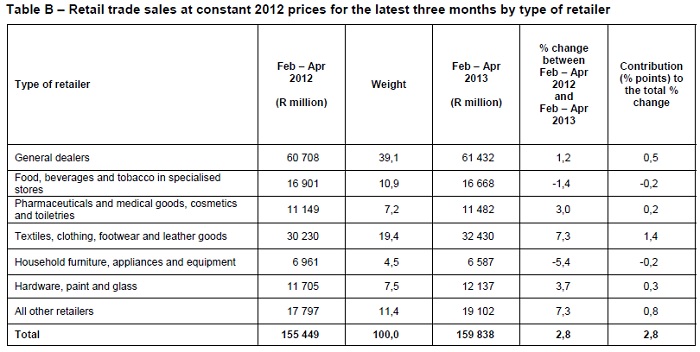

To market, to market to buy a fat pig. Yesterday. Troubles and far away, you know how the song goes. There were retail sales locally, check out the StatsSA release: Retail trade sales (Preliminary) April 2013. And unfortunately in constant 2012 prices we only saw a 1.9 percent increase year on year. In Rand terms the sectors going backwards over the Feb, March and April were the Food, Beverage and Tobacco and Household furniture, appliances and equipment. But textiles, clothing, footwear and leather goods are the most improved.

Amazingly, 39 percent of all retail sales in South Africa take place through "General Dealers". In the past I have struggled to find the definition on the StatsSA website, but it is there now: "Retail trade in non-specialised stores with food, beverages and tobacco predominating; and 'Other' retail trade in non-specialised stores." I presume cash and carries and bulk stores.

But this table is worth a look, to get a sense of where South Africans spend their money. Seems we like clothes, shoes and handbags, I can't say that I am a very good customer there. In fact I am very useless in that department, but the way I figure it, you can only wear one pair of pants and shirt and shoes at the same time, not so? I am very proud of the fact that I still have the shoes that I got married in, they still "work" and I wear them often enough.

Total retail sales for last year at constant 2012 prices was 662.8 billion ZAR, up from 633.3 billion the prior year. And was up 82 billion in 2012 from 2007. I suspect that what often happens around here in South Africa is that the chattering classes jump onto the negative commentary and tell you how awful everything is, but over the last two decades the lives of many South Africans have improved, retail sales and access to credit has improved markedly. Before you tar and feather me (don't set me alight) don't get me wrong, I agree mostly with the chattering classes. I always think that we can do better, and should do better. Education is shocking around here, that is why we like businesses like Curro, because parents will do whatever they can to make progress in life.

This article in the WSJ was excellent and explained a lot: Question for Investors: Bumpy Return to Normal or New Volatility as Central Banks Step Back? The conclusion is/was not perfect, but the story tells it like I tried to discuss yesterday. Ironically an improvement in economic activity and the outlook in the US and Europe (and Japan) means that the emerging market flows will be in the other direction, back. And that adds to the volatility that we have seen. I guess that smug line, oh, Europe have their problems, perhaps we can dispense with that now.

Talking of which, remember when folks were crowing last week when the folks from Transnet failed to get away some debt that this was a "sign" that parastatals were going to struggle with bond issuances as a result of government policy uncertainties. Well, Transnet had this statement on Monday: Transnet roars back to market with R3, 3 billion bond. What!?!? How come that there was not as much excitement about the issuance than NOT getting the issuance away? Because that is the mood that we are in now. Everyone is feeling like they are not getting their best foot forward and not making sufficient progress.

But, as the curious and inquisitive guy that I am, I wanted to know the rate achieved, so I emailed the journalist from the BusinessDay who had written a piece:

- "Good story, I read the Transnet release: Transnet roars back to market with R3, 3 billion bond.

And did not see the cost to Transnet, just the line: The issue of the 3-year floating rate note and the cost of the funding are in line with Transnet’s strategy of diversifying instruments and sources of funding.

Perhaps you could ask the specific person, .... the details at the bottom of the release: ...... what the yields were this week in the oversubscribed bond issuance, relative to the last weeks “flopped” bond auction.

The cost of funding of the expansion is really important for the public to know, because if the costs for Transnet have risen, perhaps they should rather let everyone know that too. If not, then I will shut up and sit down.

If you could find out what the two yields were, for the two issuances, I would appreciate that. Just curious."

Now the BusinessDay journalist sent the question directly to the spokesperson who replied directly to me:

- "Dear Sasha,

The three year floating rate note was issued at 3 month Jibar + 110 which is 6.23%.

Last week's bond was not issued.

Kind regards,"

Two points. One, the duration is important to note here. The longer dated debt could not be raised because investors in fixed income are now mindful that in the short to medium term the interest rate outlook if for rates to rise. Hence it would be easier to get away shorter dated three year debt rather than ten year plus. Second point, I could not ascertain who the investors were, I did ask, but I got no reply. I want to know, are you worried about South Africa's ability to raise debt for ambitious expansionary projects, or do you think we are just in a spot right now where globally fixed income is in a wait and see mode? Perhaps. Time reveals all the answers, we continue to encourage diversification, geographically that is.

Byron beats the streets

- Today I was asked by a journalist what I thought of the "liquidity bubble". Confused I asked what exactly that meant? This was his reply.

"Some of the guys I chat to say central banks could have created a liquidity bubble that might burst if QE is suddenly withdrawn or perceived to be suddenly withdrawn."

A few things popped to mind but the very first one has to be a point that former member of the Fed, Bob McTeer has been drumming across for ages. He says, and I fully agree with him, that QE has not actually put that much more money into the system. This is because banks have been using the extra cash to ramp up their reserves rather than lending it out and pushing the money into the system. This is understandable, first of all regulations have forced banks to hold higher excess reserves. Secondly, the banks are being cautious. They got their fingers burnt in 2008 and do not want a repeat.

Here is the full explanation in a piece titled The Fed Has Not Been Printing Boatloads of Money.

Having said that, at some stage this money will start filtering into the system, and even if it doesn't it sits as a nice safe haven which will allow the banks to absorb another crisis. That creates confidence and certainty which in turn creates more economic activity.

Speaking about QE the question of tapering is the new craze for anxiety. Remember Fiscal cliff, remember Greece, remember the US debt ceiling? Tapering of the fed's QE policy is the new excuse when the market goes down. I am confused though. I thought this was a good thing? If the Fed are pulling back on Quantitative easing that means they feel the US economy is in a good place and can function without intervention.

This article titled Tapering is the Green Pill reiterates my point. Another question so often asked is when will the Fed pull out? That also confuses me because it is quite clear that the Fed will not just pull out. It will be a slow evolving process, just like how they started the buying programme. The Fed have also clearly indicated when this will happen. There is no time frame, rather a benchmark. And that is the US unemployment rate. When that comes down the Fed will slow down. They have clearly stated this so no need for speculation.

Lastly, it is not 'QE' that moves share prices over the long term. Yes it helps with market sentiment but at the end of the day it is earnings which underpin share prices. If there are jobs in the market , there are more consumers. The US economy relies on its consumers. This will help earnings which will push up share prices. The fed will only pull out when these jobs are created. So please stop worrying about the 'tapering of QE'. It is just a fad.

Home again, home again, jiggety-jog. Market participants are adopting the headless chicken approach, running to-and-fro. The Japanese market fell over six and a half percent this morning as the direction from the Bank of Japan becomes less clear and the Yen firms up strongly again. Volatility has definitely risen over the last few weeks. The VIX measures that I follow are all at elevated levels this year, but have certainly been rubbished over the last year. If you were long volatility you have been caned. Not so for the last three to four weeks. My best guess is that people trading these shorter term waters are on alert for ice bergs. My other best guess is that we will sail through this in the coming weeks and the anxiety will subside.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment