"With Alcoa reporting numbers after the market close last night, 1Q Earnings Season is now open. Unfortunately the numbers were a miss to estimates and the stock is down 5% in after hours trading. They also lowered their guidance for 2016 sales, lets hope that this is not a theme for other companies reporting numbers. In the last earnings season a central theme for most companies was the impact of the stronger dollar on their international operations. This reporting season we should see some benefits of a weakened Dollar."

To market to market to buy a fat pig Tick Tock, Tick Tock. Things are heating up on the politics front, especially in Brazil. President Dilma Rousseff is one step closer to impeachment with a vote yesterday from a congressional committee recommending a Senate trial for the Brazilian leader. Just like in South Africa, people are tired of corrupt and self serving politicians. Where this becomes more pressing is when GDP growth slows, tax revenues go sideways and the man on the street doesn't have an up-tick in his standard of living. When money becomes tight is when inefficiencies are most evident, a 'cold shower' to wake everyone up as the economist Joseph Schumpeter would call it.

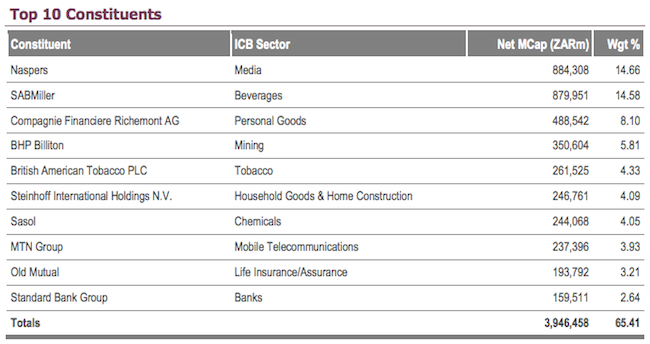

Jozi, Jozi. Our market was marginally in the green yesterday, up only 0.01%. The winners yesterday were the commodity companies, the Gold Companies Index was up 4.9%, Platinum Companies Index was up 5.8% and the Resi 20 was up 2.4%. On the negative side was the Industrial 25 which was down 0.7%, as you can see our market has moved away from the influences of commodity companies in a big way. Here is the latest rankings table for the top 10 shares on our exchange, found in the March 2016 FTSE/JSE Top 40 factsheet. Basically 5 shares account for around 50% of the market weight and the movements of these share prices determines if we have a green day or a red day. What this also means is that buying a market tracking ETF, these companies will be your main holdings. Are you happy with a BHP Holding of 5.8%, a Naspers holding of 14.7% or a Sasol holding of 4.1%?

The markets over the seas in New York, New York had a wobble at the end of the session to close in the red, the S&P 500 down 0.27% which means that the Index is in the red again for the year, down 0.1%. With Alcoa reporting numbers after the market close last night, 1Q Earnings Season is now open. Unfortunately the numbers were a miss to estimates and the stock is down 5% in after hours trading. They also lowered their guidance for 2016 sales, lets hope that this is not a theme for other companies reporting numbers. In the last earnings season a central theme for most companies was the impact of the stronger dollar on their international operations. This reporting season we should see some benefits of a weakened Dollar. The Dollar Index has weakened this year thanks to the FED saying that only 2 interest rate hikes this year was probable, the index is now back at early 2015 levels.

Company corner

Another day, another bank fine. Last week we had Wells Fargo to Pay $1.2 Billion in Mortgage Settlement and we now have Goldman Sachs to pay $5B in mortgage settlement. It astounds me how much is spent on legal fees for these cases! I think that it is great for companies to pay when they have been engaged in dodgy business practices, the next step is to start putting criminal chargers on the table for those who thought up and approved the wrong doing. Given that a capitalistic system is based around incentives, the possibility of going to jail is a stronger disincentive than the possibility of a fine which shareholders end up fitting the bill for.

Elon Musk has hit another hurdle in trying to ramp up production of Tesla cars as Tesla recalls new Model X over faulty seat hinge. The market didn't seem to be perturbed by this though, as it is 'only 2700' cars that need to be recalled, the stock ended down 0.06%. I think that these sort of problems highlights the challenges of having exponential growth in car production numbers, not only do your own systems take strain during the growth phase but so do your suppliers as they need to continually increase output. A more important number at the moment though, is that the pre-sale numbers of the Tesla 3 is now above 320 000 cars. The number highlights the huge potential for the electrical car market and gives Tesla some much needed cash flow of over $320 million through the $1000 deposit put down on every order.

Linkfest, lap it up

Sticking with Elon musk and companies that are changing the world - SpaceX successfully lands its rocket on a floating drone ship for the first time. Blue Origin, the space company owned by Jeff Bezos, has also successfully landed their rocket before but the big difference is that SpaceX's rockets can go into space where Blue Origin's can't reach that high. The significance of landing a rocket is that being able to reuse rockets will cut 30% off the cost of sending things into space.

Ben Carlson has a look at how contradictory and short sighted the finance industry can be - 10 Crazy Things People in Finance Believe. The biggest reason for some backward behaviour in the finance industry I think is having access to live prices all of the time. You are either "right" or "wrong" with every tick of the market and client money flows based on short term performance. Chasing short term gains and having a constant scorecard leads to bad investment decisions.

Home again, home again, jiggety-jog. Our market opened in the red and then promptly turned green, unlike European markets which are mostly red. Is it a risk on day, where emerging markets are in favour? Our Rand is looking healthier again today, currently trading in the R/$14.60's. A number of FOMC members are talking this evening, expect every word they say to be dissected and then a market reaction of some sort, even doing nothing is doing something.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment