"The company has continued to warn that they are likely to fall short of their installation goals, notwithstanding that they plan to install 1.1 Gigawatts this year in rooftop solar to customers (residential, business and government), that is below the 1.25 they had initially signalled. Competition from newer and more fragmented businesses, regulatory issues, issues around financing and of course the most irritating for the company, the installation costs continue to rise."

To market to market to buy a fat pig A better day for stocks locally, the weaker currency lent itself "nicely" to the industrial and resources complex. One of the reasons that the Rand may well be weakening is the weak employment data from a couple of days back. In a parallel, yet far richer universe, the presidency race in France is set between a centre right candidate intent on market reforms citing the lower employment rates in Germany and the UK, and another fiercer very far right candidate, the daughter of a former political. With the necessary steps to reform economies and make them all inclusive, the longer the stalemate remains.

It is easy for me to sit here and dictate with suggestions, I come from a privileged background in a South African context. Quality education changes everything, I know that, I believe that, as did the founder of the modern South African nation. It starts early, with children from their birth to the end of their tertiary studies. In the US, according to work done around 2013, the cost of raising an individual child to the age of 18 is 245 thousand Dollars.

In the UK, a 2012 study suggested a middle class child costs (to 21 years of age), 222 thousand Pounds to raise. In India, an upper middle income family can expect to spend 90 thousand Dollars to raise a child to the age of 21. So I guess, depending on where you sit in the economics tables of each respective country, it does cost a monster sum that includes transport (vital in a South African context) and good nutrition, before even the quality of the education is called into question. I know that some very elite boarding schools cost an arm and a leg in this country of ours, the fact that people get the opportunities to send their children there means that they are definitely one-percenters.

Bright and I were discussing Curro yesterday (or was it the day before), and noted that a couple of years ago (when Curro had 41 schools), that the business wasn't even 5 percent of the total private schooling system in South Africa. And of the overall system here in South Africa, only 5 percent of the school going population was privileged enough to go to independent (private) schools. The rest of the 95 percent of the country didn't get that opportunity. Education, healthcare (including nutrition), win there and then you will win across the board.

Back to the market quick-sticks, it was a ping pong for Anglo American again, the stock was up 4.4 percent (after being down 10 percent in the prior period), no such luck for AngloGold Ashanti, their results from a couple of days back were not well received, that stock was down 2.4 percent. Naspers cracked the 2000 mark again, that stock was up sharply, nearly three and three-quarters of a percent. See the link below that Michael inserted about TenCent. Pretty amazing stat.

Over the seas and far away, in New York, New York, stocks rallied hard through to the close. The Dow added over a percent and one-quarter, in fact both of the other two watched indices, the nerds of NASDAQ and the broader market S&P 500 added exactly the same amount. I guess against that same-same backdrop it wasn't surprising that the rally was pretty broad based, and that volatility got crushed. Energy stocks continue to catch a bad as disruptions in Nigeria lead to the lowest output on 22 years for that country, plus the Canadian wildfires (that could burn for a while still) mean that oil prices could remain at these levels (mid-forties Dollars per barrel) for a while yet. Energy stocks were amongst the biggest winners, as a collective up over two percent whilst materials rallied two and one-quarter of a percent.

Company Corner

Solarcity seems at face value, a company that has the ability to meet our energy needs, solving both the storage problem (with Tesla included) and enabling a cleaner future for the unborn children that inherit the earth from us, and previous generations. Ambitious plans, with that man Elon Musk involved as chairman and his childhood friends and cousins (the Rive brothers, Lyndon and Peter) at the helm of the business look like the perfect mix for success, hard work, determination and of course a founding principle of the business that encourages change, real change at that. Since the company listed their business back in late 2012 the stock has returned 50 percent, as ever it depends where one draws a line in the sand, from the February 2014 highs the stock is down 80 percent.

The company reported numbers on Monday evening, a few sessions after short seller Jim Chanos announced he was short the business. On that news alone from last week, the company stock price fell sharply. In fact, the share price has almost halved since the 27th of April. That is a spectacular fall from grace in such a short period of time. Whilst the company reported in their results Monday night that they had managed to install 40 percent more capacity than in the prior year.

The company has continued to warn that they are likely to fall short of their installation goals, notwithstanding that they plan to install 1.1 Gigawatts this year in rooftop solar to customers (residential, business and government), that is below the 1.25 they had initially signalled. Competition from newer and more fragmented businesses, regulatory issues, issues around financing and of course the most irritating for the company, the installation costs continue to rise. The company continues to report a loss, and according to Jim Chanos, it is the worst conference call he has heard this year. That is a little like Carl Icahn I guess, he is of course talking his own book.

The only way that the company can regain the trust of a very shattered shareholder is possibly to reduce costs heavily and meet targets. That is what I have read. I am thinking that they cannot do all of these things. Whilst this is hardly a swing for the fences type investment, in our context here in Mzansi it is more apt to say six-or-nix, anyone who has engaged in a fierce match of backyard cricket will know exactly what I am talking about. It may well be that this company is well ahead of their time, I would not count against the never say determination of the Rive brothers and chairman Elon Musk. It is possibly way too speculative and out there for many to own widely.

Linkfest, lap it up

A new research paper has shown that by following Twitter it is possible to outperform the market - The Wisdom of Twitter Crowds: Predicting Stock Market Reactions to FOMC Meetings via Twitter Feeds. I think that the research shows that money can be made in the short term when you tap into momentum and market emotions.

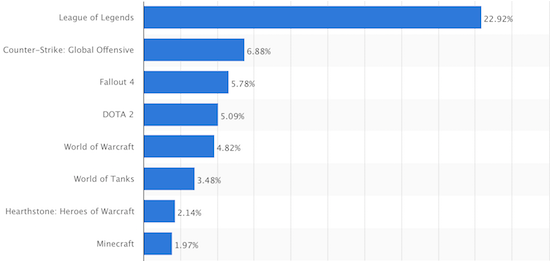

Here is one of the reasons that Tencent (Naspers) is worth what it is, League of Legends is owned by them - Most played PC games on gaming platform Raptr in November 2015, by share of playing time

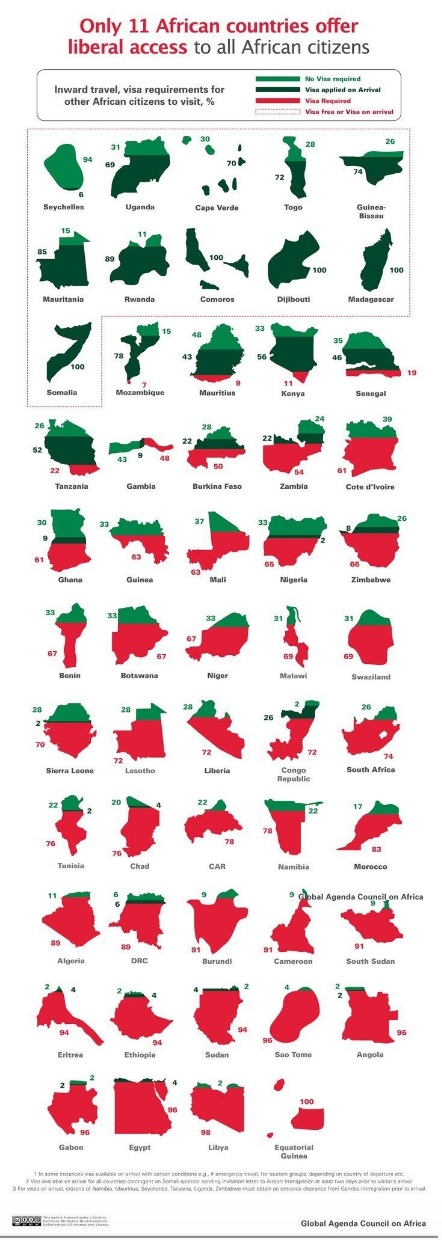

Tourism can contribute to much needed growth in Africa, we are not doing ourselves any favours though - Why Africa needs to open up to Africans

Home again, home again, jiggety-jog. Stocks across Asia are a mixed bag, futures in Europe are equally mixed. We may well be in for a slow day on the equities front. Never dull I might add!

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment