"11 months and 10 days after writing this open letter to Tim Cook, the dude said he no longer owned shares in Apple. I am guessing he ended lower than where he started. So much for being a no brainer, a company like this only coming along every half a century, the year 2020 and the car, the TV and the watch, as well as having huge respect for Tim Cook."

The latest blunders video has hit the screens last week, what haven't you watched it yet? Follow the link Blunders - Episode 12, enjoy all the latest in the world of blunders. Subscribe to the Blunder Alert! and never miss a weekly update, you will get the email delivered to your inbox at the end of the week.

To market to market to buy a fat pig Leicester City win the league. Wow. That is like Afghanistan winning the cricket world cup, or your portfolio going up three fold in a year. Such outside odds were given, there are some people who did win some serious money having a wild stab in the dark. This is apparently the worst ever season for the bookies -> Leicester City win Premier League and cost bookies biggest ever payout.

As Michael and I discussed, no worries, this will mean that the bookies get a chance to win their money back next year, as fans stick larger amounts at lower odds. Perhaps this is a chance for the bookies to reflect a little on how wide their odds are and should be. As of yet, Elvis has not been found, the same odds being offered by bookies as Leicester winning last evening back in August. I definitely thought that Leicester would struggle after their fantastic start. What do I know?

Back to something I know a little more about. Or I hope that I know more about. Markets. That general term riles me, "the market". I have just finished reading a book that I highly recommend to all of you. Written by legendary investor Howard Marks and titled The Most Important Thing: Uncommon Sense for the Thoughtful Investor, it points out many of the obvious things that we miss a lot, when you become an investor who "lives" the investments. Only when you own something, watch it, report on it, watch the fortunes of a business, does it become real.

Marks makes the same points (more elegantly I think) that we try and articulate here at Vestact. It is not that the bigger macro picture, the central banks of the world, the economic outlook and so on that matters the most, it is rather the companies that you own that matter more. Whilst all boats rise and sink with the tides in investing (all the boats being floated in a market going up, the reverse being true too), it is ultimately the quality of the investment (boat) that matters the most. The analogies with sport are well made, I suspect in my world the best sporting analogy must still be test cricket, you can leave as many balls as you want if they are not there to hit. Better than the Buffett baseball analogy. See the links below to the annual (51st) Berkshire Hathaway annual general meeting.

Talking of which, Buffett had this to say about Marks: "When I see memos from Howard Marks in my mail, they're the first thing I open and read. I always learn something, and that goes double for his book." I must be grateful to Bright, our newest employee, for introducing me to these incredibly useful insights from what seems like a really level headed chap in investment markets. Read it, let me know what you think.

Markets look, a quick peek from overnight in the US where stocks rallied sharply after a brief period of weakness, the Dow Industrials added two-thirds of a percent, the broader market S&P 500 was marked up just over three-quarters of a percent, whilst the nerds of NASDAQ added about 0.1 percent more than the broad market. Energy and materials stocks lagged a little, there was another good day for Amazon after their results, we will get that to you shortly, tomorrow hopefully. Results that moved the markets most certainly.

Company Corner

Amgen, one of the world's leading biotech companies reported results for their first quarter of the 2016 financial year on Thursday evening. This is not a company that we have owned for a long time, it is a relatively recent acquisition for our clients. In fact, we have only been buying this company for clients for around a year. The nearly four decade old company, as per their mission statement are involved in producing cost effective therapies that are based on advances in cellular and molecular biology. If you were not paying attention in those respective subjects, biology and chemistry, then I suppose like most of us without the advanced studies in the respective fields, we will have to understand what the therapies do, whether or not there will be greater need for them, whether or not the company is on the right track, whether or not importantly that the company is a good investment at this juncture.

You may know the company for the production of one of their most successful blockbusters, in fact in their field of pharma, one of the greatest therapies so far in the short history of biotech, EPOGEN. Lance and his friends, well, almost everybody who rode le tour de Farce for a number of years knows the therapy. It is supposed to be used on patients who are struggling, not "healthy people". Remember that from 1999 to 2005 there are no winners of the tour, as a result of excessive doping. Sigh. Cheats, money, power and fame.

Their number one current drug is Enbrel, you can get a complete run down of their therapies via their website, under products. Of course as an investor you will be very excited to know what is in the pipeline, remembering that the process is a tough old one. It is important to look under phase 3 to look at therapies like Repatha and Xgeva, even something like AMG 334, which might alleviate migraine sufferers constant pain.

In the world of biotech, things can get a little hairy sometimes for the shareholders. The nature of the beast determines the volatility associated with the smaller listed stocks, one FDA rejection or approval for a small business with a single therapy results in dramatic moves in the share prices. And recently the well documented Valeant woes have put a cloud over the whole sector. The sub sector as a whole is down nearly 20 percent over the last 12 months.

Amgen is one of the big hitters in the sector, with a market cap of 117 billion Dollars, the company is larger than the amount that AB InBev is shelling out for SABMiller. And is on a lower multiple, Amgen currently trades on a 17 times historical earnings multiple, with a two and a half percent yield. In the earnings release, the company guided higher for the year, adjusted earnings per share is expected to be between 10.85 to 11.20 Dollars, meaning forward the stock trades on a 14.4 multiple in the middle of the earnings range. That is hardly expensive, in fact for a business that has managed to grow Q1 comparable revenues by 10 percent year on year and adjusted EPS by 17 percent, the stock may well look very cheap.

Added to that is the fact that the stock price has not moved a single iota in the last 12 months, it is essentially flat. Whilst it may seem counterintuitive, a lower share price over a period of time where their peers have done worse (a few cases here and there) is actually a good thing for the prudent investor. An investor wants to accumulate quality for as long as they can at lower share prices, when the stock is cheaper. Obviously you want the stock to go higher in time, and be rewarded for putting your money at risk, with quality businesses, it is only a matter of time before that happens. This is one such business, we continue to recommend a conviction buy on the stock.

This I can't believe. Carl Icahn't get outsized returns by talking it up, which leads him to changing his mind after a year and a half. Less than a year ago, on the 18th of May, Carl Icahn wrote: "After reflecting upon Apple's tremendous success, we now believe Apple shares are worth $240 today. Apple is poised to enter and in our view dominate two new categories (the television next year and the automobile by 2020) with a combined addressable market of $2.2 trillion, a view investors don't appear to factor into their valuation at all."

Icahn is a hugely successful man, in an industry where the scoreboard measures the successes with the amount of money that you have amassed, the man and his team have done better than most. The 80 year old native of Queens, New York is worth around 17.6 billion Dollars, according to Forbes, that is 43 in the world, down from 31st place last year. I suppose, that other than being the Icarus man, Eike Batista, what is in a few billion here or there when the numbers are so big? Batista, remember, "lost" 35 billion Dollars in personal wealth in less than a year, the reason for the inverted commas is that it possibly wasn't there in the first place.

Back to Icahn however, on Thursday last week, 11 months and 10 days after writing this open letter to Tim Cook, the dude said he no longer owned shares in Apple. I am guessing he ended lower than where he started. So much for being a no brainer, a company like this only coming along every half a century, the year 2020 and the car, the TV and the watch, as well as having huge respect for Tim Cook. The reason for selling? Fears around Chinese growth. His biggest position is no longer. I am not sure about you when you go about portfolio construction, chopping and changing like this on a whim (and I am sure there are other examples) when the stock doesn't go up or down as predicted.

What should you do with your Apple shares? Nothing. Whilst the company is selling their core product at a lower click than previously, I think that based on current price metrics, selling is the wrong thing to do. To sell at a little over 10 times earnings and a yield beyond two and a half percent based on a single bad year, that is wrong. Apple is cheaper than IBM, Cisco, Intel, definitely cheaper than Microsoft (and certainly Google and Facebook), it may not however be, as most businesses are, comparable to any of these companies. It is one thing to say cheap, the prospects, at least the immediate prospects are concerning. I suspect not as much as Mr. Market thinks, the quality is undisputed, services is becoming a bigger part of their business, I think Chinese consumption will be just fine. We continue to accumulate, even if uncle Carl doesn't want to own them any more. BTW, Carl still thinks that Apple is a great company, which is a compliment, not so?

Linkfest, lap it up

Remember the movie, "Honey I shrunk the kids"? This is like science fiction, yet will have many applications in medicine no doubt -> World's tiniest engine small enough to enter living cells. The FT (paywall) also have an amazing piece on the breakthrough invention -> Scientists build world's tiniest engine.

If you didn't get a chance to watch all 7 hours of the Berkshire Hathaway annual shareholders meeting, here are some links to give you the highlights:

13 key moments from Berkshire Hathaway's annual shareholder meeting;

Recap: The 2016 Berkshire Hathaway Annual Meeting.

I watched most of it, it strikes you that most of what Buffett says is not ground breaking but he has a very broad knowledge and he ties simple topics together to bring insight. As he says, you don't have to be clever to be an investor but you do need to be able to control your emotions.

Sticking with the Berkshire theme, here is a speech the Charlie Munger gave a couple years back - The Munger Operating System: How to Live a Life That Really Works

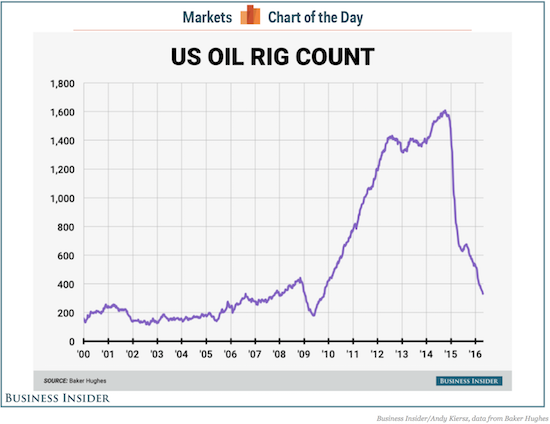

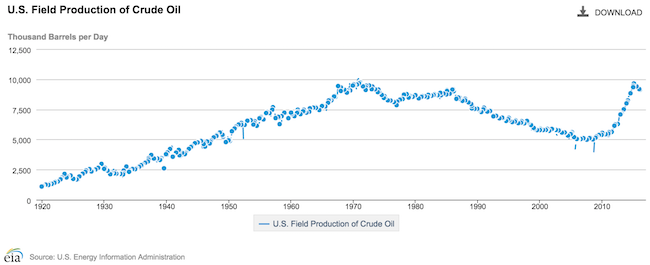

Low oil prices have been great for the consumer, the oil industry and their workers have been hit hard by it though - Oil rig count falls for 6th straight week. Note though that oil production has stayed near it's highs, even though the rig count has had a massive drop.

Home again, home again, jiggety-jog. Stocks across Asia are mixed, in Japan stocks are sinking (highly correlated to the currency) as the Yen strengthens sharply. The Aussies cut rates to an all time low, that has boosted their market sharply. Shanghai is up over a percent and a half. Time for the workers to work, not so, too many public holidays. It is what it is! I suspect that we should start a little better here today.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment