"Without skipping a beat, and looking like very modern day bidding at an antique goods auction, Steinhoff offered 150 pence. FNAC, not to be outdone, offered 153 pence a share shortly thereafter. Inside of a half an hour, Steinhoff came back with a 160 pence offer."

To market to market to buy a fat pig Stocks went slip sliding away yesterday, the Jozi all share ended down 0.87 percent to close out at 53324 points. Resources lagged after what is one of the most incredible runs I have ever seen in any subset of the market, financials were marginally ahead on the day. There was a decent inflation read in the middle of the week, lower than economists had anticipated. The recently very strong Rand (recently, last quarter and into this one) may well cushion imported inflation, which may mean that the Reserve Bank may hang back and wait and see. It certainly isn't the demand side that is likely to stoke inflation. And that is why I guess on the local retail front, coupled with marginally better retail sales that the retail complex has caught a bid.

MTN was a noticeable winner on the day, the company released some subscriber numbers prior to the session opening, we will cover those in the coming days. There was big action around Steinhoff and FNAC going head to head in order to try and acquire London listed (French based) Darty group. See below. It is really interesting to see these types of bidding wars open up, the speed was breathtaking. In the background there was the European Central Bank who were meeting and of course doing "nothing" at face value. A bit in social media about the one year anniversary of the young German woman throwing her confetti on the table and shouting "end the ECB dictatorship". Except the spelling of dictatorship on her t-shirt was ummmm ..... different.

Apparently Mr. Market is questioning whether the ECB has what it takes to stabilise and grow the European economy. Really? I thought Super Mario and his gang were going to do whatever they could to save the Euro. I remember every man, woman and their goats and dogs having made their mind up that Greece was getting booted out of the Euro. The ATM's in Greece are still dispensing cash, not so? I really haver no idea what the great central bank actions are likely to yield, one thing that I do know is that Mr. Market is seemingly always looking for answers where there may not be.

We can all make projections based on how we see the future. Their (Central banks) jobs are to make sure that business and individuals feel confident enough that they have a handle on it and then they act accordingly. Delaying purchases or investments in specific projects as a result of being uncertain about the future has knock on economic implications. So the actions of central banks and their soothing camomile tea that they serve up has real life implications. We are all watchers here.

Over the seas and far away, as we get deeper into the earnings of Q1 for US businesses, stocks slipped from around midday onwards closing at the session lows. The Dow Jones industrial average ended the session down just under two-thirds of a percent, the broader market S&P 500 closed a little over half a percent lower. The nerds of NASDAQ slipped fractionally at the end after spending most of the day hugging the thin red line. i.e. zero line hugging. The Thin Red Line refers to the movie, which is an adaptation of the novel by the same name, written by James Jones. I recall having a go at the book when world war two history fascinated me.

Talking of something that fascinates many people, the Apple iPhone projections and orders have captured the markets attention over the last week and explains the weakness of the share price relative to Mr. Market. See the 9 to 5 Mac article: AAPL drops on reports of continuing iPhone production cuts. We don't have to speculate and guess too much, results are next week on the 26th. In the end, the market is a weighing machine as Benjamin Graham said, meaning that weight of earnings will send the scales in the direction of heavier or lighter. I for one am always excited to see company results, more so than central bank meetings, more so than monthly/weekly economic data releases, more so than what politicians say and do, that is what excites us here at Vestact. Companies. And the perpetual weighing machine. Countries and companies are not households, don't make that mistake either, just as an aside.

Company corner

Visa reported numbers last evening. This is one of the most exciting companies to own. And the thesis is pretty simple really. The fact that we are moving towards a cashless society with more speed and momentum than at any time in history means that this company will continue to be the beneficiary of a move away from physical currency. It is amazing to think that in an internet covered world, people still use physical cash as much as they do. I saw just the other day that the German finance ministry was mulling whether to put a cap on the Euro value of any transaction, 5000 Euros would be the maximum on a cash transaction. We often say when looking at Visa's business that governments, tax authorities, banks and financial institutions would prefer this type of ability to monitor all transactions, and thereby making the transportation networks and security carrying costs of cash obsolete. Of course not everyone has a cell phone and debit/credit card.

I have seen those that worry that the traditional networks will be jumped in favour of the newer technologies. What makes us think this won't happen is that the big switchers, Visa/MasterCard etc, already have built the trust and the infrastructure and all the other electronic payment methodologies will piggyback off the networks. Apple Pay for instance, which has hundreds of millions of phones as potential payment devices, uses the big pay networks. Stick your "physical card" into the application and pay at the merchant. Nobody ever sees the card, your thumbprint verifies the transaction, everyone is happy, most especially the banks who contend with credit card fraud all of the time. If it eliminates fraud, that makes everything cleaner for all concerned. In the future, there will be less cash, more electronic transactions, everyone except for the people printing money.

We will have a link to a more detailed report on Monday, the stock has taken some heat in the aftermarket, with guidance lower than anticipated. The stock is down 3.8 percent pre market, it is up (before this slide) over four percent this year. Herewith a preview of the results themselves, expect more Monday -> Visa Inc. Reports Fiscal Second Quarter 2016 Results.

Stryker reported numbers two evenings back. Here goes: Stryker reports first quarter 2016 results. Over here at Vestact we are not big ones for knowing where consensus is, and second guessing how the stock price will react. Often the stock price reacts in a very different way to what you think, anyhow. As we often try and get across, you are the owner of the business. The share price represents what the relative prospects are, on all the news available and that you know, as well as projections, as priced by the collective market. If the market perceives the earnings trajectory to be sharply higher, you can bet your bottom Dollar that the stock will trade on a much higher multiple relative to the rest of the market.

Stryker has three businesses, Medical & Surgical, Reconstructive and Neurotechnology & Spine. Two months back we wrote about the full year numbers: Stryker 4Q and full year results, as you can see, the business is a very North American and very US centric one. Eddy Elfenbein points out in his Friday morning weekly email that the worst of the Dollar strength seems past the company and that obviously their raising guidance has been a positive for the stock price. The company is expecting 5.65 to 5.80 Dollars worth of earnings for the current year, meaning that the stock at the top end of the range trades at 18.8 times earnings, 19.3 times at the lower end of the earnings range. Whilst that hardly seems cheap for a company that is growing earnings in the middle single digits, we really think that the sector is one that is poised for another strong growth spurt.

As we pointed out in the end of year results, the company will continue to add to patient safety in medical centres, making sure that minimal accidents happen, thereby improving efficiencies and improving productivity. We continue to accumulate the stock at current levels, it is a very attractive business to own in a future where more medical surgeries will become commonplace, knees, hips and the like will be simple procedures, even more so than today.

What is going on at Steinhoff? And more specifically, why are they involved with a business called Darty? Darty is a London listed, mostly French business, that seems (as per their website) to sell all sorts of household products from computers and electronics (including photography) to household appliances, garden equipment, about everything a home needs. The last six month results (HY results 2015/16 announcement) saw a very marginal sales increase. The stock back then had just risen as another French business that is similar, FNAC, made a scrip (shares) offer to Darty shareholders. A month ago, Michael gave a rundown of what was happening -> Steinhoff buying Darty, drops HRG.

As you can see, the big difference is that Steinhoff have the cash, for FNAC this is an all shares affair. Two days back, the Steinhoff subsidiary that is looking to buy Darty, Conforama, announced that they had secured 19.5 percent of Darty at 138 pence a share. FNAC turned around yesterday and said that they'll offer 145 pence a Darty share. Without skipping a beat, and looking like very modern day bidding at an antique goods auction, Steinhoff offered 150 pence. FNAC, not to be outdone, offered 153 pence a share shortly thereafter. Inside of a half an hour, Steinhoff came back with a 160 pence offer.

I am guessing out loud here that based on the smaller size and scale of FNAC, their inability to woo a sizeable amount of shareholders inside the business looking to be acquired, that the market has decided Steinhoff are the number one bidder at this stage. And that FNAC are unlikely to go any higher than this already stretched territory. I may be very wrong however, Darty count Vivendi as a 15 percent shareholder, they certainly have the firepower and are keen to lend a hand here. Michael gets a great quote in this Bloomberg article -> Steinhoff Leads Rapid-Fire Darty Auction With $1.2 Billion Offer. The pound seat seems to be that of Darty for now, it is obviously an attractive enough asset to chase (from 65 pence in the middle of last year). Darty shareholders will decide after the auctioneer catches their breath.

Linkfest, lap it up

I love optimism. It is infectious. It makes us better, happier and advances humanity a lot more than being perpetually pessimistic. Pessimistic people seem to know more, have the "secret sauce". That is why I am sure many will ridicule Jack Ma (the founder of Alibaba) when he Takes on the China Doomsayers. Thanks Jack, I'll side with you.

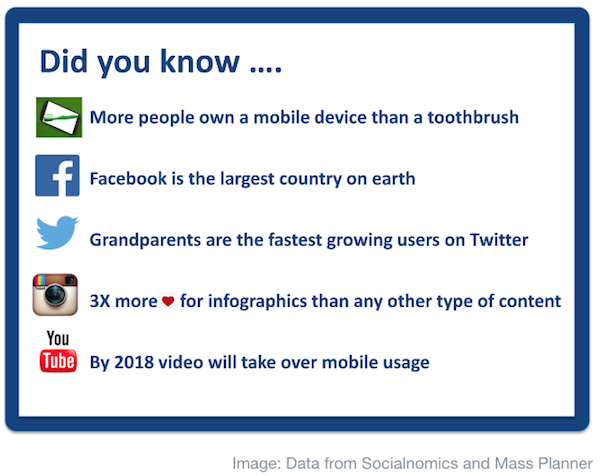

Social media has seen the rise of some large companies, connecting and sharing information is of great value to society - 6 ways social media is changing the world

A Wealth of Common Sense, shows how money and finances are very different depending on your perspective of life - Personal Finance is Personal. I think it also highlights the need to have flexibility and a personalised investment plan.

The need for people with the right skill sets is an increasing problem for companies, I didn't realise how big the problem seems to be in some parts of the world. Japan was also not the country I expected to see at the top of this list, how is a developed nation with a highly skilled population struggling so much. A case of the wrong skills? - The Countries Facing The Greatest Skill Shortages

You will find more statistics at Statista

Home again, home again, jiggety-jog. Oh bother, Prince/Symbol/The Artist Formerly Known as Prince/Jamie Starr or the man born as Prince Rogers Nelson passed away last night our time. I can't say that I ever went out of my way to own an album of the chap, I did like a few iconic songs however. He does sit in a very elite grouping of folks who sold more than 100 million albums, people like Paul McCartney, Kenny Rogers, Fleetwood Mac and Neil Diamond (for you old timers), as well as Bruno Mars and Adele for you millennial folks. A great artist, that judging from my Twitter stream, touched many and was magnificent in concert. The great thing about music is that it never goes away, I learnt the other day that Otis Redding died at the age of 26 in an airplane crash. Taken too soon.

Japanese stocks are trading higher as we write this, the Nikkei is up over half a percent. Chinese markets are lower, Shanghai is down around two-fifths, Hong Kong (yes, it is part of China) is down 0.9 percent. US stock futures are a mixed bag, tech stocks pointing to as lower open, the broader market pointing slightly higher. We will no doubt start lower along with global markets here, as we kick off Friday, ahead of another two short weeks here in South Africa. We have had and will continue to have a huge amount of company results, including Alphabet (Google) which missed the markets expectations and got sold off after hours. As did Microsoft. A few misses means going into the weekend we are likely to be lower here for the rest of the day.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment