"Here are some more huge numbers from the company. Monthly Active Users (MAU) is now at 1.65 billion people of which 1.09 billion log on each day! The average US mobile user spends 30 minutes a day on Facebook and if you include their other apps like Instagram and Messenger (not WhatsApp) the number jumps to 50 minutes a day on Facebook content."

To market to market to buy a fat pig Our market bucked the global trend and finished the day in the green, up 0.3%. Anglo American PLC had another stellar day, up 9% on the news that they sold one of their non-core assets for $1.5 billion. This is part of a move from the company to reduce debt levels by a third and shore up their balance sheet and in the longer term, start paying dividends again. Over the last month Anglo is up 135% in Rands and 173% in pounds, unfortunately the stock is down 30% since last year this time. The MTN share price also had a a strong day yesterday, finishing up 3.9%, Google could not find any specific news for the move higher. One article that is worth reading though is Ten things you didn't know about MTN, only 1 in 7 subscribers currently uses data! There is huge scope for growth going forward.

In New York, New York markets were down over 1%, the Dow down 1.2%, the nerds of the NASDAQ down 1.2% and the S&P 500 doing slightly better, only down 0.9%. Apple who is a big contributor to the US market being down 3% for the day would have been part of the reason for the market weakness. The further dropping of the Apple share price came as activist investor/ hedge fund manager, Carl Ichan said that he has sold his stake in Apple. Remember this from May last year - Icahn says Apple is dramatically undervalued? Icahn was saying that the stock should trade around $240, so when he comes out and says that he has sold his entire stake it rattles some 'investors".

Company corner

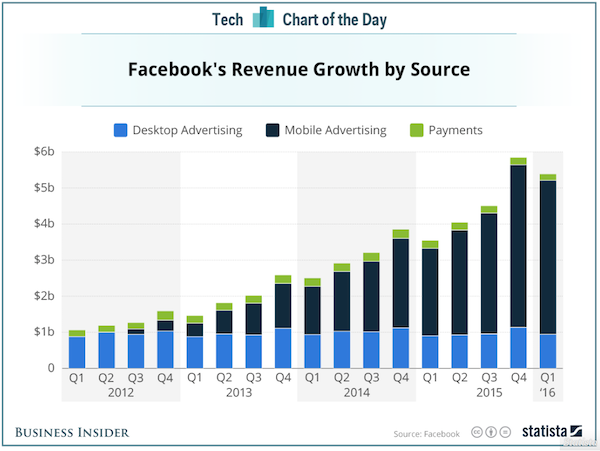

On Wednesday Facebook released their 1Q 2016 numbers and they smoked analyst expectations. The stock was up 7% yesterday. Here are the numbers, Revenue for the quarter is $5.4 billion, up 52% YoY and Net Income is $1.51 billion up 195% YoY, so still huge growth coming through. The big driver of growth has been on the mobile front where revenue grew by 73% and now accounts for 82% of all revenues, mobile is also more profitable than your PC adverts. On the advertising front their average price per advert is up 5% and impression rates are up 50%, both due to a higher mobile to PC mix (adverts on your phone are in your face, where on PC they are to the edges of your screen). Have a look at the huge revenue growth from Facebook since it listed.

Here are some more huge numbers from the company. Monthly Active Users (MAU) is now at 1.65 billion people of which 1.09 billion log on each day! The average US mobile user spends 30 minutes a day on Facebook and if you include their other apps like Instagram and Messenger (not WhatsApp) the number jumps to 50 minutes a day on Facebook content. Some one pointed out on Twitter yesterday that with a following of over 1.6 billion people and an average interaction time of 50 minutes, Facebook now rivals most world religions.

Where will the growth continue to come from? At the moment the Average Revenue Per User (ARPU) is $3.32, if we zoom into the US it is $12.43, in Europe it is $3.98 and the Rest of the World only $0.91. On a global front we will see more advertisers turning to Facebook, with the result being that ARPU's start to look more attractive for areas out side of the US. In the US itself more advertisers are including mobile advertising as part of their advertising budget, with Facebook saying the shift has been from "should we use mobile to how do we use mobile". All regions had more than 50% revenue growth rates in constant currency, amazing global growth. All this growth is not cheap as you can imagine, the forward P/E of the stock is 25. As Facebook keep up all this growth, their P/E will quickly get into the teens and probably a small dividend being paid. Facebook is still a buy in our book.

Linkfest, lap it up

Cullen Roche tries to explain why gold has a premium over its productive use. In the end he can't, it is all down to people's belief that gold is worth something and a "safe asset". If the money system collapsed tomorrow would gold be worth anything or would canned food be worth more? -There are no Good Gold Analysts.

There are some inventions from the space race that help our everyday lives, here are technologies developed by NASA which are saving lives - These NASA inventions are saving thousands of lives on Earth

Just a weird fun fact for the day - Half of All Western European Men Are Descendants of a Bronze Age King

Home again, home again, jiggety-jog. Amazon is up 12% in premarket thanks to strong numbers overnight, the stock on the open should be at an all-time high. Our market is in the red along with European and Asian markets. Our Rand is looking stronger this morning, sitting around R/$14.20. The big event for the weekend is the Berkshire shareholder meeting which you will now be able to stream, Berkshire Hathaway 2016 Annual Shareholders Meeting - LIVE. Enjoy the long weekend and enjoy some wisdom from Buffett & Munger.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment