"I for one can't wait for an autonomous vehicle to drive me around, freeing up precious time to do more important functions. Our investments in this area include NVIDIA and Tesla of course, fringe positions away from the core. Having said that though, Alphabet/Google and Apple have had varied success with their own projects in automated driving."

To market to market to buy a fat pig Stocks in Jozi rocked yesterday. Poor folks riding the "Argus", as I guess it will affectionately be known, those clips of people trying to go into the wind were at some level funny, at another level scary. What happens if riders had turned and had 100km winds at their backs. Definitely the right decision in the end, an expensive exercise. Ai shem, "sorry", as we say in these parts. Stocks as a collective rallied over a percent, the resource stocks were "particularly active", at the top of the leaderboards was Steinhoff, Anglo and Discovery. At the other end of the spectrum was Standard Bank, Reinet and AB InBev. It was mostly a day for the bulls.

There was a decent set of results from Rand Merchant Investments, the name change away from Rand Merchant Insurance tells you that they are looking for investments outside of Discovery and Outsurance. The company makes some interesting observations about the current operating environment and what could happen:

"South Africa is experiencing a tough macroeconomic environment, characterised by high inflation and weak growth, resulting in pressure on the disposable income of consumers. Ratings agencies share the view that more needs to be done to improve South Africa's growth prospects. A downgrade to sub-investment grade could result in higher interest payments, a weaker Rand, higher cost of living and subdued confidence, giving rise to higher unemployment and lower investments. Against the background of an increasingly complex regulatory environment, local growth in new business volumes and profit at RMI's existing investments are expected to be affected."

The shareholder base of this business is Remgro at 30 percent, Royal Bafokeng at 15 percent, the PIC and Allan Gray at 8 percent apiece. The company owns 25 percent each of Discovery and MMI holdings (created through the merger of Metropolitan and Momentum in 2010), 84 percent of Outsurance and 100 percent of RMI investment managers. They recently (Feb) bought a nearly 30 percent stake in a UK listed short-term insurer, Hastings Group, for as much as half a billion Pounds. On an earnings basis, as per the last full financial year, Discovery contributes 30 percent, Outsurance 47 percent and MMI 23 percent.

RMI is the single biggest shareholder in all of their investments. That is the way they like it. It is a small team of significant investments, the market cap is around 64 billion Rand, I think at last count there were around 7 odd employees. Really. The stock, as far as I can tell, is trading at about a fair price. Anyhows, we own the best investment in their stable, Discovery! Nice business, strong team, I think that they are going places.

Stocks across the oceans and far away were mixed by the close, a couple of sessions ahead of what is expected to be an interest rate hike by the Federal Reserve. Nobody seems freaked out at all, the stars are aligned, if one was to borrow a horoscope view. You know, there are only 12 kinds of people in this world, and it matters what day you were born on, you see? What gobbledygook. I suppose I shouldn't be like that, each to their own. Session end the Dow closed marginally down, one-tenth of a percent (led lower by mostly Intel, see below, Chevron, GE and Merck also contributing), the nerds of NASDAQ managed a gain of nearly one-quarter of a percent, the broader market S&P 500 ended the session a little better than where they started.

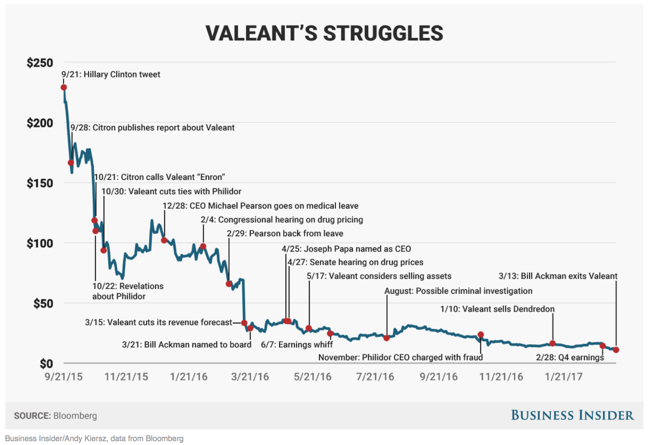

Hey, Bill Ackman and Pershing Square (his investment vehicle) finally bailed on Valeant, around 11 bucks a share. Paulson and Co. (John Paulson, the fellow who made a killing out of the housing crisis) is now the biggest shareholder, almost alone. Is this investment, as they would say in garden cricket a "six or sticks?" Valeant traded down 10 percent last evening, the market cap is now 5.6 billion Dollars, trading at roughly the same levels (after market) as back in September 2008, at a current 52 week low. Some suggest the loss for Ackman was about 2.8 billion Dollars, from the 257 Dollar highs in the middle of 2015 to current levels, the free fall has been dramatic. The company suggested a new path ahead, enabling them to focus on new investment opportunities. The fund has only around 11 billion in assets now, don't feel too sorry for him. Check out the BusinessInsider graph - The collapse of Valeant, as told by its stock chart.

At the same time, his short in Herbalife still is in focus, I saw that Carl Icahn's investment vehicle owns nearly one-quarter of the business. Two diametrically opposed views on the same company. Ackman is short one billion Dollars worth (at the time), Icahn owns one quarter of 5 billion Dollars. This is Spiderman up against Batman, we all know that Buffett is Superman. Whether or not Ackman thinks that this is a pyramid scheme or not, I would not be making investments against the health and wellness space, that seems against the grain of the way the world is moving. These battle lines were drawn a while back, the "winner" will no doubt emerge in time. Is Pershing perishing, as Michael put it?

Have you ever heard of the business, incorporated in the Netherlands, called Mobileye? The business has been around for a long time, 17 years of technological advances have lead us to the point where driverless cars are possible. The business is being acquired by chipmaker Intel for 15.3 billion Dollars - Combining Technology and Talent to Accelerate the Future of Autonomous Driving. As per their website, Mobileye is "the leading supplier of software that enables Advanced Driver Assist Systems (ADAS), with more than 25 automaker partners including some of the world's largest."

If you had any doubt whatsoever that driverless technology was just some sort of fad, then this should dispel that immediately - "Mobileye's vision safety technology for ADAS is deployed on over 15 million vehicles and counting, making today's roadways safer for all." The company has worked in collaboration with Intel before, promising a fully autonomous BMW by 2021. The company has trademarked Road Experience Management. I for one can't wait for an autonomous vehicle to drive me around, freeing up precious time to do more important functions. Our investments in this area include NVIDIA and Tesla of course, fringe positions away from the core. Having said that though, Alphabet/Google and Apple have had varied success with their own projects in automated driving.

Linkfest, lap it up

Talking shorts and longs, how does this all stack up, do you think? Shopping mall debt, is it too risky? Bloomberg reports Wall Street Has Found Its Next Big Short in U.S. Credit Market.

Biltong is now a science. Today, Maxine Jones will receive a Phd in Food Sciences - Stellenbosch student has a doctorate in biltong. She is suggesting that biltong has guidelines. Noooooo ..... not regulation.

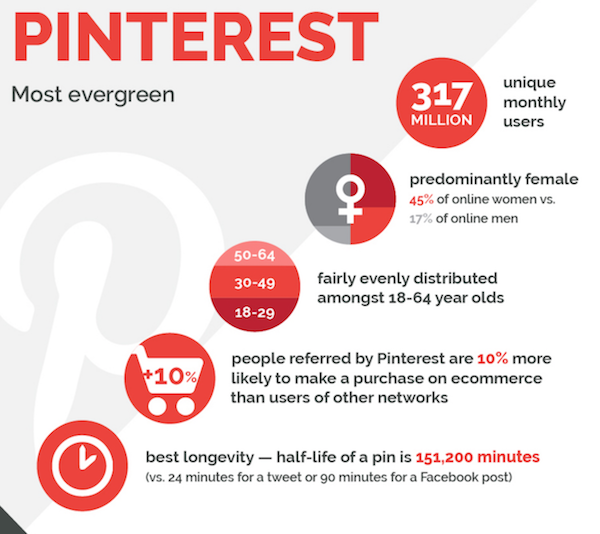

Social media sites are still growing like gangbusters, here is the user breakdown of each main site - The Key Differences in Demographics for the Top 7 Social Networks

Home again, home again, jiggety-jog. Brexit is closer. The Scottish independence referendum 2.0 is also on the cards. The Fed start their 2 day meeting today. I am sure people will get excited about that. Markets are mixed to begin with.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment