"African Rainbow Minerals also had a cracking day, as did Lonmin and GoldFields, all up over ten percent on the session. It was one of those rare, rare days. All as a result of a Federal Reserve not minding that inflation gets out of whack, whilst they raise rates at a slow and measured pace."

To market to market to buy a fat pig As we suggested yesterday, it was going to be a monster day for stocks and that was the case. As a collective, stocks closed up just over two percent by the time all was said and done. Financials added two percent, industrials a percent and a half, perhaps held back by a firmer Rand. The local unit reaching the best level to the US Dollar in around a year and a half. The real action however was in the resource stocks, up over three percent by the end of the day. Kumba added over ten percent, Anglo and AngloGold Ashanti added six and a half percent, Amplats nearly five percent. There were only three stocks amongst the majors in the red, Steinhoff, Reinet and Old Mutual, all with listings offshore! Most of the majors were a percent to more stronger on the day, 75 percent of the ALSI 40 was in that bracket.

African Rainbow Minerals also had a cracking day, as did Lonmin and GoldFields, all up over ten percent on the session. It was one of those rare, rare days. All as a result of a Federal Reserve not minding that inflation gets out of whack, whilst they raise rates at a slow and measured pace. That is "good" for metal prices, that is not too good for the Dollar, and by extension better for the local unit, the Rand. In other words, a Fed that is not worried about inflation, means that there is a good chance of lower inflation here and that may mean rate cuts later in the year. Divergent central banks and their respective policies. And positive too for yields in emerging markets, as long as the currency factor can be taken out a little. Risk versus reward.

Remgro released results post the market close last evening. We had seen a trading update a week and a bit prior, so we knew what to expect. The stock now trades at a pretty big discount to their intrinsic net asset value, which currently is 257 Rand. The stock closed last evening at 225 ZAR, this represents an over ten percent discount. Headline earnings per share, excluding once-off costs (related to the Mediclinic rights issue and listing in the UK) and option remeasurement was up slightly, the dividend was also up slightly, both just less than 5 percent. There is and was a case to be made in the past that this was a better investment than a unit trust, I think that I stand by that. Far cheaper, and pretty diverse, more nimble. Investments in food and booze, banking and financials, insurance, industrial holdings and healthcare investments.

I would prefer to hold a business that had a whole lot of unlisted vehicles like Unilever South Africa, Kagiso Tiso, Total and NATREF. Otherwise the argument could be made that it is far easier to then own their best listed assets, in this case we own Mediclinic. That said however, Berkshire is a perfect example of a business that holds huge listed and unlisted companies and is well diversified. Again, if you have astute managers, who identify the opportunities and you can invest in them through one vehicle, why not? I agree, far better to own one listed entity such as this, than an expensive mutual fund. The stock is down around one percent this morning.

Across the oceans in a chilly New York, New York, stocks were flat to mixed. The Dow jones Industrial Average lost 15 odd points, the broader market S&P 500 lost 0.16 percent by the time the trading day ended, it was only a less than one point gain for the nerds of NASDAQ that saw them close higher amongst the majors. Healthcare stocks took some heat after the Trump budget revealed more for guns and less for medicine and the arts, less for education, agriculture, labour and more for security and veterans - read the Washington Post What Trump cut in his budget. I guess that was the mandate that he was elected on, Americans who voted for him feel unsafe.

Financials and technology stocks did OK, Oracle added over six percent on a day, the company had earlier printed results that were decent enough (after the bell Wednesday), for the watchers and expectant crowd. Missing on the top line and beating on the bottom, as they say on the Street. I am not too sure that this is the greatest and best business to invest in, they certainly have a wonderful product, we can attest to that around here.

There was an IPO from a Canadian business, for outdoor-wear. Canada Goose, heard of them at all? In what has been a very mild winter with a bad winter storm here at the end of the North East winter. Perhaps the timing was excellent, the stock was up over 25 percent. 60 years of work in the making, it is a reminder that a life's work can only result in true riches for another generation. Perhaps it is less than that, Bain Capital (over $75 billion of assets under management), the private equity folks, have come to market here to extract value. Bain will own 57 percent after the IPO, no doubt they will extract more.

The grandson of the founder, Dani Reiss will be there too, he is only 43. This is not too dissimilar to a much bigger sized business, Columbia. Family still very much involved there though. It is a "luxury goods" business, Canada Goose. There are some people who do not like their fur, some jackets sell for 700 to 1500 Dollars a pop!!! Whoa. It looks very interesting at face value, they have plenty of scope to grow across the globe, PETA does have a point about their stuff. Yip, if you don't like fur, don't even begin to look at this one. Valuations look quite rich, double that of Columbia, Canada Goose is on a higher growth trajectory. Speculative though, at the extreme luxury end, it is better to own Richemont and LVMH.

Company corner

This fellow, Horace Dediu, writes incredibly well. With interest to us mostly is his writing on Apple, this is a really cool article that starts "Apple is doomed. So are you. As mortals we are used to the idea of death." Titled Gravity, it really is worthwhile reading to the end. Horace explains how there were 8 separate events in the 43 year history of the business, where they were doomed and bound to fail, as per the graph. Moments where the iPod and the iPhone were doomed, the stock was sold off 40 percent as a result, multiple times. There were of course moments in their history where the company really was on borrowed time, Steve Jobs brought them to the pinnacle with the iPod and then the iPhone.

They really do make wonderful products, at the end of the day the company has enough internal innovation and enough demand for their core product to keep going. And a war chest second to none, their cash pile is nearing (if not there already) one quarter of a trillion Dollars. That is more cash than most business sizes in the mega cap listed environment. And just recently, the company attracted another fabled investor, Warren Buffett. Buffett is twice the age of the business, he must have been familiar with their products for most of his adult life, he must have seen Steve Jobs as a hard charging young man that was trying to change the world.

It is notoriously difficult to predict which business will be the next first mover in technology, what Apple have done better than everyone else is bring the next big thing later and better, apart from their first product that is. It is also difficult to think of many businesses that have four decades of business relevance with essentially just a handful of products (6 really), and currently one huge success. As the company is secretive and keeps their cards close to their chest, we may have to wait for what CEO Tim Cook (At the AGM) referred to "not visible" products that could become a priority. We remain long, knowing that product development is a multiyear "thing".

The share price may fall another 40 percent tomorrow, anxieties around the "next big thing" not emerging. We continue to accumulate and hold. And watch.

Linkfest, lap it up

What? Do you think that the McDonald's Twitter password was ronald, all lowercase? Their Twitter account was compromised last evening, sending out a tweet about the number one in the US, saying that he had small hands and is a "disgusting President". This should not happen, better encryption should lead to safer tweeting, surely fingerprints are better? McDonald's tweets go rogue with 'tiny hands' jibe at Donald Trump. Embarrassing for all, nobody wins here.

Often we do not realise the testing that goes into a specific product. This article from Co.Design explains internal testing in the notoriously secret Foxconn factories - Exposing The One Part Of Apple Design You'll Never See.

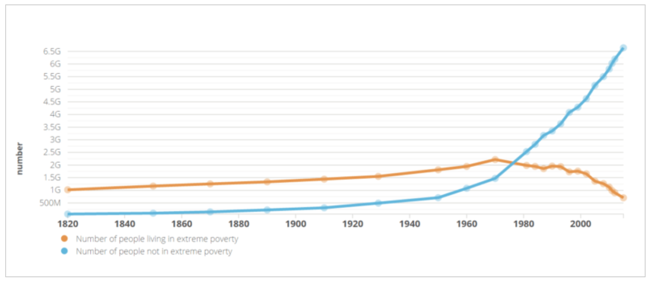

This is pretty amazing. Only when you see all of these graphs will you believe that the world is invariably getting better - Five graphs that will change your mind about poverty. One of our favourite websites. "From 1820 to 2015, the number of people in extreme poverty fell from over a billion to 700 million, while the number of people better off than that rose from a mere 60 million to 6.6 billion."

Home again, home again, jiggety-jog. Stocks across Asia are lower, US futures are lower. Happy St. Paddy's day. Here are some guidelines from last year - Guinness Tells Beer Drinkers: Keep Your Head And Embrace The 'Stache. Good luck with that sportslovers!

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment