"I often compare the five or six hour course, the trading manuals and software before you are unleashed in an ocean of liquidity (Forex markets trade over 5 trillion Dollars a day) to being given the best clubs and six hours of "training" and then told to tee off against the best"

To market to market to buy a fat pig It is Memorial Day in the US today, which means officially it is the start of the summer. I mean, it means unofficially it is the start of the US summer. The start of the Euro football championship, the end of the official football season, well done to Real Madrid, Los Blancos. They were taken all the way to the end and into penalties by their neighbours across town, the two best sides in knockout football in Europe in the most prestigious club competition on the planet. That is until last evening, Michael and my team, the RCB were not able to get over the line. Sigh, three finals, three unsuccessful attempts at getting there. Virat and AB, not quite, once again. It is also a bank holiday in the UK today, we are stuck in the extraordinary spot where we have neither the US or UK markets open on exactly the same day. Expect sailing on the pond today, a lot of drifting around.

And then of course, the race which captivates so many people, the Comrades, which was epic. The men, the record shattering was unbelievable from David Gatebe from Rustenburg. He just smashed the lot, the record, the whole field. He was 20 minutes ahead of the last gold medal. Running at that pace (3.35 minutes per km), that is around 6km ahead of the 10th placed fellow. He had time to take a shower and change. And then Joburg local Caroline Wostmann was conquered by that race and beaten by sometimes training partner. Ai shem. Perhaps another guy from our end next year, someone from the office had better give it a go. Me? Maybe.

In a sense, investing is somewhat like ultra distance marathon running. Except there is no clear beginning and no clear end of any sort. And the race is always on, the markets are always open for your participation, you need not have had much training either. In currency markets which is also available on trading platforms, there is loads of leverage which could wipe out your capital in the blink of an eye. Sadly, and in many other fields of expertise there are lots of barriers to entry. I suppose that is both good and bad about capital markets, provided you have a little capital, you can get started almost immediately.

I often compare the five or six hour course, the trading manuals and software before you are unleashed in an ocean of liquidity (Forex markets trade over 5 trillion Dollars a day) to being given the best clubs and six hours of "training" and then told to tee off against the best. Is trading a skill like others? Yes. Can anyone do it? Yes, in the same way that you too can buy a set of running shoes and golf clubs, you can trade. The sceptic in me, and having seen people walk into trading sessions, if the software is so bulletproof, why doesn't the instructor use the software to make a living, rather than teaching? Simply put, as in many other fields of expertise, the chances of top end success is minuscule. Not that it should prevent you from trying, you may have the skills.

We tend to want to make money the old fashioned way. Picking and sticking. Quality. Check. Repeat. Stay the course. Always stay the course. For many, when the market goes sideways or seemingly goes "nowhere" the confidence wanes. In truth, when stocks go sideways, or down, that is an opportunity that doesn't present itself very often. In the moment it is not easy to recognise that you should be accumulating quality. Ignoring the noise and others with short term agendas is a skill in itself. Equally, not getting drawn into your own BS, that is also a skill.

Enough, lesson over, I am no teacher, you are no pupils, we are all grown up here. We all know the risks and rewards of equity markets. We all know that there are many things beyond our control in equity markets, we all know that we control a few things. Which is why we are as afraid of flying as we are investing, it is a control thing. We cannot control the airplane, we are strapped into a seat and all the while we know that statistically it is the safest way to get around. Investing is the same, except we can get out of the investing airplane at any point and hop back in. We know that there can be turbulence, we know that provided we pay attention and steer clear of speculating that the ride can look very smooth over time. Yet we live in the fear that there may be a disaster, we spend too much time worrying about a small outcome rather than the bigger picture.

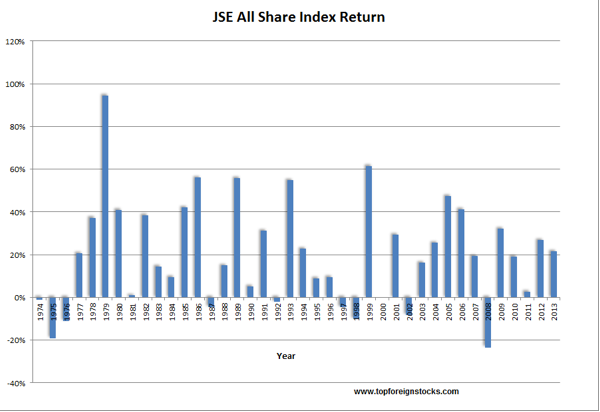

Stocks Friday ended one-third of a percent higher for the session, the overall Jozi all share index closed at 54105 points. That is where we are nowadays. I managed through some snooping to find some data of where and how we have done over several decades. Two interesting pieces, firstly from 1926 to 2009 - South Africa FTSE/JSE All Share Index: Historical Total Returns Chart.

That shows the years of 10 percent or less drawdowns as being 12, 20 percent or less being 6, and only two years of worse than 20 percent drawdowns, 2008 and 1970. One I remember well, the other, I wasn't born. Only one person in this office was, and I am guessing he was more worried about toys and blocks back then. 2009 was a year where stocks rallied by more than 30 percent. There have been two years in the history in which the JSE rallied by more than 90 percent in a single year, that being 1979 and 1933.

1979, that must have been the monstrous gold rally as a result of the oil embargo. Yes, no? What I find quite interesting is that the market rallied over 50 percent in 1986, in an era in which we were a pariah state and effectively defaulted on our external debts. That is right, no downgrade to "junk", rather a complete straight to D for giant default. And equity markets? 1987 was tough, a drawdown of 10 percent or less, 1988 we made it all back, and some more, 1989, we rallied by over 50 percent, 1990 was a return to a drawdown of 10 percent or less.

Do the math, and then tell me, is it worse now or was it worse then? Two different currencies, two different classes of citizens? As "bad" as sometimes the moment in the markets feel, it is worthwhile drawing on past experience, if only to tell you that we have made progress. Another piece (from the same source) of years of returns on the Jozi all share index can be found here - South Africa's FTSE/JSE All-Share Index Returns By Year. And then the associated returns, herewith the image, courtesy of the same website, Top Foreign Stocks.

The point is simple. Stay the course, do not get spooked by political shenanigans beyond your control, they certainly influenced a large portion of the first part of the graph. And ratings downgrades? Well, we defaulted in the mid eighties, do you remember falling and fumbling and hand wringing? Let me know if you remember those times, I would be very interested to know how it was back then.

As mentioned, it is a holiday in the US today, and not so much action is expected locally as a result of that. Friday stocks were definitely open for business, and by the end of the session were modestly higher. Ahead of the long weekend. The Dow Jones added one-quarter of a percent on the day, the broader market S&P 500 added over four-tenths of a percent whilst the nerds of NASDAQ managed to muster a nearly two-thirds of a percent gain on the day.

Google/Alphabet was a winner on the day, Alibaba and Baidu were bigger winners, Tencent is trading near (if not above) their all time high, slightly lower this morning. Which explains why Naspers was trading at one point at an all time high Friday, the company is by market capitalisation within a whisker of 1 trillion Rand. There has definitely been a faith restored in Chinese internet stocks recently and some pretty aggressive buying in the last few sessions. Since their SEC announcement Wednesday last week, Alibaba is up 7 percent plus in two sessions.

Company Corner

Some client feedback on Monsanto and John Deere, as promised:

I'm less convinced about Monsanto and Bayer. While their products are amazing and have had a huge impact on agriculture, yields and hence food security, I worry about the long term sustainability of the business. I think they are going to find increasing aversion to products like glyphosate (Roundup) and the genetic modification. Less so GM, but they are increasingly modifying for integration of the two - like Roundup ready seed.

This issue was brought home to me starkly on Friday: I am looking at buying a worm farm!! 4.5km of worm rows, consuming 70 tons of manure every 10 days and producing hundreds of tons of vermicast every year. The value of vermicast (which is just a polite term for worm poo) is that the worm processes the manure/compost and thereby makes the resultant material 10 - 20 times more beneficial to the soil and thus to the plants (crops). So what does this have to do with Monsanto? Well, on Friday I spent a couple of hours with the guy selling his worm operation. He has been applying vermicast and a tea that he brews up from the vermicast, to his lands for some time now.

One particular field is worth mentioning: He has been following the vermicast strategy for 5 years in this field, which adjoins his neighbour and across the fence is the poster boy for Monsanto - he used Roundup ready seed (GM and resistant to Glyphosate) he also uses anhydrous Nitrogen gas injected into the soil and all manner of other petroleum base fertilisers and chemicals. No expense is spared and he farms for maximum yields. These two fields, which are ostensibly the same soils, same rain fall, etc. are amazing to see. The worm man will reap some wherein the region of 7t/ha while the other fellow will have a "mis oes" - he will be lucky to get 1t/ha. The worm man is producing a yield 50% higher than average (for the district) in the worst drought in 30 years. And this was done with less than half the "normal" application of fertilizer. Astounding to see.

The problem is that we as farmers have been ploughing N.P.K into our soils for 100 years and using hectic chemicals - the upshot is that we have destroyed the microbial life in the soils. A healthy soil will carry as much as 3 tons of microbes, mostly bacteria and fungi. Turns out these fellas are crucial in working the soil and making nutrients available to the plants, improving water penetration and retention.

You add to this that the vermicast can be produced at about 20% of the cost of the chemical fertilisers we use and the case starts to look even better. Like the worm man says as we look out over the two crops side by side: "This guy is pending millions to farm himself into sh(1)t, with the help of the chemical and fertiliser reps! - I'm busy doing the opposite; reducing input costs and increasing yields." Those of us familiar with income statements know the exponential effect those two factors have on a business.

So.... long way of saying that in the long term, I think that agriculture is going to move away from the heavy chemicals and fertilisers we have been using. I'm concerned about the sustainability of the likes of Monsanto's long term prospects (and I mean long term - farmers are amongst the slowest adopters in the world), added to which I don't like their business ethics.

Currently I like worms - and Deere & Co, of course. Monsanto - not so much.

He did add after that:

The part that I didn't put in the note yesterday was that in some ways, Monsanto (And I guess the likes of Du Pont, etc. fall into the same boat) is like a BAT or a Phillip Morris. I say a bit, because the advancement in seed technology (including GM) has been phenomenal - so they have done some good. BAT and the rest of the 'bacci boys can't claim any such benefit to society. - Ok, so maybe it's actually a crap analogy, thinking about it a bit more.

Thanks as ever for your feedback! We call the man above the "downtown investor".

Linkfest, lap it up

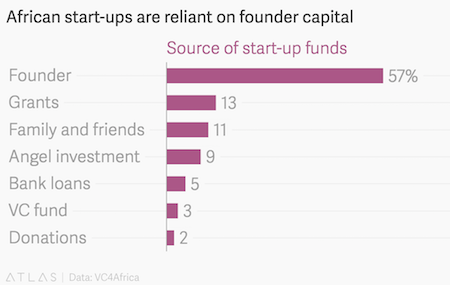

Having access to capital is imperative for entrepreneurs, which in turn means it is imperative for job creation - African start-ups are securing more investment - but there is still room for growth. The African continent still has a long way to go to reach a desirable level of access to capital.

As renewable energy gets cheaper more people are adopting it, which in turn will make it cheaper due to economies of scale - Santiago's subway system will soon be powered mostly by solar and wind energy

As more and more of us move online and move more stuff to the cloud, capacity needs to grow - Facebook and Microsoft are laying a giant cable across the atlantic.

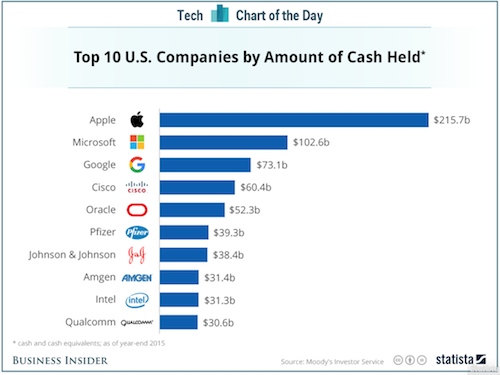

All the infrastructure development is at least giving tech companies something to spend all their offshore money - Three US companies are hoarding the most cash

Home again, home again, jiggety-jog. Last time we are saying it, holiday today in the US and the UK. The anxieties about the middle of the week are likely to be centre stage, at least on the local front. Expect quiet and subdued trade.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

High Retention CPI

ReplyDeletehttp://androidappinstall.salvusappsolutions.com/account/login

High Retention is our more advanced CPI product. Users get incentivized for downloading, installing, and keeping your app

for at least three days.This is the right campaign type for you if you are looking for users to keep your app for at

least a certain amount of time in order for you to improve your play or app store ranking.

High Retention CPI