"So what is causing the selling? Like we have tried to explain, it is a combination of Greece bailout talks, Central Bank gyrations too. Just yesterday the ECB president Mario Draghi said that investors must get used to volatility, bond yields have been wild. The last two days have seen the biggest spike in German Bond yields since 1998. In 17 years! That is pretty big. And that explains a lot about the moves in equity markets, not necessarily in developed markets however."

Have you any wool? Another day of selling for local equities, that is now 11 out of the last 12 days, the only respite came on Tuesday. This is of course in the category of things that you have no control over. And of course nobody owns the secret sauce, yet I see trading courses everywhere. Now a trading course is certainly not like a tennis or a golf coach, right? A sports coach can be a great person to point out your mistakes, perhaps they are a not a master of that particular discipline. Jake White was in the first 15 when he attended Jeppe Boys, he started his rugby coaching career at Parktown. He then went on to being provincial schools coach, the rest is history. I am guessing that exactly the same can happen in business, and it does happen.

The first program that Bill Gates ever wrote was tic-tac-toe, which enabled you to challenge the computer. We refer to tic-tac-toe as noughts and crosses in these parts, my daughters love it. That was the starting point however, X and 0. Kind of binary, don't you think? Mark Zuckerberg also learnt to program in BASIC (Beginner's All-purpose Symbolic Instruction Code). They were great coders and certainly had the platforms to work with, even though they were effectively a generation apart. You can do as well as the tools around you, I am very sure that the landscape will be far better than it is now, in years to come. Whilst we are on the 6th version of the iPhone, the first version was only released in late June of 2007. In other words, the iPhone turns 8 at the end of this month. If you lay the first version against the current version, it is perhaps not too dissimilar to a Toyota Tazz next to a Lexus NX. They both work, one is just a whole lot better. The first Galaxy was released by Samsung in June of 2009, Galaxy is growing up too and turns 6.

Blackberry subscribers went from 2.5 million in February 2005 to 80 million by the end of 2012. Currently that number is 37 million and shrinking, WhatsApp killed the exclusivity thing I guess. And to think that in 1999, Research in Motion (the Blackberry manufacturer) had released an interactive pager. That must have been awesome. I had a Nokia 3310, which was incredible at the time. Imagine what it must feel like to give up your phone that tells you (weatherman speak with fork tongue) almost anything you want to know. Twitter is only 9 years old. Facebook is 11. We have managed to establish that the iPhone is nearly 8 and the Samsung Galaxy range will be 6 soon. Instagram turns 5 later this year, we use the term IG like it was part of Shakespeare sonnets. The aforementioned WhatsApp is also only 6 this year. CNN just turned 35 years old. 20 years ago your breaking news was on cable network television, today it can break anywhere. Any guesses on the future? I suspect that technology will move quicker and not slower. Snapchat turns 4 in September, Google turns 17. Believe it or not LinkedIn is nearly 12.

Back to my point however on the speed at which things move and how you can get caught into thinking that this has always been the way. This is important when trying to understand investor psychology. As investors we have to deal with many pitfalls in markets, they happen. 11 out of 12 sessions down in a row is terrible for those who are long, most especially if you bought recently. We all have to live with stock market volatility, that is the nature of investing in something where there is liquidity, sentiment and multiple participants. Do not look at the prices of the equities that you own as a reflection of their business currently, or their prospects in the future.

In the immediate term, the share prices right now represents the balance of the buyers and sellers and what they think about the future based on the current news. For a transaction to take place there needs to be two different and divergent views on the securities of that specific company, and that price to be in the middle. So what is causing the selling? Like we have tried to explain, it is a combination of Greece bailout talks, Central Bank gyrations too. Just yesterday the ECB president Mario Draghi said that investors must get used to volatility, bond yields have been wild. The last two days have seen the biggest spike in German Bond yields since 1998. In 17 years! That is pretty big. And that explains a lot about the moves in equity markets, not necessarily in developed markets however.

Rate hikes in the US might not necessarily be bad for equities markets (I am starting to sound like the perma-bull, Wharton Finance professor Jeremy Seigel), this point in time certainly seems very much like the taper tantrum. The taper tantrum was closely linked to the Federal Reserve ending their bond buying program and winding their necks in, that came and went. Of course the Fed will raise rates, our argument about lower inflation for longer means that a new normal of what we consider high interest rates will be established. In other words, the higher end of the rate cycle (when the peak is reached) will be lower historically.

Greece and those talks (no progress just yet) are ongoing, they owe money tomorrow and seemingly have the resources to pay them. Short term problem solved. Long term, well not so much. It sounds so simple to say that the problems of Greece can be solved by making sure that the economy grows, naturally there will be a primary surplus (as a result of collections rising), when pensions and salaries are lower as a function of austerity, when does a country return to growth? The debt to GDP ratio worsens when economic output plunges and the debt burden grows, or even stays the same. Expect some sort of deal soon, my best guess is before the weekend. I could be wrong. The former French Finance minister says that the next few hours and days are critical, in these talks that is.

The short answer as to when the selling will end, when will people stop being spooked by this recent bout of bond selling? Equally when will the bond selling end? I do not know. The sell off has been viscous, German bond yields have gone from 0.05 percent to nearly 1 percent in 50 days, a really sharp move for something of that size and scale. This chart courtesy of MarketWatch:

So this has gone horribly wrong for the ECB. So far so BAD. Bond yields have risen sharply after rallying to possibly ridiculous levels, some of the short term in duration stuff turned negative. Oh dear. Now what? Stay put. Hold tight. Do nothing. Markets are selling off aggressively across Europe, I saw the French market was off nearly two percent at one stage. Phew, hunker down, batten down the hatches, the storm is going to be wild for a bit. The worst thing to do is to get spooked. No. Don't sell quality assets as a result of something beyond your and my control. If anything, find some extra funds that need to get invested and do exactly that, invest it. If you are looking for a good explanation of the inverse correlation, The Relationship Between Bonds & Interest Rates, follow the link.

Linkfest, lap it up

If you ever wondered why swiss cheese has holes, well now you know - Swiss cheese hole mystery solved: It's all down to dirt

Two interesting stories coming out of JP Morgan recently - In bid to cut costs, J.P. Morgan cuts voicemail for some employees. For a company of JP Morgan's size it wont be a huge saving but how does the saying go, "take care of the pennies and the pounds will take care of themselves". The other story is about Jamie Dimon, the companies CEO - Jamie Dimon Is Now a Billionaire, and He Got There in an Unusual Way. Many people who are in banking say that he is the best in the business.

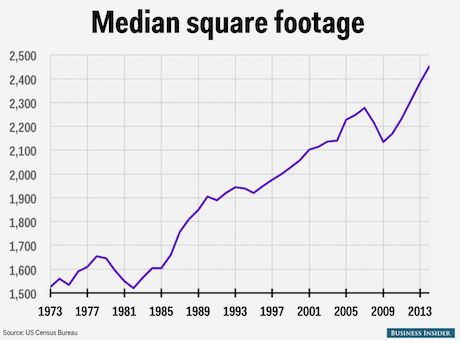

Could housing size be a proxy for middle class wealth? Or is this a trend of moving to cheaper neighbourhoods so one can build a bigger house? - America's houses are getting bigger

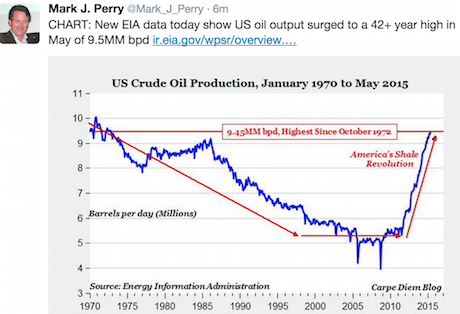

Here is another cool image from Twitter and Mark Perry. It highlights just how big Shale oil has been, taking production from about 5.5 million barrels a day to over 9 million -

Yes sir, yes sir, three bags full. AB and the great Hash cleaned up at the Cricket Awards last night. I have to concede that I am never going to crack the nod for the Proteas, even as chief bottle washer. It is better that I do this job here. Markets are selling off globally, that includes here. Resource stocks have turned negative for the year, the Rand to the Euro has breached 14. In the same way that the bond yields have spiked, the Rand has gone from 12.70 to the Euro in mid April to above 14, 14.05 now. It is about flat for the year. If I asked you, which currency of these three has performed worse against the Dollar over the last 12 months, what would your answer be? Which is worst, the Yen, the Rand or the Euro? Answer: They're all pretty similar.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment