"Total global assets were 263 trillion Dollars by the middle of last year. And the growth for the year was 20 trillion Dollars, i.e. from the middle of 2013 to the middle of 2014. North America owns 34.7 percent of total wealth, Europe owns roughly 32 percent."

To market to market to buy a fat pig. Short weeks are a drain on productivity, I seriously think that the powers that be should stick all public holidays on Mondays or Fridays. It makes for better planning and is better for the economy, we need not forget the important dates in our history, we must just be more practical about it. For instance, make this date (tomorrow) the third Monday in June. That way we can always remember Youth Day and the uprisings of many of the students of Soweto on that fateful day in 1976. You can read about it, lest we ever forget how horrible apartheid was and how the after effects still live with us today. We seriously need to work harder to upskill ourselves and continue to improve, we should always be demanding better and strive for better.

Locally on Friday markets closed marginally lower, financials the laggards, whilst resources tried their best to see the markets higher, alas. It had been however, a week of improving prospects, this after a number of weeks of selling. In fact, since the markets made their highs in late April, the going has been tough. Of course there have been the obvious issues impacting on markets, the biggest of them all is as to when the US Fed will raise rates. That seems to be the all important matter that is capturing the attention of the markets across the globe. Since December the 16th of 2008, where the Fed set their target rate to be between 0 and 0.25 percent, there have been no moves on interest rates. Of course the market moves interest rates all of the time, since that time the bond markets have tried to predict where rates are going to next.

Right now the effective Fed funds rate is 0.13 percent. The 10 year "constant maturities" treasury rate is 2.39 percent. Two weeks ago it was 2.19 percent, that is a sizeable move in just a couple of weeks. The market always second guesses what the Fed funds rates is likely to be, it is important. Do people spend too much time anxiously awaiting indications or information from the Fed as to when they will raise rates? There have been many false starts in the recovery and fixed income markets have long been in a state of wondering as to when the Fed will raise rates. We have gone from a time of worrying about the size and scale of the extraordinary bond purchase programs (Quantitative Easing) to a time of when will that program end, to where we presently are, when will the Fed raise rates?

Again, as we have said over and over again, the Fed watches the incoming data and collects their own data, they will raise rates when they feel that they have to. Remembering that their mandate differs from ours (The South African Reserve Bank), ours is inflation targeting, their mandate is growth and price stability. Which means that they are flexible. There are times when it pays to have a more flexible mandate, there are other times when it most certainly does not. I suspect that if you have the ammunition, then good and well, use it. Here we are held sway by external currency moves that are far beyond our control, the central bank governor, Lesetja Kganyago, is always at pains to articulate this to the market. He is of course right, the currency will be battered and improve as a function of global forces.

The next Federal Reserve meeting of the FOMC (the Federal Open Market Committee) will be Tuesday and Wednesday this week. I often used to refer to the Fed blankey, we all need assurances about what someone in a position of authority seems to think is going to happen next. Our views have absolutely no bearing on where rates will go next. So whilst it is worth getting excited about (like most of the rest of the Market), one should just watch and accept that rates cycles turn both ways eventually.

The other secondary matter that is certainly closer to conclusion are the talks between the rest of Europe and Greece, with regards to meeting closer in the middle and accepting some sort of conditions. There was a total of 45 minutes talks last evening, before they "broke down" again. Sigh. Some Eurozone official was quoted as saying that he thought Greece wanted these talks to go nowhere. So it remains the same, the stock market in Athens is around 7 percent down. Sigh. I am there next Thursday, I shall scope it out for you fellows. I can't imagine that the default route is smart, I do however get the sense that the rest of the EU has bailout fatigue. We shall see.

We do not live in the Sudan (even if we entertain their leaders, at your expense I might add), we do not live in North Korea, or many other pariah states for that matter. Although strictly speaking, we would not have entertained president for life Omar Hassan al-Bashir if we thought that Sudan was a pariah state, you get my drift? The courts are testing the process as we speak, who knows, perhaps the field marshall (colonel at the time of the coup that he assumed power) will be arrested. He is the only head of state wanted by the International Criminal Court. Period.

Where is this going? The truth is, we may live in a state which sometimes gets us down, there are however many choices for individuals, including investment choices. You have choices, unlike many of those other places. You have choices to invest abroad, you have choices to invest in businesses that do more businesses with more customers offshore. Stop thinking that you are confined to one geography. I tear my hair out when I hear chattering classes suggest that companies looking for offshore investments are somehow unpatriotic. The world does not end at the Beit Bridge, Pafuri, at Alexander Bay, Nakop, or Komatipoort (Lebombo), nor does it end at Kosi Bay.

No, there are many more countries and another 7.25 billion other customers and people to trade with. If local companies want to search for and more importantly, execute on international expansion plans, then I am all for it. After all, I consider myself a citizen of Earth. Until we start trading with unknowns elsewhere, we should encourage trade everywhere across the planet. And the same should count for your investments too. Think global, another terrible side effect of apartheid was insular thinking by local citizens.

Stat of the day

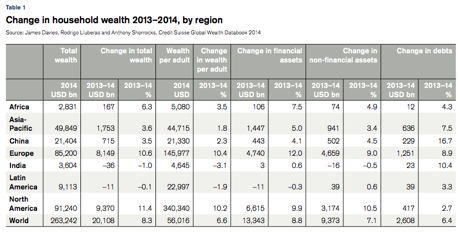

How rich is the world? I mean, what are the collective assets of the world? I suppose that it is not a definitive number, Credit Suisse however released a report titled: Global Wealth Report 2014, which estimated that total assets were 263 trillion Dollars by the middle of last year. And the growth for the year was 20 trillion Dollars, i.e. from the middle of 2013 to the middle of 2014. North America owns 34.7 percent of total wealth, Europe owns roughly 32 percent. I am afraid to say that total wealth on this continent (Africa) is just over one percent of global wealth. True story, check Table 1 from the publication:

Wealth per adult on the African continent is just over 5000 Dollars each, the global average, which is skewed by North America (340 thousand Dollars) and Europe (146 thousand Dollars) is 56 thousand Dollars. I am pretty sure that as a result of the Chinese stock market surge, this would look very different over the last 6 months. There are stories appearing of small scale traders making "lots of money" all over the show. I have seen pictures of people selling bananas with trading screens. There are 200 million brokerage accounts in China. What interests me the most is that in the year 2000, Japanese millionaires (Dollars) accounted for 75 percent of all Dollar based millionaires in the region (Asia), that has since fallen to 40 percent, with most of the growth from China and Australia.

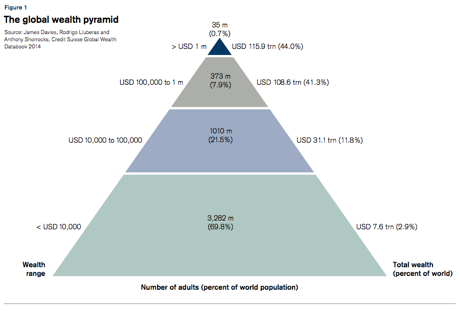

Two more graphs. Firstly the global wealth pyramid, which layers what the percentage of the wealth of the world.

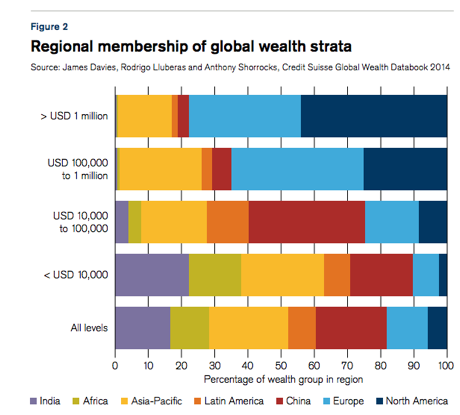

What does that tell us? It tells us that 0.7 percent of the total population have total assets of 115.9 trillion Dollars, or 44 percent of the global assets. That is an eye opening amount. Those are all the people with assets of more than 1 million Dollars, of which there are very few. The next "bracket" on the pyramid is a more chunky 7.9 percent of the global population owning 108.6 trillion Dollars, or 41.3 percent. That is the bracket of 100 thousand Dollars to 1 million Dollars. There are very few people that own 85 percent of the global wealth, to fit into that bracket you have to own more than 100 thousand Dollars. Figure 2 however confirms what all of the above tells you, most of the really wealthy people are in Europe and the US, we said that already. Check:

There really is no conclusion, this is just an indication of rich people across the globe still live in the developed world, where rule of law and infrastructure is tops. The fact is however that it continues to evolve and quite quickly, there are richer and richer people. Although in the back of assets in excess of 50 million Dollars, there are only 128,200 individuals, it is estimated. Does that sound about right to you?

Linkfest, lap it up

Subscription only, still if you have any free articles left from your FT reading, then check this one out: Renewable power will overtake coal if climate pledges are kept. Wow, by 2030 coal will be smaller than all alternatives. The best of the alternatives? Is it solar? Elon Musk seems to think so, he is quoted as saying: "The sun shows up every day and produces ridiculous amounts of power." That is funny and true at the same time.

Quartz had an interesting interactive graphic, that is pretty self explanatory: Africa's neither 'rising' nor 'falling' but it is growing-fast. What I find quite hard to stomach is that there are various other bodies, like the EU that funds the AU, I am glad to see that the AU has a plan to change that.

Zimbabwe have finally retired the Zimbabwean Dollar, at least the old one that is. Chinese news site Xinhua reports: Zimbabwe set to end use of defunct currency in Sept. As the BusinessInsider reports "Zimbabwe is paying its citizens $5 for 175,000,000,000,000,000 Zimbabwe dollars." I guess what happens when you do not respect money supply. It is strange to accept that the same politicians who destroyed the economy still preside over it.

Remember that rover landing on a comet? It is awake. It woke up as it got closer to the sun after being dormant for a while, all of seven months. It even tweeted a hello -> Hello @ESA_Rosetta! I'm awake! How long have I been asleep? #Lifeonacomet. Amazing how a seven month sleep is jolted awake with a battery recharge. Fits in nicely with the Elon Musk observation above.

The biggest opening weekend for any film was set this weekend. Jurassic World grossed more than 500 million Dollars globally, the movie itself cost around 150 million Dollars to make. See the WSJ article: 'Jurassic World' Stomps Its Way to Global Box-Office Record. Currently on IMDB, nearly 62 thousand folks give the film an average of 7.7 out of 10. The director is a young (38 year old) chap, Colin Trevorrow, could this be his Jaws moment? The first Jaws movie was directed by Steven Spielberg, before Colin Trevorrow was born, total budget back then was 9 million Dollars, grossing 470 million (1975) Dollars. Jaws is according to Rotten Tomatoes (a review website), the best movie Spielberg ever made. It also kept you from swimming.

Home again, home again, jiggety-jog. We are flat here today, whilst our market may be tired and waiting for futures closeout later this week, the two issues continue to plague global markets are front and centre.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment