"The company thinks that there are many opportunities in emerging markets, as well as making Japan and China big parts of their business. The share price has taken another leg up after having initially traded lower. There are loads of moving parts, and many different "things" going on."

To market to market to buy a fat pig Stocks were marginally lower here in Jozi, down 0.15 percent on the day by the time the closing bell rang. Resource stocks sank nearly a percent by the close, industrials were better, the weaker Rand lent a hand to some of the dual listed stocks. Woolies fell sharply, they were trading ex-div, which means that if you buy them today, you won't get the dividend. Most of the selling of some other SA inc. stocks came just after 15:00, perhaps a sell order across the board? For every seller of course there is a buyer, the price is the important thing, at what level are you willing to own or not own a business and to share (or not share) in their future profits. That is the simple question with a very complex set of answers.

Lonmin clocked another 12 month low, things look a little desperate with a Rand Platinum price that is trading at and near 12 month lows too. And there everyone thought that mining was so easy and miners just make super profits. Or at least the broader public do. Mark Twain is attributed to describing a mine (although never authenticated) as "a hole in the ground owned by a liar." Hmmm .... perhaps he meant extreme optimist. Twain's real name was Sam Clemens, he himself was a prospector in Nevada. We are all the richer for him having become an author. He was also a failed inventor and went bankrupt from his business dealings. Makes sense that he harboured (perhaps) such hard feelings to miners and their optimism.

Stocks across the oceans and vast blue seas initially cheered an ADP report that showed the US economy had created nearly 300 thousand jobs in the month of February, this is the precursor to the non-farm payrolls number on Friday. See - ADP Employment Reports. Pretty much all sectors adding jobs, cementing perhaps the connection of the dots between the equity market expectations and this read, a strong labour market is good for the US. Confidence can move an economy, even if one set of confidence is another set of despair, if you get my drift.

Into the second half of the session we saw some selling emerge, energy stocks in particular were slammed during the course of the session, down two and a half as a collective. Petrobras sank over seven and a half percent by the close, Exxon off 1.8 percent and Royal Dutch Shell shed over two and a half percent. By the end of the session, the Dow was off one-third of a percent, the broader market S&P 500 sank around one-quarter of a percent and the less buffered (by falling oil prices) nerds of NASDAQ managed to squeak out a gain, up 0.06 percent by the close.

Snap cracked back, up over six and one-third of a percent on the session. Caterpillar are the current target of a government accusation that the company had committed tax fraud. Huh? In order to maintain a higher share price, the report suggests, read the NYT article titled Caterpillar Is Accused in Report to Federal Investigators of Tax Fraud. It is complicated, and relates to the Swiss subsidiary. Of course, tax rates for businesses differ all around the world. Internally the company had apparently suggested that the movement lacked a business strategy, other than the obvious. The company has not had a chance to look at the report yet, and as such, cannot comment for now. The stock sold off 2.81 percent. We shall see what transpires, we don't own any shares in the business.

David Tepper [Appaloosa asset management, a wild (mostly positive) returns and big hedge funds, 14 billion AUM] was on the box yesterday, he let slip with a few PG16L words. The CNBC host Joe Kernan tried his best to stay relevant with him. He is short bonds and long European Equities, he is still an owner of Apple stock, although he did sell some of them. He doesn't think that the market is cheap, he doesn't think it is expensive. He also said something interesting about young(ish) people that manage money. 40 year olds, people my age bracket. He said something along the lines of "guess what, it can all be good". Possibly referring to the 90's period in which people of this age would not necessarily have been "involved" in the markets.

You are so far behind, in my mind, the curve now for the potential upside, downside potential. We can talk about the fed. we can talk about the ECB. Everybody still looks on the negative side of life on everything for some reason. Almost ten years, nine years after the downfall. It's not just a negative side of life. You have to be on the positive side of life.

I agree with him. You have to be positive, good things will then happen to you, even if it feels tough. Peter Lynch, fabled investor, says something similar in his "principles" "Unless you're a short seller or a poet looking for a wealthy spouse, it never pays to be pessimistic."

Company corner

Aspen released numbers for their six months to end December this morning. This is a business that has transformed from being a small to major generics business, to now positioning themselves as a (in their words) "global, multinational organisation focused on therapeutic specialties." Anticoagulants (to treat thrombosis) and anesthetics, much of this is new business. This compliments their older businesses, infant nutritional (formula and the like) and lastly the High Potency & Cytotoxics division.

That division is a little more complicated, those therapies treats everything from thyroid conditions to Parkinson's disease, as well as female cancers and hormonal imbalances. And there you thought the business was just a generics company, how the last five years have changed most of that. First Baby formula, and then the European oncology therapy and now becoming a key global participant in hospital procedures and aftercare of patients. i.e. The therapies compliment one another, post operations (where you have to have anesthetic), you need anti coagulants in order to prevent clotting. There is a very *nice* graphic, The Aspen Timeline on their website.

The numbers. Let us take a quick look. Asia Pacific contributes 19 percent to group revenues, South Africa 23 percent and International (Europe, Latin America and North America) 58 percent. Group revenues clocked nearly 20 billion Rand for the first half of the year, up 13 percent from the prior comparable half year. Normalised HEPS increased 6 percent to 692 cents. The dividend has grown quite strongly, still, expect the company to yield less than two percent. One doesn't own the stock for the dividend, you own it for growth. That is why the share price has been more than a little disappointing over the last 18 months, they have been bedding down a number of transactions.

The group has operations in 70 different countries, there are multiple different currency fluctuations that impact on the company earnings. Stephen Saad suggested that they were now looking to report with constant currencies, an international practice. That should make for less volatility. The company thinks that there are many opportunities in emerging markets, as well as making Japan and China big parts of their business. The share price has taken another leg up after having initially traded lower. There are loads of moving parts, and many different "things" going on.

Linkfest, lap it up

I think just like the books that were a fad for a while and then faded away, this concept won't work either - Netflix's interactive storylines will destroy actors - and relationships. Will still be interesting to see what the take up is though by audience and you never know, maybe this type of TV finds a niche.

If your history teacher told you that Edison invented the light bulb, they are wrong. There were at least 23 other people who had invented lightbulbs before him - Innovation Diffusion Lessons from Edison. It is all about execution and a lot less about the idea, here is a bit of history on the light bulb - Who Invented the Light Bulb?

I am always amazed by how awesome the FitBit software is, how the product is quite loved by those that use it, yet by how awful the investment has been. In my mind Apple should just buy FitBit for the software alone, I am pretty sure that they are working on a better version on their side. This is pretty useful for fitness freaks, via the article titled The Sleep Science Behind Fitbit's New Alta HR Fitness Tracker - "There seems to be a strong correlation between your sleep and your runs. The last 10 weeknight logs show that you had 20 mins more restful sleep on days you ran vs. days you didn't."

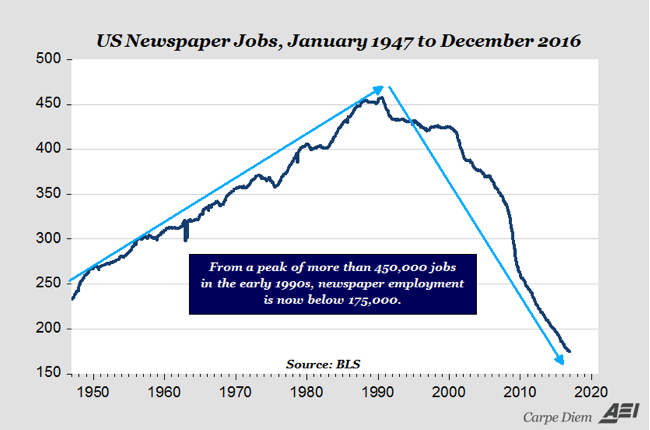

This graph, courtesy of our old pal Prof Perry is self explanatory - Wednesday evening links, all charts and map edition. These are newspaper jobs in the US, what is interesting to me is that peak newspaper jobs seem to come pre the full scale ramp up of the internet. Do you think that it was 24 hour news TV in the 90's and then the internet from the 2000's? We remain invested in internet businesses that attract more and more advertising, Alphabet, Facebook, Naspers and Amazon.

Home again, home again, jiggety-jog. Stocks have started lower here in Jozi, it sounds a little like groundhog day. Resource stocks lower on balance. Europe ... the ECB and inflation. US futures are looking a little worse for wear at the moment.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment