"By these numbers one can easily see (sunnies on your head) that there is still plenty of room for growth globally. The sun may be very important to the successes of the likes of Tesla/SolarCity and the progress that Elon Musk makes for humanity, it is certainly very important for Luxottica. Like clockwork, the sun comes up and goes down each and every day, there is ALWAYS going to be a market for their products, of course their lenses in their other business help people who couldn't see before."

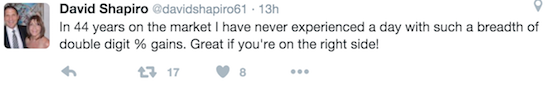

To market to market to buy a fat pig. Our market was on fire yesterday taking it's lead from the strong finish in US markets and when the final bell rang we were up 2.25% David Shapiro had a tweet yesterday which sums things up nicely.

Here is what the individual stocks looked like at the close. The last time I saw so many big green numbers was when QE3 was announced and traders couldn't buy enough stock quickly enough.

As you can see, the stocks in the red were the dual-listed ones. Thanks to traders taking the view that another FED rate hike won't be coming around anytime soon, the Dollar sold off and the Rand reached R/$15.75. The second part of David's Tweet is important to note though, if you were frightened out of the market with the big drops in January you would have missed this little rebound. Taking a look at the Woolworths share price for example, at the peak of pain around 2 weeks into this year, the share price reached lows of R86 a share. At around that point in time the media companies wheel out the guys who have the gloomiest view on the world and the future. You then say to yourself: "these guys who are on TV (so they must be clever) say that this is only the start of the pain. I have already lost 20% on my Woolworths position, lets sell them before it gets even worse." Woolworths is now 11% higher off its lows in the middle of January.

The problem with trying to time the market is that you normally sell after it has had a big pullback and then only get back in after it has had a big rebound. That is a sure way to lock in losses and miss the rallies. Bright found a stat yesterday that showed if you missed 1.3 days out of 10, over the last 55 years on the JSE, your returns over the last 55 years would be 0%. So on an inflation adjusted basis you would be in a deep hole! The big 2008 speed bump is still fresh in most peoples mind, so we all get a bit jittery when markets fall 5 - 10%. One of the main reasons why 2008 was so big though is because most people did not think what happened could happen. I won't fall into the trap of saying "this time is different", we have however seen companies build stronger balance sheets due to the 2008 "cold shower".

Company corner

Luxottica is a company founded by an orphan, not that it matters too much right now. Although technically not , his guardians were too poor to look after him. He redesigned the world of sunglasses (sunnies, shades), as well as the way people look at these semi luxury items. A good pair is not cheap, it is almost technically a durable good in terms of the duration of the life of the product. We should recycle them more often, those old out of fashion scratched Oakley's should find a home somewhere, or be sent to sunglasses heaven. Or sunglasses hell, no doubt when you are being recycled, it hardly seems like a good outcome for the piece. Luxottica, the company is a manufacturer and seller of their own brands, as well as manufacturing brands for lifestyle brands across the globe.

You will know their flagship brands, such as Oakley and RayBan, as well as their outlet Sunglass Hut. The company is controlled (perhaps too much) by founder Leonardo Del Vecchio. He is around 80 years old, tough as nails in controlling his empire and is a testament to how to overcome all. Not too dissimilar in a sense to the Spanish success story, the Ortega family, the folks who founded Zara. The company also operates in the huge lens market, making customer and optometrists lives a whole lot easier, in terms of turnaround times to get your specs.

Enough of that, there is no such place where shades check out and go to heaven, they disappear to the bottom drawer. The company reported full year numbers to end December last week. At face value the numbers reflect the global economy for middle to upper middle income consumers. Adjusted net sales on a comparable basis increased mid single digits, currency headwinds saw growth at current exchange rates only reflect a 2 percent rise to 8.8 billion Euros, profits of 1.42 billion Euros. A miss in terms of expectations from the market, and of course in this kind of jittery environment, it is always sell first and then ask questions later.

The company certainly ticks a lot of boxes. Selling semi luxury goods to rich people (by global standards). Their sales mix geographically is around 59 percent North America, 19 percent Europe. Meaning that the rest of the world, including Asia Pacific (at 13 percent) is only one-fifth of total sales. Down here, where the sun shines relentlessly, we fit into the category of rest of world, with a mere 3 percent of sales, I guess not quite a rounding area for the whole continent and the middle East, almost though. Latin America makes up the rest with 6 percent.

By these numbers one can easily see (sunnies on your head) that there is still plenty of room for growth globally. The sun may be very important to the successes of the likes of Tesla/SolarCity and the progress that Elon Musk makes for humanity, it is certainly very important for Luxottica. Like clockwork, the sun comes up and goes down each and every day, there is ALWAYS going to be a market for their products, of course their lenses in their other business help people who couldn't see before. I fit into that category, I had the laser operation, I am guessing that it may be another decade before I have to wear glasses all the time again. Money well spent though!

Expectations are always important for investors. Expectations that the custodians of your hard earned funds are looking after your best interests. Expectations that revenue and earnings growth are going to meet and beat your lofty trajectory. Shareholders are a real demanding lot, and why not, they after all have many choices, right? In this case the stock looks rather pricey at a forward multiple in the region of 25 times earnings. The dividend yield (in Euro terms, before tax) of around 2.75 percent is acceptable in a very low rate environment.

We started out the piece suggesting that founder De Vecchio was a loner from a very young age, not by choice. After a period of calm in terms of leadership, there have been CEO and co-CEO ructions, too many in fact, which is not great news for investors. Uncertainty, and the prospect that the founder still has an overreaching arm. Not able to find a captain to drive the business, perhaps that is the untrusting nature of his past. It is not normal for us to stay with a hold on a specific business, we are a buy or sell house, the current share price justifies the reality that the very short term sees stodgy growth. If you have this business in your portfolio, there is nothing to do. The growth rates will return, I have conviction on that score, not for the time being. This is where you need to be patient for a little while.

It is not a company that we hold. In fact, we may never hold shares in Credit Suisse. It has however been very newsy and particularly yesterday where the stock was plumbing to one quarter of a century lows. When one puts it like that, it seems a whole lot worse. 24 years of investing gains evaporating, meaning that lifers at the bank who have careers coinciding with that time might well be forgiven for feeling sick to the stomach yesterday. Newish CEO, Ivory Coast's finest (and France, he holds dual citizenship), Tidjane Thiam has his work cut out for him. He is less than a year into the job and must be wondering why he left the relative safety of Prudential. He certainly was putting on a brave face yesterday.

Weak global growth and a period of low interest rates are making global banks re-think once again, post the 2008 financial crisis. We may think of those as distant memories, for many folks involved in financial institutions, their mates all around them (in particular) in the risk taking areas have long packed their cardboard boxes. Government regulations have meant that the banks are less profitable, more regulation means costs in the form of fewer revenue generating people (who fulfil a very vital role for financial stability) have risen. Banks with exposure to oil companies, basically the whole world is connected to this important commodity, are starting to see stresses. So while lower prices may be a windfall for consumers, if you're looking to borrow for expansion, perhaps your credit score had better be world class.

It certainly is a reminder that even whilst Credit Suisse falls into the bulge bracket of banks (basically the too big to fail category), it is never easy to pick the right vehicle for investing, even if you pick the right theme. Some of the normal metrics such as price to book, in this case 0.62 might make it seem like a no-brainer, the value of some assets being written down might well reflect that the market has it right. Wells Fargo (one we do own) denied that they were looking to buy Credit Suisse's assets. If I had to stick my head on the block and say whether or not the worst is over, I would say we are more than half way through this malaise. Someone else's pain is always an opportunity. Credit Suisse should recover in time from these depressed levels. It doesn't mean that you should buy it right now. That is also an important investor lesson, you can't (and don't want to) own everything. If you don't understand it, the depths and breadth of banking, avoid.

Linkfest, lap it up

Elon Musk is changing the world one battery at a time - Elon Musk Says Tesla's Next Home Battery Is Coming This Year. If you don't know what is the difference between the PowerWall and the PowerPack watch the video of when Musk launches Tesla Energy - Tesla Powerpack

As a bit of a follow on from our conversation above - It's Never A Perfect Time To Invest In Stocks. One of the side notes in the article is that currently markets are following the oil market, in days gone by it was the total opposite. Nothing is certain when it comes to the market!

Home again, home again, jiggety-jog. Our market is a mixed bag this morning with the ALSI slightly in the green and the Rand holding strong under that R/$15.90 level. The big market moving news will be the US jobs number at 15:30 our time, expect that data to shift currencies and markets.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment