"Whilst the actions of the Fed are beyond the control of the long term equities investor, and anxieties will always remain around "what the Fed does next", in time the present actions fade into market obscurity. Remain invested in quality at all points in the cycle."

To market to market to buy a fat pig Fed raises rates to 0.75 to 1 percent, that sort of range. Not that it was unexpected, this was for Mr. Market the most expected rate hike since the one two Decembers back. The tweet of the day belongs to Brett LoGiurato, who is the editor over at The Business Insider. He looks like an older Dennis the Menace. You have to be both a tennis fan and a markets fan, I had to explain this to my eldest daughter, she then "got it".

There was nothing to be afraid of, even though 2061 years ago Caesar was stabbed by his fellow politicians. Nowadays that is more figurative than literal, right? From fearing the Fed and their punchbowl removal, there was little for Mr. Market. You can read the statement here -> Press Release. Some important lines for those of you who think your are good at Fedspeak.

"The stance of monetary policy remains accommodative, thereby supporting some further strengthening in labor market conditions and a sustained return to 2 percent inflation."

There was a single dissenter, i.e. a single fellow that didn't want rates to go up. He is the youngest voting member, you will recognise the name and face from the financial crisis, one of the architects of TARP, the Troubled Asset Relief Program. Neel Kashkari is his name. Kashkari always reminds me of Sylar from the program Heroes, except he has no hair. I suspect that Kashkari is destined for great things, for the time being, finance Twitter is mocking hime for being too millennial. Not fair, he was born in the early 1970's.

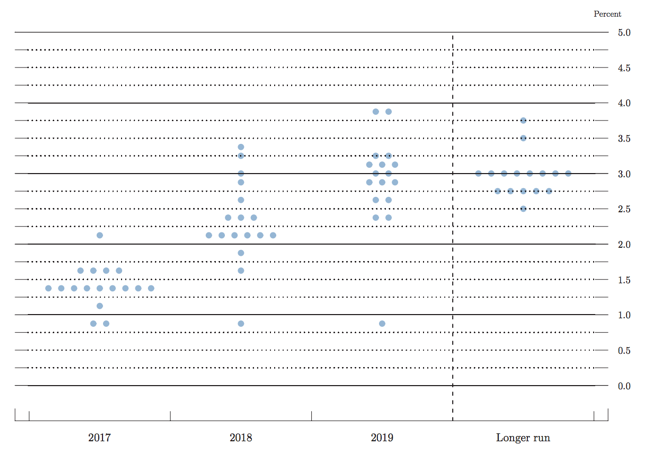

The "dot plot" pointed to a long term rate of around three percent, in other words, 8 to 10 more hikes from here on out, reaching that level beyond 2020. Bearing in mind that we are on track for another two rate hikes this year.

Thanks for all of that. Thanks to the Fed, Roger and Janet and Neel. We are stocks people. We own equities. We own companies and a fractional participation in their long term profitability. That is what we do around here. We try and identify the best possible choices (in a sea of plenty), and from that we try and stay the course i.e. the favourite holding period is forever. Often in retail clients, their biggest mistake is to get spooked when the going gets tough and to hurry into the market when it is nearing a cyclical peak. And then to suggest that the equities market is not for them. Reminder, if this was very easy, then everyone would do it, and the valuations would always be out of whack. Like always.

The other change that buoyed stocks and saw bond yields lower, was that the Fed were willing to see inflation expand for a while. This is seen as accommodative for the US economy, by extension stocks, and not really that helpful for the US Dollar in the short term. That is why you see commodities higher, Rand stronger and stocks on fire. Session end the Dow Jones had added just over half a percent, the nerds of NASDAQ clocked in a three-quarters of a percent gain, whilst the broader market S&P 500 added 0.84 percent on the day.

Whilst the actions of the Fed are beyond the control of the long term equities investor, and anxieties will always remain around "what the Fed does next", in time the present actions fade into market obscurity. Remain invested in quality at all points in the cycle.

Back home, where the sunlight is shortening and the inevitable winter rolls around, we were completely flat on the day, up 0.01 percent by the time the closing bell rolled around. Some retail sales data showed that it is getting increasingly tough out there, perhaps the worst has past, January and February seem to have been tough on the retail market. Resources were a bright spot, having rallied around half a percent on the day, I am expecting much more today, judging by the current prices and the reaction to a "dovish" Federal Reserve. The Rand is seeing a lift this morning, as a commodity producer and as an emerging market with a "reliable" capital market, this is good for us. Perhaps a lid can solidly be put on inflation and the consumer will no doubt look in better shape, come the second half of the year.

Sun International was absolutely caned. The stock was taken out back and thrashed. Down nearly 15 percent on the session. This was not as a result of men in togas with daggers, rather a trading update, coupled with a business update. The results themselves will be released towards the end of the month, the company expects half year earnings to be 35 to 45 percent lower than the prior financial year, diluted headline earnings per share.

There are loads of moving parts in there, including a 208 million Rand impairment charge of the Carousel asset, remembering that historically some of the assets were placed away from the cities, as a result of apartheid and agreements with the "governments" in these territories. With new legislation and no "homelands", South Africans can partake in entertainment and lose money far closer to home. I am kidding! Slot machines are every bit entertainment as going to the movies, it may not be your "cup of tea", it is what it is. I suspect that the opening of the Menlyn Time Square will be good for the group, time will tell whether or not they are able to attract tons of business. This has traditionally been a sector that we have not invested in.

Company corner

The big news clanging around is that Anglo American are getting a new investor, in the form of Anil Agarwal. Agarwal is the founder and chairman of Vedanta Resources, according to Wiki, he controls the business through his investment vehicle Volcan Investments. Sounds almost superhero like. He sounds like a bit of a scrapper, the Carl Icahn type, rather than a polished high society fellow, like Bill Ackman. We need all these people. He has been around for 4 decades, he has done the hard yards.

Here is the announcement from stock exchange news - Volcan Investments Ltd announces an investment in Anglo American plc. It is a little complicated:

"Volcan Investments Ltd ('Volcan'), announces today that it intends to make an investment in Anglo American plc shares of up to 2.0 billion Pounds. Volcan intends to finance the investment in Anglo American plc shares through the issuance by Volcan Holdings plc (the 'Issuer'), a wholly owned subsidiary of Volcan, of a mandatory exchangeable bond, led by J.P. Morgan as Sole Bookrunner, on or around 11 April 2017 ("Closing Date") that will be secured by Anglo American plc shares. Volcan and the Issuer intend to purchase the Anglo American plc shares in the market via a combination of purchases from investors in the mandatory exchangeable bond and on market purchases, subject to certain conditions, until or close to the Closing Date."

Well, good for Anglo American, whether or not this is the "right time" in the cycle, Mr. Agarwal is getting a discount. In May of 2008, Anglo American's LSE price was 35 Pound Sterling, they are currently 12 Pounds, having rallied 131 percent over the last year. Agarwal, good for him, I suspect that South African investors may well warm to this chap, if he is right about Indian infrastructure requiring a "lot" of resources over time, he may well be the right man. Board seat, useful insight, good for the business. Now, let them just close the nitty gritty of the deal.

Tesla announced that they were raising money - Offerings of Common Stock and Convertible Senior Notes. 1.15 billion Dollars in total. Musk himself will be buying 25 million Dollars of common stock, effectively ten percent of the offering (of common). This is not unexpected, we have continued to see suggestions that the company needs to raise money. As they say in what is a very short release: "Tesla intends to use the net proceeds from the offerings to strengthen its balance sheet and further reduce any risks associated with the rapid scaling of its business due to the launch of Model 3, as well as for general corporate purposes."

1.15 billion Dollars, relative to the market cap of 43.33 billion Dollars, 2.65 percent dilution. It is perhaps less than the market expected. The stock is actually up around two percent after-market, then again I am not always sure what is happening in the background, with a large short interest (over one quarter of all the shares outstanding), and such divergent views on the successes of the business. We will maintain that Musk is a doer, and a dreamer and someone who has been able to execute all the way through from vision to current. Reusable and cheap rockets? Yeah baby. Charging stations and cheaper electric vehicles, with driverless technology? That is him my friends, he has been the guy that has been able to put this all together.

Linkfest, lap it up

Looking back it is no surprise seeing which companies did the best, we were all part of the winds of change that helped sectors become dominant forces - The Ten Best Stocks of The Last Ten Years. The key line that stuck with me is below, basically holding a stock during volatility is harder than spotting the opportunity in the first place.

"I will have to do the most work on 'holding' them. It does not take as much work as you might think to spot winners. These stocks spend a lot of time on the 52-week and all-time high lists."

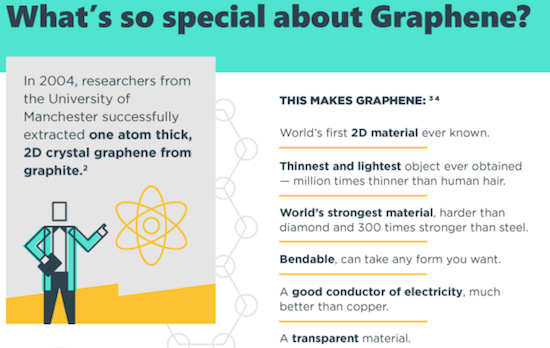

Wow, this material looks like it could revolutionise industries from agriculture to medicine to transport - Graphene: The Game-Changing Material of the Future. The only problem is that currently it is prohibitively expensive. So was steel though.

Home again, home again, jiggety-jog. Sanity has prevailed in the Netherlands elections. Great country, wonderful people, I know a lot of good people from there, they are terrific, OK? Not all of them, the pushback against right leaning folks has meant that the Euro has caught a bid. We should enjoy a positive day of "relief" and higher commodity prices, perhaps cue "fireball" in the background and fade it in with your best DJ skills.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment