"That "longer term" is MUCH lower than anywhere historically. It leaves me with the one question, over and over again. Why the hysteria? So what if the inflation rate is at two percent and rates find a new trajectory to 3.75 percent? And the rate hike is going to be slower, we have always said that would happen. You cannot go from 0 to 4 percent in 16 meetings, two years out. So I am guessing that we may see 0.25 percent, then another 45 day hold, then the meeting after that, and so on. The Fed funds rate is out of your control, yet somehow it seems like the one and only story."

To market to market to buy a fat pig. Stocks locally were in catch up mode, settling the gains from the previous international sessions. Industrials ruled the roost, the commodity stocks were sold off. In particular iron ore prices dived, impacting on Kumba specifically and Anglo American. I have read and seen that Kumba could, if iron ore prices settle at the long term average of around 40 Dollars a ton (they would have to fall by another one-third) call their dividend into question. Those of you who know and have been following the business that is two-thirds owned by Anglo, will know that in the past, Kumba used to be an excellent dividend payer. One of the best around. Unfortunately they do not control the iron ore price, that is controlled globally as a function of demand and supply, specifically in new steel manufacture. Where is Imperial Crown Trading now? Remember that, claiming prospecting rights on existing production at Sishen. Well, at least the law prevailed in the end.

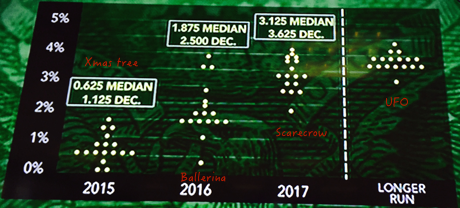

Over the seas and far away, it was all about what the Fed did and said. Here is the statement: June 17, 2015. Moderate growth, jobs gains steady, inflation is low, it appears like Goldilocks really. We often suggest that in this rates hike we are going to see something that suggests lower than the previous highs. Meaning that the longer term high end, where rates finally settle will be lower than people predicted in the past. I saw this graphic yesterday on the telly, from Bloomberg:

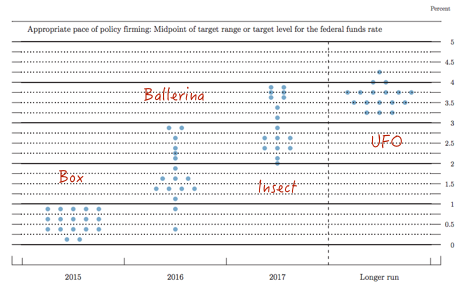

Those are the shapes that I saw, lastly it flattens out to a UFO. There are 17 people who are asked where they think that rates can end up. Then, yesterday, the Economic Projections of Federal Reserve Board Members and Federal Reserve Bank Presidents, June 2015, had a similar projection. The shapes change, scarecrow is now an insect, the front end projections have flattened out to a box.

What is important to see is the "longer run" projections which are, in the opinion of the board members and presidents, around 3.5 to 3.75 percent. And that is against the historical rates cycle of this, from trading economics, United States Fed Funds Rate 1971-2015. I wrote on the chart and drew a line to see where it will end up.

That "longer term" is MUCH lower than anywhere historically. It leaves me with the one question, over and over again. Why the hysteria? So what if the inflation rate is at two percent and rates find a new trajectory to 3.75 percent? And the rate hike is going to be slower, we have always said that would happen. You cannot go from 0 to 4 percent in 16 meetings, two years out. So I am guessing that we may see 0.25 percent, then another 45 day hold, then the meeting after that, and so on. The Fed funds rate is out of your control, yet somehow it seems like the one and only story. I have better use of my time, you should also focus your attention on matters more interesting, like reading about your favourite companies. By the end of the session, the S&P 500 had gained 0.2 percent, in a session that had fluctuated between down one third of a percent and up half a percent, at various points.

Another Fed meeting done, another wait. If one always waited for the next data point before making an investment, you would probably never invest a cent. True story.

Thanks for your feedback on the JSE, first listings and founding date. Ironically with all my blasting of the folks in the mother city, it took a superior googler to find the information, who happened to live in Cape Town. Friendly banter, you know. According to this page on SA History: The Johannesburg Stock Exchange is established, the official founding date of the JSE is 8 November 1887. Sauer and Commissioner streets was where the "tent" was. There is more however, Wiki says that it was on the corner of Commissioner and Simmonds Streets, where London Businessman Benjamin Minors Woollan set up the Johannesburg Exchange & Chambers Company.

Commissioner street is (according the same Wiki) where Anton Rupert started his very first business, the Voorbrand Tobacco Company. It is also where the first ever movie was shown in South Africa, May 1896. A chap by the name of Carl Hertz brought the moving pictures here, on a boat. He was apparently a famous magician that appeared in front of the House of Commons to show that his trick of making birds disappear, did not actually harm the birds. Politicians, making society safer for birds since 1921. On that very corner now is the most magnificent building, corner Commissioner and Simmonds, called the National Bank Building. Stunning. Diagonally opposite is Clegg House, built in 1935 and covered in pink paint as a sign of neglect from a protest, from a Colombian/American artists of the name Yazmany Arboleda. Opposite Clegg House is a Gauteng provincial building and the corner diagonally opposite to that is the Gauteng Social development building.

The second JSE is actually where a Post Office sorting office is now, methinks, Main, Fox and Pixley ka Isaka Seme Street, formerly Sauer. For those of you who don't know, Pixley ka Isaka Seme was the first black lawyer in South Africa and founder and president of the African National Congress. He studied in the US and in the UK, at Oxford. I wonder why he does not appear as much in our early history as he should? I mean, he is the founder of the ruling party. So there you go, some more on the history of the JSE, our old pal from Canada piped in with some juicy bits, any one fancy some translation:

"SAB listed first in London in 1895 and then in Johannesburg in 1897. I am not sure why, except that Sammy Marks' partner, one Mr Lewis, lived in England and maybe there were more investors there than in JHB to take up the stock. Not so long ago a treasure trove of Sammy Marks' letters were found walled in, in the Sammy Marks' House in Pretoria, but I think they are still untranslated from their original Russian. There used to be a Sammy Marks archive at the University of Cape Town, but I don't know if it still exists. Nobody today seems interested in those pioneer ZAR industrial entrepreneurs, who established the alcohol, cement & explosive industries before the Boer War."

Nice, keep it coming.

Company corner

Naspers released a trading update as the market gong rang. I mean, as the electronic bell rang. The last trade in the spot market crossed the ticker, that sort of thing. We do not have a closing bell in the literal sense, the time just gives up the ghost on the spot market. Here goes the trading statement, which can be found on the SENS link on the Naspers website:

We expect core headline earnings per share to be between 25% (2 726 cents) and 30% (2 835 cents) higher than the comparable period's 2 181 cents.

So, by that measure core headline earnings per share puts the company's valuation, as per their share price (1832.69 ZAR) at 64 times. Of course this argument of how to value Naspers has been going on for an absolute age, they often trade as a proxy for Tencent, which trades on a 47 times multiple. At the first quarter reporting period, Tencent was able to grow earnings year on year at 22 percent, you could still argue that the PE unwind (the share price growing into the earnings) is possibly not what the market would like. Like Oliver Twist and his porridge, the market always wants more. Porridge is apparently being generous, the kids back then had to eat gruel, more drinking than eating.

The trading statement continues:

It is expected that earnings per share for the year ended 31 March 2015, will be between 135% (3 422 cents) and 145% (3 567 cents) higher compared to the prior period's 1 456 cents, mainly as a consequence of gains recognised by our associates on the sale and remeasurement to fair value of investments. These gains have been excluded from both core headline earnings and headline earnings per share.

Nice. The results are on the 29th of June, I am actually peeved that I am going to miss those. Ah well, you can't win them all. The market has responded in a sort of favourable fashion to these results, even though it looks a little like a marginal miss on earnings. Year to date the stock is up 20 percent, from the recent highs in April, the stock is down nearly 7 percent. Over the last five years the stock is up a whopping 548 percent.

Stat of the day

When you think of the futures markets, you think of furious contractual prices in almost anything that has excessive gearing and high risk. According to Wiki however, the sixth king of Babylon, a fellow by the name of Hammurabi is the origin of futures. In fact, there is a law code called the Code of Hammurabi. It is well preserved and dates all the way back to 1754 BC, that is around 3771 years ago. Ancient Mesopotamia, which lay on the fertile Euphrates river valley. The code itself is visible on a stone, beautifully preserved and coincidentally (as we spoke about the place yesterday) is visible at the Louvre, in Paris. The saying, an eye for an eye and a tooth for a tooth comes from this code law.

Law 104 (there are many) when translated to English from the Akkadian language (many middle eastern languages came from here) says the following: "If a merchant gives an agent corn, wool, oil, or any other goods to transport, the agent shall give a receipt for the amount, and compensate the merchant therefor. Then he shall obtain a receipt from the merchant for the money that he gives the merchant." Today of course the contracts are very important in all commodities, for farmers to be able to lock in their price before they had delivered their crop. Equally for the buyer to know what their inout costs were likely to be in the finished product. The first major modern day futures exchange is the Dojima Rice Exchange in Osaka. Sadly it was disbanded just before the Second World War. The largest is still in Chicago, the Merc as it is known. Not the German car. The founding date of the Chicago Mercantile Exchange (CME) is in 1898, AFTER the JSE was founded. Put that in your proverbial pipe and smoke it.

Linkfest, lap it up

Looking at adverts from the past gives some insight as to how society operated and how people viewed things - How Apple and IBM Marketed the First Personal Computers. I think we have shared this video before, it shows teens watching a 90's advert for the internet - Teen React to 90's Internet. Given how easy and common place internet connection is, it is hard to imagine life without instant information and cat videos.

I know many bookworms who have said they will never use a Kindle but after they did they won't go back to ordinary books - Amazon announces new Kindle Paperwhite with a high-resolution screen.

Home again, home again, jiggety-jog. Greece, oh yes, we forgot to talk about that. Who knows where that will end up, equally, who knows what the interest rates trajectory is likely to be in the US and what that means for exchange rates globally. For now our equities market is marginally higher.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment