year is not enough. Advertising revenue, what I truly believe is the future of the business, represents 84 percent of the total, but there was quite a big jump in quarter on quarter advertising revenue growth, 28 percent. Phew. Without having done too much homework, the Zynga guidance then comes as no surprise. But their advertising revenue as a percentage of total sales is actually as low as it has ever been (to contradict myself a bit), as a direct result of an increasing cut of payments done of their website revenue.

It was a meet in earnings, but the lack of guidance was clearly a disappointment for investors. Even though the company tells us that daily and monthly user trends were sharply higher year on year and that mobile users were exploding. Which brings one to the future, the need for the company to increase advertising revenue on their mobile platform. This is something that Facebook have been struggling with, and the people who cover the stock even more so.

There are new methods of monetizing their product that have come out of these results, sponsored stories. Now if you are a user and a real junkie, you know what I am talking about. I try and use the platform, but it is tough to keep up to date, but exceedingly easy to use. My conclusion is going to be lame again. I back the team, I back the product, I believe that they will monetize the base in ways yet known to us. They will become apparent. The risks you face being a shareholder in this business is that someone else invents something more amazing, and then you have the problems that Microsoft have now. Although Facebook are still in their toddler stage, in terms of their business life relative to the grown up but still young Microsoft. Either you have a genius here, or you have a child that might just blend in. And nobody likes ordinary. I think that profiling of 20 to 25 year olds patterns on Facebook will be key to future revenues. I shall do my own homework.

Currencies and commodities corner. Dr. Copper is last trading at 342 US cents per pound, higher on the session, the gold price is higher at 1623 Dollars per fine ounce. The platinum is also higher at 1415 Dollars per fine ounce. The oil price, well, that had a ripper yesterday, so it is up a more modest 20 cents per barrel, NYMEX was last quoted at 89.59 Dollars per barrel. The Rand is stronger, 8.23 to the US Dollar, 12.96 to the Pound Sterling and 10.12 to the Euro. We are stronger out the blocks on a day that the Olympics officially start. And we are near our all time highs, around a percent away. And everyone tells me that "things" feel so bad.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment