"People buy these cars if they are rich enough and conscious enough to be part of the change away from fossil fuels, which clearly impacts on the well being of the planet longer term. There are of course many who suggest that there is not enough evidence to suggest the warming of earth is caused by excessive usage of fossil fuels, as Taylor Swift puts it, the haters are going to hate. I think that Musk is going to change the world. And have a long lasting impact on the world when he leaves it."

To market to market to buy a fat pig. A very good day in the end, volumes were huge as a result of the Futures closeout. Coincidentally we talked about the futures contracts origin dated back to Mesopotamian times, nearly 4000 years ago. It just goes to show you how close food and its scarcity has always been to humanity, an abundance of calories for rich people has skewed "things" recently. Recently by humanity standards. We only recently settled around 10 thousand years ago in urban areas, before that we (the royal we) lived like the Croods, deciding how to survive today. We live in the information age nowadays when you can retweet someone from half way around the world who you have never met. We can see pictures and videos of places that we never would have had instant access to, if it was not for the internet.

Sometimes however the fluid information age is not altogether a good thing. Many people trade around events such as the current Greece "crisis" based on the news flow that is readily available. You can follow the Greek finance minister on Twitter, you can follow various market aggregators. Last night, last evening, there was a please keep us in the Euro march (Pro EU) to the Greek parliament in Athens. I am there next Friday, just around the corner from the parliament, perhaps I can capture a picture or two. Market seems unflustered by all the goings on, perhaps it really is priced in. Dutch finance minister Jeroen Dijsselbloem suggested that a Greek exit is possible. IMF head Christine Lagarde talks of needing adults in the room. The Greek PM's partner, a woman by the name of Peristera Batziana (known as Betty) says she will leave him if he cuts a deal with Europe. Really? All this has led to a crisis and urgent meeting for all of the EU folks Monday. The week after the Greeks actually run out of money. No money, no ability to pay anybody, it all starts getting real.

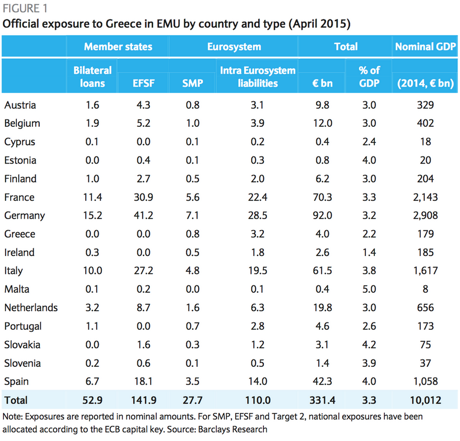

The Guardian had this graphic, which was via Fabrizio Goria, which shows how Barclays has added it all up, which country is on the hook for what. Here goes, Official exposure to Greece in EMU by country and type (April 2015):

So there, Germany, France, Italy and Spain owed 260 odd billion Dollars. How do they view all of that? Their citizens must be equally peeved that there is a never-ending pit of money and seemingly there seems to be a lurching from bailout to bailout. There must be fatigue from all the other people who are participating in a project which is, less you forget, getting bigger and bigger each and every year. There are far more benefits of being inside of the Eurozone than there are of being outside.

Markets globally seem to be OK with the worst case scenario, I am pretty sure that if it does happen then there will be a flurry and a flutter. Last evening US markets closed at and near all time highs, tech stocks printed another all time high, the broader market S&P 500 was a little way away. I guess this might be as a result of the afterglow of the Fed going slowly on interest rates, tip toeing back into the market. Perhaps for the first few rates hikes they can move the band (currently 0 to 0.25) from 0.25 to 0.5 and so on. In other words tip toe really slowly, let the rate settle at around 0.36 - 0.40 percent, it does not need to be a straight, OK, here is 0.25 percent. It is currently around 0.13 percent. SO perhaps the next move is likely to be exactly that. Anyhow, no need to get your knickers in a knot about it.

I have started reading the Elon Musk book. It is nothing short of amazing. I am giving away too much here to my colleagues, they have great admiration for the man and his businesses, here is the book: Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic Future. He really is a person that I think is hell bent on changing the world. And he is, one car at a time, with the "fuelling stations" being rolled out across the country too, giving you the freedom to drive a Tesla wherever you want. Those charging stations are apparently for free for Tesla clients. There is no margin to be made at a dealership level, nor in longer dated services. The car is supposed to have as little go wrong with it as possible.

As investable companies, the two that you have access to (no SpaceX yet) are SolarCity and Tesla. SolarCity is probably not going to make a profit for a couple of years, it currently is valued by the market at 5.5 billion Dollars, Tesla is valued by the market at 33 billion Dollars. They make niche products, not mainstream cars. They only want to operate in the high margin segment, they cannot expect everyone to own one. No. The company is manufacturing motor vehicles that have been ordered already. Which is why I guess they are able to be in a different space than anyone else. They are neither cheap nor hellishly expensive, the cheapest 70D model is 75,000 Dollars (there is a 7500 Dollars credit), the P85D costs 105,000 Dollars. The starting price of the BMW i8 is 136,500 Dollars. The BMW i8 has a longer range than the Tesla, it is not as if there is no competitor. And by jove, as these things go, these vehicles are incredibly beautiful, well made.

People buy these cars if they are rich enough and conscious enough to be part of the change away from fossil fuels, which clearly impacts on the well being of the planet longer term. There are of course many who suggest that there is not enough evidence to suggest the warming of earth is caused by excessive usage of fossil fuels, as Taylor Swift puts it, the haters are going to hate. I think that Musk is going to change the world. And have a long lasting impact on the world when he leaves it.

Stat of the day

Do you remember the "Pounds, Shillings and Pence, your teacher makes no sense" rhyme? Yes/no? The actual currency measurements in 12ths was derived from the Roman measurement weights, which in turn were derived from old Greek measurement units. A finger, a palm, half foot, span of fingers, foot, forearm and a cubit were all units of measurement. A cubit was of course the length from your middle finger to your elbow end, the bottom of the elbow. There were also single and double paces, and then a fathom, which is six feet of water. A fathom was two yards, which was based on the outstretched arms of a man, an average sized fellow I guess. Although nowadays you would hardly say that six feet is average sized, right? Obviously we are all different sizes, bigger people would possibly have been sent to negotiate when it came time to pay up, literally lending the saying of sending in the heavies to do the dirty work credence.

The older mile (which was a thousand paces in Roman times) was less than 1500 metres, 1481 metres to be exact. Perhaps by the time the English parliament made the Weight and Measures Act 400 odd years ago, better diet and nutrition had seen to it that humans were taller, and thus able to walk 100 metres further with the same number of steps. The French had to expunge their nobility before they could come up with the metric system, seeing as the kings foot was a taken measurement. For the metric system we can thank French philosopher, scientist and mathematician (he obviously had a knack for numbers and had a personality, perfect for the job), the Marquis de Condorcet, for putting the wheels in motion. If the only thing that King Louis the 16th did, it was instructing the Marquis to do this. Luckily for us there was no measurement of the forehead of Marie Antoinette, we would struggle to find that one!

Linkfest, lap it up

This article highlights how valuable luxury goods can be - Porsche now makes more money for Volkswagen than the VW brand itself. The line that stood out to me was "Last year, for the first time, Porsche made more money than VW, even thought VW sold 25 times more cars (4.6 million versus 187,000)".

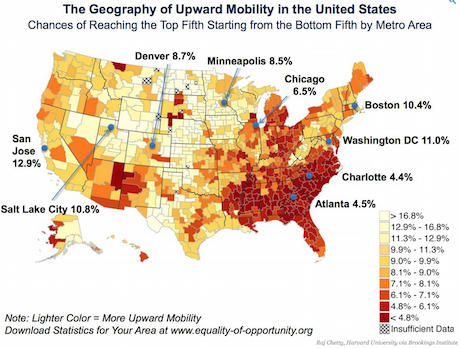

If you are born in the poorest fifth of Americans what are your chances of moving to the top fifth? I found it interesting that it was the midwest where your chances were the best as compared to the east coast, where you would assume there are more opportunities. I would assume because there is more competition in the East it is harder to rise. Plus there are higher living costs - Here's where American children have the best chances of going from poor to rich.

The number of hours you spend at work may not directly relate to your wealth - Where in the world you're most likely to be working too much or napping. The stats show how vast the differences in hours worked are, "More than 40% of Turkey's employed population works in excess of 50 hours a week, compared to just 1% in Russia and the Netherlands.". I think generational wealth plays a factor in how much the average person works, in Western Europe and Scandinavian countries there is a large amount of generational wealth.

You can now play your tape decks again - 'Jurassic Park' Theme Hits No. 1 for First Time. The song was created 22 years ago for the first movie.

Yesterday marked the 200 years since the Battle of Waterloo. The battle and its result no doubt had a ripple effect on European history - The Economist explains The Battle of Waterloo. The defeat resulted in Napoleon being shipped off to a small island where he eventually died. That is where the phrase, "meeting your Waterloo" comes from.

Home again, home again, jiggety-jog. The Chinese market has been absolutely caned this week, down in "correction" territory. It was down a whopping 6.42 percent for the day alone. That seems to be having little or no impact on global markets. Still, the last 30 days finds the market up fractionally, and up 25 percent for the last three months. Tell that to someone who bought shares 7 days ago, when the market was nearly 13 percent higher than it is now.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment