"Airbnb will possibly achieve 2.8 billion Dollars in revenues this year. The company trades at roughly 11 times revenues, if you are using that metric. Priceline, the listed entity that owns Booking.com amongst other platforms (see recent note - Priceline 4Q & FY numbers - still strong growth), trades on 8.5 times revenues, with a multiple of 40 times. Not cheap, although, growing like gangbusters."

To market to market to buy a fat pig A mixed bag for stocks across the oceans and deep blue seas, stocks in New York, New York ended marginally better after a see-saw day. The Dow Jones added all of 0.01 percent by the time the closing bell clanged, the nerds of NASDAQ double that, whilst broader market S&P added 8 times the Dow, falling short of one-tenths of a percent. Yes, at face value it was an average day. Crude oil WTI, fell below 50 Dollars a barrel for the first time since December, rumblings of a brave face photo opportunity with Russia and Saudi, and perhaps all OPEC members not really able to make good on the quota cuts. Funny that, a cartel can work until real competition sends them packing. By that time they are so inefficient, they lose market share. The oil price did pick back up again, energy stocks closed in the green.

Snap Inc. lost a little ground, the stock is such old news and will be listed for a week now. Ha ha, nope, I am kidding. Just like Evan Spiegel's fiance, Miranda Kerr, who asked why Facebook keep copying Snapchat. Oh no, that is real. Why is that important? Facebook through their multiple platforms, WhatsApp, Instagram and of course Facebook, are bringing their users similar, if not identical features that Snap has. Interesting. In the old days it was Facebook that was being "copied". See - Facebook's Clones Attack Snapchat.

Talking of money being raised, Airbnb, who do not plan to go public any time soon, raised another 1 billion Dollars, giving it a valuation of around 31 billion Dollars in this current funding round. Uber is apparently worth 70 billion as per their last funding round. You can actually get some deep dive data on private business, for a price, over at PrivCo. Got a spare 199 Dollars to get information on Airbnb?

Oh wait, there is a Santa Cruz Sentinel article for that - Airbnb raises another $1 billion, with no IPO in sight. See the metrics there? Airbnb started with 4 people in 2008, now they employ nearly 3000 people. The company actually makes money and is (unlike Snap) not "pre revenue" (a little unfair to Snap).

Airbnb will possibly achieve 2.8 billion Dollars in revenues this year. The company trades at roughly 11 times revenues, if you are using that metric. Priceline, the listed entity that owns Booking.com amongst other platforms (see recent note - Priceline 4Q & FY numbers - still strong growth), trades on 8.5 times revenues, with a multiple of 40 times. Not cheap, although, growing like gangbusters. At the same time, Priceline raised over 1 billion Dollars (1 billion Euros), check it out - 0.800% Senior Notes due 2022.

We like the sector, experiences trumping "things". The story of Airbnb is pretty amazing, with the initial goal to make a few bucks. See, I was wrong on "if money was the starting point, you wouldn't succeed". Perhaps Airbnb won't ever make more than a few bucks?

The original email from Joe Gebbia to Brian Chesky reads as follows:

"brian, I thought of a way to make a few bucks - turning our place into "designers bed and breakfast" - offering young designers who come into town a place to crash during the 4 day event, complete with wireless internet, a small desk space, sleeping mat, and breakfast each morning. Ha!"

In Jozi, where the weather has been "funny" and almost unseasonal, stocks were cold as a collective. The all share sank three-quarters of a percent to end the day below the 51 thousand mark. A three year return for the ALSI shows around 7 percent. That is it. Resources on the day sank over two percent, Kumba down nearly 7 percent on the day. Iron ore prices have sunk recently, after having doubled since last June. It is also (the iron ore price) half of what it was in September 2011, as ever, it depends on where you draw the line in the sand.

At the opposite end of the spectrum, Steinhoff gained after having been beaten down over the last few sessions, the weaker Rand has had something to do with that. Read, weak commodity prices = weaker Rand. The same could be said for Russia, or Saudi or Australia. So .... if you have been wondering why the currency has been so strong, look no further than better commodity prices. Now ... the Gold price is below 1200 Dollars an ounce and sliding platinum prices.

Company corner

Some more on the Aspen H1 results from yesterday. Make sure that you watch this fabulous interview (that lasted longer than initially planned) - Aspen H1 normalised HEPS up 6%. Self inflicted (supply chain) problems in South Africa, those have been fixed and a turnaround is afoot. An interesting question, when asked about why own Aspen today, at these levels, he gives an answer which I suspect a shareholder should expect. He said that 40 reporting periods of increased earnings, time and time again, tells you something. And he tells of how the business was harder at the beginning, cap in hand sitting in front of the bank manager. In some ways he says, it is easier to run a bigger business. Interesting perspective, not too dissimilar to those of Phil Knight of Nike in his book, Shoe Dog.

Paul actually saw both Stephen Saad and Gus Attridge in the foyer of the JSE yesterday and chatted with them. Not too much different to what Stephen said there. I will tell you something about this guy, he was asking Paul about his family and his running regime (Paul looks fit). That shows you the fellow genuinely cares about other people around him. I have heard a story too of him flying locally on coach and helping fellow passengers stow their luggage in the overhead compartments (there is always a fight over those, right?), from another client of ours. I wonder if the person sitting next to him knew that he would on paper be a Dollar billionaire?

After listening to him yesterday, we are very happy that the business here is in the "right" hands. They have had to close all the transactions and make sure that shareholders finally see the fruition of the hard work. A big base in a "good space". They will push and look for opportunities, including in infant nutritionals in China (baby formula), they are advanced in their thinking about entering China directly. We continue think that this is a fabulous business, with boundless opportunities. Whilst we are going to continue to "wait" and be patient in a stronger Rand environment, I think the stock represents a great opportunity now.

Linkfest, lap it up

I was talking to a client a week or so back, we were interrupted by her pool people at the gate. She disliked her pool. How about this low maintenance option? Recycled shipping containers in Aussie are being used as fibreglass pools - Shipping container pools.

The smart home is already a "thing". In some instances, Nest, a subsidiary of Google is a market leader. They are, according to Mark Gurman writing for Bloomberg, working on something new - Alphabet's Nest Working on Cheaper Thermostat, Home Security System.

An online clinic that reverses type 2 Diabetes? Here already. Although in their infancy, this business is looking to shake things up - Virta Health Launches to Reverse Type 2 Diabetes as New Study Demonstrates Reversal Possible Without Surgery. Their outcomes so far have been pretty amazing, Preliminary 6 month trial data shows 87 percent of patients reduced or even eliminated insulin and they had on average 12 percent weight loss over 6 months.

This is one of the best articles that I have read in a long time, via Paul, it does require a subscription though, you may be able to get your "free FT" articles - The problem with facts. The telling line "Once we've heard an untrue claim, we can't simply unhear it." What a research paper cited in the piece is that only 4 percent of people read "seriously". Finally. I understand Facebook

I think this headline says it all - Despite Modi's anti-corruption drive, 70% of Indians must still pay bribes for basic services. Is it still wrong if society just assumes that a bribe is part of the price of a good?

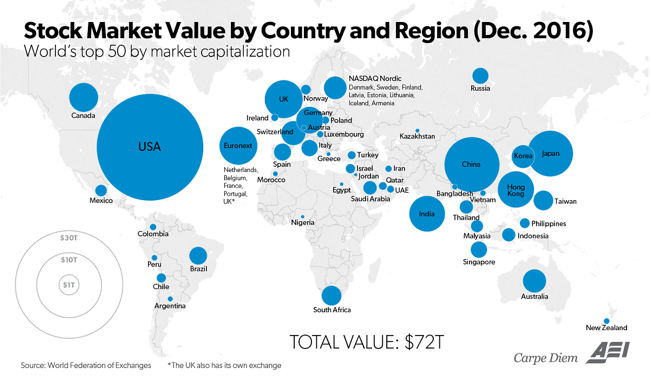

All the stock markets in the world? Check this out, via our pal Prof. Perry at AEI

Home again, home again, jiggety-jog. Stocks have started better here in Jozi, again the Rand is marginally weaker. Non-farm payrolls today. Exciting stuff sportslovers.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

No comments:

Post a Comment