"to borrow the words of Marc Anthony, things have gotten over complicated. Complication stifles growth. Complication stifles the human spirit, which just wants to be set straight on a path to prosperity."

To market to market to buy a fat pig What a ripper. The Dow Jones Industrial clocked through 21 thousand points and then ripped even higher than that. Up nearly one and a half percent by the session end, 21115 is the new level for blue chips. The broader market S&P 500 also touched an all time high, up 1.37 percent to 2395. Yip, it was definitely an incredible session. The nerds of NASDAQ added just over a percent and one-third, over 5900 points by the end of the session. Apple touched an all time high, the biggest company in the world had a market cap of 733 billion Dollars by the close. Still a long, long way to go to "get there". Berkshire added nearly three and a half percent. Financials and basic materials were the biggest sector gainers on the day, utilities were the only major loser.

What gives? Why the huge rally of herculean proportions? What changed? In practice ....... nothing changed. In theory, from the Trump address to Congress the session earlier, everything changed. Changes pending in everything from simplifying the tax code, long overdue, to infrastructure development, also long overdue. And less regulatory hurdles to overcome, even Buffett reckoned, ".... and Buffett is a reasonable man", to borrow the words of Marc Anthony, things have gotten over complicated. Complication stifles growth. Complication stifles the human spirit, which just wants to be set straight on a path to prosperity. In many ways, having the system that the US has is favourable for the risk taker, that sort of behaviour has always been encouraged. There was a snippet I recalled suddenly from the Buffett letter over the weekend, that spoke about asset transfer, it went like this:

'It's true, of course, that American owners of homes, autos and other assets have often borrowed heavily to finance their purchases. If an owner defaults, however, his or her asset does not disappear or lose its usefulness. Rather, ownership customarily passes to an American lending institution that then disposes of it to an American buyer. Our nation's wealth remains intact. As Gertrude Stein put it, "Money is always there, but the pockets change."'

That is the way that it works with the American system, land of the free and all that. Then I recalled a story of a fixed income fellow that kept a Russian Imperial note issued by the Royal Treasury (pre-revolution) that was worthless when the communists took over. Worth zero. Zip, nil. Nothing. Lutho. Equally, the stock market became worthless in late 1917 in Russia. The same happened in China in 1949. Did you know that the Russian Famine of 1921 killed 5 million people? Another one in 1932-1933 killed 7 to 10 million people. Another one in 1947 killed one to one and a half million people. In China, between 1959-1961, it is estimated that around 43 million (max) people died of starvation then.

So communism in the 20th century killed around the same population as we have here, Statistician General, Pali Lehohla said we had 55 million people at the end of 2015 (just the other day), we have around 57 now, from what I could understand on the wireless. So that is communism. The destroyer of capital and a starvation method, responsible for the deaths of millions of people. Capitalism, it may not be the most perfect system, that leaves many people behind, it sure is a far better alternative. In communism that same asset goes to the state, there is no incentive to improve and effectively all the capital that is sunk into the asset goes to zero. Destroyer of capital, and by extension, taking humanity backwards.

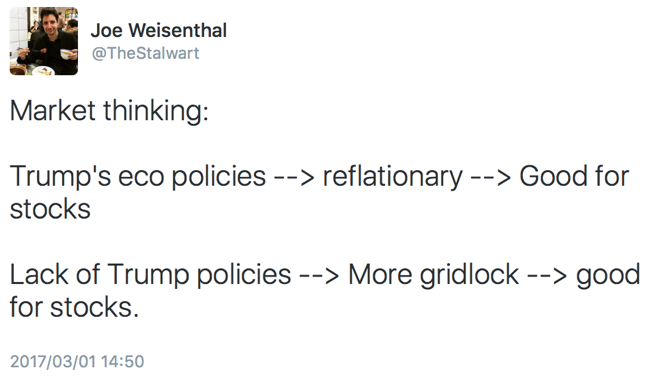

On the other hand, if someone takes an asset off another, as a result of affordability, they can make more use at that point. And create more economic value. And more opportunities in the broader economy, creating jobs. Cycle repeats, even when the assets are a dog for one person, they may be a "gold mine" for another. Although, as they say in the classics, it is the people who make picks and spades that make the money during a mining boom. Trump rally, YUGE or not, sustainable or not, will have to be backed up with substance and I really do think that DC is ready to tackle these issues. If nothing else, Trump has ruffled enough feathers for the collective to know that action is needed. Joe Weisenthal (now at Bloomberg), had this tweet that is interesting at some level.

Locally, stocks rallied over a percent into the close. Resources were the winners on the day, up nearly two and a half percent. There was a new 12 month high for Nedbank, the company had reported numbers that were welcomed by the market, this morning was the turn of Standard Bank, results that comfortably beat market consensus. I expect the stock (Standard Bank) to act favourably. South32, BHP, Glencore, Kumba and Anglo were all top of the pops on the leaderboard, MTN and AngloGold Ashanti at the other end of the spectrum, the board nobody wants to be on.

Aspen had a trading update head of their numbers in a week today time, quite a number of moving parts in there, including significant variations between normalised earnings per share and earnings per share. It looked light at some level, the stock is lower. MTN had results today, although at face value they look "bad", the market has responded favourably. We will do a write up on MTN in the coming days.

Linkfest, lap it up

If you have been around the stock market for any period of time you would have heard the terms "going short" or "short interest" or even "short squeeze". For many people the dynamics of shorting are a mystery, here is an infographic breaking it down for you - Is Short Selling Stocks Worth It?.

The recent strong moves in the market highlight why being invested instead of on the sidelines generally works out better for you - Proudly Permabullish

Netflix is building their moat, between them and the competition - Netflix's new AI tweaks each scene individually to make video look good even on slow internet.

Home again, home again, jiggety-jog. Snap is listing today, lovely to be young! Are you a user? The platform certainly has multiple eyeballs, the analyst community is mixed on this investment, all that matters in the end is if the advertisers come to the platform. I am not an active user of Snapchat, it is "difficult" for me to navigate my way around. Bright nailed it, he said, it is like tabloid meets technology.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment