"No football fans, not Wayne Rooney and his merry bunch, rather Discovery are introducing Vitality to Canadian based financial service group Manulife, and not your beloved Red Devils. Which as far as I can tell (ducks under the table), are not having the best season in the history of everness (I made up a word). Their only consolation is that Chelsea are having a worse season. Whilst at face value this may seem like a "new" announcement, it is really an extension, the company operates under the brand name John Hancock in the US."

To market to market to buy a fat pig. A day of high drama locally, and not at all in the markets. It is interesting to see the mechanisms of the highest court in the land and how it all works. At the market end of Msanzi, here in Jozi, we were getting pasted. Stocks that was, the cricket fellows were back to winning ways last evening. Super. Thanks for that. It seemed like someone decided that all emerging markets were a sell. That is why I think that some of the big index constituents were slammed, Naspers which is a huge part of any South African inc. investment exposure was beaten. The overall index closed down 2.2 percent.

I started looking at my trusty Naspers sum of the parts calculator. Not really, I just normally take Tencent, and the value that it represents inside of Naspers. Bearing in mind that Chinese and Hong Kong markets are closed for a golden week, Chinese New Year celebrations and what is the single biggest human migration of our time. Tencent last traded (last Friday) in Hong Kong at 143.9 Hong Kong Dollars. The exchange rate of one Hong Kong Dollar to the Rand was 2.08. The market cap of Tencent was last at 1.34 trillion Hong Kong Dollars. Naspers owns 33.85 percent of Tencent. So, doing simple back of the matchbox calculations, you get 943 billion Rand. That is the value, in Rand terms of the Naspers stake in Tencent.

So of course when you see the market cap of Naspers this morning at 759 billion it makes complete sense. Huh? What? How can that possibly be right? Unless after golden week and the holidays in China we are expecting the value of Naspers' stake in Tencent to do something crazy, this seems borderline lunacy. As I often note when doing this calculation, we must be far smarter than the people in Hong Kong (which is closer to the centre of the financial world pendulum), as we apply this heavy discount. Tencent is by no means cheap, the stock trades on a multiple of 30 plus, which obviously gives the market investors here in Msanzi some concerns. When selling emerging markets, be careful not to lump everything together. Different companies in different territories have different prospects.

Over the seas and far away in New York, New York, stocks finished a little lower on the day, after having been both up and down around two-thirds of a percent. Twice up that much, twice down that much. In the end the nerds of NASDAQ which ended down just over one-third of a percent was on the end of the sellers wrath. Both the Dow Jones and the S&P 500 closed less than one-tenth of a percent lower. Today the worries from European banks persist, stocks in Japan taking another drubbing. Equally the Japanese Yen is seen as a "safe haven" sending that market lower, as the currency touches a 15 month high. Both the Deutsche CEO and the German finance minister said there was nothing to worry about, with regards to liquidity of the financial institution. When the company manages to convince the market, the dust will settle. Until then, people will be skittish.

Company corner

No football fans, not Wayne Rooney and his merry bunch, rather Discovery are introducing Vitality to Canadian based financial service group Manulife, and not your beloved Red Devils. Which as far as I can tell (ducks under the table), are not having the best season in the history of everness (I made up a word). Their only consolation is that Chelsea are having a worse season. Whilst at face value this may seem like a "new" announcement, it is really an extension, the company operates under the brand name John Hancock in the US. You will recall from our message last year in April: John Hancock tie up. They have operations all over the world, a strong presence in Asia and in Europe. In fact, if you remember right, the company was a worldwide sponsor of the 2008 Olympic Games in Beijing.

All folks who use the Vitality program know it well, your single aim and goal is to tell your friends how awesome you are and how many Vitality points you have, whilst their savings and points levels resemble those of mere ordinaries and not superheroes. Or something along those lines. Not too much of a hurrah in the announcement on either of the websites, this one from Manulife: Manulife to reward Canadians for healthy living. Another example of the white labelling of the Vitality program, I am pretty sure that the product will be hugely successful with Canadian consumers looking for savings. Watch the associated video, it is fun. When John Hancock made the announcement, there were already 700 thousand Vitality members across the US.

Manulife is listed on the Toronto Stock Exchange, (it has an ADR program on the NYSE), the market cap in Canadian Dollars is nearly 35 billion Canadian Dollars. That makes it around 400 billion Rand, which on the ranking tables makes this huge business around the size of Vodacom and Old Mutual put together. It truly is an enormous business, it seems to trade on pretty good metrics, a yield of close to four percent (pre tax) and a earnings multiple of less than 14 times. Like most financials worldwide, the stock has been pounded recently, the three month return is minus 20 percent, marginally worse over 6 months. Over five years Manulife is down 7 percent, bottoming out in 2012 at around ten and a half Canadian Dollars, currently 17 and a half Dollars, there and there abouts.

I trawled through the annual report of Manulife in order to get an understanding of how many life insurance clients the group has in Canada. I could not find it sadly, they do always refer to millions of customers. This is another big scoop for Discovery. The Vitality program is nothing short of awesome for the life insurers. There are some startling facts in the Discovery Annual report around the Vitality program.

" The impact of exercise on hospital admissions is profound. A survey of Vitality members has shown that members who exercise twice a week are 13% less likely to be admitted to hospital than those who rarely exercise. Members on the two highest Vitality statuses have an eight year longer life expectancy compared with members who are not on Vitality or who are on the lowest status."

As in that new Virgin Active advert (Get Up. Get Active.), get off your ass today. Ha ha! Good one. Highly engaged Vitality members claim 50 percent less than non-Vitality members. The trick is for the life insurers and medical aids to engage all their customers to become Vitality members and work hard on their health, by extension the claim levels drop. And that means that the profitability of the business increases significantly. That of course is excellent for your Discovery shares! So if you are a Discovery shareholder, make sure your fiends get out there and exercise and make healthier decisions. And then talk extensively about your Discovery Vitality status, that'll stump them. We continue to accumulate Discovery and expect more of these global partnerships.

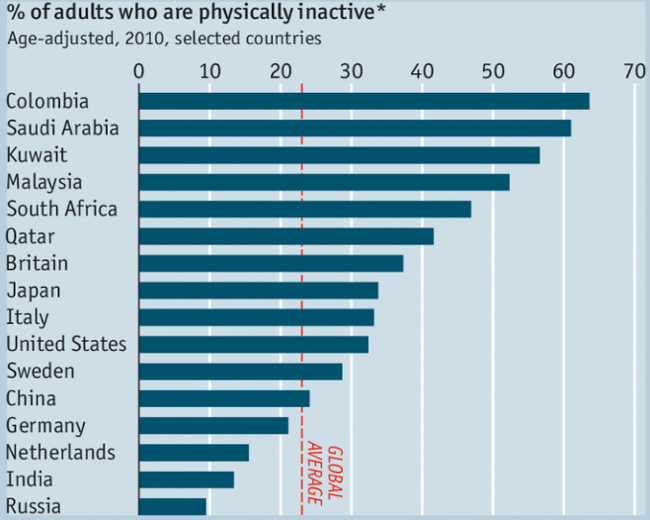

I will leave you with an image from the Discovery presentation last year (via the Economist), percentage of adults that are physically inactive. I just don't get Russia, it is bitterly cold in winter. Colombia? What is that about, the weather is good there, not so?

Linkfest, lap it up

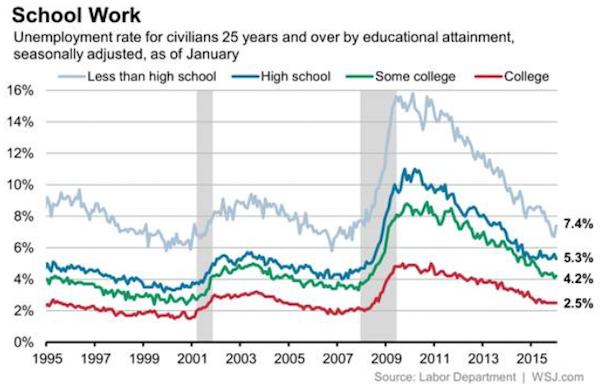

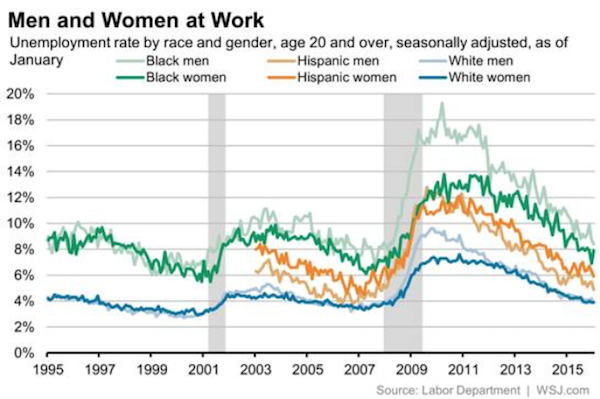

Last weeks jobs report out of the US caused a rather large market reaction. Thanks to the WSJ we have graphs which give us a clearer and bigger picture of what is going on - The January Jobs Report in 12 Charts. Here are 3 charts that stand out.

For a consumer driven economy with very low inflation, this is not bad wage growth.

For a consumer driven economy with very low inflation, this is not bad wage growth.

It is no surprise that having a higher education leads to better job opportunities, the outworking has been a surge in student debt as people try position themselves for the best opportunities later in life.

It is no surprise that having a higher education leads to better job opportunities, the outworking has been a surge in student debt as people try position themselves for the best opportunities later in life.

In a perfect world all these lines would be the same, there is still a clear difference between races though. It was only in 1968 that the Civil rights act was passed in the US (Civil Rights Timeline). More and more research has shown that it takes decades for generational wealth to be accumulated and fully reverse past injustices.

In a perfect world all these lines would be the same, there is still a clear difference between races though. It was only in 1968 that the Civil rights act was passed in the US (Civil Rights Timeline). More and more research has shown that it takes decades for generational wealth to be accumulated and fully reverse past injustices.

I would like a 107 000% return over the next 30 years. To do that you need to maintain an average annual return of around 26% - The 30 best-performing U.S. stocks of the past 30 years. Consumer and healthcare stocks seem to appear most frequently on the list.

Home again, home again, jiggety-jog. US futures are lower. Perhaps as a result of realising that they are more polarised than at any other time in history. Seriously? Where is that Howard Dean rant, you had better watch it again to quickly realise that politics is for the few. We do of course have the Fed chair Janet Yellen testifying in Washington DC in front of politicians, elected officials, that should be fun.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment