"We all knew that Russia and Saudi Arabia were meeting, the market I thought was expecting some production cuts from OPEC and the majors. It seems that the truth is that the budgets of all the oil producers rely heavily on the volumes being as high as possible. Saudi and Russia (and many other producers, Venezuela and Nigeria spring to mind) have had serious budget problems recently. So volumes almost have to remain high."

To market to market to buy a fat pig It was a mixed bag yesterday, with the major oil producers of the world (the two biggest) meeting alongside some other important producers in Qatar trying to have an impact on markets. Ironically it is the free market that has given consumers of the world these lower prices, the fracking revolution has shaken up the balance of power in the market. Whilst we were all held to ransom in a sense from the cartel that is OPEC, newer producers in the form of Russia (not a part of OPEC) and of course the revival of the US oil industry, has meant that consumers of the world have more choices. And just at the point when the producers are feeling the most pain, the Iranians can start exporting oil again.

I guess trying to corner the market and make it your own is always met with human innovations to try and wrestle price control away. Which is why that I think in any scenario of Eskom making much higher demands from their customers will definitely be met by increased solar utilisation, with the panels and battery technology having improved significantly in recent times. Perhaps Eskom should think of the same types of business models that the likes of Solarcity has currently, you install and lock in customers with a fixed price, rather than those with resources and heavy users moving on as customers. And once they are gone, they are unlikely to ever come back. If the suns sets forever and the greatest power source known to man never comes back, I am guessing we have bigger problems than just power.

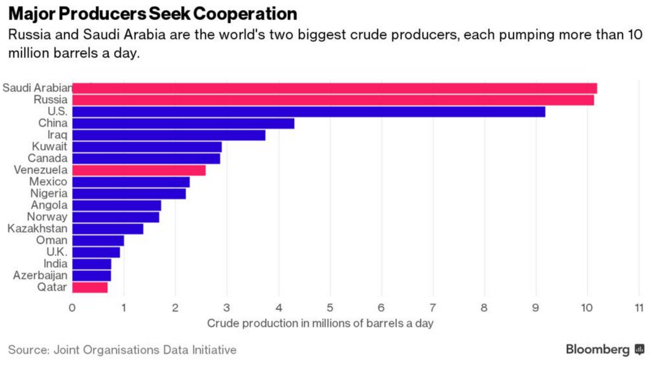

Back to markets and more specifically the oil market. We all knew that Russia and Saudi Arabia were meeting, the market I thought was expecting some production cuts from OPEC and the majors. It seems that the truth is that the budgets of all the oil producers rely heavily on the volumes being as high as possible. Saudi and Russia (and many other producers, Venezuela and Nigeria spring to mind) have had serious budget problems recently. So volumes almost have to remain high. Before we get onto what was agreed, herewith a wonderful graph showing who the largest producers are on the planet of oil, this I got via the Twitter account of Javier Blas (we spoke about him yesterday, he is a must follow for the commodities market):

Did you know that China was such a large producer? Being such a big country with a population that has a high resource demand, you would think that they would have their own reserves which they would sweat hard, I had no idea that they were the fourth largest oil producer on the planet. The reason Venezuela and Qatar are in pink(ish) is that they are the other parties that agreed to a production freeze. That was the decision. Not a cut, which would have squeezed the market higher (I think), rather not too much.

A spectacular article from Blas' colleague, Liam Denning, at Bloomberg titled Oil Producers Frozen With Fear fills in all the blanks you may have. The oil price responded in the fashion that I guess you would have expected after those expectations (Great Expectations of everything), here is another graph from Blas:

So as you can see, the upshot of it all was the markets started selling off from their best levels on the day, and that was a global thing. The Jozi all share had crested 50 thousand points during the course of the morning, and had been trading at the best point for the year (we are only 7 odd weeks in) so far. We slipped away and finished the day down 0.93 percent, financials and resources dragging the market lower.

Local finance Twitter was ablaze with the Anglo American results and restructuring plans, I am pretty sure that by now you have read a lot of it. The company is basically going to turn into a leaner machine, encompassing South American copper assets, Diamonds and Platinum, both leaner operations themselves. Your guess is as good as mine as to who are going to buy the rest of the assets at these prices, there may be a cat and mouse affair that ensues here. Kumba? That no doubt is going to be unbundled, what about the London shareholders though?

And what about Minas-Rio? As you recall, we wrote about it a year and a half ago: Five years late and woefully behind budget. At that time the price paid for the asset in Brazil, and the money sunk into it represented half of the Anglo American market cap. Since then, October 2014, the Anglo American share price is now worth 70 percent less in Pound terms. In other words, what they paid for and spent on this project is now worth more than their entire market capitalisation. Thanks Cynthia Carroll and Mark Moody-Stuart for nothing.

The share price of Anglo American initially resounded favourably to the asset sales, debt reduction, as well as heavy handed cost cutting measures. Asset write downs, slimming down and then the realisation that there may be very few buyers for these assets in a hurry and that the debt reduction plans may not be enough set it. And don't expect a dividend any time soon either. And the stock then ended lower, although comfortably off the worst levels. We continue to avoid the sector and believe there may be more pain for Anglo.

Over the seas and far away, stocks in New York, New York opened much better after having missed the global rally Monday. Stocks rallied all the way through to the close, the Dow Jones Industrial Average added nearly 1.4 percent, the broader market S&P 500 added one and two-thirds of a percent. The rally was led in large part by technology, which as a whole added two and a half percent, sending the nerds of NASDAQ up two and one-quarter of a percent higher.

Alibaba was undoubtably on the receiving end of very favourable Chinese credit numbers, that stock was up 8.88 percent on the day. Astonishing. Even after that sharp move higher, the stock has traded down 18.43 percent year to date and is down more than one quarter of its value over the last year. And nearly 30 percent down from the listing price! Surely on a multiple of 16 times and in the sweet spot of Chinese consumerism, this must be a good opportunity?

Company corner

Tiger Brands released a trading update that was not really that inspiring yesterday. It showed, the stock closed down 5.66 percent on the day. Follow the link from their Investor Relations page: Trading update for the four month period ended 31 January 2016. The company points out the obvious: "Domestic sales volumes softened marginally as a result of increased levels of pricing pressure and a slow-down in consumer demand. With consumers under considerable financial pressure, the impact of the depreciating rand and rising soft commodity prices was only partially offset by price increases."

It is certainly tough out there for consumers, imagine if the oil price was at elevated levels? And the Rand was at the same level. It would be painful. With trading conditions likely to remain pressured, it may be a year where the prices of the food producers already reflect the reality, this is going to be a tough year. The company has strong brands, there is little you can do about the drought, sometimes you cannot pass all the costs onto the consumer, who may well shop down to less iconic brands. We continue to "hold" Tiger.

I keep looking at the results of Tesla day after day and promising Michael that I will hammer them out tomorrow. And then of course something else happens. The company reported this time last week, at least I have the whole day over California, so it is not quite a week late: Tesla Fourth Quarter & Full Year 2015 Update. There are some pretty powerful things in there, that letter from Elon Musk to his fellow shareholders. The fact that the business is unique as a motor vehicle manufacturer, in that they still know everything about their car once it has left the assembly line. How many manufacturers of any sort can claim to know everything about their products (provided the user wants that) once they have sold it? I can't think of too many. Tesla continues to collect data from their users, with the Autopilot learning at a rate of 1 million real-world miles a day. That is pretty astonishing.

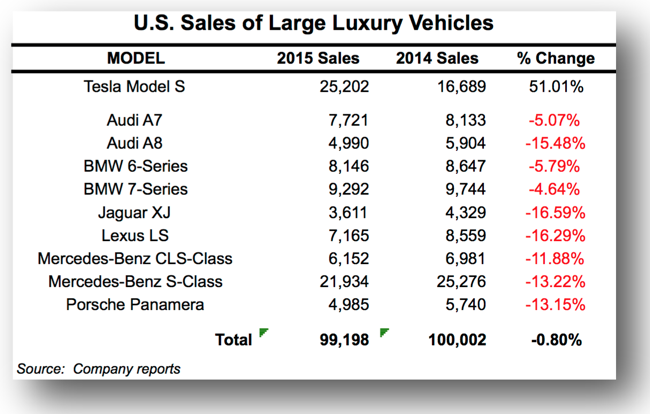

The market enjoyed the fact that the company produced strong operational cash flows, notwithstanding the fact that the costs per vehicle are still significantly higher than before. What I found very interesting is that in the luxury segment of the motor vehicle in the United States, Tesla saw stronger sales than any of their competitors. We chuckled on the comparison when no BMW models were included in the "large luxury vehicle" category, it is what it is. Here goes, 2015 compared to 2014:

When comparing this company however to their competitors, you can see that they operate in one specific market currently. People who have genuine concerns about the state of the environment globally, i.e. aware of climate change, and most importantly, have the ability to switch over to a very expensive and niche product. Motor vehicles in most parts of the world where the company operates face stiff competition. Their advantage is simple. They are looking for specific customers, their cars have very few moving parts, as as such require little or no maintenance. The updates are done through the night whilst you are sleeping, via the internet. The product is revolutionary and very different from before.

As an investor however, the basics still apply. You part ways with your hard earned money and supply the company with the capital to be more profitable than the prior year, over a long period of time. With a company of this nature, who are looking to revolutionise transport and supply home solutions (the Powerwall battery) that use the best power source known to man (the sun), you are going to have to expect major volatility and expect a wild and bumpy ride. We continue to accumulate as a speculative investment that should not carry a significant weighting in your portfolio. You are essentially buying the future and often you have to (as is with the likes of Amazon) pay up for that privilege. I mean, the CEO of Tesla wants to go to Mars and settle there with his other business and he is serious about that. The company as an investment is not for everyone, and still forms a small part of spec picks. It is still however in our opinion a buy at these levels.

Linkfest, lap it up

Facebook and Alphabet both have projects that have the goal of getting interest to the poor. Facebook is experimenting with having solar power drones fly over rural areas and transmit the data down, the Alphabet route has been to go with balloons - After Nearly Going Pop, Google's Project Loon Heads Into Carrier Testing This Year. "That balloon, Teller said, last year travelled around the world 19 times over 187 days last year.". Having access to the internet is one of the ways to help people out of poverty.

Research shows that more trade between countries is better for everyone - The ancient 'Silk Road' is back in business as new train connects China to Tehran. If we do what we are good at and then import what other people are good at, in total we have more resources to go around.

It is not often when looking to spend over R 1 billion that you get asked to wait 2 years - Why You'll Have to Wait Years Before Getting That Gulfstream Personal Jet. In 2015 Gulfstream delivered 150 aircrafts, showing that there is still strong demand from the super wealthy and corporates.

Home again, home again, jiggety-jog. Stocks are mixed across Asia, Shanghai is higher, Hong Kong is lower. And after a face ripping rally yesterday, Tokyo is understandably lower. US Stock futures are lower. The Europeans continue to fumble around on bank liquidity. Meanwhile ex Goldman Sachs banker, one of the overseers of the Troubled Asset Relief Program (TARP) and now president of the Minneapolis Federal Reserve, Neel Kashkari, suggests that the big banks that fit the tag "too big to fail" should break up. What do you think about that? I must admit, I am pretty mixed in terms of my feelings, where greed, leverage and money is involved, smart financial engineering to boot, in an industry that rewards risk taking, caution should always be the watchword. Perhaps more smart regulation should apply, not smaller itty bitty companies.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment