"Did you know that Jan Smuts had been Finance Minister of South Africa around the First World War? Smuts was a lawyer by training. It is important to know recent history, and to contextualise current events against those. Whilst it feels bad now, it is certainly better in many respects since then. We have free speech, we can watch and consume anything we want, we can talk and gather without fear, we can all vote and have a say. The courts act without favour. These are important things."

To market to market to buy a fat pig Politics continues to dominate local and global markets, with a "will he stay?" or "will he go?", with "he" being the minister of finance. The truth is that we don't know anything more than what we read, and perhaps the gathering of the sources process is fraught with cloaks and daggers. Politics, what fun! In terms of how one goes about the investing process, it is a long term consideration, unless you see a Russia 1917 or China 1949 type situation, i.e. the total destruction of capital markets. Heck, Venezuela still has a "functioning" Stock Exchange.

Paul said yesterday (or the day before), that he is old enough to remember the appointment of Barend du Plessis as finance minister in the mid eighties .... and as Forrest Gump says, and that is all that I have to say about that. du Plessis was a math teacher and former SABC administrative officer, before a brief corporate career, returning to politics (having been involved in student politics). Sound familiar? And du Plessis was Finance Minister for 8 whole years. Did you know that Jan Smuts had been Finance Minister of South Africa around the First World War? Smuts was a lawyer by training. It is important to know recent history, and to contextualise current events against those. Whilst it feels bad now, it is certainly better in many respects since then. We have free speech, we can watch and consume anything we want, we can talk and gather without fear, we can all vote and have a say. The courts act without favour. These are important things.

Session end, a slightly weaker Rand boiled the exchange, and in particular the resource complex, which added over a percent collectively. The Jozi all share index added just around one-quarter of a percent on the day. Losers were financials and banks again, FirstRand down three and three-quarters of a percent, RMB holdings sank over three percent, Standard Bank was down nearly three. At the opposite end of the market, in the winners column were the likes of South32 and BHP Billiton. Naspers also rallied strongly, a lot of Rand hedges caught a bid.

The other "big news" was that the UK have delivered papers to the EU, Brexit has officially begun. You can download the document from this page - Statement by the European Council (Art. 50) on the UK notification. A 44 year relationship is expected to come to an end inside of the next two years. The document is all of six pages. May still wants a relationship with Europe, I suppose you cannot move geography. Check out what the European Council president tweeted:

He (Tusk), then gave a press statement - Remarks by President Donald Tusk following the UK notification. He said: " ... paradoxically there is also something positive in Brexit. Brexit has made us, the community of 27, more determined and more united than before. I am fully confident of this, especially after the Rome declaration, and today I can say that we will remain determined and united also in the future, also during the difficult negotiations ahead."

And then a telling part, which leaves the door open. I guess, that is the way that I read it:

"There is nothing to win in this process, and I am talking about both sides. In essence, this is about damage control. Our goal is clear: to minimise the costs for the EU citizens, businesses and Member States. We will do everything in our power - and we have all the tools - to achieve this goal. And what we should stress today is that, as for now, nothing has changed: until the United Kingdom leaves the European Union, EU law will continue to apply to - and within - the UK."

And to end it all off, the last line: "What can I add to this? We already miss you." Exactly. Bremain my bro, bremain.

Across the oceans and wide seas, stocks in New York, New York were mixed. The Dow closed down one-fifth of a percent, the broader market S&P 500 added just over one-tenth of a percent by the close. The nerds of NASDAQ was where the action was for the bulls, up nearly four-tenths by the close (which is two-fifths, right?). Amazon rallied over two percent on the day, to an all time high, the Souq acquisition (although small), is a great stepping stone to a more meaningful offering in the Middle East.

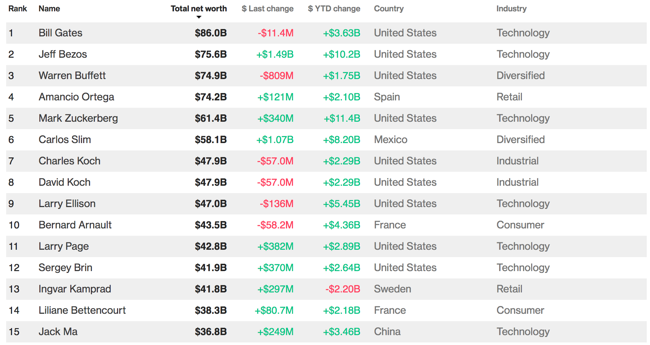

The population of that region is roughly 220 million, which is concentrated to the core. It is bigger if you include Turkey and Egypt. Far bigger, over 400 million people. It is a good step for Amazon to test their technologies in an area that is definitely very different from some of their other older more established areas. Unless of course you talk about streaming, you do not need a territory for that. The upshot of the higher Amazon share price meant that Bezos is now on paper the second richest man, according to the The Bloomberg Billionaires Index:

Elon Musk is in 96th place. He does rockets, energy and motor vehicles. Charlene de Carvalho-Heineken is the biggest shareholder of Heineken. Rob, Jim and Alice Walton are in places 16-18. They made their money the good old fashioned way. You know .... inheritance. Hey, it depends what you do with it, that is what is important. The top 13 people are all self made. The Waltons have been slipping in recent years, perhaps as a result of the rise of ..... Amazon.

Linkfest, lap it up

New York has started fining AirBnB hosts for renting out their apartments - An Airbnb host was fined $1,000 for renting out an apartment in Trump Tower. I had a look this morning and there are still places to rent on AirBnB in New York, I guess hosts are going with the logic that it is still very hard to find them and fine them?

Instead of fighting change, you can embrace it and become a leader in the industry - Big Oil Replaces Rigs With Wind Turbines. Oil will be with us for many many decades but producing clean energy is a sector that will continue to grow for the same time period. It makes sense to use your expertise in building offshore oil rigs to now build wind farms.

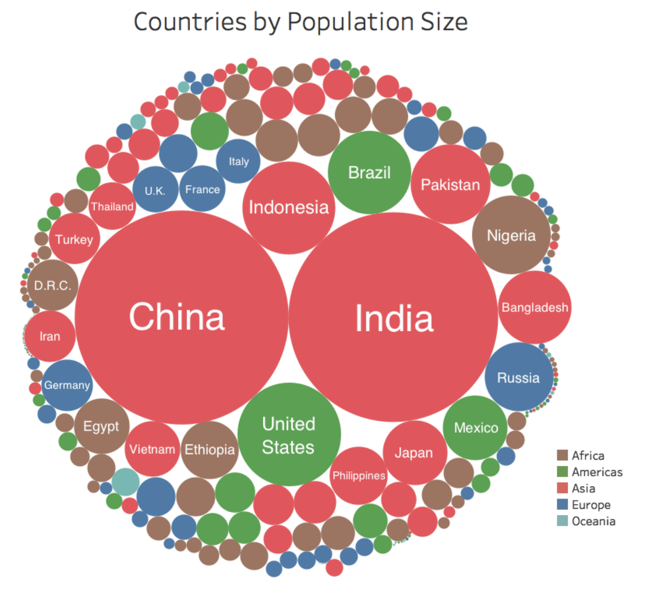

We love patterns. This is why this one, from the VisualCapitalist is so awesome - The Population of Every Country is Represented on this Bubble Chart.

Home again, home again, jiggety-jog. Stocks across Asia are mostly lower, Shanghai is off around a percent. US Futures are marginally higher.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment