"Recently of course with the currency volatility and lack of ease in doing business (as a result of some sanctions) I am guessing that it hasn't been easy for them. At the end of the session, the stock closed down 2.2 percent, the London share price (ticker MNDI) is exactly flat over the last year, it has had a terrific 5 years, up 116 percent in Pound Sterling."

The very new blunders video is out: Blunders - Episode 8. It includes Reuters, McDees, a young hedge fund manager and of course to wouldn't be complete without a juicy piece from Russia. To never miss an episode, subscribe to the Blunder Alert!, and get the mail delivered to your inbox.

To market to market to buy a fat pig A mixed bag to start with and then hey presto, stocks caught a bid and then rallied higher across the board. That was the action locally here in Jozi, leading the charge amongst the majors were the likes of Capitec and Anglo American, both rallying over 4 percent. Brait, Aspen and Discovery too rounded out the top five best performing stocks amongst the big caps, at the opposite end of the spectrum amongst those stocks wallowing in the red was Mondi and Barclays Africa. The latter as a result of going ex dividend (there parent Barclays, want some monies), whilst Mondi sank on a release that they were being investigated by the Russian Antimonopoly commission. I trawled the English part of that website, either my skills around the inter webs have faded a little, or the English version wasn't up, so I could not see the specifics.

Mondi have a pretty significant global business, with operations in around 30 countries. Their operation in Russia is pretty large, it accounts for about 25 percent of the workforce, as well as having significant forestry assets in the Komi Republic. In terms of production revenues, it is a little over ten percent, from that aspect it is bigger than South Africa, around the fourth most significant territory for them.

A big deal, bearing in mind that significant pots of money was spent upgrading their number one production asset there, over 550 million Euros in 2010. Recently of course with the currency volatility and lack of ease in doing business (as a result of some sanctions) I am guessing that it hasn't been easy for them. At the end of the session, the stock closed down 2.2 percent, the London share price (ticker MNDI) is exactly flat over the last year, it has had a terrific 5 years, up 116 percent in Pound Sterling.

Over the seas and far away in New York, New York, stocks were mixed post the jobs Friday report. Initially a muted start led to some selling, all the majors sold off a little, the Dow and the broader market S&P 500 sank just shy of one-third of a percent, whilst the nerds of NASDAQ lost just shy of half of a percentage point. Apple seems to be gaining some friends and momentum again, I have read many articles over the last few weeks supporting the growth of their business, their under-appreciated services business in particular. Apple closed at their best price since the beginning of the year, the stock YTD is up just over five and a half percent.

One stock that didn't gain any traction and slid over three percent was Facebook, there was a tweet from the CEO of Oculus suggesting that the Rift (the Virtual Reality Headset) wasn't selling as well as he would have liked. Hey, perhaps the sideswipe at Apple fan-folks (you can't say fanboys) has something to do with it. Or maybe it was more along the lines of another brokerage firm saying that you should buy the stock, you should however wait for the weakness of their results in two weeks and a day. Deutsche Bank analyst Ross Sandler expects a miss and therefore it could be a buying opportunity. Phew, what a job trying to predict the earnings and prices in the very short term, suffering from quarteritis is a horrible no good thing. I guess in his defence, I am sure old Ross gets paid bucketloads and is probably very good at making these predictions. The shorter the better, right?

Lastly, one stock that was slam dunked after-hours was Allergan. The stock is down an astonishing 22 percent after-hours, with a market cap of 105 billion Dollars, you do the math, it is easy enough! It is a pretty interesting set of events, read the FT article here (subscription only, sorry): Allergan plunges 22% on new tax inversion curbs. Basically the headline says it all, the Obama administration is trying to stop the inversions for the purposes of getting a lower tax rate. In other words, moving your headquarters to Ireland from the US to lower your tax rate is, based on this new set of events, becoming harder and harder to do. Yowsers, back to the drawing board for Allergan and Pfizer no doubt, earnings stripping no allowed, this may well make Pfizer re-think the deal. Busy folks in the tax department today no doubt.

Linkfest, lap it up

Thanks to the likes of Apple Music and Spotify there is a legal and relatively cheap alternative to pirating music - The Rise of Music Streaming

You will find more statistics at Statista

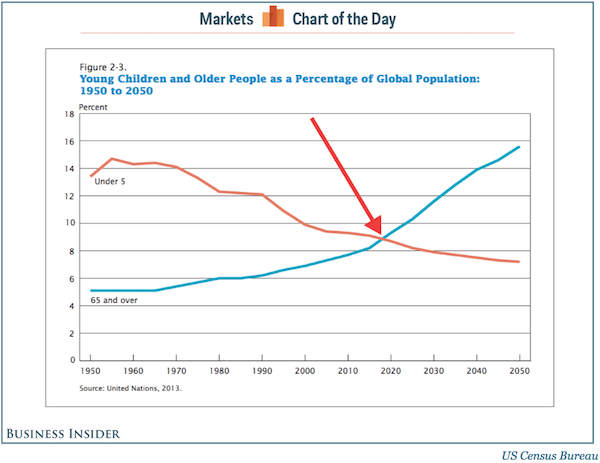

The major changes in demographics is one of the key metrics to look at when considering long term investing - We're about to see a mind-blowing demographic shift unprecedented in human history. Another big shift in demographics is the emergence of the millennial generation.

Here is the shareholder letter from Amazon in 1997 when the company listed - Amazon 1997 shareholder letter.

A few lines that stood out:

"When forced to choose between optimising the appearance of our GAAP accounting and maximising the present value of future cash flows, we'll take the cash flows."

"Sales grew from $15.7 million in 1996 to $147.8 million -- an 838% increase." (Sales are now over $100 billion)

'when I interview people I tell them, "You can work long, hard, or smart, but at Amazon.com you can't choose two out of three" '

Home again, home again, jiggety-jog. Over to the East where the sun rises, stocks are a mixed bag. Shanghai is up nearly a percent as we write this, the Nikkei in Tokyo is down nearly two percent. Stocks in Hong Kong, which coincidently look about the cheapest (forward) than any other global stock market, at less than ten times, are trading down 1.4 percent. I suspect based on the lower close on Wall Street that we would start along those lines.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment