"I think that the point that I am trying to make is that using a broad based brush to paste the same bunch together is "wrong". All boats may be floated at the same time, and all boats go lower when the tide goes out, not all boats are the same."

To market to market to buy a fat pig Locally in Jozi, again with a weakening currency, stocks closed the day out higher than where they started, in fact nearly at 53 thousand points again on the Jozi all share. That is up nearly two-thirds on the session yesterday. We had traded around these levels in January, 53 odd thousand points, we did cross this level in February 2015. It has been pretty much stop-start since then I am afraid, the economy finds itself in a bit of a funk, the Rand has been all over the show since Feb 2015. Eleven and a half then to nearly 17 in the middle of Jan 2016, back to current levels of 13.80 to the US Dollar.

Different businesses have performed with different returns, you may think that the Resources 10 has had a good 3 years, you would be very wrong, just parts of it. In Rand terms, down nearly 40 percent over that time. The Financial 15, for all the battering that they have had to withstand, 4 finance ministers, lower sovereign credit ratings, Emerging market jitters, have held up pretty well, a total return of just over four percent in that time. In Rand terms.

Industrials have been "the place to be", with a return of nearly 30 percent over the last three years. That is not exactly a great return, it is better than the rest of the market. The All Share over three years is up a mere 10 and three-quarters of a percent. It has been really tough to be invested locally, it may well turn out that the businesses accumulated during these tough times are "good value".

Bidcorp announced a transaction yesterday, they are buying 90 percent of a business in Spain, called Guzman Gastronomia and Cuttings. The business turns over 100 million Euros a year, so roughly 1.5 billion Rand. At the half year stage, that just "finished", Bidcorp clocked half year revenues of 67.8 billion Rand, this is a small acquisition relative to the overall business. It does however give them a foothold in another territory, and the company continues to talk about the "out of home" growth in foodservices. i.e. more people eating out, more people get ready made and prepared foods. We continue to like the Bidcorp story long term, we think that the slow and steady approach sneaks up on you.

New York, New York! Yeah baby. Let us digress for a second here. I saw an insert on a fellow who looks for artefacts (my youngest loves that program) and he was in Tokyo, the busiest underground transit system in the world, taking 8 million passengers a day. 3.33 billion trips a year! What was more amazing was that everyone was completely still on the metro, nobody talks. Not a peep. The New York subway system is the 7th busiest in the world, 1.7 billion trips per annum. It is a whole lot nosier, in true land of the free style. And that is where we have stock holdings, the hustlers with the laws to back it up, make it a great place for investors.

Not last evening, at least not for the bulls. It was a tale of two markets, the first half and the second half. Stocks were enjoying strong gains after a decent ADP jobs report (the precursor to the non-farm payrolls on Friday), all three major indices up comfortably over half a percent. And then the Minutes of the Federal Open Market Committee, March 14-15, 2017 were released. Some Fed members cautioned against current valuations, it wouldn't be the first time and it definitely will not be the last time.

"Broad U.S. equity price indexes increased over the intermeeting period, and some measures of valuations, such as price-to-earnings ratios, rose further above historical norms. A standard measure of the equity risk premium edged lower, declining into the lower quartile of its historical distribution of the previous three decades."

And another nugget:

"Many participants discussed the implications of the rise in equity prices over the past few months, with several of them citing it as contributing to an easing of financial conditions. A few participants attributed the recent equity price appreciation to expectations for corporate tax cuts or to increased risk tolerance among investors rather than to expectations of stronger economic growth."

Do you remember the time that the Fed worried about Biotech and Technology stock ratings? In the middle of 2014, Janet Yellen spoke of stretched valuations - Monetary Policy Report, July 15, 2014 - "Equity valuations of smaller firms as well as social media and biotechnology firms appear to be stretched, with ratios of prices to forward earnings remaining high relative to historical norms. "

Since then, the Twitter stock price is down 62 percent and Facebook is up 114 percent, so which one was she talking about? Since then, Amgen is up 32 percent and Valeant is down 94 percent, again, which one were they talking about?

I think that the point that I am trying to make is that using a broad based brush to paste the same bunch together is "wrong". All boats may be floated at the same time, and all boats go lower when the tide goes out, not all boats are the same. As Byron said, the Fed is not particularly good at picking market tops and bottoms (that is not their job) and you have to be a stock picker over time! Equally, I am really looking forward to the current earnings season, which will kick off over the next few weeks, and will wrap up in around 6 weeks from now. Post that, we will have a much better idea of what valuations are likely to look like, and whether they are too rich currently. We always remain the course, regardless of what people say at any given point.

Session end, the Dow had lost one-fifth of a percent, the nerds of NASDAQ were down nearly six-tenths of a percent whilst the S&P 500 lost nearly one-third of a percent. Amazon didn't stop, the stock is up six sessions in a row, approaching some sort of a record, as far as I understand it. All this as Bezos sells 1 billion Dollars of stocks in order to fund his rocket project. Michael said, tax to pay and rockets to build, there is 70 billion or so of Amazon shares, why not?

Linkfest, lap it up

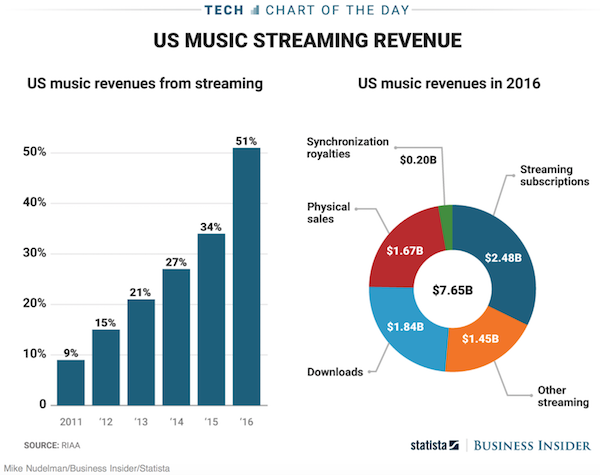

Spotify is a music streaming service where you can have the free version with regular ads or the paid version with no ads, that used to be the only main difference between the two offerings. Now the music industry is pushing back saying that new releases should only be available to paid subscribers for a time period - Spotify to host top stars' albums for premium subscribers only. I think this is the correct decision.

Here is why signing this new deal with Spotify is important for universal - Streaming services aren't the future of music - they're the new normal

What creates economic growth? Confidence plays a big part in making the pie bigger. Confidence leads to spending and investing which then leads to growth which leads to higher employment and salaries which leads back to spending and investing. Then the cycle repeats itself - Public Confidence In The U.S. Economy Hits 10-Year High

You will find more statistics at Statista

You will find more statistics at Statista

Home again, home again, jiggety-jog. Stocks across Asia are mixed to lower, the sell off overnight has definitely spilled over into Asia. We could start the same way here.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment