"An interesting number that came though was the positive impact for Visa from the Indian government clamping down on cash. Visa saw a 100% increase in transactions compared to last year and a 50% increase on access points over a 5 month period. Other governments may not be as harsh as the Indian government when it comes to clamping down on cash but I think it will come."

To market to market to buy a fat pig The market friendly results in the French election meant green for global markets, the CAC 40 was up over 4% with some of the French banking stocks being up around 8%! The All Share for the first time in a couple of days opened in the green and managed to stay in the green the whole day closing off 1.4% higher. At the top of the leaderboard were some of our core holdings, Steinhoff up over 5%, Discovery up over 3.5% and Woolies up 3%. Gold miners were at the bottom of the pile again, the index down 5.4%. With things going "according to plan" in the French election, the gold price was lower as investors traders no longer needed the safe haven asset.

Unfortunately reaching 12 month lows was Aspen, all the negative news around their pricing has hurt the share price. Given that Aspen sold ARV's at a loss at one point, I don't think gauging the customer is in their culture. Hopefully the investigations in the relevant countries are completed quickly so that the company can focus on what they do best, which is taking forgotten drugs, removing inefficiencies and then getting them to the consumer. As I said to a client yesterday, watch this recent video of Stephen Saad (Stephen Saad results interview) and then when you are done watching you will want to buy more shares at these low levels!

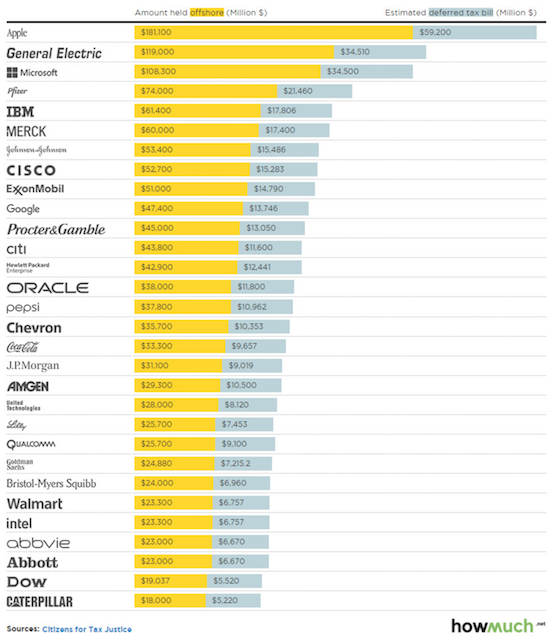

New York, New York Record highs again for the Nasdaq which is reaching a phycological landmark of its own, 6 000 points. It was up 1.2% to 5 983 points. The Dow was up 1% and the S&P 500 was also up 1%. Tomorrow we should see the revised Trump tax plan, where Tech companies could be some of the biggest gainers. Tech companies are cash making machines and given that their services are available over the inter webs, tax structuring has meant that they are all sitting on huge amounts of money offshore. I'm sure that the first thing that CFO's will look for in the Trump tax plan is if there is a tax holiday to bring billions of dollars back to the US without having to incur a huge tax bill. Here is an article from last year showing how much each company would have to pay in tax if they wanted to bring their cash back to the US, given the age of this article you can assume that most of these companies have even bigger cash piles now - These 30 Fortune 500 companies have the most cash in off-shore tax havens.

As you can see there is potentially a huge windfall for the IRS, which can buy many F-35 jets/ build many miles of wall. As things stand, the IRS will see little or none of those taxes, companies would rather not pay the US tax and try invest that cash in other countries. There is a delicate balancing act that needs to be done now. Giving these companies a tax holiday will mean that money comes back to the US, which leads to billions more being spent in the country, great for economic growth and employment. Giving a tax holiday sets a precedent though, which means companies will continue to accumulate cash offshore and then wait for the once a decade tax holiday. The final question to ask is how much of a tax break do you want to give? Giving a 100% tax break would probably mean that most of the offshore cash comes back to the US, giving a partial tax break would mean the IRS still collects some tax but that not all the offshore money comes back to the US. We will have to wait and see what is included in the new tax plan, if anything at all.

Company corner

Last week we had market beating numbers from Visa, this was for their (Fiscal Second Quarter 2017 Key Highlights). Here are the numbers quickly, Revenue of $4.48 billion growing at 23% (expectation was $4.3 billion), Adjusted Net income of $2.1 billion which translates into EPS of 86c growing at 27% (expectation was for 79c). The market has come to expect outperformance from Visa, the stock is only slightly up (less than 1% as I look at it) after these results. Even though popping share prices are exciting, not much movement in the price after a good set of numbers means that all of a sudden you can by the same stock at a cheaper valuation.

Trump and some of his top people have been talking recently about the Dollar being too strong. The initial impact of a weaker Dollar would be to increase the profitability of US based multinationals. For Visa, a strong Dollar took 2.5 percentage points off of their revenue growth and took 4 percentage points off of the EPS number.

An interesting number that came though was the positive impact for Visa from the Indian government clamping down on cash. Visa saw a 100% increase in transactions compared to last year and a 50% increase on access points over a 5 month period. Other governments may not be as harsh as the Indian government when it comes to clamping down on cash but I think it will come. Populations are ageing, governments need extra tax revenues, a large cash component in commerce has correlations to low tax compliance, the result is a big push lead by government to stamp out cash. Tax avoidance is just one negative aspect of cash, there is enough research to show that many illegal activities (like the drug trade) which have a negative impact on society is conducted using cash. Removing cash will not mean illegal activities cease to exist, it does mean it makes it harder to conduct, so some positive impact on society?

The important number for Visa though is what does usage look like? Transaction volumes are up 42% (thanks in part to the purchase of Visa Europe) to 26.3 billion transactions for the quarter. On the value side, all the transactions came in at $1.7 trillion, up 37% for the quarter compared to last year. Buying Visa now means you believe that the usage of cards and the Visa network will only increase for many years into the future. The argument against Visa is that there are rival payment methods popping up like PayPal, for most online shops you can now pay using PayPal instead of your credit card. Yes you can fund your PayPal account with a bank transfer but most people still use their credit card to top up their PayPal account. Paypal and Visa already have a very good working relationship. That goes for the multitude of other payment systems out there, Apple Pay, Android Pay, Venmo, Zapper and many more options.

The stock currently trades on a forward P/E of around 23 times, not cheap but not expensive for a company growing double digits. Management expect revenue for the full year to be up between 16% and 18% with no change on the company's margins, so similar operating earnings growth. When it comes to EPS growth there are a whole host of moving parts to take into consideration, the biggest would be the number of shares in issue. The board has given the green light on buying an additional $5 billion of Visa stock, taking the total share buy back war chest to $7.2 billion. Over the last 3 months the company bought back a little over 19 million shares for a value of $1.7 billion. Happy holders and buyers of this company.

Linkfest, lap it up

This would have been unthinkable a decade ago - Britain goes a day without coal-fired power for first time since the 1880s. The article doesn't say so but I assume that this was part of Earth week celebrations.

With spring on the cards in the Northern Hemisphere, ice is melting and Russian oil companies are getting ready to increase their production again - Russia's Oil Cuts Won't Be So Easy If OPEC Deal Is Extended

As Buffett says, you don't need a high IQ to be a successful investor. Emotions and overthinking a situation can lead to poor investment returns, humans struggle to see past the now - Isaac Newton was a genius, but even he lost millions in the stock market

Home again, home again, jiggety-jog. Another green day for our market, Naspers is having great day, up over 2% getting within a whisker of its all time high. The Rand is having a weaker day though, back below (above?) the $/R 13.00 level. Banks and Retailers are both down over 1%, for some reason SA Inc is out of favour at the moment, can't see any new news out though.

Sent to you by Sasha, Michael and Byron on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment