"The company needs to address the production problems so that it can become a profitable business in the long run. A mass market product that will cause the other manufacturers to change and reinvent themselves, to give the consumer what they want, a clean energy vehicle. For the time being, lower mainstream energy prices means that Tesla is swimming against old school mentality."

To market to market to buy a fat pig And when we were down, we were down, and it stayed that way all day long. There was no up or down, and certainly no halfway up. Our local index, the Jozi all share, closed down over one and one-quarter of a percent yesterday, above the 51 thousand mark. Stocks globally had sold off through the day, the few reasons that I could pick up were lower PMI readings from Europe, IMF chief Christine Lagarde warning of slower global growth, falling oil prices likely to impact on financials and banks, and their exposure to the sector.

Perhaps a breather after a decent rally. Take your pick, please don't ever fall into the trap of referring to the market as some beast, or give sweeping statements of how it goes up or down based on x or y. That may be right in the short term, asking "how is the market?" is the same as asking about the weather, or your favourite sports team. Perhaps the Greek answer of "it's complicated" should be the answer, that'll stump them!

Dragging local markets lower here yesterday was the broader resource complex, Sasol was softer on a weakening oil price, that stock fell nearly 6 percent. Anglo American sank over five percent, Glencore nearly lost the same, you get the picture. At the other end of the spectrum in the mega caps, were the usual suspects when the currency weakens, Richemont, British America Tobacco, SABMiller, AB InBev, Mediclinic and Reinet, as well as a move northwards for AngloGold Ashanti. Otherwise it was pretty slim pickings for the bulls, some feasting for the other kind of market beast, the bear.

If you had to ask me which one I would be, on a forever basis, I would have to pick a strong raging bull, after all, over the last 40 years the Dow Jones is only up 1718 percent. Over the same time the S&P 500 has crushed the Dow Jones, up 1938 percent. The NASDAQ, notwithstanding the giant bubble of 2000 is up 5349 percent in 40 years. Yip, I am going to advocate staying long. Not that past performance has ANYTHING to do with future performance, equity markets are a good place to invest, provided you pay attention.

Over the seas and far away, in New York, New York, stocks sank and traded at the lowest point as the session closed out. The broader market S&P 500 lost just over a percent, the Dow Jones Industrial Average lost exactly three-quarters of a percent, whilst the nerds of NASDAQ were just shy of being down a full percentage point. Allergan was in the news for all the wrong reasons, the proposed merger between themselves and Pfizer is for all intents and purposes over. I would say that the stock at this point does look attractive, pity the merger between the folks that make the little blue pill and the folks that make Botox never happened. A real end to end solution! Cheeky! The BusinessInsider has this piece from a few hours back: Pfizer and Allergan will terminate their proposed megamerger tomorrow.

Casting an eye over to where the sun rises, although there is little to no chance of seeing it here today in Jozi, we are experiencing a lovely Scottish summers day at the moment, stocks are mixed to the slightly lower. Hong Kong stocks are a smidgen higher, Shanghai stocks are down around one-fifth of a percent and Tokyo stocks are off around one-sixth. The much stronger Yen hasn't been helping that stock market, year to date that market has sold off viscously, down 17.4 percent year to date, would you believe. And in fact, not too far from the recent year lows reached in mid-February.

These Panama leaks have certainly put the cat amongst the pigeons, as Michael pointed out, just having an offshore company doesn't make you a crook, it is how you utilise the vehicle that represents what your behaviour is likely to be. There has been a big tree to fall, the Iceland PM quit in response to an outcry in that country. Fancy that. He did say that he was stepping down for a bit. He is still leader of his political party. And you wonder why politics has to have membership to a "party"? A small country, only 320 thousand people, I am pretty sure that there is someone, who knows someone, and so on.

Company corner

Tesla bears were kicked in the chops, after what looked like a miss in sales numbers the session prior, less than 15 thousand vehicles for the quarter, the company suggested that they would deliver somewhere in the region of 80 to 90 thousand vehicles for the year. Here are the sales numbers -> On Track for Full-Year Delivery Guidance. To put this into context, I read that last year there were 116 thousand electric vehicles sold globally, of the plug in kind. That sounded a bit low to me. Bearing in mind that the global car market is somewhere in the region of 83 million vehicles, China at 21.1 million and North America at 20.6 million. Europe sales were (including Russia) at 18.8 million units. Basically those three regions account for all of the consumer related vehicles, Toyota sold over 10.15 million units as the number one seller globally.

And then Tesla had, by Saturday night in a tweet from Elon Musk, pre-orders for 276 thousand units of a car that is expected to be delivered at the end of 2017. And currently, they can't make more than 15 thousand vehicles (including the highly prized Model S and newer Model X) a quarter. The company wants to deliver 500 thousand vehicles per annum by 2020, at that size and scale, they wouldn't even be 5 percent of the total global sales of Toyota. I am guessing what Musk and the gang are looking for here, the final point would be a desirable, above average price. A Toyota Corolla "starts" at 17,300 Dollars, the Tesla Model 3, even though it is affordable, costs double that of the Toyota Corolla. On a comparable basis, the BMW i series, the electric vehicle, sees the lower end model start at 42,400 Dollars. I can't help then think that the Tesla is superior in every way to the lower end BMW, even pricing!

For the last quarter, Tesla had component supply problems with half a dozen parts of the roughly 8000 that go into a Tesla. As the release says: "missing even one part means a car cannot be delivered. Tesla is addressing all three root causes to ensure that these mistakes are not repeated with the Model 3 launch. That is what investors what to hear, the company needs to address the production problems so that it can become a profitable business in the long run. A mass market product that will cause the other manufacturers to change and reinvent themselves, to give the consumer what they want, a clean energy vehicle. For the time being, lower mainstream energy prices means that Tesla is swimming against old school mentality. That too will change, of that I have little doubt. It is, and always will be a high Beta stock, which has a small place in wide portfolios.

Linkfest, lap it up

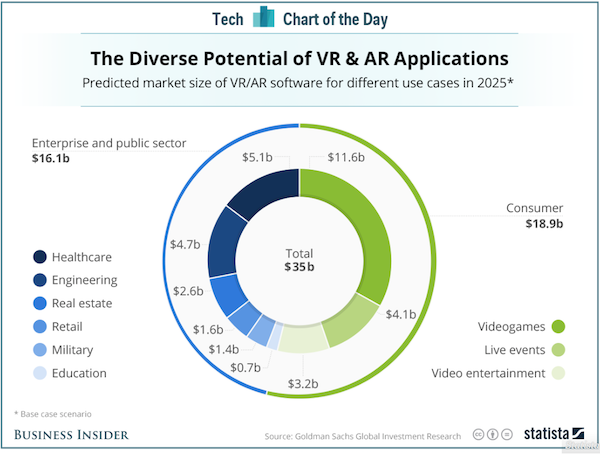

Virtual reality is expected to be another big growth segment for the tech industry - Here's where the big money will be made in virtual reality. I'm surprised to see education listed as such a small slice of the pie, being at the battle of Waterloo would be a great way to learn about it.

This company is looking to sell kits which can transform your car into a self driving one. There is still much work to be done but the goal is to sell the kit for less than $1000 - The hacker who built his own self-driving car is ushering in the age of cheap AI

Here is a video showing the progress for the new Apple Campus. The size of the campus is a bit mind blowing - A new drone video over Apple's campus gives a crazy perspective on just how large that dirt pile is

The price of pork bellies is up 30% this year all thanks to the growing popularity of bacon. In the US, they now produce more pork than they do beef - Bacon surge

Home again, home again, jiggety-jog. Futures are higher, around one-third of a percent, we should maybe start out fractionally better. Chinese PMI has given the markets a small boost. Hump day today people, get your stuff together, I can feel that the second half of the year is going to be better than the last little while. I don't know why, I just have a hunch.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment