"They have obviously identified the company as ticking all the boxes. Owning companies is what they do. And that is why this is more important, whilst it represents a small investment for both parties, it is important at the fringes. Apple stock rose 3.71 percent, off the 52 week lows."

To market to market to buy a fat pig A strong showing for the local equity markets, a much weaker Rand as a result of seemingly (or reported) more political interference. It has been claimed that the claims are baseless, so I guess we deal with the information that we have. Market participants are like highly charged bunnies on a caffeine and energy drink diet only, standing in front of two buttons engaging in a whack-a-mole amusement arcade flashback. And unlike the one choice and single pill that Neo has to choose from Morpheus in the Matrix, Mr. Market seems to react in a more haphazard manner. The collective is jittery at best, sell first and then ask questions much later.

With the Rand selling off, not all local stocks were sold, in fact if you have timed your entry into equity markets and only bought gold or platinum stocks since the beginning of the year, you think that this is easy. And fun. And that you must be good at it. As a collective, platinum stocks are up a whopping (nearly) 105 percent year to date. And gold stocks are up a more astonishing 112 percent. Tell me what you think the gold price is likely to be in five years time, or find someone who will give you detailed and reliable forecasts on an ongoing basis, and I will say that you have found the one, sticking to the Neo and Matrix theme. It is way too hard to own some segments of the markets with any semblance of reliability, and by that I mean in earnings and then by extension the share price.

Whilst prices go up like crazy, people will think of the stock as a "good one", when the share price goes down, it must be a "bad one". It really matters what the company does and what it is likely to do, and by that, it doesn't mean the share price. It means what the company does. And let me just say that I can't understand the allure of owning precious metals over other investment classes. There always will be for historic reasons many people that will seek to own either physical metals. After all, it is like people who only invest in property, that is something that you can see and feel. Equities come with horror stories (some real), patience and quality in earnings is what ultimately drives superior returns that are longer dated.

At the end of the session, once the dust had settled, stocks as a collective were up 1.57 percent, with a 4.37 percent gain in the broader resources market being the highlight. If you drilled further down, you would find that in the platinum sector all the action was happening, and in particular with Lonmin. After the deepest and perhaps most dilutive rights issue that I have ever seen at the end of last year, the company has worked hard to reduce costs, and although loss making (still), you can see through the mist.

The stock responded in a manner that you may not have expected, up a whopping 20 percent. That is fairly significant for some investors, not the least the Public Investment Corporation of South Africa who took 29.99 percent of the shares at the rights issue. At one pence. After the 100 for 1 consolidation the share price is trading at 195 pence last evening. From early December, in pounds and cents (really just pence), the PIC have doubled their money by having followed their rights. Equally you could argue as a shareholder from before, they were absolutely trashed. 30 percent of a 553 million Pounds market cap business is better than two acorns (owed to them) from a oak tree near a bay. Again, not for us.

Vodacom had results too, this for their full year. It has been pretty much telegraphed to the market. Data on the rise, sharply at that, and continued pressures put on the pricing specifically. That is a very good thing for consumers everywhere. The company bemoaned the slow roll out of broadband infrastructure here in South Africa. That was in the direction of the people over at Telkom (SOC) methinks. We will take a more detailed look at the business over the coming days.

Barloworld also reported numbers that at face value looked just OK to me, the market marked the stock down heavily, down over six and a half percent by the close of business. I suppose the company is stuck in a difficult spot, construction and mining. In Russia, South Africa and the Iberian peninsula. Good company, tough spot of the economy. If I had to pick one in the sector, perhaps Imperial is "better". We still prefer and hold loads of Bidvest shares, in a couple of weeks they are about to start the process of forcing us to choose between the two businesses. We will advise then.

Over the seas and far away in New York, New York, stocks were bucking the trend, up sharply. The Dow Jones Industrial average up a percent exactly, the broader market S&P 500 was up a fragment away from a percent. The nerds of NASDAQ added nearly a percent and one-quarter of a percent. The one story attracting all of the attention was a simple filing by Berkshire, and you can look through the table for interests sake -> Information table for form 13F. According to Investopedia, "The SEC form 13F is a filing with the Securities and Exchange Commission (SEC), also known as the Information Required of Institutional Investment Managers Form. It is a quarterly filing required of institutional investment managers with over $100 million in qualifying assets."

So why the buzz? I suppose it is always interesting to note what Berkshire is or isn't owning, i.e. what they are selling and what they are buying. Berkshire owns shares. Berkshire sells shares and doesn't own them any more. Own being the operative word. The company is in the business of stock (and company) ownership. And therefore doesn't trade. The name that appears for the first time on this 13F form is Apple. And that is what all the buzz was.

For the first time, the investment managers Todd Combs or Ted Weschler are owning the stock. Todd or Ted. Cast your mind back to the Peter Rabbit books, Mr. Todd was the sneaky fox who tries to eat bunnies and all sorts of other characters from the Beatrix Potter books. In this case, Todd is an investment manager who is the future of Berkshire investments, along with Ted. They have obviously identified the company as ticking all the boxes. Owning companies is what they do. And that is why this is more important, whilst it represents a small investment for both parties, it is important at the fringes. Apple stock rose 3.71 percent, off the 52 week lows. Much was made of Warren Buffett now being associated with Apple stock. I only have a single question, how does Buffett's old friend Bill Gates feel about this? As Michael said, I don't think Gates really cares, maybe 20 years ago.

Linkfest, lap it up

Infrastructure is one component needed to keep Africa growing and help uplift people out of poverty - Africa needs to trade with itself - here's how. One of the stats show "Africa had the lowest level of intra-regional trade, at just 18%.", there is much room for improvement.

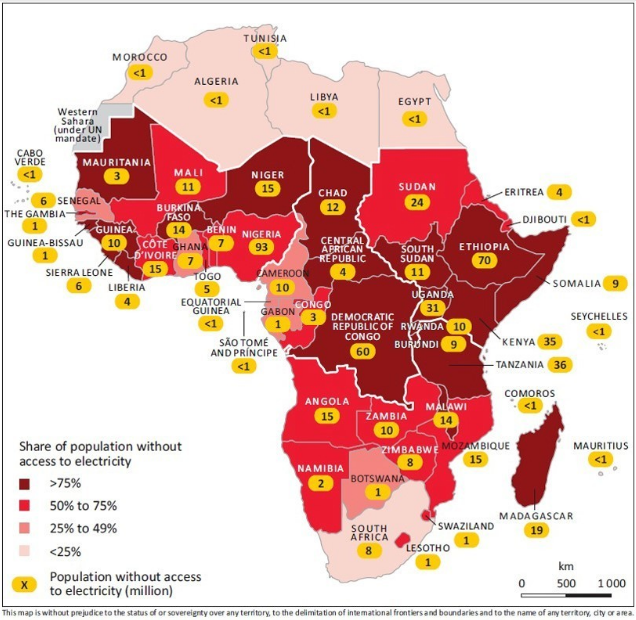

I can't imagine a country functioning in the modern economy where more than 75% of the population doesn't have electricity.

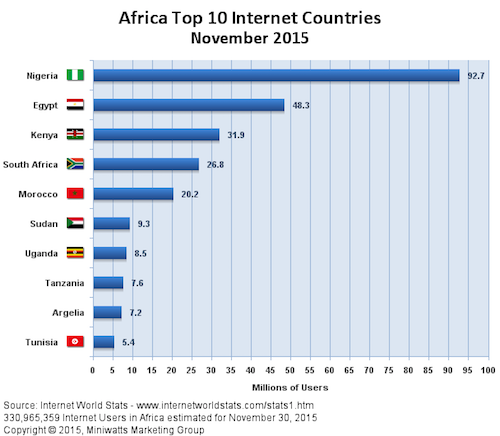

How is it that only 27% of South Africans have access to the internet? MTN accounts for around 19% of Nigeria's connection numbers.

If books brought you fond memories why not wear the scent, to make you happy and to try lure a partner who is also a bookworm - The sweet, sexy smell of old books is a perfume fad

Does this graph indicate that life is all downhill until you have a midlife crisis and then appreciate life more after that? The only investment implications that I can think of is that healthcare spend for older people is still a great area to be in, to be happy in old age you normally need to be healthy as well - This chart shows the age when most people feel the least happy.

Home again, home again, jiggety-jog. Markets are green again today, Lonmin is up another 2%. The Rand topped out at R/$15.70 but has recovered a bit to the R/$15.50s, expect some Dollar volatility when the US CPI data comes out this afternoon. If inflation is higher than expected there will be an argument to be made that the FED is closer to an interest rate hike.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment