"Whilst the US may not be a big producer, they certainly are heavy enough to have tilted the balance in favour of Joe Consumer for the moment. I wonder what sort of impact this will have on the innovation in the green space, the economics being less profitable at lower oil prices means there is less of a push."

To market to market to buy a fat pig. That was a pretty epic comeback for stocks last evening, down and out at one stage, markets came roaring back in a very uneven session. The S&P 500 was down a percent with 2 hours to go in the trading session, it closed a whole half a percent higher. The Dow Jones Industrials had a more epic move higher, ending comfortably over a percent to the good, down a percent at the beginning of the session. The nerds of NASDAQ closed up shop around one quarter of a percent lower, that does mask the fact that the index was down over two percent with two hours to go.

Why would stocks move like this? It turns out that the correlation between the oil price and stocks has stuck, at least for the time being. Persistent worries around global growth and oversupply has seen the oil price plunge, and as this Bloomberg article points out, this is the largest transfer of wealth in human history: BofA: The Oil Crash Is Kicking Off One of the Largest Wealth Transfers in Human History. As our old pal Joe Weisenthal (ex BusinessInsider), the author of the article points out, SUV sales in China are up sharply and so is the number of miles driven in US, thanks to cheaper gasoline prices. Invariably that leads to a pick up in demand, which means the slack is picked up at some stage.

I get the sense, and I was thinking about this a lot yesterday, as we all know we are awash with crude, we have been told this on all the media platforms we access. We have all become experts on oil markets, in the same way that we were experts of nuclear power stations in the aftermath of the meltdown at Fukushima post the tragic tsunami in 2012. We were experts on Greek politics and their debt restructuring, we were all experts on what the Germans and French should do to keep the Eurozone together. And what the Fed should or shouldn't do, remember equally that the Fed printing money was all going to end badly, remember that? And that they didn't know what they were doing? Well, it turns out that they did, steady baby steps back into the market. Now, as I said, we are all experts on oil markets.

Nobody saw low oil prices coming, the fall from the relative stability of 80 to 90 Dollars a barrel to below 30 Dollars a barrel in a mere 18 months. There wasn't a single person predicting it. We all loved the idea that the US shale production was growing quickly, the innovations and the shift of power away from un-diversified economies was breathtaking. With it came a loss of power from the oil producers, it meant that another freer market was able to operate independently, including the newly allowed export rules from mainland USA.

The story that catapulted oil prices higher was that various OPEC and other oil producers were teeing up for an emergency meeting -> Six Oil Producers Agree on Emergency Meeting, Iran's Shana Says. It doesn't mean that there is going to be a meeting, it just means that if an extraordinary meeting is called, then Venezuela, Iran, Nigeria, Ecuador, Algeria, Iraq, Russia and Oman are there like a .... bear? Driving this are the Venezuelans, their oil minister has been visiting the Iranians. The Venezuelan oil minister is quoted as saying that current prices are below equilibrium and that there are speculators. Commie-speak for I can't handle the fact that the market, i.e. consumers of the world, control the prices.

And then there is this story, with innovation and cost cutting, as this Bloomberg piece points out -> Texas Isn't Scared of $30 Oil, US output last week was the best January since 1971. Whilst the US may not be a big producer, they certainly are heavy enough to have tilted the balance in favour of Joe Consumer for the moment. I wonder what sort of impact this will have on the innovation in the green space, the economics being less profitable at lower oil prices means there is less of a push. Having said that, I came across some research on the internet (Greentech media) that suggested that Global Solar PV Installations Grew 34% in 2015. It is entrenched now, and is possibly part of a revolution. I hope so, for humanities sake.

OK, that leads me to our markets, in Jozi, Jozi, stocks adding over one percent as resource stocks were wildly higher on the day. As a collective resource stocks were up three and one-quarter of a percent, Anglo soared over 9 percent, AngloGold six and a half percent, Glencore nearly five percent higher, BHP Billiton up just shy of three and a half percent. At the bottom end of the scoreboard was AB de Villiers Rand Merchant Investment Holdings, Old Mutual, Aspen and Naspers all markedly lower on the day, relative to Mr. Market of course.

On balance however, stocks were all higher on the day. There was an FT story earlier in the day, before the market opened: MTN hires ex-US attorney-general Eric Holder to fight $3.9bn fine. The Nigerian government official is quoted as saying: "It looks a little desperate, like they couldn't find anyone with proximity who is able to influence the president" Oh, I didn't know that is what consumers all across Nigeria were looking for in their cell phone provider, influence over the president.

Linkfest, lap it up

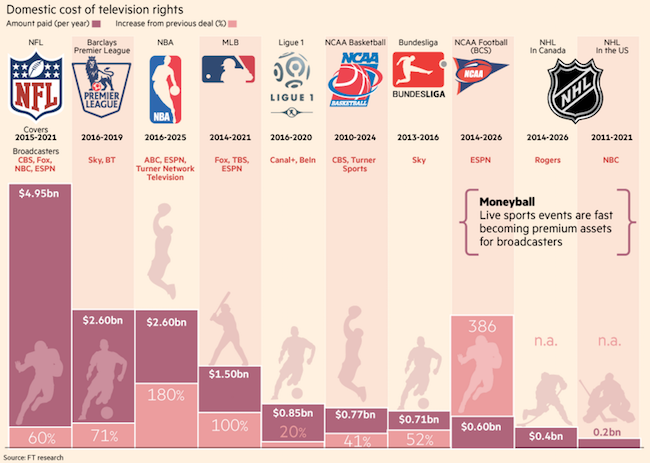

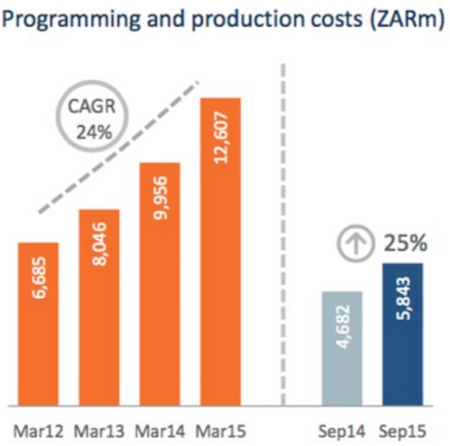

The biggest cost component of your DSTV subscription is to cover sporting content and the trend is one of rising broadcasting right costs - Can broadcasters afford the premium for live coverage of leading events?. Mix the rising cost of broadcasting rights with a weaker Rand and this is the result - Expect a big DStv price hike in April.

Going forward we will probably see further margin compression from Multichoice as they struggle to pass these increased costs onto their customers.

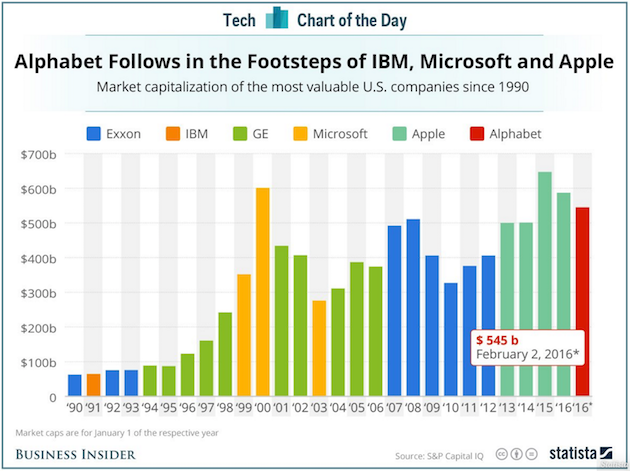

Have a look at which companies have been the most valuable over the last 25 years. It is interesting to see how it took Apple 15 years to surpass the high water mark set by Microsoft in 2000. Also note how the company values have been rising thanks to inflation but also thanks to huge population growth and the growth in global income levels - Here are the most valuable companies in America since 1990

Even though Naspers has a small presence in India the growing smartphone business is good for their business - India has overtaken the US to become the world's second-largest smartphone market. The last point made by the article is that 1 in 3 smartphones bought was done online, which shows the big shift toward e-tail.

Home again, home again, jiggety-jog. Stocks across Asia are mixed, the Shanghai market is higher, the Nikkei is lower, whilst the Hang Seng is much higher. All rather mixed. US futures are pointing to a stronger start, poor GoPro can't catch a break. Great devices, limited market. The stock trades on a single digit multiple now, it looks like the number of devices used last year (according to the software downloads) is around 25 million, hardly sounds like a lot. GoPro on a go slow.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment