"Will the Fed raise rates? Not sure! I am very sure that as investors we have absolutely no control over what the Fed does now, next week, next month, next year or ever actually. Not a single iota of control. So best we stop worrying about the next move and what to do around the Fed. And best we worry about the only thing we have control of, ownership of stock of a business."

The very new blunders video is out: Blunders - Episode 8. It includes Reuters, McDees and a young hedge fund manager. To never miss an episode, subscribe to the Blunder Alert!, and get the mail delivered to your inbox.

To market to market to buy a fat pig Them jobs. Everybody wants a job, needs one actually. It is the modern day equivalent of hunting and gathering, the industrial revolution changed all of that, advancing all technologies simultaneously and throwing the old world out of sync. To a certain extent we (the collective we, humanity) are grappling with technological advances that see us enter the age of information and machines. Driverless cars, self check in, electronic this and that. All this means is that labour intensive jobs are going to become harder to come by, the machines will do more. We will need people to fix the machines, repair them, most importantly invent new ones. The service economy is going to be huge, there will of course be jobs a machine can't do. Give me a haircut like Jennifer Aniston, I'm having problems from my childhood, those sort of jobs.

There was a dated interview in which Johann Rupert compared a diagnostics medical machine and the expertise needed yesteryear to interpret incoming data, how that required well trained humans to do that. Nowadays machines can do that. Yet cutting hair, babysitting, those jobs have to be done by humans, for now I guess. Anyhow, for the time being whilst the world evolves around us, we continue to watch the most highly anticipated data release monthly, the US Employment Situation Summary. Friday saw another shouting match between CNBC hosts Rick Santelli and Steve Liesman (their most famous moment -> Steve Liesman Issued A Devastating Line To Rick Santelli Live On Air), this time I guess about the quality of the jobs added to the US economy.

That is right sportslovers, it was jobs day Friday, normally the first Friday of the month sees the US labour (spell it whichever way you want) department release these numbers. They are volatile, they are prone to revisions, they are some big moving numbers. They are for Mr. Market the most important numbers monthly, across the globe. And that is whether you like it or not. Taking a glance at the scoreboard first, and then the market reactions, the headline numbers included a higher monthly additions to payrolls across the US than anticipated, an unemployment rate that ticked higher as a result of the labour force participation increasing, and an average hourly wages increasing. Over the last year wage growth has been average, average hourly earnings have increased 2.3 percent. In a global context that is not bad, bearing in mind that the Dollar has been king, average Americans can buy more globally with their money.

The upshot of it all was that this report was seen as a sign of continued strength in the US economy. Will the Fed raise rates? Not sure! I am very sure that as investors we have absolutely no control over what the Fed does now, next week, next month, next year or ever actually. Not a single iota of control. So best we stop worrying about the next move and what to do around the Fed. And best we worry about the only thing we have control of, ownership of a business. The greatest creator of wealth known to mankind, I think of course for the ordinary retail customer.

If you think about it, in capital markets it is the only "field" that you can be alongside Buffett, Soros, Gross and all the giants of the investment world, as well as ownership alongside Gates, Rupert, Saad, name them, you can own shares of the same company they own shares of. You may never get invited to participate in a round of golf at Augusta, or serve and volley on centre court at Wimbledon, or bowl an over at Lords, you can own the same ordinary shares as the giants of the business and investment world. Your one ordinary share is equal to one ordinary share of those giants. Except that Warren Buffett (according to Yahoo! Finance) owns 26,675,175 shares of Berkshire Hathaway. At 215740 Dollars a share, even owning one of these is a stretch for most investors. You can of course own the B shares, they are more reasonable (from a normal person portfolio construction point of view) at 143.78 Dollars each. Point made about ownership and participation I guess.

Mr. Market reacted in a positive fashion, good news is after all good news. Stocks rose across the board, the Dow Jones Industrial average added 0.61 percent, the S&P 500 was up a fraction more than that, the nerds of NASDAQ added 0.92 percent after all was said and done. Locally, we didn't really get the benefit of the rally in New York, even though we have the extra hour here now, as well as the extra hour at the beginning of the day, thanks to the clocks being turned back in Europe and North America. Stocks lost a little over one and one-quarter of a percent. It was pretty much broad based weakness, resources having a bad time of it, down just over two percent as a collective. The stronger Dollar (good jobs report) equalled a weaker Rand, naturally. Emerging markets concerns. What, again?

Across the seas and to where the sun rises, stocks are mixed, Japanese stocks are lower by around one-quarter of a percent, stocks in Hong Kong are over one and one-third of a percent off. You would have expected after that rally on Wall Street for stocks to perhaps be better, oil prices are falling. The Saudi's suggesting that they would freeze their output only if the Iranians did. There was of course much bigger news on the oil front.

The announcement that Saudi Aramco (valued at 2.1 trillion Dollars) looking to float 5 percent of the company on the Riyadh stock exchange, Al Arabiya reports: Saudi Aramco IPO signals serious economic reform prospects. Unfortunately as is often the case, sales happen at depressed prices relative to before. This article suggests that the company is worth 1.25 trillion Dollars. I am guessing the market will determine the value of the company. The Saudi's need to diversify their economy in a serious way.

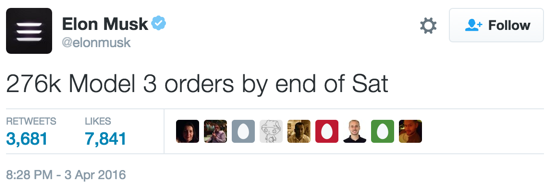

They may well only have a ten to twenty year horizon, depending on how it goes with that fellow Elon Musk. The demand for the new Tesla has been so overwhelming that Elon Musk tweeted that the company is going to have to rethink production planning, this as the pre-orders nearly topped the 200 thousand mark. Yowsers. Orders have (in Dollar terms) passed 10 billion Dollars by Saturday, check it out (the number of vehicles multiplied by the selling price):

Absolutely astonishing! This still doesn't scratch the surface, it just tells you that there is very strong demand out there for affordable electric cars. And if you think about it, these are not really cheap, in the same league as the BMW 3 series. A pre-owned 2016 2 series with very little on the clock costs around 40 thousand Dollars.

Linkfest, lap it up

Here is a bit of fun for a Monday morning. Can you picture our JZ, doing what the other JZ does? - China's churning out hip-hop propaganda videos to win over young people

It looks like good genes and a good diet are what is needed to live past 100 - In One Italian Village, Nearly 300 Residents Are Over 100 Years Old. The peoples diet also included a healthy dose of wine.

Talking of wine - Why Italy is mulling wine classes for schoolchildren

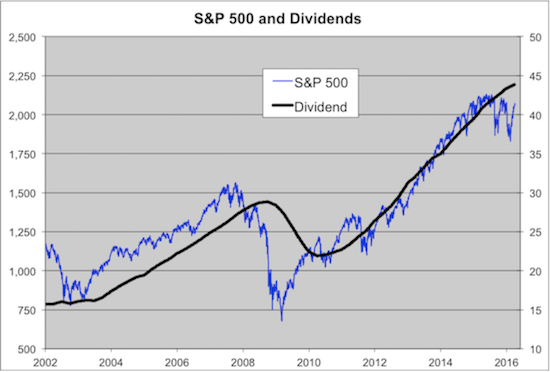

The dividend yield is a good measure of how underlying companies are doing. Dividends are paid with cold hard cash, which you can't pay unless the business itself has that cash - Dividends Rose 4.6% in Q1.

Home again, home again, jiggety-jog. UK markets are set to open lower, futures are pointing to around one-fifth lower. It may be an interesting day for all concerned.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment