"Stocks in Jozi were whiplashed, an iron ore price that has been ditched in a hurry (perhaps post the first Trump policy roadblock) and a firmer Rand that weighed on both the commodity stocks and the Rand hedges. By the time that the bell rang for the close, resource stocks were on the ropes, down over three percent at the end of the day. Industrials had shed over a percent and one-quarter."

To market to market to buy a fat pig Stocks in Jozi were whiplashed, an iron ore price that has been ditched in a hurry (perhaps post the first Trump policy roadblock) and a firmer Rand that weighed on both the commodity stocks and the Rand hedges. By the time that the bell rang for the close, resource stocks were on the ropes, down over three percent at the end of the day. Industrials had shed over a percent and one-quarter.

There was very little to be excited about, stocks across the board were lower by over a percent and a half. Only Hammerson, Growthpoint and Woolies were showing any exciting day returns to speak of, all three up over a percent to the good. In the losers column it was a widespread "red-spread", a whole lot of bleeding going on I am afraid. Kumba was down nearly 9 percent by the end, BHP, Anglo, Glencore and Steinhoff all fell over three and three-quarters of a percent.

Aspen was whacked over four percent. Another nasty story about the company "celebrating" price hikes for cancer therapies, in internal emails. Or so an investigation has shown. These drugs were bought from GSK, and Aspen have hiked the prices of some of these therapies post the transaction, and in some cases by a lot. The company responded with a release on SENS, which said the following (amongst others):

"The content of the reports concern matters that are sub-judice. Out of respect for the integrity of ongoing legal processes with European regulators, as well as the court in Italy, Aspen will not comment on these public allegations. Instead, Aspen looks forward to the opportunity to demonstrate the integrity and legality of its practices in the context of these legal processes."

That is fair enough. If the company thinks that they have acted ethically, then they will show this. European healthcare is tricky, the public healthcare systems are huge in the lives of ordinary citizens, equal rights and getting a fair shake is a "given". The last part of the release shows how much smaller this business is, relative to the rest of the business:

"The oncology portfolio in question generated revenue in the European Union in Aspen's financial year ended 30 June 2016 of EUR60 million (R963 million). The majority of the revenue was from the sale of tablets which have an average price of approximately EUR2 per tablet. The Aspen Group's total revenue for the year ending 30 June 2016 was R35.6 billion."

So .... as usual in these situations, we suggest that one awaits the outcome of the investigation. I don't know Stephen Saad well enough to say what he is feeling as a result of this, I am pretty sure that he is hurting and wants to get to the bottom of this. He does not strike me as a person who is after the buck, he genuinely wants to make a difference. He has. And will continue to do so. Hold and take the wait and see approach.

Stocks across the oceans, in New York, New York closed off their lows of the day, alas for the bulls, still in negative territory. By the close the Dow had shed over half a percent, most of the drag coming from Goldman Sachs (poorly received earnings - WSJ - Goldman Misses Big on Trading, Trails Rivals Badly and Goldman's Mighty Traders Strike Out), the stock was down around four and three-quarters of a percent. I always get the sense that Goldman is like Austin Powers. Loved by insiders, secretly outsiders are jealous.

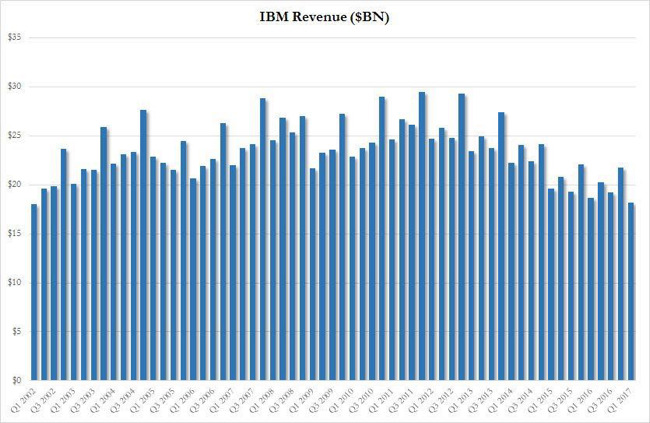

JNJ results from the company which saw the share price sell off over three percent, we will write up on this one too. The broader market S&P 500 gave up three-tenths of a percent, whilst the nerds of NASDAQ fell by a little over one-tenth of a percent. IBM also reported after-hours, the stock has been completely kiboshed, down over five and one-third of a percent in the aftermarket. Check this out, revenues for Q1 and Q3 since 2002. Not good. Perhaps Buffett and Berkshire knows something we don't?

Looks like it is getting a little desperate. Having said that, there is a still a dividend underpin of around three and one-third of a percent and an earnings multiple of around 12, the stock looks ex-growth. A whole lot of cost cutting whilst they re-engineer themselves into the internet of things era, I have no doubt that they can do it. When you invest in a company with "legacy" issues, know that they can change and morph into something else, as a result of their resources and existing customers. For one ..... IBM have moved to Apple hardware and are a whole lot more productive.

Jeepers creepers, where'd ya get those peepers? Those are the opening lyrics made famous by Louis Armstrong. The song was actually written by Harry Warren, the first fellow who wrote for movies. Nominated for 11 academy awards, and winner of three, writer of over 800 songs ..... and yet, we associate the song with Louis Armstrong. It is just the way it goes. Like Michael Collins, the third astronaut in Apollo 11, the fellow who made it possible for Armstrong and Aldrin to step on the moon, and get back. Mind you, 24 people have "gone" to the moon, only 12 have ever walked on it.

My point is that there is a lot of stuff that goes on in the background, with exceptional people who are not in the limelight. I learnt that some small things change people, make them exceptional. A good example is the certificate from the Dale Carnegie School of Public Speaking that hangs in Warren Buffett's office. This is more important to him than his business and undergraduate college degrees. Before he did that course (which can still be "done" - Public Speaking Mastery, starting this Thursday), he was petrified of talking in public. I learnt this from watching the documentary "Becoming Warren Buffett", it is a must watch.

Back to Collins and Warren (from above), who knew who Sir Jony Ive was before he rose to prominence in an Apple post Steve Jobs? He is one of the people who has improved productivity dramatically for humanity. OK, and he is responsible for all that has been spawned from smart technology too. Currently he is the chief design officer at Apple Inc., one of the most iconic brands on the planet. And does he do it for the money? Nope. Maybe. Perhaps not. Often if the starting point is to be famous, or make money, you may never get there. In the end, Ive and Warren (Harry) were recognised for their brilliance. It makes you wonder how many people WANT to work at Facebook, Google/Alphabet, Amazon, Berkshire, Tesla and the like, as a result of other people who are trailblazers.

Linkfest, lap it up

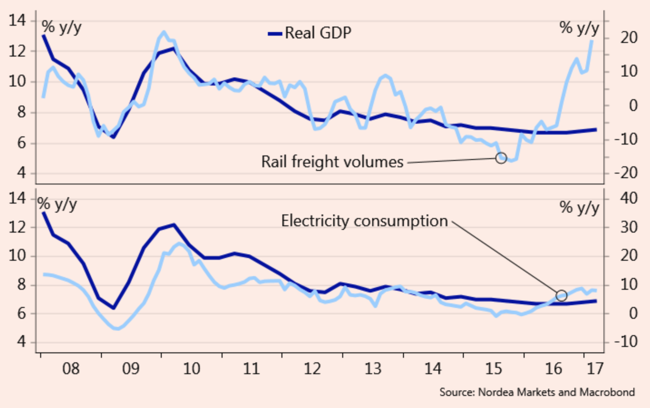

China and associated economic news has gone a little silent in this politics driven world, Brexit, French Elections and of course Trump. It is refreshing to see some data suggest that whilst 7 (and thereabouts) percent growth may be the norm now, there are small signs that electricity demand and rail freight volumes are picking up in China - China: Housing-led recovery in Q1.

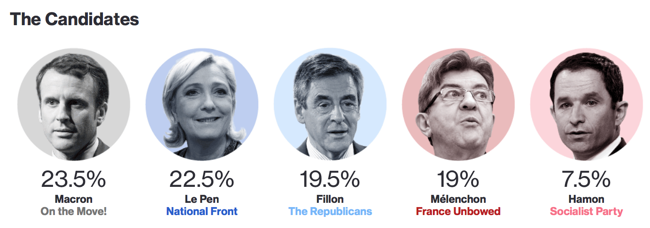

Confused about the French elections? The first round is this weekend, here goes a nice Bloomberg guide on who/what and how - The Latest on France's Presidential Election. My best guess is Fillon (anyone) trumps Le Pen in the second round and brings something fresh to politics there.

This is *very* interesting. Perhaps discuss this with two separate generations, the one above and below (if you still have access to those) and let us know what you think - The United States of Work

Home again, home again, jiggety-jog. I am off for a bit! Mikey and Byron will take care of you, I will return with fresh new ideas and fresh insights. I hope. Earnings season continues, regardless!

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment