"L'Oreal has acquired three skincare businesses from Valeant. You may recall that from last year Valeant was not just a fallen angel, it was sent to Hades, tossed to Tartaros, booted to the underworld of investing. OK, not that bad, close though. The French cosmetics giant has paid 1.3 billion Dollars in cash, in what represents around that same amount (1.3) in percent of their market cap. For a group of skincare products that produce sales of 168 million Dollars."

To market to market to buy a fat pig Up, up and away for stocks on the local front, resources marched higher in a hurry and dragged the rest of the market along with them. There were huge gains for Anglo American, Amplats and BHP Billiton (and even Richemont too, that stock soared 4.7 percent). Only Woolies was a noticeable loser, apparently there is a sales update for the festive season today, so who thinks they know, or who does know is another question. It is not what I say, rather what I do! At the bell, the all share index had climbed to the best levels since late October, up just over one and one-third of a percent to 51740 points.

Across the oceans and seas, the nerds of NASDAQ posted a 0.36 percent gain on the session, another closing and intraday all time high. The broader market S&P 500 lost 0.01 percent, so I guess that is flatter than a pancake. The blue chip index, the one founded by those hipsters ahead of their time, the Dow Jones Industrial Average sank again, down 0.16 percent by the close. Again, it seems to be energy stocks trailing as the oil price is "finding a level". I do have very little idea or clarity on where to next for the oil price. On the flip side, materials (commodity) stocks added over two percent on the session. It could all be put down to faster factory gate prices in China, PPI rose to a five year high. So there it is, at some level this indicates faster factory activity.

We are a giant fan of Howard Marks around here. He is clear and concise. Not like my style, which isn't the cup of tea of all and sundry. Less Rooibos or Early Gray they say. Sorry, this is what I have. The BusinessInsider said that the memos "read like Michael Lewis ghostwriting for Warren Buffett: insightful, direct, homespun, expert and sharply pointed." Anyhows, Marks writes with a super style, he is 70, born just after the Second World War like a whole lot of folks, "baby boomers" is the generation I am referring to.

My parents are part of that, people who returned from war full of hope for a new generation. In large part, despite the cold war, we have of course as humanity made many advances. The age of the internet, jet flight, information being disseminated from all avenues. We have more computing power in our pocket than NASA had 50 years ago. This article (Apollo 11: The computers that put man on the moon) puts us straight.

"The so-called Apollo Guidance Computer (AGC) used a real time operating system, which enabled astronauts to enter simple commands by typing in pairs of nouns and verbs, to control the spacecraft. It was more basic than the electronics in modern toasters that have computer controlled stop/start/defrost buttons. It had approximately 64Kbyte of memory and operated at 0.043MHz."

That makes me want to laugh out loud, apparently even that acronym is so old. LOL. Even Marks would be familiar with the acronym. In his latest memo, there is plenty in there that is very relevant for ourselves. I would urge you to sign up for these memos and then make sure that you read them in full, he produces them around every three to four months, which makes for perfect reflection. Titled Expert Opinion, it has all sorts of useful nuggets.

The overwhelming feeling I get is that Marks (he has long experience) thinks that the media chasing and being opinionated has become clouded (and biased) in their reporting. Most importantly, as we often point out around here, making hard and fast predictions is for fools. The part that I enjoyed the most was the recent investment times and "the importance of Macro" over the last dozen or so years. I am happy (or worried) to say that I completely agree with him. People place too much emphasis on central banks and the economy and forget that they own neither, they own real life, breathing businesses. And his answer is almost the same as Buffett gives (Buffett is a little more friendly I think, just a touch), how is he supposed to know when the Fed are likely to raise rates and does it really matter?

So read this note. It will make you feel better about investing. The truth, and this is from one of the best distressed debt investors of our time, is that nobody knows. I often compare investing in equities to flying in an airplane. There are people who are scared of flying, yet they know the facts tell them that it is the safest form of travel. It all boils down to control. Sitting in a fairly expensive seat for the comfort, an airline passenger is completely reliant on the technology and skills of others. Somehow we think that traveling down a subpar surfaced road on a rainy day riding next to a hunk of rusted metal with slicks going over the speed limit is perfectly safe, that is a different story altogether.

Investing in quality businesses is something that we should all do regularly, adding as and when we can, monthly, quarterly, whenever we can. Share price drawdowns are like turbulence. The trick is to remain calm. And do something that you can control, your emotions, your actions. And whilst it feels "bad" and goes against your investing heart. Your heart may flutter when you see the P&L column lower, know ironically that that is an investors best friend, uncertainty and lower prices on the same businesses. Nice, thanks Howard Marks for another gem. Investing is also like putting together an infinite piece puzzle. The more you do it, the clearer the picture looks. The more you do it, the more you realise your work is never finished.

Company Corner

L'Oreal has acquired three skincare businesses from Valeant. You may recall that from last year Valeant was not just a fallen angel, it was sent to Hades, tossed to Tartaros, booted to the underworld of investing. OK, not that bad, close though. The French cosmetics giant has paid 1.3 billion Dollars in cash, in what represents around that same amount (1.3) in percent of their market cap. For a group of skincare products that produce sales of 168 million Dollars.

Here is the pretty detailed release from Valeant, explaining what the products are that the French company is buying - Valeant To Sell CeraVe, AcneFree And AMBI Skincare Brands To L'Oreal For $1.3 Billion. That is 7.73 times sales. As for L'Oreal themselves, the total group revenues are over 25 billion Euros, with a market cap of nearly 96 billion, the whole group trades on around 4 times sales. Again, it is not necessarily what the sales are, it is what the profits are. Skincare is their biggest business (30 percent for L'Oreal) and should continue to grow over the coming years, as more people get richer in urban settings. Herewith our last report from November - L'Oreal 3Q numbers - steady growth.

We made a couple of points back then, relevant then and relevant now (two months changes nothing): the share price has been a downright disappointment for investors, at least in the very short term. L'Oreal are a whole lot less leveraged than their peers and trade at a pretty big discount relative to their historical multiple. The business also has an element of defensiveness too, hair washing and make up application (and removal) and general facial care is hardly going to go out of fashion. Our conclusion was as follows: "Defensive and growth, this is a good business, the big daddy of the industry. We continue to recommend this stock, we continue to accumulate. Buy."

Project Titan is the car aspirations of Apple, for their electric car. It was dealt a blow, which has turned into a winner for Tesla as they stuck out a letter last evening - Welcome Chris Lattner. Lattner has an awesome pedigree - "He comes to Tesla after 11 years at Apple where he was primarily responsible for creating Swift, the programming language for building apps on Apple platforms and one of the fastest growing languages for doing so on Linux." Expect those driverless cars quicker than you think! Either that or Musk and him will hate each other.

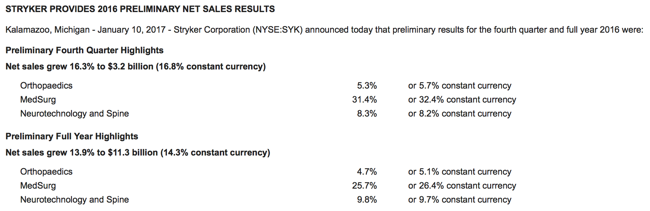

Stryker released an update, something called a 8-K form. Which is preliminary results for the fourth quarter and full year 2016 release - > 2016 preliminary net sales results. Herewith the table:

The whole market in healthcare was on fire, Zimmer Biomet was also on the charge, up over 6 percent, whilst Stryker in normal trade added nearly two and a half percent, an extra percent was added after hours. As it stands, this company sees their stock now trading at an all time high. I suspect there is much more to come, great business in a great space. We continue to accumulate (see the last report - Stryker 3Q numbers - strong product growth) what is a great business. In two weeks time we will see the full year numbers, and we have good reference now.

Home again, home again, jiggety-jog. Stocks have opened mixed here in Jozi, some up and some down. What tends to happen with the first hour of trade is a certain vacuum as direction from European markets is lacking. All good, we wait for some important retail updates to tell us whether or not we are on track, nothing like real company data to tell you what is happening out there.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment