"My point is simple. It always turns out better than you think. There is never a better time to own equities than today. There is no use saying that I missed the March 2009 generational lows and trying to wait for another one. There are so many articles that tell you how the world is ending and that stocks are going down 50 percent tomorrow. In reality, through the 50 years that Buffett has been associated with Berkshire Hathaway, the shares have lost their value by more than 50 percent twice. Or strangely, once in a generation. Makes you think, doesn't it?"

To market to market to buy a fat pig. Whoa. It is not often that you see a move like that, stocks locally up nearly one and three quarters of a percent, halting the worst emerging market sell off in nearly a generation. 24 years right, that is in the middle of what is considered Generation time. If you read the Wiki piece you can see that a generation measure is pretty simple, the time taken to produce the next generation. As simple as that. I can imagine that in some parts of the world it is much higher than in other parts of the world, people are having fewer children and indeed, having children later in life.

The population explosion in the last few generations has been something to behold. According to various measures there have been around 105 to 110 billion people to have ever walked the earth. We crossed 1 billion people for the first time around the time when Napoleon was awesome, 1804. It took another 127 years for the next billion to be added, the human population effectively doubled from 1804 to 1927. The next billion, i.e. from 2 to 3 took 33 yeas, by 1960 there were 3 billion souls alive at any one given time. And then "things" really sped up. By 1975 there were four billion of us, 5 billion was reached in 1987 (a mere 12 years), by 1999 there were 6 billion and in 2012 we had crossed the 7 billion mark, slowing from the pace of adding a billion every 12 years.

Expectations are that we will reach 8 around 2025, slowing again after that, 9 billion by 2045-2050. As famed baseball player and coach, Yogi Berra said: "It's tough to make predictions, especially about the future." Berra quotes make those of "The Honey-Badger" (Nick Cummins) seem lame. No wonder consumption has rocketed like it has, at the same time rapid industrialisation has taken place too, over the last 40 years. Urbanisation rates are over 50 percent now, in 1950 that was closer to 30 percent. Back then (and I am guessing, doing simple math), in 1950, with around 2.7 billion people on the planet, only 800 million lived in cities. Nowadays, there are 7.3 billion of us, with the urbanisation rate over 50 percent there are 3.7 billion people in cities. So nearly 3 billion people have moved to cities in 65 years, roughly 46 million a year. And we have not starved, as Malthus suspected, the Malthusian catastrophe did not transpire.

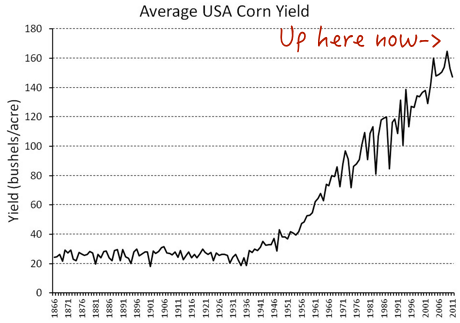

Why didn't this happen? It is not as if there was more arable land available? Crop yields have rocketed. In the US, last year (a record year) corn yields were an estimated 171.7 bushels per acre. See this graph which shows United States long term yields per acre, revolutionised farming methods must have started post the Great Depression.

And it seems to be getting better and better, meaning that greater technological innovations mean that people can live and work in cities if they prefer. The yield per acre of land, for corn at least and specifically to the US, has increased 8 fold in a time that the population has increased less than fourfold. Yet the sad truth is that 2 billion people globally go to bed hungry each and every night, and more than 1 billion people are obese, remembering that obesity is not necessarily connected to wealth, rather cheaper calories. You can talk about the good old days, the truth is that generally human lives have been improved. I guess it is easy to say from where I sit, tell that to somebody in the multiple conflict zones around the world, of which there is the Global Conflict Tracker tool. Sad.

There are more of us demanding more services and products. Newer companies are being formed all of the time, providing products and services that you would have thought not useful 40 years ago. Look at your desk, look at all the things around you and imagine a world with a rotary dial telephone and nothing else on it, other than an in and out tray. I saw a fabulous video that describes exactly that. See here, how all the clutter on your desk moves to your notebook (laptop) over time:

(video courtesy of:bestreviews.com/best-desk-chairs#evolution-of-the-desk)

My point is simple. It always turns out better than you think. There is never a better time to own equities than today. There is no use saying that I missed the March 2009 generational lows and trying to wait for another one. There are so many articles that tell you how the world is ending and that stocks are going down 50 percent tomorrow. In reality, through the 50 years that Buffett has been associated with Berkshire Hathaway, the shares have lost their value by more than 50 percent twice. Or strangely, once in a generation. Makes you think, doesn't it?

Factoid of the day

We take fixed income markets for granted, we take equity markets and interest rates for granted, yet we never question how they came about? According to Wiki, the first general government bond was issued by what is today the Netherlands, less than 500 years ago. In 1517. Interest rates were around 20 percent, talk about expensive debt! The very first government debt issued by a national government was apparently the English, back in 1694. It must have been complicated, from a reporting point of view. What is more astonishing is that the very first electronic trading platform, the NASDAQ, is less than 50 years old. Although the evolution to straight through processing (matching on market in an electronic environment) did not happen immediately, we now take it for granted that sometimes we are trying to buy or sell stocks against algorithms and high frequency trading participants, happy to have the liquidity.

What I have not been able to conceptualise is why global daily forex transactions is in excess of four trillion Dollars, the US international trade of goods for their entire year is around the same amount, and equal to just over one-fifth of their entire economy. What is also very interesting is that whilst commodities investing may not be the best long dated place to part with your hard earned money, commodity trading as a percentage of global trade is more than any other industry.

Linkfest, lap it up

Many of the web pages that you use get revenue from advertising, which is then used to produce the content and maintain the site. What happens though when people use software to block adds? As more people move online this question becomes more prominent - Block shock

Here is why Amazon is leagues ahead of their competitors, given their scale they can do things cheaper than the rest and create big brand loyalty - Why Amazon Is Putting 'Minions' on Their Boxes

It is hard to comprehend that there are still countries as isolated and backward as North Korea - This is what it's like to teach in North Korea.

It is not a surprise given all the hype around the fight that Mayweather and Pacquiao are one and two - The World's Highest-Paid Athletes. It still blows my mind that someone can earn that much off one fight! I suppose when there are only two athletes to share the profits, they take home big money. Compare that to Football where there are two teams to split the profits between.

Here is a nice list of food you can feel better about eating - 10 foods to nourish your brain. Glad to see that red wine and dark chocolate made the list.

This is a pretty long article which goes through energy consumption patterns of human beings, starting with the discovery of fire and ending with the awesomeness of Tesla. The objective of the article is to show how Tesla will change everything. If you do not read it word for word, browse through it and speed read. There are also some great images and graphs. How Tesla will Change Your Life.

Home again Markets are marginally higher here after the huge rally yesterday. The currency is weaker and commodity prices are down, that tells you that the Dollar is stronger.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment