"Pitch and their pitchfork came to town Friday, another downgrade and this time both sets of debt, local and foreign currency denominated. Either way you look at it, there is no way to paint lipstick on the proverbial pig. The one thing that it may well do is galvanise us, and government, into thinking more about austerity. Make no mistake, there are the resources available, it is how they are used."

To market to market to buy a fat pig Pitch and their pitchfork came to town Friday, another downgrade and this time both sets of debt, local and foreign currency denominated. Either way you look at it, there is no way to paint lipstick on the proverbial pig. The one thing that it may well do is galvanise us, and government, into thinking more about austerity. Make no mistake, there are the resources available, it is how they are used.

I saw a story a few weeks back, that is loosely associated with the story of debt that belongs to the collective, i.e. the citizens of the land - It only took a few centuries, but Denmark has finally repaid all its foreign debts. Denmark only own internal creditors now. Will they ever pay them off? Maybe. Perhaps. Norway and Germany do not borrow externally either. It is not to say that foreigners do not own Danish debt, they do, as per the article, 40 percent of all debt is owned by folks who are not Danish. And with government debt being 23 percent of Danish GDP, we may well see lower debt levels, which may mean lower tax rates in the future.

Back here however, we have to deal with the reality of higher borrowing costs. And potentially an economy that slides further. You cannot dictate terms to people who you want to lend you money, that is how it works. Have y'all read that book This Time Is Different: Eight Centuries of Financial Folly? Although some high level students did pick holes in the research, it is still an excellent read, I read it when it came out over a December holiday once. It may hold some truths and scenarios, the market ultimately dictates to people at what rates to borrow money.

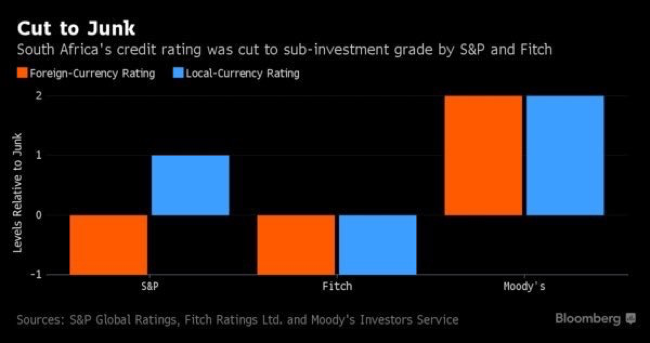

I found this via the Twitter-verse Friday (via Bloomberg), this is a graph of the three ratings agencies:

Stocks Friday locally closed lower, we were however off the worst levels of the session. Resources sank three-quarters of a percent, financials actually rallied nearly one-quarter of a percent. The stocks at the top of the leaderboard were the precious metal stocks, Amplats and AngloGold Ashanti rallied hard. Kumba and Anglo American were on the opposite part of that, in the down section. It was of course non-farm payrolls Friday, roundabout the same time as the Fitch review and release. The headline number, the number added was a "miss", even though average hourly earnings and the unemployment rate was a meet and beat. As such, the Dollar actually lost some ground and the Rand strengthened for a while. There are many internal watchers who must be confused with this scenario, not realising the world does not end at Alexander Bay and Simon's town/Simonstown. "Boulders" is not the end of the known universe, that is all you need to know. Oh, and that Moody's are on a look see ......

What this means for consumers is that basically for each and every million Rand worth of home loan debt, the cost rises over 8000 Rand per annum for every percent that the interest rate goes up. Which the central bank may be forced to do, in order to combat inflation. Which may, or may not emerge as a result of higher prices in the form of fuel, transportation and basic foodstuffs, all priced in Dollars ultimately. So this will impact on people with fewer resources available for transport and food, at the end of the day, it is ordinary people who are impacted on the most. We are a watcher in these situations and will advise if there are any steps to take.

Across the oceans and vast deep blue seas, across the equator, stocks in New York, New York closed mixed to lower. The Dow Jones slipped 0.03 percent, the nerds of NASDAQ ended 0.02 percent lower, whilst the broader market S&P 500 ended the session down 0.08 percent. Stocks were down around one-third and up one-third during the course of the session. The Employment Situation Summary, showed "(t)he unemployment rate declined to 4.5 percent in March, and total nonfarm payroll employment edged up by 98,000". At a headline level, the number of jobs added seems weak. The unemployment rate was lower than people anticipated. So whilst there was some to like, there was some to not like.

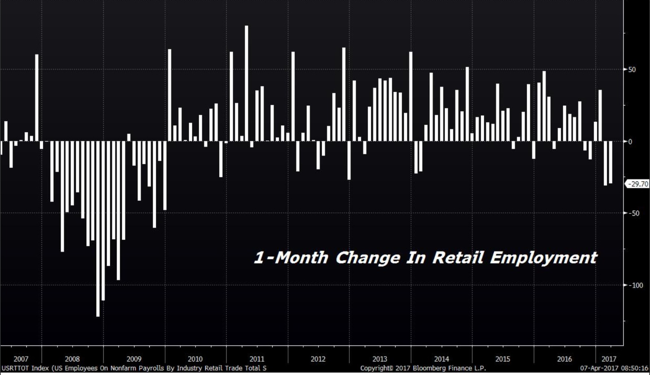

Over here at Vestact we own companies. Not the Fed or any other central bank, not monetary policy, not politics, not the macro picture ..... just companies. And we try and make sure that they are the best ones, in industries that are likely to grow, ahead of the rest of the world. Walmart caught a bid, some folks believing that their online offering has gotten better. Talking of retail, this is the worst retail report for a long time, I found this via the Twitter-verse:

So what is happening here? More online shopping and fewer retail activities taking place inside of the brick and mortar stores, I think is the general consensus. The bigger and specialist retailers will have the correct channels, the bigger and older diversified chaps, it is going to be harder.

Linkfest, lap it up

This is a nice problem to have. It is interesting that the power demand has also been dropping in the UK, people moving toward more energy efficient appliances and "green" houses - The UK's electrical grid is so overrun with renewable power, it may pay wind farms to stop producing it.

The problem with some big capital intensive projects is that there is a big lag time from the time of order to the time of delivery. The result is that the shipping industry goes through periods of over supply and then under supply, the last few years have been tough for ship operators - Slower global trade is sending more ships to the graveyard

An interesting read on how your reading of fiction might not be a distraction. Five Ways Reading Fiction Makes You Better At Your Job.

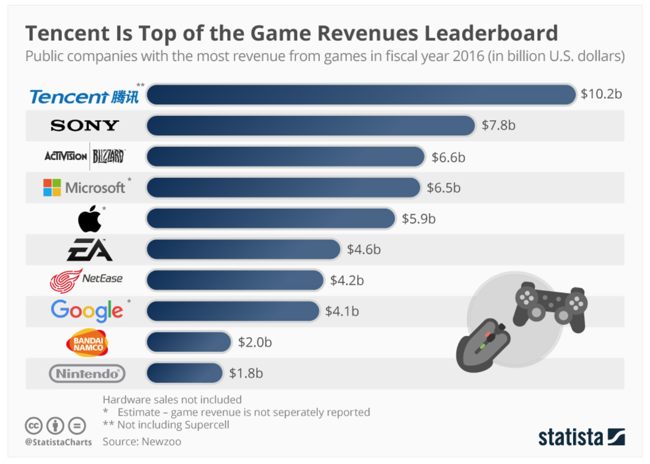

This is awesome, and you are possibly an owner of it (via Naspers) - Tencent is Top of the Game Revenues Leaderboard.

Home again, home again, jiggety-jog. Sergio Garcia, finally. That took a while, just like investing. If you keep "chipping away", things will change for you. Elliot have taken a stake in BHP Billiton, who wants to break this business apart, the stock is up sharply. A weaker Rand has boosted the market to begin with.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment