Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. An interesting day in Jozi to say the least, we had better than anticipated local manufacturing data yesterday and some employment data earlier in the week which points to a stronger than anticipated recovery. That data, manufacturing data was all the way back from February. But we have said that already. One event at the beginning of the week (or was it late last week?) that irked me so, was the Concrete and Cement Institute announcing that the competitions authority had asked them to stop printing the monthly cement stats. And now we were only going to get stale data, three months old and once a quarter. Because you know, the old data from the official streams are looking bad with their 45 day late releases. And you would have noticed that the Mooi River Index is slow in coming too, I suspect that there are similar problems.

The only data that is timeous and forthcoming and on time is from Transnet. Perhaps there is a blue light brigade driving the person releasing the results, ala the sports minister, who used some fancy German motor vehicles to ride behind him as he struggled up the hill on his bicycle at around a quarter to seven in the morning in the Northern Suburbs of Johannesburg. Yes. Really. BUT, it turns out that he normally does this activity at four in the morning. I can only beat the streets at 5am, perhaps I should wake up an hour earlier and be on the lookout for him, see what he is up to at that time. Riding clearly.

OK, away from all of that, there were comments that were made by a high ranking ECB official, a French fellow by the name of Benoit Coeure who said two key things. One, that the problems that Spain has will normalize soon, or could normalize from the current situation and more importantly for me anyhow, alluded to the fact that although the ECB has not used the Securities Market Program to buy Spanish bonds, he did not say that they (the ECB) wouldn't. That is about as typical as it gets in a European context. Mixed messages all the time, but I guess with the language barriers and multiple cultures we shouldn't expect anything less. It always amazes me that the ECB's press conferences are held in English. Yes, English. The language of the olde enemy across the channel, English. Perhaps in time all Europeans will speak English as their second languages.

After a better session prior, we did not enjoy the same gains that global markets did, our Jozi all share index rose only 15 points, or 0.04 percent to end at 33632 points on the day. Banks sank half a percent, resources added 0.7 percent but industrials sank nearly half a percent to drag. There is very little from a company point of view at the moment, there was news of course that Standard Bank were reducing their stake in a Turkish unit from around three quarters to just one quarter. But we would be expecting that kind of move, that has been the strategy as of late, less emerging market exposure, more Africa push.

This is kind of left field, I saw on a Google alert set for Anglo American that they had a permit suspended for power supply for their Brazilian Iron Ore project, Minas-Rio. Not good news at all really. But according to the Bloomberg story titled Anglo Has Power-Line Permit for Minas-Rio Project Suspended, Anglo have in their minds followed all the necessary rules and regulations when applying for the power. And apparently, from another source, the expectation is that Anglo will have the licence reinstated inside of the next two weeks. Or course the opposite would be disastrous. This is one of their key projects, and expected to be producing around 30 million tons of iron ore pellet feed annually, coming online at the end of next year. Power is key. We shall check this one out, but I suspect as a school friend of mine, who lives in Brazil said once, the number of regional and state taxes and mining regulations were many. So, some are suggesting that this might be local government versus state government and muscle flexing. Nice. Or not really nice.

Nokia. What a disaster. They still sell roughly 25 percent of all the worlds mobile handsets. BUT, that is apparently the lowest levels since the dot-com go-go days of the late nineties. In fact I noted on "the twitter thingie" that the share price was last at these levels (pre market and during normal trade) when the big seller was this awful thing (which was a cracker at the time), the Nokia 6110. Follow the link to see all the awesome photos of a 6110. I remember a few mates having those, I had the amazing 3210, one of the best selling models of all time, according to Wiki, Nokia sold 160 million of these.

But, the stock is near 15 year lows. Those phones sold were great at the time, sadly for Nokia both Samsung and Apple have been dominant in the smart phones, where the margins are so much better. Samsung in the coming quarters could even overtake Nokia. One can almost compare Nokia to General Motors. Being in a dominant position in their market and then falling from grace, I like to think that the brands (or too many) actually might have something to do with it. That is where Apple are sublime, they have only ever launched 5 phones. Check out the list of Nokia phones over the years: List of Nokia products. Remember that old thing about General Motors whole array of brands, all of which fell out of touch for a while. They are back, the question is, will Nokia be back?

The stock fell in a heap, down 16 percent at the close to 4.24 Dollars a share (their ADR program), in the middle of the year 2000 the stock traded at 58.50 Dollars. Since then, the stock is down 92 and a bit percent. Sis. But since October 2007, where the market was clocking their last all time highs, the Nokia share price is down 88.5 percent. Terrible. Their press release tells it all: Nokia lowers Devices & Services first quarter 2012 outlook and provides second quarter 2012 outlook. See this line, this is why the stock (or one of the reasons) got crushed: Nokia currently estimates that its non-IFRS Devices & Services operating margin in the first quarter 2012 was approximately negative 3 percent, compared to the previously expected range of "around breakeven, ranging either above or below by approximately 2 percentage points"

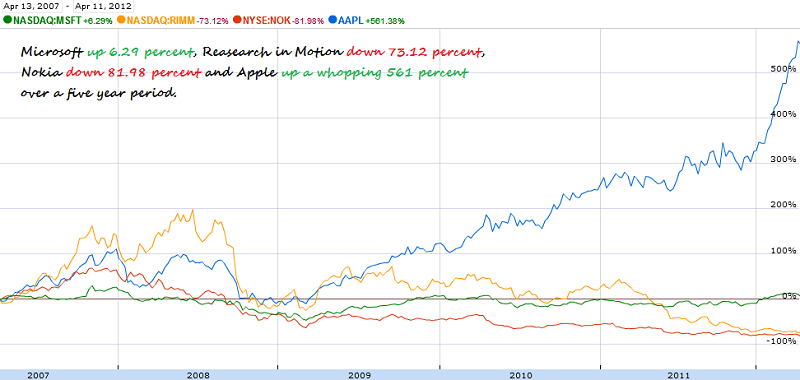

I have seen some people already lump RIM and Nokia with Borders, the now defunct bookstore chain and Kodak, the Polaroid kings that failed to change. RIM of course makes the Blackberry and we had a whole lot to say about their recent results, not so long ago in this piece: RIM's Waterloo. Waterloo on the French side. So, what next for the people over Nokia. First things first, they are in agreement that the Windows phone and the strategic tie up with Microsoft is the future. The Lumia 900 launched a few days ago. There is a great review by the folks over at PC World, Nokia Lumia 900. They like the phone. But with the closed Windows platform you can't do everything that you can on an Android phone, I would presume that would be their target market. As an Apple user I would have to see something wow before I would consider the switch. Too early to write an epitaph for either RIM or Nokia, but one thing is completely clear, investors have voted as consumers voted with their choices. Here is a five year price chart that I hacked from Google finance of the stocks that I have taked about above:

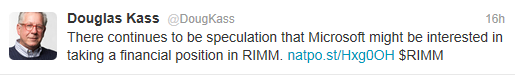

Microsoft, I threw them in there too, in fact there was and is a rumour that exists that Microsoft could take some stake in Research in Motion. Yeah I kid you not, I saw it via one of the folks I follow on the twitter thingie, Doug Kass:

That link resolves to a story titled: Does Microsoft want a piece of RIM? But that would be weird and stuff, not so? Nokia, RIMM and Microsoft in the middle. Sounds like a digs that I would not like to live in. Who actually knows, perhaps Microsoft will acquire both of them over time, as a combined market cap (Nokia and RIMM = 22.72 billion USD) to Microsoft last evenings close (254.62 billion USD), it is just less than nine percent. In reality Microsoft could buy both, but I am sure that there would be an antitrust case to answer.

Currencies and commodities corner. Dr. Copper was caught a bid, 371 US cents per pound, the gold price is marginally lower at 1655 Dollars per fine ounce. The platinum price is slightly better at 1586 Dollars per fine ounce. But both are looking worse for wear, remember we asked the question, when are gold miners going to hedge? Perhaps not. Who knows? Not I. The oil price is last at 103.02 Dollars per barrel. The Rand has firmed a little, last at 7.95 to the US Dollar, 12.68 to the Pound Sterling and 10.44 to the Euro. We are marginally lower here today, having been higher. If we are looking for a number to change todays events or course, then I suspect that the weekly jobless claims number could be your thing. I suspect that the filings will be lower as a result of Easter time.

Parting shot. Bill Gross, the worlds largest bond manager, or of the company PIMCO that is the largest bond fund in the world has been slowly leaking out of treasuries and getting into {wait for it} mortgage backed securities! His flagship fund, according to the WSJ has gone from a 38 percent weighting in MBS's in September all the way through to 53 percent at the end of March. So, what is he up to? Well, I guess it points to probably many people starting to shift out of government bonds, safety first into something with a greater risk profile. And remember that loveable old guy, Warren Buffett who said that American houses, single family houses were the best investment that he could see right now. Not just him you see, turns out Bill Gross has been voting with his feet too!

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment