"The numbers quick sticks, for the full year, as those are available. The company produced revenues of 21.662 billion Dollars, an increase of 8 percent on the year. The company spends an enormous amount on R&D - Research and Development (looking for the next huge therapy), 18.7 percent of all revenues. That is a big, big number, one in six Dollars they make are trying to advance the causes of humanity further."

To market to market to buy a fat pig. Wow, that was huge, a day of fund manager FOMO. Fear of missing out on the recent rally. Stocks locally added 0.9 percent on the day, the Rand had strengthened significantly during the course of the previous session, and we hung onto those gains. I wasn't quite sure whether it was Dollar weakness on account of the Fed having stepped away, and seemingly for a little while, whether it was Rand strength on account of stability and the Reserve Bank doing the right thing, as painful as it is for consumers with debt. Or whether it was generally markets across the globe catching a bid. And by extension, the flows return to emerging markets at the fringes.

Not all stocks in Jozi had a good time Friday, the resource counters went off the boil badly, the session prior had been a ripper. Which lead me to the dumbest headline of last week. Amazon, which we will cover, had rallied around 9 percent during the ordinary session on Thursday, results were reported after the market. The stock sank around 11 percent in the aftermarket on Thursday, eventually closing down 7.6 percent in ordinary trade on Friday. During the course of a very good week for equities markets, the stock ended down 1.5 percent.

In three days the stock was down the difference between the Thursday spot market and the aftermarket, 2.3 percent. Yet a headline read, Jeff Bezos net wealth plunges 7 billion Dollars. Talk about being selective about your data. According to Bloomberg billionaires on Friday, Jeff Bezos "lost" 3.8 billion on Friday, (Gates "made" 1.8 billion Dollars), he is still "worth" on paper 52 billion Dollars. A less exciting headline would read, "Jeff Bezos creates 275 billion Dollars in value since 1994." A better headline would be, "From 0 to 107 billion Dollars of revenue in two decades". Less exciting you see.

Over the seas and far away stocks were on a tear, fund manager FOMO deeply intrenched, the broader market S&P 500 added nearly two and a half percent on the session, the Dow Jones Industrial Average a whisker below that, whilst the nerds of NASDAQ added just shy of 2.4 percent for the session. And the action was pretty much broad based, all sectors popping and enjoying good gains for the day. Visa was on a tear after their more than decent results, the stock was up just over 7 percent on the day, equally the Microsoft results were well received and the stock ran up gains of 5.83 percent on the day. Earnings, those count more than the actions of central banks in the end. The best session for equity markets since September last year!

The Friday session softened the blow of a horrible January, which in fact was the worst January for equity markets since 2009. Simple writing mistake there, including the same word (January) in the same sentence. Did it again, same! Sorry purists, languages must evolve. I gave my daughters a copy of Macbeth and asked them to read it, English 405 years ago is not the English of today, written or otherwise. Stocks, the broader market S&P 500 ended off January down around 5 percent, in the case of the nerds of NASDAQ, down more, off nearly 8 percent for the month.

That is nothing, as the out-doers of one another would say (we slept in a hole in the ground and woke up before we went to bed), Chinese stocks, the Shanghai Stock exchange, is down 24 percent year to date. And we are only in February. Things can only get better, in the words of D:REAM, it seems like the view is that the Chinese economy is walking around in zombie mode. Just this morning the Bloomberg headline reads: Record China Factory Gauge Slump Adds to Monetary Policy Dilemma. Yip, Happy New Year for next Monday!

I would say that broad based worrying about the Chinese economy is wrong in the long run, dead right in the short term. A shift of any sort takes time, if you have investing time on your hands (which we all should), then ignore the short term changes and pay attention to the structural ones. Chinese stocks today are down sharply, at least those in Shanghai, down over a percent and a half, stocks in Hong Kong are down around three quarters of a percent, whilst Japanese stocks in Tokyo are up nearly two percent. Stock futures across to the US are marginally down, around 0.1 percent. We should open better here, on account of catching up to Wall Street charge.

Company corner

Amgen reported numbers for the fourth quarter and full year last week Thursday, after the market closed. This stock is new to the recommended list, perhaps a refresher on what the business does is in order. The company treats serious illnesses, that includes cancer, kidney diseases, rheumatoid arthritis and bone diseases, primarily. The company uses (a lot of this is from their website) advanced human genetics to firstly understand the conditions, before researching and manufacturing at the highest possible standard.

It is what the market refers to as a biotechnology company. The company has been around since 1980, the company was founded in that year in Thousand Oaks in California. They do have a presence here in South Africa, it seems from a web snoop that their business is just off Ballyclare Drive in Bryanston, in the Ballyoaks Office Park. That is very close to where Michael used to live. Amgen has been listed for a long time too, since mid 1983. In that time the stock has delivered a return (without dividends) of 44375 percent, five stock splits later. Why, oh why, Grandad, did you not pick this one? Or at least work there, along with the other 18 thousand odd folks who no doubt have stock options.

Whilst the stock is heavily owned by institutions and mutual funds, nearly 88 percent owned, the spread of shareholders is decent enough. There is however one institution, Capital Research Global Investors which owns 13 percent of the business. Capital Research Group is a private financial services business that manages over 1.4 trillion Dollars worth of money, a big and solid "partner" to have. Other big holders include all the usual suspects, I noted that Bill Gross' new employer, Janus Capital, owns over 2 percent of the stock. Third Point, a fund run by high profile investor Dan Loeb owns 1.37 percent of the company, not huge, enough to make you sit up and notice who you are alongside as an investor however.

The numbers quick sticks, for the full year, as those are available. The company produced revenues of 21.662 billion Dollars, an increase of 8 percent on the year. The company spends an enormous amount on R&D - Research and Development (looking for the next huge therapy), 18.7 percent of all revenues. That is a big, big number, one in six Dollars they make are trying to advance the causes of humanity further. Net income clocked 7.954 billion Dollars, adjusted EPS for the year of 10.38 Dollars represented an increase of 19 percent on the year prior. At 152.73 Dollars, where the stock closed on Friday evening, the valuations certainly look attractive. And whilst spending a lot of money on R&D, the stock still yields 2.62 percent at these levels.

The company also gave guidance for the full year in the conference call, revenues expected to be between 22 to 22.5 billion Dollars (ahead of previous guidance), with adjusted EPS expected to be between 10.60 to 11.00 Dollars. Also, ahead of the previous range. Again, forward the stock looks really good value, bearing in mind that the margins are superb and the fact that the company is in a spot that is really sweet.

The company has six flagship products that generate around half of their revenues, Enbrel (treats five diseases including Rheumatoid Arthritis, ankylosing spondylitis and types of psoriasis), Prolia (treatment of postmenopausal osteoporosis), XGEVA (similar to Prolia, bone problems), Sensipar (treats secondary secondary hyperparathyroidism in adult patients with chronic kidney diseases), Vectibix (treatment of metastatic colorectal cancer), and Nplate (treats low blood platelet count in patients with chronic immune thrombocytopenia, a blood therapy).

These treatments are all pretty specific and are designed to improve the lives of their patients significantly, highly specialised therapies. There were good gains shown in sales of Kyprolis, used for the treatment of multiple myeloma, again a blood cancer therapy. Some of their legacy medicines like Neupogen (a support therapy whilst you are on chemo) and Epogen (red blood cell anaemia treatment, made infamous by Lance and his friends) are experiencing competition from cheaper sources. Equally some of the much newer therapies like Repatha (high cholesterol treatment) are making progress, and quickly at that.

There are some very interesting therapies at an advanced stage that look exciting, including migraine therapies, breast cancer therapies and inflammatory diseases. This is an exciting area to invest in, I think the last time that I looked at this company, the conclusion was similar. You can part with your hard earned funds and own a business that contributes to humanity in a positive fashion, like Amgen, and I would much rather be in that boat than in another business selling products that cause the diseases they are looking to cure. Personal preference. We have added aggressively to the stock and will continue to recommend this company as a strong buy.

Last week we had Johnson & Johnson Reports 2015 Fourth-Quarter Results, which were a small beat on earnings expectations but a miss on the revenue side of things. As we have spoken about in previous notes on JnJ, they are basically three companies in one with the following devisions, Pharmaceutical Products, Consumer Health Care Products and Medical Devices.

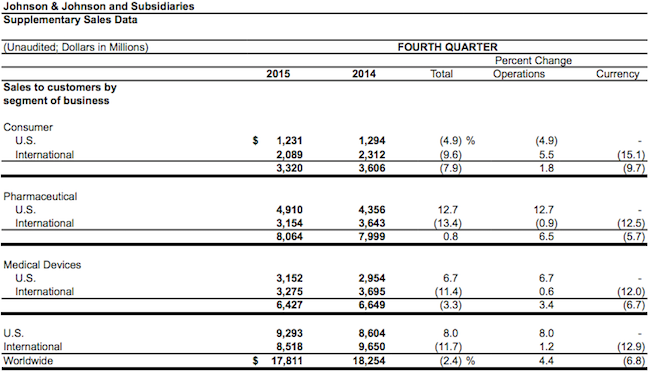

Here is a look at how each division did compared to the 4Q last year:

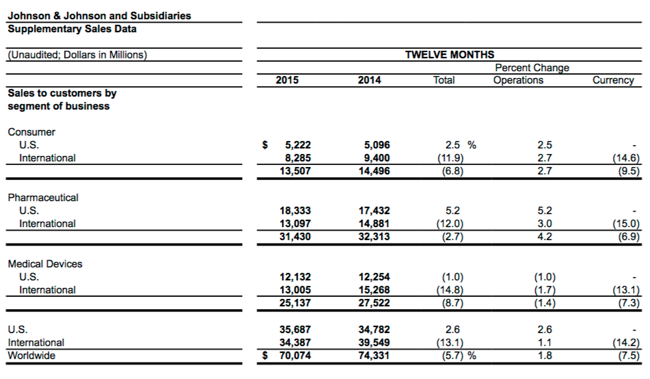

Here is how the full year numbers compare to the previous years:

The first thing that stands out is how big an impact the strong Dollar was on the numbers. The down side to having around 50% of sales offshore is that currency movements have a big impact on overall numbers. When the rest of the world catches up to the US, the numbers will have a huge tail wind from a weaker dollar and increased international sentiment.

Looking to the year ahead, "The company announced its 2016 full-year guidance for sales of $70.8 billion to $71.5 billion reflecting expected operational growth in the range of 2.5% to 3.5%." and " Additionally, the company announced adjusted earnings guidance for full-year 2016 of $6.43 to $6.58 per share reflecting expected operational growth in the range of 5.3% to 7.7%.".

The stock currently trades on a P/E ratio of around 19, which is not cheap considering forward looking growth is only in the single digits. Investors are paying up due to the defensive nature of the industry/company. Helping the bottom line going forward JnJ are shaking up their laggard Medical Devices division with an expected saving of $1 billion in coming years. There is also pressure on the board to potentially spin off one or all of the divisions, which based on investment banker spreadsheets, should unlock value for investors.

Don't expect too much share price appreciation unless some corporate action is announced. We still like the healthcare sector and the stock, adding on weakness.

Home again, home again, jiggety-jog. King Djoko, what an incredible performer. As much as I am NOT an Andy Murray fan, I felt really sorry for the bugger, five finals and five runner up placings, I guess the 1.9 million Aussie Dollars runners up prize money will soften the blow somewhat. Stocks should open a little more exciting today, we continue to be in the middle of the best season of them all, earnings season.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment