"OK, back to the point at hand, the sell offs and how long they lasted and what the response was at that moment in time. I am going to also take the responses from the great doom Twitter account (his world is always ending) ZeroHedge (the doom attracts 311 thousand followers) and the voice of reason, Eddy Elfenbein, as well as our own Paul Theron"

We are very pleased to announce the debut of Business Blunders the YouTube version. Paul is innovative and as long as I have known him is someone who is always looking to stay fresh. In fact the older he gets, the wiser he gets and he stays hip. He is possibly the fittest I have ever seen him. OK, enough of that, I am not looking for a raise here, I am trying to introduce what will be a fun segment, you must equally do two things when viewing this "video". Subscribe to the YouTube news channel after watching this Blunders - Episode 1. Or even better (and easier), go sign up for the video link to be delivered to your in box: Blunder Alert! Tell us what you think!

To market to market to buy a fat pig I was prompted by a post of a relatively young, London based Bloomberg journalist's blog on the global market nearly entering bear market territory (down 20 percent from recent highs) to do a little exploratory work on recent vicious sell offs, and to test the memories of my colleagues. It always feels completely awful when you are in the midst of a market sell off, you cannot recognise whether or not this is part of something that is likely to continue for an extended period of time, or whether the confidence will return, the world really isn't finished and better company earnings guide prices higher. Being pessimistic does attract people to your theories, you always seem to hold the secret sauce that everyone yearns for.

I set out to check all the sell offs over the last half a decade, keep it to those time frames. After all, lots happens during a relatively small period of time in history, yet at the same time, much doesn't change either. People who work at organisations for a generation can tell you of hard and easy times, they can tell you of how the company managed to do x or y in response to a crisis, or perhaps how they wrestled market share away from their competitors with better delivery or superior products. In fact, I would love a three paragraph piece on your experiences in a specific industry and how you have seen it change. Most especially if you have been around in a single industry/company for two to three decades. I would love to hear how "things" have changed. How spreadsheets have made your life both easier and harder. That sort of thing. Send it!

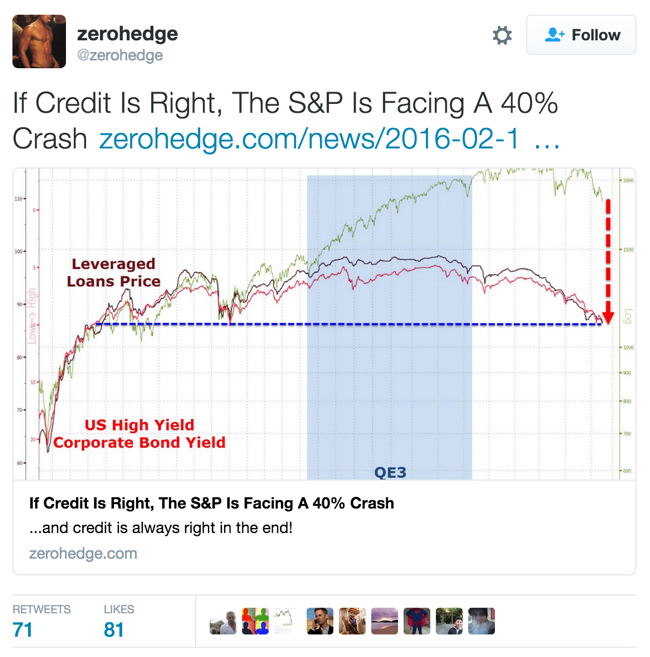

OK, back to the point at hand, the sell offs and how long they lasted and what the response was at that moment in time. I am going to also take the responses from the great doom Twitter account (his world is always ending) ZeroHedge (the doom attracts 311 thousand followers) and the voice of reason, Eddy Elfenbein, as well as our own Paul Theron. First, in the middle of 2011, from late July 2011 to the beginning of October 2011 the S&P 500 fell from around 1343 points to a low of 1074 points, a loss of around 270 points, down around 20 percent, what would be referred to as a bear market, not so? Standard and Poors had downgraded US debt, yields on Greek debt was at a record high, the debt crisis in Europe wasn't contained. At the depths of the market despair, what was ZeroHedge saying?

Stuff like this:

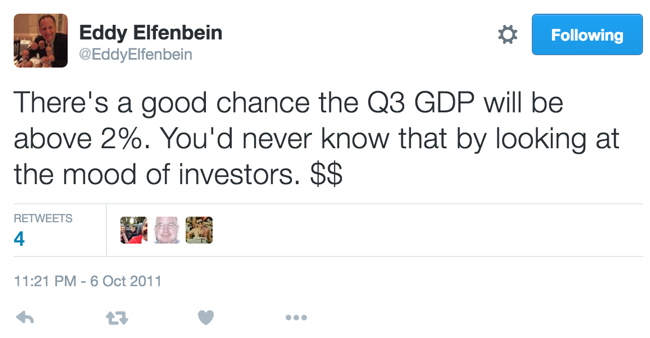

Which led you to this "news" from the anonymous fear feasting blogger: "The S&P 500 is now over 20% lower from the highs, and we are officially in a bear market. Gun to our head, and with an eye on where MS is trading, we are going much lower. But even gun to our head we are unsure if the S&P will enter triple digits first, or if that will be preceded by Morgan Stanley "Benjamin Button-ing" its teenager status..." There you go, the market was going to single digits, MUCH lower, you should stick a gun to your head, they said. What did voices of reason say? Eddy said this:

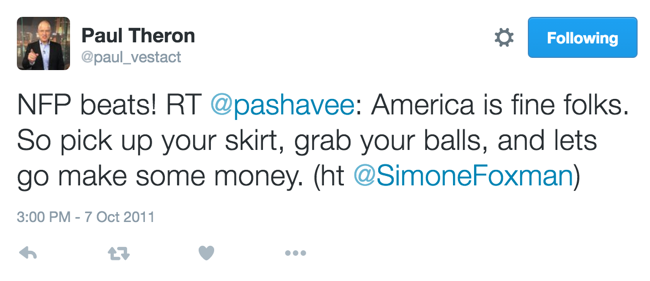

And then Paul? He was a little less subtle, this was pretty hilarious, Paul retweeting a fellow:

Since ZeroHedge said we should have stuck a gun to our heads the market is up nearly 62 percent, the broader market S&P 500 that is. That has been the Dollar return for equities. {Insert heavy dose of sarcasm} Not bad for a world that was going to hell in a handbag.

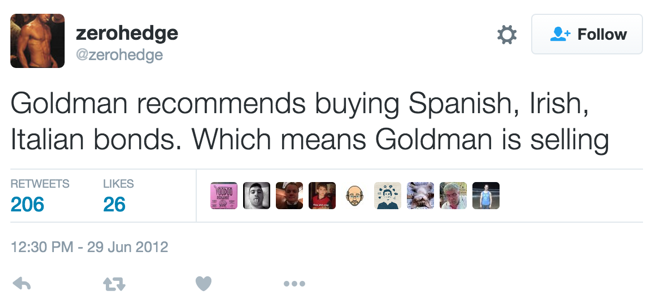

It didn't take long for another bout of heavy selling to ensue, stocks were sold off heavily during the course of the end of April 2012 through to June 2012. Stocks sold off on the S&P 500 from levels of 1405 to 1277, down around nearly ten percent, or a "correction" if you prefer technical language, which I certainly do not. Again a period in which Europe was dominating the headlines, the emergency loans, Angela Merkel scrambling, Mario Draghi also pleading and scrambling himself. So of course the end was nigh, ZeroHedge:

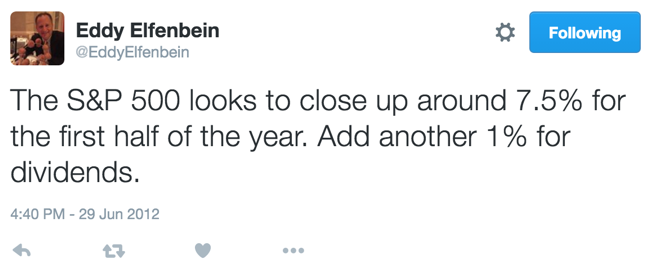

In a related post from that day (the 29th of June) on the update from the Europeans, ZeroHedge said in a post titled Hardball In Brussels: "The markets are rallying but the realization that nothing really was accomplished, meaning implemented, will drive the markets the other way soon I fear." And then Eddy, what was he saying? Obviously not bearish:

I think you get the point. I could go on currently, this is what ZeroHedge is "saying" and the tweets as you always see get retweeted furiously:

Of course being bearish makes for very compelling reading. You could possibly go all the way back on the bearish peoples timelines and see whether or not they ever change their tune. As with us. We advocate the long term holdings of companies (and not share prices). It is very important to remember that you own stock which reflects the outlook at any one given point in time. Those folks who bought Facebook at their disastrous IPO feel fine right now, those who own Twitter and equally participated in their IPO feel awful. Both companies have different sets of outlooks, and the market is pricing them accordingly. In his weekly letter Eddy had this to say on current valuations:

"The drop in medium-term rates has been a strong signal for prudent investors to focus on stocks with generous dividends. Let's work some simple math. A five-year Treasury currently pays you 1.11%. That's above half the dividend yield for the S&P 500. For the return of stocks to match the return of the five-year, stocks would have to decline by 1.11%, on average, for the next five years (this assumes dividends remain the same). That would bring the S&P 500 about 100 points lower by February 2021."

We would continue to advocate that owning stocks is a far better outcome than current fear suggests, negative yields everywhere. Whilst market sell offs are unnerving, if you have spare funds, add them when the moment, like now, arrives. Whilst you can never catch the perfect bottom, you can own quality assets at a cheaper price. Stay the course, own the company, the clouds pass. for the time being it feels bad, I just thought a little perspective may be in order.

Company corner

Woolworths released six month results yesterday morning. We had already been sort of primed during the course of last month, the 26 week trading statement was released on the 14th of January. Group sales increased 17.1 percent, if you exclude David Jones (acquired on the 1 August 2014), sales grew by 12.3 percent. Basic and headline earnings grew 52.8 and 44.9 percent respectively. Headline Earnings Per Share grew by just 3.6 percent, remember that there are far more shares in issue now, due to the rights issue. Clothing and General Merchandise sales grew 12.5 percent, a pretty pleasing result. The Food business grew sales by 12.1 percent, with price movement (inflation) of 5.7 percent. It all looked OK, Ian Moir suggested in an interview that they continued to take market share across their respective businesses.

There are some *nice* graphs in the analyst presentation, showing you the Woolies diversity, both geographically from a revenue perspective (43 percent Australia, 57 percent Africa) and from a turnover per segment. That is as follows, 14 percent Country Road (take me home), 20 percent Woolworths Clothing and General Merchandise, 36 percent Woolworths Food and the balance, 30 percent being David Jones (and his locker). Problems seem to be Womenswear in their Country Road stores down under. C'mon Sheila. It is also important to remember that this six months is being measured against five months of David Jones, on that basis, David Jones is not that flattering.

The outlook is mixed, whilst the group concedes that their core clientele in both South Africa and Australia are by no means immune to a global economic slowdown of any sort, their trading for the first six weeks of this year was in line with the results for their first half. Their plan of action is to review their cost base and continue to sweat CAPEX as best as they can, I suppose this is always a natural response.

I like the CEO Ian Moir, I think that the group has done an amazing job with the clothing over the last half a decade. My kids actually prefer this destination to all others, when it comes to clothes and food. I do too, I have shareholder user biases unfortunately. You have to use the products that you are a shareholder of, that is the way that it goes in my family, and generally in this office as well. It does also help to get the user experience, talk to the staff, observe subtly.

The stock however got pounded like a tough steak on a day that the rest of the market was selling off heavily. In part there were a couple of reasons, I will include a few from the presentation. "South African economy likely to become more constrained". Yip, sounds about right, I think that this is kind of overstated, we are not Greece (to paraphrase the Spanish prime minister Rajoy). And then "Australian economy and retail environment to remain tough in the short term."

The real clincher I guess was the Janet Yellen line: "Both economies are commodity-based and therefore reliant on China". This is true. We do both (Ourselves and Aussie) have more diversified economies than say for instance Russia, or Angola, or Nigeria for that matter. One line in there that we liked equally: "Expect the upper income consumer in both regions to remain relatively resilient." Also true, whispers are of increased taxation for high income earners here in South Africa might test this theory. I still think that Woolies offers a quality proposition, i.e. you get what you pay for. Their returns policies are excellent, their staff is incredible when compared to their competitors. Shoppers judge value for money.

The stock closed down 7.65 percent on the day. Their "sector peers", stocks like Truworths and The Foschini Group sank 3.74 and 5.86 percent respectively. Pick n Pay lost 0.59 percent, Shoprite 1.1 percent, those are the food retailers. So I guess you could say half the market and half the results that were not well received. The company does currently command a higher multiple relative to their peer grouping, that is perhaps one of the reasons. Whilst we note that there are several speed bumps and major obstacles, we continue to feel that management execution will be spot on and their target grouping will continue to be resilient, and newer customers will be attracted to their quality offering. We maintain our buy rating on the company, accumulate on weakness.

Twitter had their full year numbers on Thursday (Twitter Q4 and Fiscal Year 2015 Shareholder Letter). The stock has been under pressure and these numbers didn't help give the stock a leg up. Over the last year the stock is down a huge 70%!

Here is a quick overview of the numbers, full year revenues up 58% to $2.2 billion, 4Q revenues are up 48% to $710 million and the number of advertisers is up an impressive 90% to 130 000. So there has been solid top line growth and good traction made on getting a foot in the door with advertisers, the problem lies in the user growth numbers. There was no user growth between the 3Q and 4Q and only a 9% growth year on year.

For a company that currently trades on a market cap of 5 times sales (after the stock has fallen 70%), you can't have flat user growth. The users are the lifeblood of the company, if eye ball numbers are not growing then you very quickly hit a cap on the revenues that you generate from advertisers. Currently there are 320 million Monthly Active Users (MAU) of which 80% access the site via mobile.

The other problem with being a shareholder currently is that over the last year $682 million was granted in stock options. That is a huge number considering that the current market cap is around $10 billion and that revenues are only around $2.2 billion. Stock options are not a once off expense because once those stocks have been issued, current shareholders then have to share all future profits.

As a daily user of the service, the user experience has got better as of late. Also if you read the shareholder letter they have a long list of ideas/ user experiences currently in the pipeline. For our information driven world and especially for those of us who want news minutes after it happens, Twitter is a core part of our daily routine. I think that in the coming quarters they will start hitting their stride, the unknown hanging over the company with the change up in CEO's is gone and Jack Dorsey seems to have a clearer vision for the company than Dick Costolo did.

Linkfest, lap it up

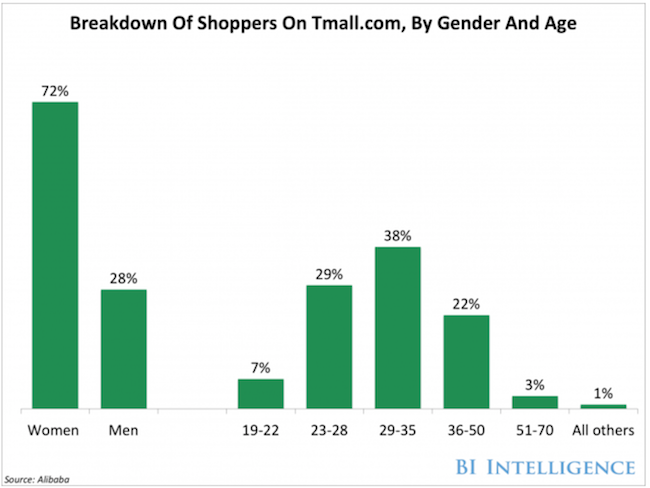

Here is a look at what online Chinese retail demographics looks like.

Im sure that there is a similar trend in brick and mortar shops, does this mean that the men are just better savers or that woman just do all the shopping for the family?

After the clobbering the markets took yesterday here are some reassuring numbers from Ben Carlson - When Global Stocks Go On Sale. History is not the future but in the last 10 global bear markets, there are only 2 occasions where stocks were not higher one year later.

Earlier this week Japan lowered their interest rate into the negative territory. A couple years ago negative interest rates was something that was considered undoable, who would pay to put their money into a bank? Currently 30% of of European government debt has a negative interest rate - Negative Interest Rates.It is easy to hide thousands under your mattress, not so easy if it is millions. People are willing to pay for the security that they will get all their money back, minus the interest they are paying obviously.

Home again, home again, jiggety-jog. Stocks have started on fire here, up sharply. US futures are about flat, stocks bounced hard in the last hour and a half of trade, where they were at their lowest point. I suspect that the buyers are going to return in the coming days.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment